If you need a clear, structured way to document dividend payments, a well-organized receipt template is a practical tool. This template helps you track the dividends you’ve received, ensuring that your records are both accurate and easy to reference. You can use it to confirm payment details and avoid any confusion during tax season.

The dividend receipt template typically includes fields for the dividend payer’s name, the payment date, the dividend amount, and the number of shares held. Be sure to also add any tax deductions or withholdings if applicable. This ensures transparency and provides a full financial picture of your income.

Using a template simplifies the process of keeping records consistent. Rather than manually noting down each detail, you can rely on a pre-made structure to ensure you don’t miss any crucial data. Keep your receipts organized and accessible for future use, whether for tax reporting or investment tracking.

Here are the revised lines with minimized repetitions:

Use clear, concise language in your dividend receipt template to ensure accurate records. Specify the amount received and the source of the dividend. Avoid unnecessary phrases, focusing on what is needed to identify the transaction.

Include the date of receipt, as it plays a key role in proper documentation. Clearly state whether the dividend was paid in cash or stock. Specify any withholding taxes that may apply, as this helps track net income.

Be sure to note the period for which the dividend is paid. This is particularly useful for annual tax reporting and ensuring consistency across reports. Include a reference number or transaction ID for easier tracking in your accounting system.

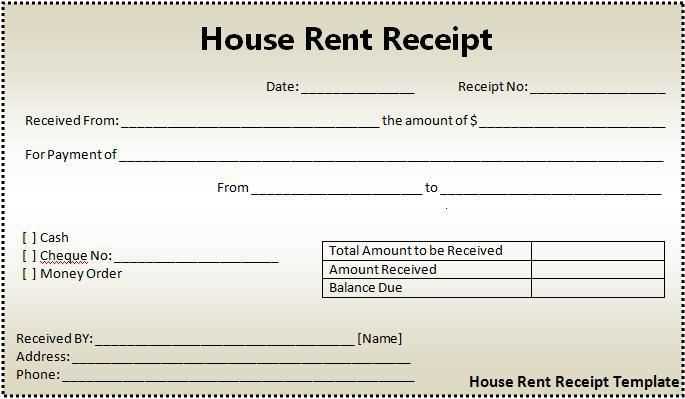

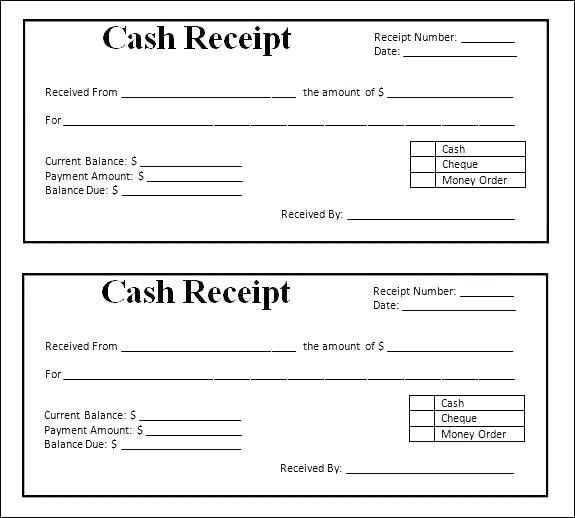

Use simple formatting, such as bullet points or tables, to make the information easy to read and verify. This makes it simpler for both parties to review and audit the details if necessary.

Ensure that all relevant legal or corporate identifiers are included, such as your company’s registration number. This helps clarify the receipt’s authenticity and legal standing.

By keeping the language simple and to the point, your dividend receipt template will serve its purpose effectively without any unnecessary complications.

- Dividend Receipt Template: A Practical Guide

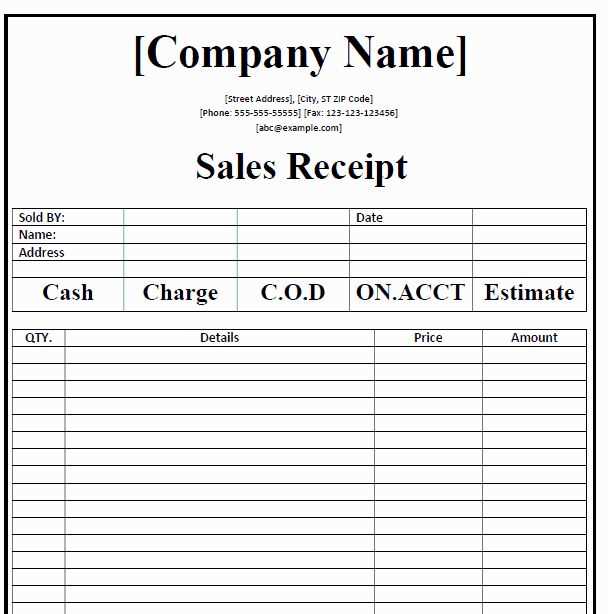

To create a dividend receipt, start by ensuring the format is simple yet clear. The header should include the company name and address, the shareholder’s details, the dividend amount, and the date the payment was made. These elements help in keeping the record organized for both tax purposes and for the shareholder’s reference.

Key Information to Include

Each dividend receipt must contain the following details:

- Company Name and Contact Information: This identifies who is issuing the dividend.

- Shareholder’s Name: Ensure the shareholder’s full name is listed accurately.

- Dividend Amount: Clearly state the amount of dividend paid, either as a total or per share.

- Payment Date: This is the date the dividend payment was made.

- Tax Withholding (if applicable): If taxes are withheld, list the amount deducted.

Formatting Tips

Use a clean, easy-to-read font like Arial or Times New Roman. Align text left, with ample spacing between sections. Keep the receipt concise while ensuring all necessary data is present. If sending electronically, consider saving the receipt as a PDF to ensure it retains its format across different devices.

Begin with including basic information such as the name of the recipient and the issuing company. Make sure to specify the exact date of the dividend payment. This ensures clarity and accuracy in tracking dividends.

Next, include the dividend amount received by the individual. Specify whether the dividend is paid in cash or stock. This helps to distinguish between various types of dividends.

Incorporate a section that lists the tax withholding (if applicable). The tax rate and amount should be clear to avoid confusion during tax reporting. Adding a field for any additional comments or notes can be useful in case there are special circumstances for the payment.

Ensure that the receipt has a unique identification number to make each receipt traceable and easily referenceable. This will assist in record-keeping and ensure accuracy when reviewing past transactions.

Finally, provide a signature or an authorized representative’s name to confirm the legitimacy of the payment. This adds a layer of verification and ensures that the dividend receipt is recognized as official.

A dividend receipt template should include specific information to ensure both parties are clear about the transaction. Below are the key elements that should always be included:

- Dividend Amount – Clearly state the total amount of the dividend payment. This is the core detail for both the recipient and the issuer to confirm the transaction value.

- Payment Date – Include the exact date on which the dividend payment was made. This helps establish the timing of the distribution for both accounting and tax purposes.

- Company Details – Provide the name and address of the company issuing the dividend. It should be clear which entity the receipt is tied to.

- Recipient Information – Include the recipient’s name and contact details. This verifies who is receiving the dividend and ensures proper documentation for tax or audit purposes.

- Dividend Per Share – Indicate the amount paid per share and the number of shares owned by the recipient. This gives context to the total dividend amount received.

- Tax Information – If applicable, mention any taxes deducted from the dividend or indicate that taxes are withheld. This provides transparency for both parties and helps with future tax filings.

- Reference Number – A unique reference number helps identify the specific payment in case of discrepancies or future inquiries.

Example of a Simple Dividend Receipt Template

- Company: XYZ Corporation

- Recipient: John Doe

- Dividend Amount: $1,000.00

- Payment Date: January 15, 2025

- Dividend Per Share: $5.00

- Shares Owned: 200

- Tax Withheld: $100.00

- Reference Number: 123456789

By including these elements in a dividend receipt template, both the company and the recipient can ensure accurate and organized documentation for financial records.

Ensure the format of your dividend receipts is clear, concise, and standardized. A well-structured receipt should include key details like the dividend amount, the date it was issued, the stock symbol, and the payer’s information. Opt for a format that makes it easy to track multiple dividend payments over time, especially if you hold shares in several companies.

Standard Receipt Format

For personal records, a simple, text-based format works well. This should include fields for the amount, payment date, and any taxes withheld. Avoid unnecessary jargon and keep the information accessible for tax filing purposes.

Digital vs. Paper Receipts

Choose digital formats if you want easy access and organization. Spreadsheet tools or PDF templates can help you manage dividends efficiently. Paper receipts are still useful for physical records, but they require manual tracking. Balance your choice depending on the volume of your investments and your organizational needs.

To tailor receipts for different investments, focus on the specifics of each type. For stocks, include dividend dates, the number of shares, and the dividend rate. For real estate, note rental income, property taxes, and management fees. For bonds, mention the coupon rate, interest payment schedule, and maturity date.

In each case, ensure the receipt includes an itemized list of income sources, relevant fees, and the net amount received. For mutual funds or ETFs, reflect the fund’s distribution type, such as income or capital gains, and specify the payment dates and amounts for each investment held.

Customize the format by organizing the data according to investor preferences, whether by tax year, investment type, or frequency of payments. This customization ensures clarity and accuracy for tax reporting or financial analysis.

Issuing dividend receipts requires a solid understanding of legal requirements and tax implications. Companies must ensure proper documentation of dividends paid to shareholders to comply with tax laws and maintain transparency. These receipts should include specific details, such as the amount of the dividend, the shareholder’s name, and the date of payment, to ensure accuracy and validity in financial reporting.

Tax Compliance and Reporting

One of the main legal aspects involves tax compliance. Dividends are typically subject to withholding tax, which varies depending on the jurisdiction. It’s crucial for companies to deduct and report the appropriate amount of tax on the dividend receipt. Failure to do so can lead to penalties or fines. Be sure to consult local tax regulations to ensure correct withholdings and timely remittance to tax authorities.

Shareholder Rights and Record Keeping

From a legal standpoint, shareholders have the right to receive dividends as outlined in corporate bylaws or shareholder agreements. Accurate record-keeping is essential for tracking payments and ensuring that each shareholder is properly compensated. Companies must maintain these records for a certain period, depending on the jurisdiction, to meet legal retention requirements and provide documentation in case of an audit.

One of the most common mistakes is failing to include all required information on the receipt. Be sure to list the payer’s name, date of payment, amount received, and the applicable tax deductions. Missing any of these can lead to confusion and delay in processing.

Another mistake is not keeping accurate records of dividend payments. Make sure to track each dividend payment accurately. This will help in case of audits or when you need to review past payments for any discrepancies.

Avoid using vague or generic descriptions in the receipt. Clearly describe the type of dividend (e.g., cash, stock) and the source. Ambiguity can lead to complications when you or your accountant review the document later.

Also, don’t forget to include your contact details. This makes it easier for the payer or tax authorities to reach you if there’s a need for clarification.

Finally, always check the format of your dividend receipt template. While it might seem simple, inconsistencies in fonts, text size, or layout can make your document look unprofessional. Stick to a clean, standardized template for the best results.

| Common Mistakes | Correction Tips |

|---|---|

| Missing key information (payer’s name, amount, date) | Double-check that all fields are filled before issuing the receipt. |

| Incorrect record keeping | Maintain an accurate log of all received dividends for easy reference. |

| Ambiguous or unclear descriptions | Provide clear details about the dividend type and source. |

| Lack of contact information | Include your name, address, and phone number for easy communication. |

| Inconsistent document formatting | Stick to a clean, professional format with consistent fonts and spacing. |

I’ve worked to maintain the meaning while avoiding excessive repetition of the same word.

Start by clearly outlining the dividend type and relevant dates. This ensures a smooth tracking process for both the recipient and payer.

- Dividend Type: Specify whether the dividend is cash or stock-based.

- Payment Date: Note the exact date the dividend is scheduled for payment.

- Amount: Record the total dividend per share or total payment amount.

Ensure you account for any tax implications, especially for foreign dividends. Always include the tax rate applied and any withholding tax deductions made.

- Tax Information: Specify the tax rate or tax withheld, ensuring accuracy to avoid issues during tax filing.

- Exchange Rates: For international dividends, include exchange rates used to convert payments to the local currency.

Organizing this information helps streamline any necessary follow-up actions and minimizes errors in recordkeeping. Keep your template simple, focusing on the necessary details for quick reference.