Use doctor receipts templates to streamline your billing process. These templates allow for quick, accurate creation of invoices for medical services, ensuring that all necessary details are included. A well-organized receipt minimizes errors and keeps the financial records clear.

Consider customizing the template to fit your practice. Adding your practice’s name, contact information, and a list of common services can help save time when issuing receipts. It’s also helpful to include sections for patient details, treatment descriptions, and payment methods.

Ensuring accuracy in receipts is key. Check that all figures are correct and that the service description aligns with what was provided. A receipt template will help avoid confusion and maintain transparency in your transactions with patients.

Here’s a detailed plan for an informative article on the topic “Doctor Receipts Templates” in HTML format with six practical and specific headings:

Begin by addressing the need for standardization in doctor receipts. Discuss the importance of clear and accurate documentation for patient visits, including the treatment provided and fees charged. Highlight how templates help ensure uniformity and reduce errors.

1. Benefits of Using Templates for Doctor Receipts

Provide specific advantages such as saving time and improving organization. Templates eliminate the need to start from scratch with each receipt, streamlining the process for healthcare providers. Additionally, templates ensure consistency across all patient records and prevent omissions.

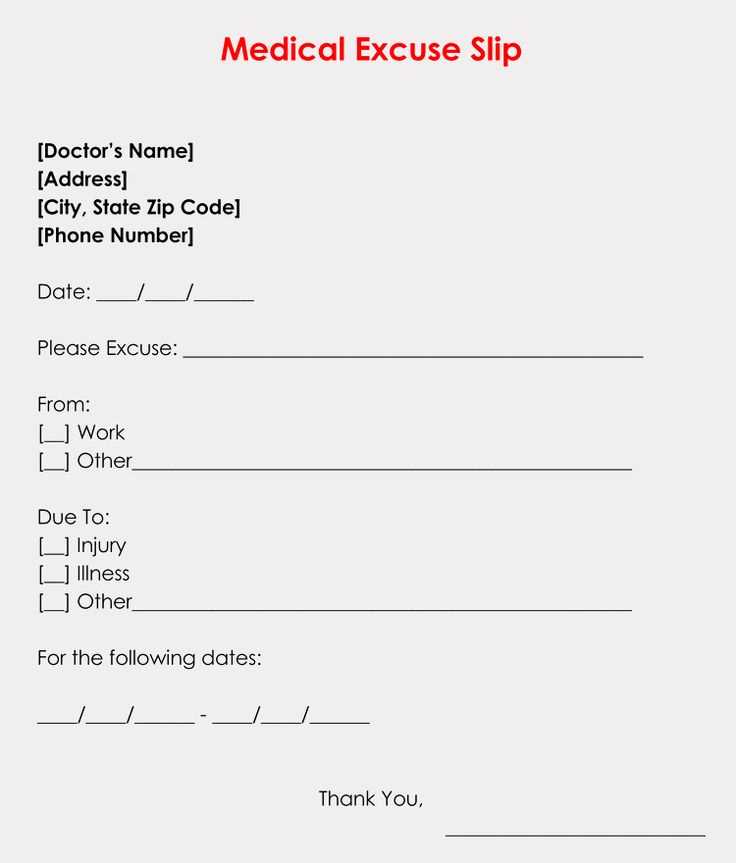

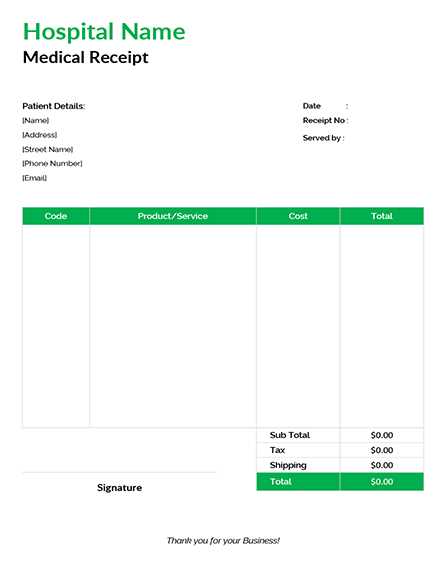

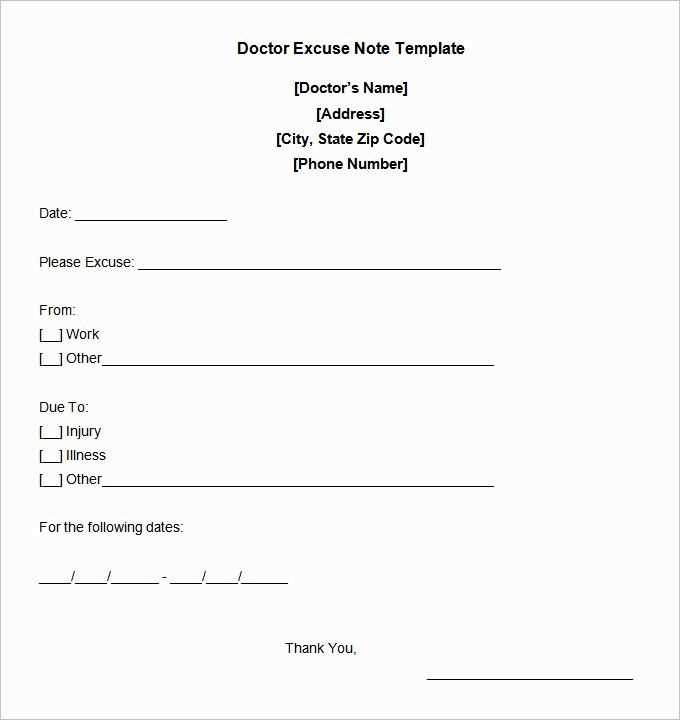

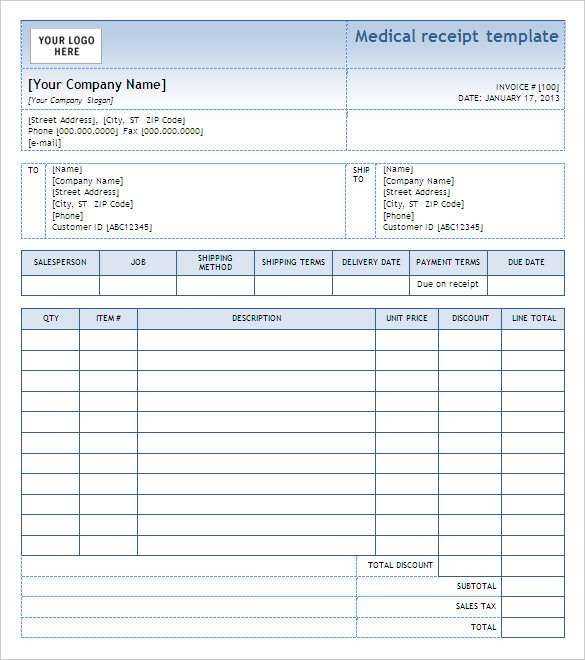

2. Key Information to Include in a Doctor Receipt Template

List critical details to incorporate in every receipt. This includes the patient’s name, treatment date, procedure or service description, fees, and payment method. Also, ensure that the provider’s contact information and practice details are clearly visible.

Example: Include the doctor’s name, medical license number, clinic address, and phone number to ensure the receipt is complete and legally compliant.

3. Customizing Doctor Receipts for Specific Services

Guide on tailoring receipt templates for various specialties. Whether it’s general practice, dentistry, or therapy, explain how templates can be adapted to fit the needs of different types of healthcare services.

4. Template Formats and File Types

Detail the available formats such as PDF, Word, and Excel, and discuss their benefits. PDFs are easy to print and share, while Excel allows for easy integration with practice management software. Provide tips for choosing the best format based on office setup and patient communication preferences.

5. Legal and Tax Compliance Considerations

Explain the importance of ensuring that receipts meet local healthcare regulations and tax requirements. Mention the need for clear breakdowns of services rendered and payments made, as receipts are often required for insurance claims and tax reporting.

6. Automating Receipt Generation with Templates

Discuss how using digital tools can automate the generation of doctor receipts. Mention software options that integrate with medical practice systems, making the process quicker and reducing administrative workload. Automation can also improve accuracy and help with record keeping.

- Guide to Doctor Receipts Templates

Doctor receipts templates simplify the documentation process for medical services. Using a clear, consistent format ensures both accuracy and professionalism in transactions with patients. Below is a step-by-step guide to creating and using these templates:

- Include Patient Information: Always start by capturing the patient’s name, contact details, and any other relevant personal information. This ensures that receipts are properly attributed and easy to reference in future appointments.

- Detail the Services Provided: Specify the medical treatments, consultations, and any additional services rendered. Include accurate descriptions, such as the type of examination or procedure, along with the corresponding cost for each service. This transparency builds trust and avoids confusion.

- Use Clear Payment Terms: List the payment method (cash, card, insurance, etc.) and any outstanding balance, if applicable. Clear payment terms help prevent misunderstandings and keep both parties on the same page regarding the transaction.

- Include the Date: Always include the exact date when the service was provided. This ensures that the receipt serves as a reliable record for both the patient and the healthcare provider.

- Include Contact Information: Include the doctor’s practice name, address, phone number, and any other contact details that the patient might need for follow-up purposes.

- Formatting and Legibility: Keep the layout simple and easy to read. Use clear fonts, organized sections, and bullet points where necessary to separate key details.

By following these guidelines, a doctor’s receipt will not only meet legal requirements but also provide clarity for patients and healthcare providers alike.

Choose a template that aligns with the specific needs of your practice. A tailored approach will help streamline daily tasks, making documentation smoother. Select a template that includes all necessary sections such as patient details, diagnosis, treatment plans, and prescriptions, without clutter. Ensure that it reflects the unique characteristics of your practice–whether it’s for general care or a specialized field.

Consider how much customization is needed. Templates with editable fields allow you to adjust sections as per your requirements. This flexibility ensures that you can modify the document layout or content as your practice grows or changes over time.

Also, think about accessibility. Templates that can be easily accessed on different devices and integrated with existing software systems will save you time. Ensure the template is compatible with your electronic health records (EHR) system for seamless integration and efficiency.

Lastly, assess the level of simplicity. A clutter-free template will enhance readability and make it easier to use during consultations, improving patient communication and reducing errors in documentation.

When adapting templates for specific services, focus on aligning the design with the service’s core functions. Each service requires distinct details, and templates should reflect those unique needs to ensure clarity and relevance.

Adjusting Layout and Fields

Modify the layout based on the type of service provided. For example, a healthcare service template might prioritize patient details and medical history fields, while a consulting service template may highlight project goals, milestones, and timelines. Ensure that essential information is easily accessible and logically placed.

Incorporating Specific Terminology

Use terms and phrases that match the service’s context. For legal services, incorporate fields for case numbers or client agreements. For tutoring services, include space for lesson topics, student progress, and session dates. Customization of terminology will make the template more relevant and professional.

Ensure the template maintains flexibility for various use cases, making room for adding or removing sections as needed. This keeps the template versatile without overcomplicating the process for any particular service.

Ensure accuracy in every receipt. Medical receipts must reflect precise details to comply with legal standards. Include the correct patient information, treatment dates, and service descriptions. Misleading or incomplete data can lead to disputes or legal issues.

Adhere to healthcare regulations. Different jurisdictions have varying laws on how medical receipts should be structured. Verify that your receipt aligns with local laws on privacy, billing, and patient consent. Missteps could lead to fines or loss of licensure.

Maintain confidentiality. Medical receipts contain sensitive patient data. Make sure to follow privacy laws like HIPAA in the U.S. or GDPR in the EU to avoid breaching confidentiality. Secure data storage and careful handling are necessary to prevent unauthorized access.

Be transparent with payment details. Clearly list the services rendered, any insurance coverage applied, and any outstanding amounts. Transparency prevents misunderstandings and protects both patients and healthcare providers in case of financial disputes.

Provide clear documentation for reimbursement claims. Many insurance companies require medical receipts for claim processing. Ensure all required information is present and accurate to facilitate prompt reimbursement, avoiding delays or claim denials.

Begin by entering the patient’s full name at the top of the receipt. Ensure you accurately spell the name to avoid confusion. Next, include the date of the visit, clearly written in the format requested by your local regulations. This should be the date the service was provided, not the date the receipt is being issued.

In the next section, list the type of treatment or consultation provided. Describe the service with enough detail to ensure clarity, including any diagnostic codes if applicable. It’s crucial to specify whether it was a routine check-up, emergency consultation, or specialized treatment, as this impacts insurance claims.

Record the total cost for the services rendered. This amount should reflect the agreed-upon fee before any discounts or insurance adjustments. If there are multiple services, break them down individually. Each service should have a corresponding price to make the receipt transparent and verifiable.

Include any relevant information about payment, whether it was made in full, partially, or pending. If the patient paid on-site, note the method of payment, whether it’s cash, credit card, or another form. Also, if the receipt is for insurance purposes, mention that the receipt serves as proof of payment for reimbursement.

Finally, sign and date the receipt. Your signature authenticates the document, confirming that the details are correct. Ensure that the patient’s contact information is available in case there is a need for clarification or further follow-up.

Group receipts by category such as business expenses, personal purchases, and medical expenses. This makes retrieval easier when needed for tax purposes or reimbursement.

Use Digital Tools

Scanning receipts and storing them digitally is an efficient way to manage receipts. Apps like Evernote or dedicated receipt scanners offer organization and search features, making it simple to access past purchases on any device.

Label and Date Receipts

Label each receipt with relevant details like the store name and item purchased. Adding the purchase date will help you track spending over time, making it easier to organize by month or year for budget analysis.

Store receipts in clearly marked folders or file organizers if you prefer physical copies. Designate a spot for each category and sort receipts immediately after purchase to avoid clutter.

Review your receipts periodically and discard those that no longer serve a purpose, like those for items under warranty or purchases outside of a relevant tax year.

Ensure accurate information on each receipt. Double-check the date and time of the transaction to prevent discrepancies. Incorrect dates can lead to confusion for both the business and customer.

- Missing or Incorrect Business Details: Always include the full name, address, and contact information of your business. Errors in this area can cause issues with tax reporting and customer service.

- Inaccurate Itemization: Make sure all items are listed correctly with their corresponding prices. Overlooked or incorrectly priced items may create confusion for your customer.

- Tax Calculations: Double-check that taxes are calculated properly. An incorrect tax rate could lead to legal consequences and customer complaints.

- Ambiguous Payment Method: Clearly specify how the payment was made–whether it’s cash, card, or another method. Failure to do so can complicate transaction records.

- Lack of Transaction Reference Number: Include a unique transaction or receipt number. This helps track purchases and resolve disputes quickly.

- Unreadable Fonts or Layout: Choose clear fonts and ensure the receipt layout is easy to read. Poor formatting can make critical information hard to decipher.

Avoid these mistakes to maintain professional, clear, and legally compliant receipts. Accurate receipts build trust and support smooth business operations.

Organizing medical receipts is a key part of maintaining accurate records for both doctors and patients. The best approach is to have a clear structure in place for your receipt templates, ensuring consistency and completeness with each transaction.

Key Elements for a Doctor’s Receipt Template

Start with basic patient details: name, contact information, and the date of service. Ensure the description of the services provided is clear and concise, listing each treatment or consultation separately. Including the doctor’s name, specialty, and contact details makes the receipt more professional. The total amount paid, as well as any insurance or payment methods used, should be included for transparency.

Template Example

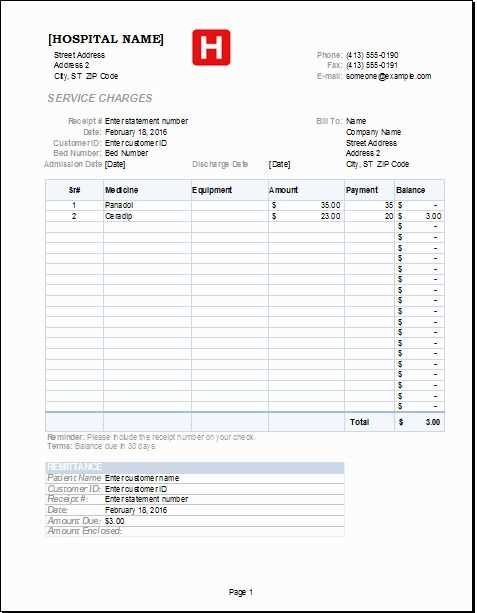

| Field | Description |

|---|---|

| Patient’s Name | Full name of the patient receiving the service |

| Doctor’s Name | Full name and specialty of the doctor providing the treatment |

| Date of Service | The date the medical service was provided |

| Services Rendered | Clear description of the services or treatments offered |

| Total Amount | The total cost of the services, including taxes |

| Payment Method | Cash, card, insurance, or other payment methods used |

Consider using a digital template for easy adjustments and tracking. Regular updates can streamline receipt creation, making it more efficient for both patients and healthcare providers.