When crafting a donor receipt, clarity and accuracy are your primary goals. A well-structured template provides essential information to the donor, ensuring they receive the correct documentation for tax purposes. Each receipt should include the donor’s name, donation amount, date of donation, and a clear statement of whether the donation was monetary or in-kind.

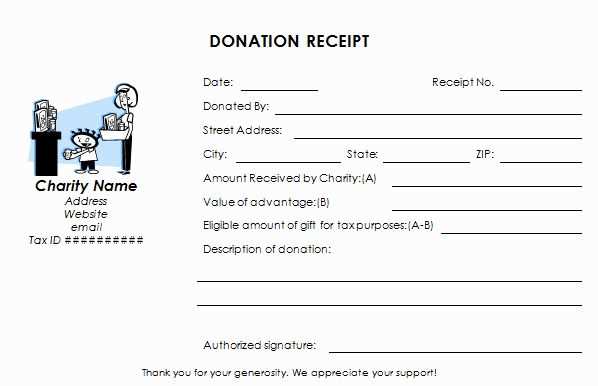

Acknowledge the value of the gift in the receipt by specifying any items received in exchange for the donation, such as goods or services. This is necessary for compliance with tax regulations. The receipt should also reference your nonprofit’s tax-exempt status, including the IRS 501(c)(3) designation, if applicable.

In addition to the donation details, include a brief thank-you message. Gratitude strengthens the relationship with your supporters and encourages continued giving. A simple, heartfelt note expressing appreciation for their contribution can go a long way.

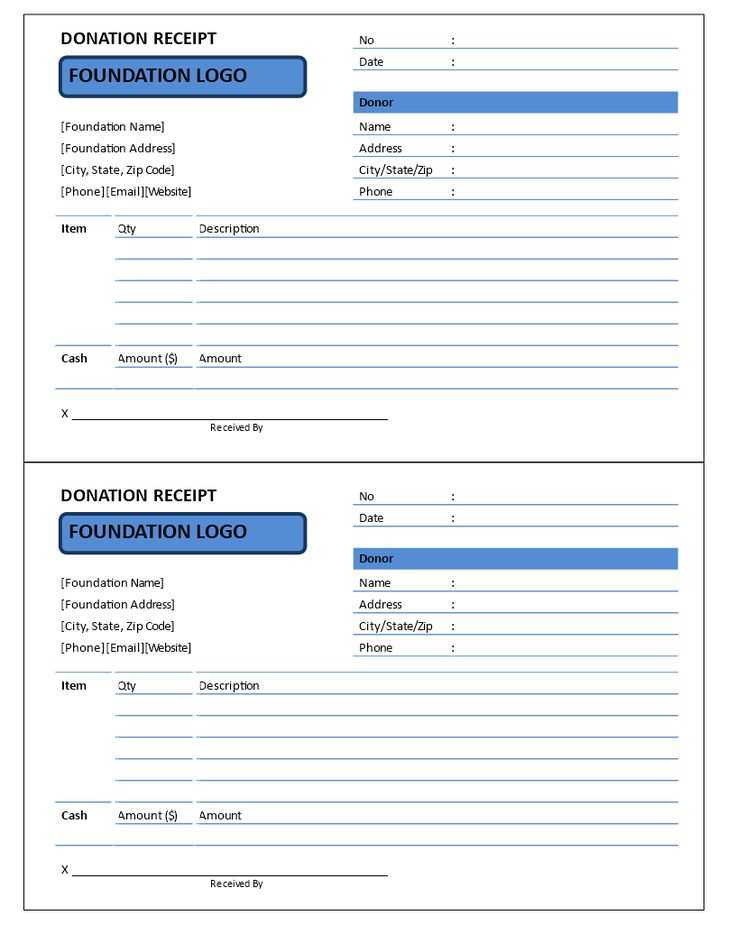

Finally, ensure that your template is easy to customize and can be adjusted for different donation amounts and types. A streamlined design with clearly labeled sections makes the receipt more user-friendly for both your team and the donor.

Here are the corrected lines without duplicates:

The template should clearly reflect the details of the donor’s contribution, ensuring transparency and accuracy.

Start by including the donor’s full name and contact information, then provide a detailed description of the donation. Avoid duplicating these details in different sections of the template.

The date of the donation is another key element. Make sure it’s not repeated elsewhere within the document. This avoids confusion and keeps the template concise.

Include the amount donated and specify whether it was a one-time or recurring contribution. Ensure these values appear only once in the template to prevent redundancy.

Finally, add a message of appreciation or a thank-you note for the donor. This adds a personal touch, but avoid repeating it in multiple sections of the document.

| Field | Correct Format |

|---|---|

| Donor Name | John Doe |

| Donation Amount | $500 |

| Date | February 12, 2025 |

| Message | Thank you for your generous support! |

- Donor Receipt Template

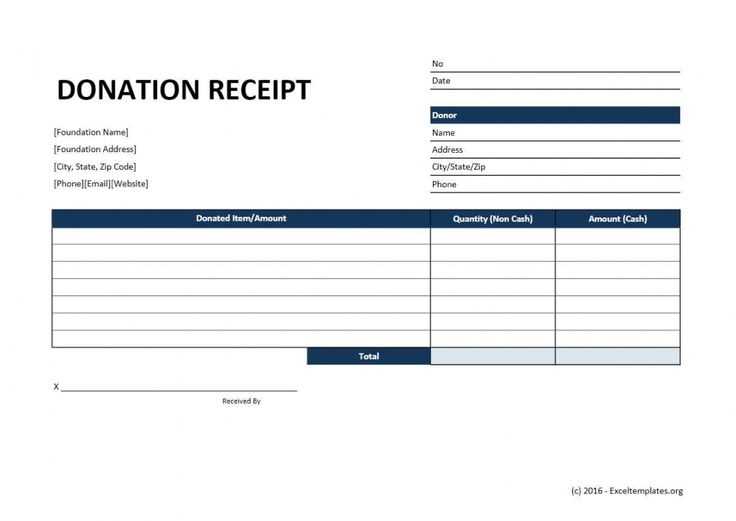

Designing a donor receipt template should prioritize clarity and transparency. Include the following key elements to ensure compliance with legal requirements and build trust with your donors:

1. Donor Information

Start by clearly stating the donor’s full name, address, and contact information. This section helps both the donor and the organization keep accurate records of the transaction.

2. Donation Details

Provide a detailed description of the donation. Include the donation amount, date, and any specific instructions (e.g., restricted gifts). If the donation was in-kind, describe the items and their estimated value.

3. Acknowledgement of Tax-Deductibility

Clearly mention that the donation is tax-deductible and include the organization’s tax-exempt status number. This will help the donor with their tax filing.

4. Thank You Note

A brief message of appreciation goes a long way. Express gratitude for the donor’s contribution and support, reinforcing their positive impact on your cause.

5. Signature and Contact Information

Include a space for the signature of an authorized representative of the organization and provide contact details in case the donor has any questions.

Include specific details on your receipt to ensure it meets tax deduction requirements. Clearly list the donation amount, the date it was received, and the donor’s full name and address. If the donation is a non-cash item, describe it and assign a reasonable fair market value.

Required Information

The IRS requires the following details to validate the receipt for tax deductions:

- Donor’s name and address

- Amount or description of the donation

- Date the donation was received

- If applicable, a statement indicating whether any goods or services were provided in exchange for the donation

Clear Donation Descriptions

For non-cash donations, provide a detailed description of the item(s) donated, along with their fair market value. Avoid vague terms like “various items.” Use specific item names and a reasonable valuation, which may require professional appraisal for high-value items.

For clarity and compliance, include these key elements in your donor receipt template:

- Organization Details: List the organization’s full name, address, phone number, and website to confirm the source of the receipt.

- Donor Information: Include the donor’s full name and address for record-keeping and future communications.

- Donation Date: Specify the date on which the donation was made to ensure proper timing for tax purposes.

- Donation Amount: Clearly state the total value of the donation or the items donated. If applicable, include an itemized list of donated goods.

- Donation Purpose: Indicate whether the donation was for a specific program or for general support.

- Tax-Exempt Status: Confirm the organization’s tax-exempt status (e.g., 501(c)(3)) to help the donor with tax deductions.

- Goods or Services: If the donor received goods or services in exchange for their donation, outline what they were and their value.

- Tax Identification Number (TIN): Include the organization’s TIN for reporting purposes.

- Signature: A signature from the organization’s authorized representative validates the receipt.

Additional Considerations

- If the donation is recurring, include details on the payment schedule and start date.

- Make sure the receipt is easy to read and includes all relevant details for tax reporting.

Send receipts as soon as possible after receiving a donation. A quick acknowledgment builds trust and shows appreciation. Ideally, do this within 24 to 48 hours to maintain momentum and transparency.

Include clear, detailed information on the receipt. List the donor’s name, the donation amount, and the date it was received. Specify whether the donation was monetary, in-kind, or a combination, and if it’s eligible for tax deductions. Always mention your nonprofit’s tax-exempt status and include any required legal disclaimers for tax purposes.

Ensure that your receipts are personalized. Address the donor by name, and add a short, heartfelt message of gratitude. A personalized note strengthens donor relationships and encourages future contributions.

Make sure your receipts are easy to read. Use a clean, simple design with legible fonts. Avoid unnecessary jargon or complex layouts. The receipt should be straightforward and visually appealing to make a positive impression.

Consider offering electronic receipts, especially for online donations. An emailed receipt is fast and convenient for both you and the donor. Ensure the email subject is clear, and the message body is concise, containing all necessary information in one view.

If you issue physical receipts, ensure they are printed on quality paper and mailed promptly. Include your organization’s return address and contact information, making it easy for the donor to reach out with questions or concerns.

Regularly audit your receipts for accuracy. Mistakes in donation amounts, dates, or donor details can lead to confusion or tax issues. Double-check all information before sending, and update your records as needed.

Lastly, maintain a record of all receipts sent for accountability and transparency. This can help with future reporting, tax filings, and donor stewardship efforts.

How to Use the “Donor Receipt Template” Effectively

Ensure that every donor receipt is personalized with relevant details. The template should include the donor’s name, the date of the donation, the donation amount, and a description of the donation (cash, goods, services, etc.). This clarity helps maintain proper records for both the organization and the donor.

Clear Breakdown of the Donation

Provide a detailed itemization of the donation. If the donor contributes goods or services, include descriptions and approximate values. For monetary donations, specify the exact amount and mention if it’s a one-time donation or part of a recurring gift.

Tax-Exempt Status Information

Include a reminder that the donation is tax-deductible, and clearly state your organization’s tax-exempt status. This reassures donors that their contribution may be eligible for tax benefits, encouraging future giving.