A well-structured doc receipt template saves time, ensures accuracy, and provides a consistent format for financial records. Whether for business transactions, reimbursements, or service payments, a properly formatted receipt protects both the sender and the recipient. The key is to include all necessary details while keeping the layout clear and easy to read.

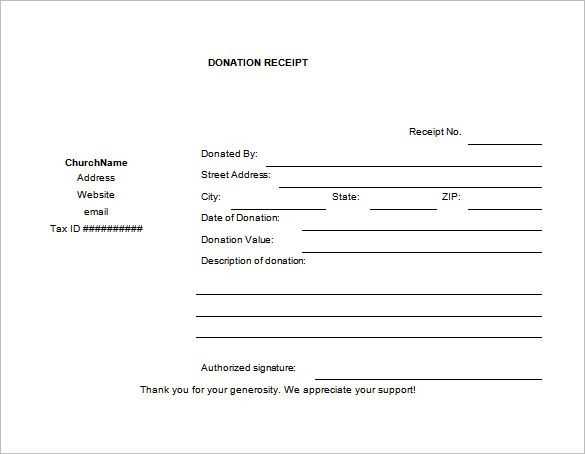

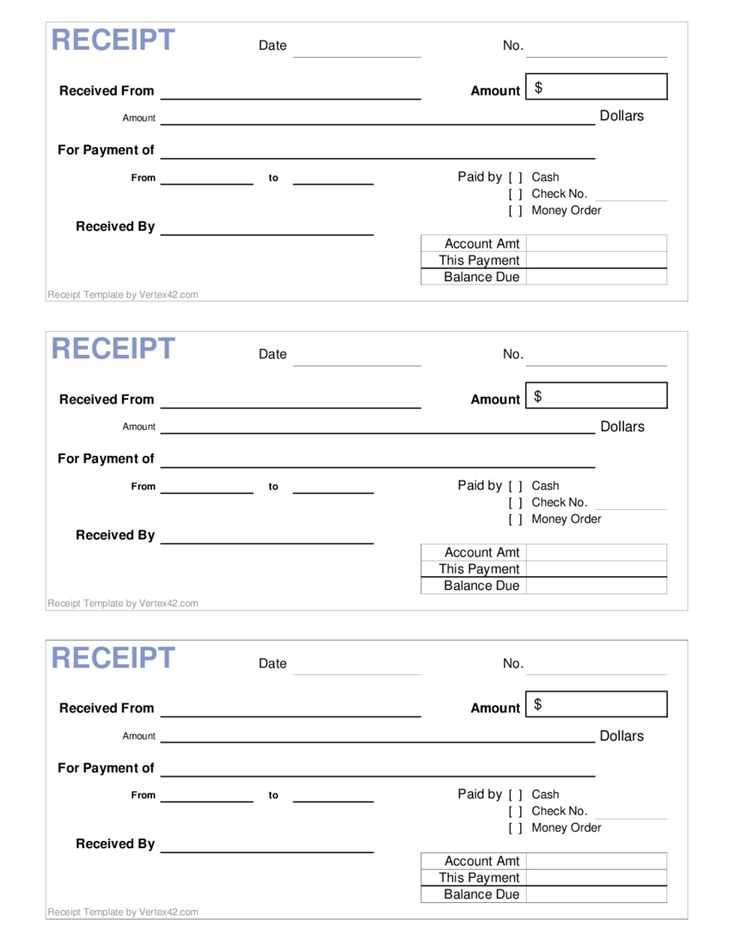

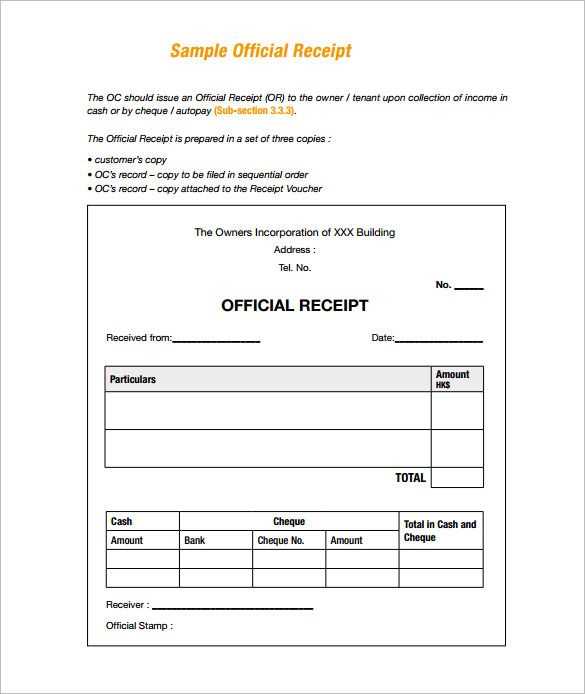

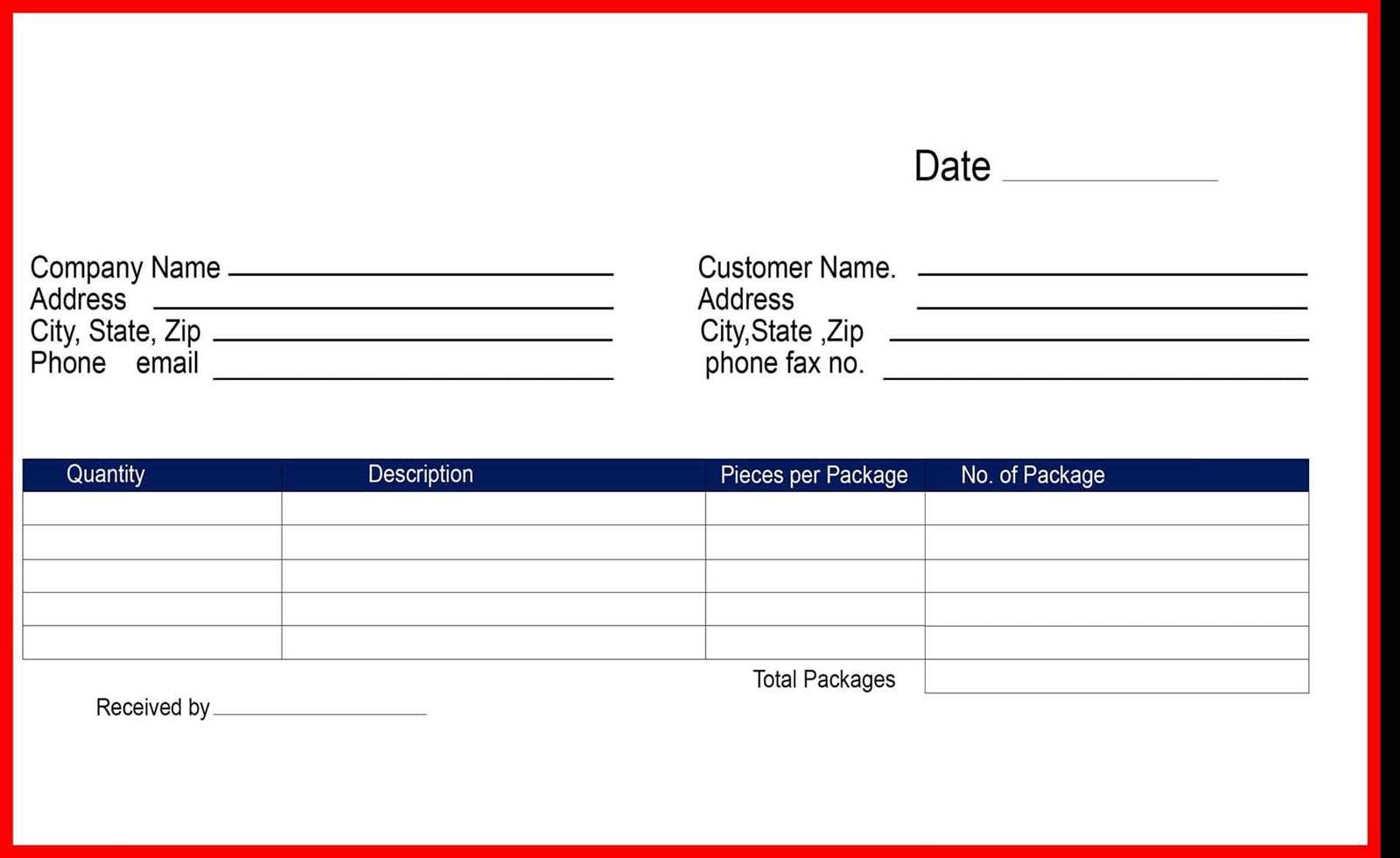

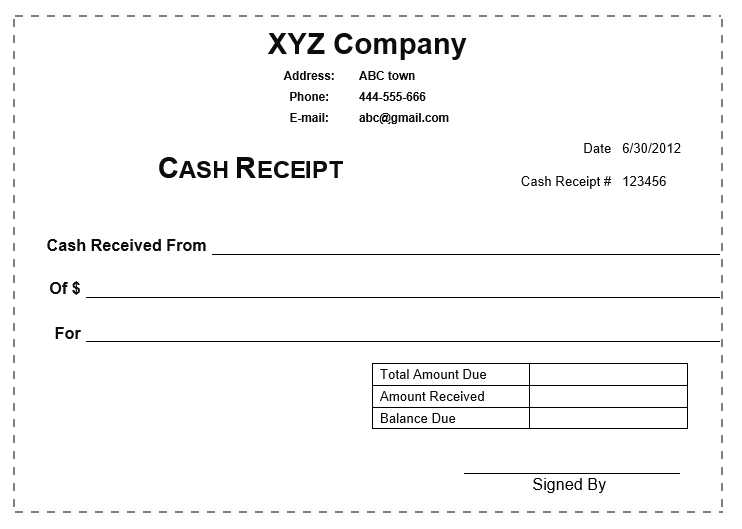

Every receipt should contain essential details: the date of the transaction, names of both parties, a unique receipt number, a breakdown of charges, and the total amount. If applicable, include payment methods, tax details, and company information. Consistency in formatting makes it easier to track records and avoid disputes.

For convenience, many businesses use pre-designed templates that allow quick customization. A good template should be editable, support multiple formats (Word, PDF, or Excel), and align with your branding. Digital receipts also enhance organization by reducing paperwork and enabling seamless record-keeping.

Using a structured template not only saves time but also improves financial transparency. Whether you’re a freelancer, a small business owner, or part of a larger organization, a well-prepared document receipt ensures every transaction is properly documented.