Key Information to Include

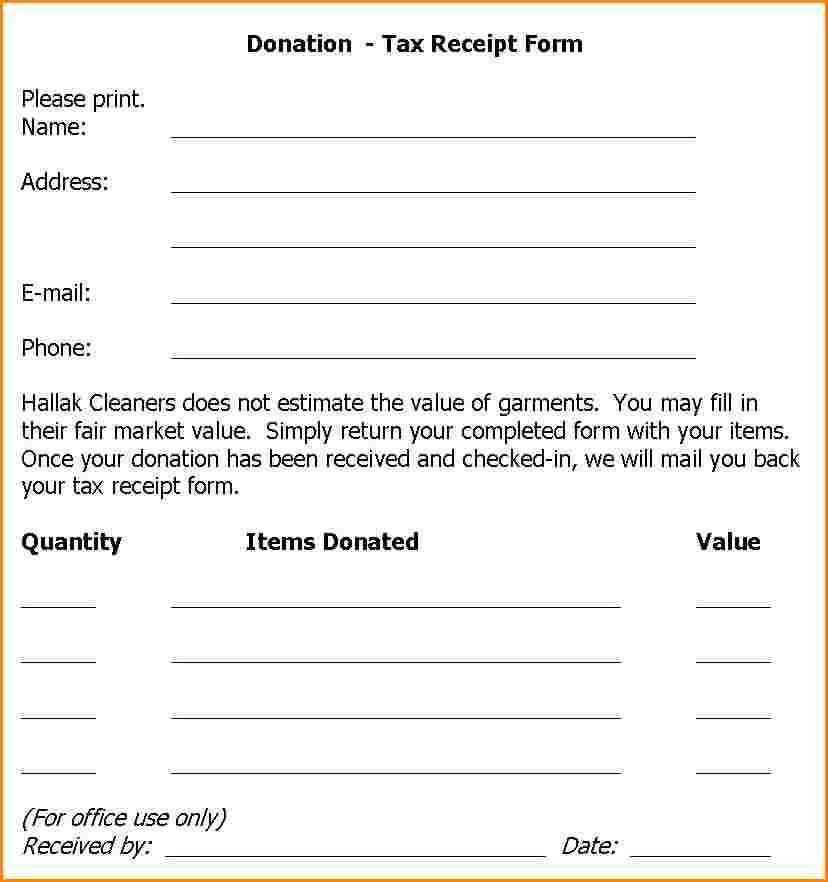

A donor tax receipt should be clear, concise, and contain all the necessary information for both the donor and the organization. Here’s a list of the must-have elements:

- Organization Details: Include the name, address, and contact information of your organization. Make sure it’s easily identifiable.

- Donation Details: Specify the date of the donation and the exact amount donated, whether it’s cash, goods, or services.

- Receipt Number: Assign a unique receipt number for easy tracking.

- Donor Information: Include the donor’s name and address. This is crucial for tax purposes.

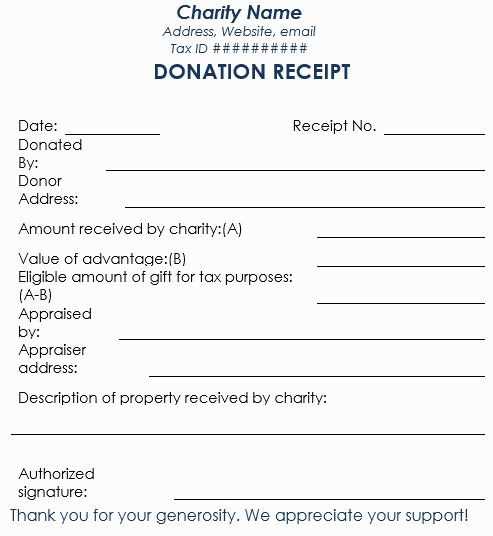

- Tax Identification Number: List your organization’s tax ID or EIN number to validate the donation.

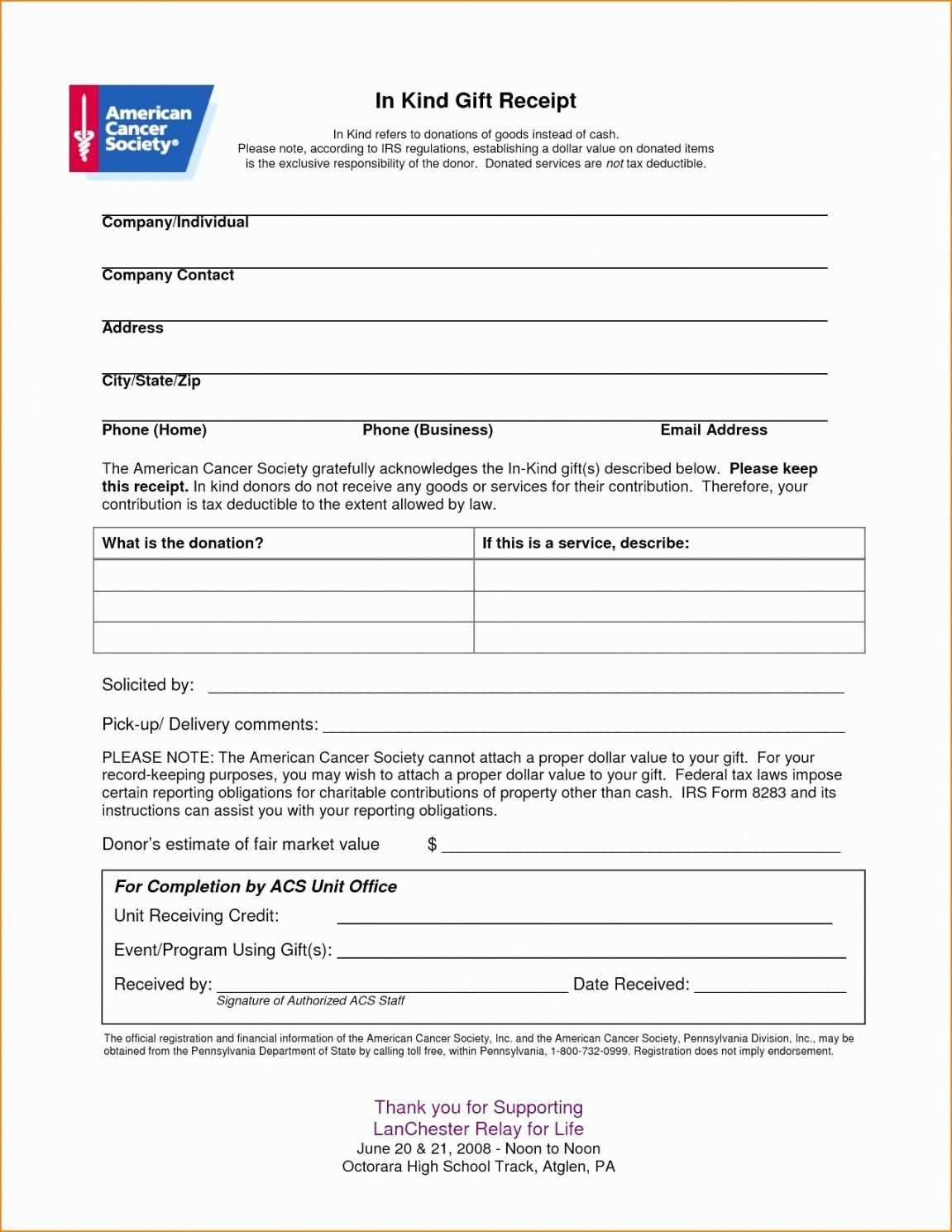

- Statement of No Goods or Services Provided: If no goods or services were exchanged for the donation, provide a clear statement of this.

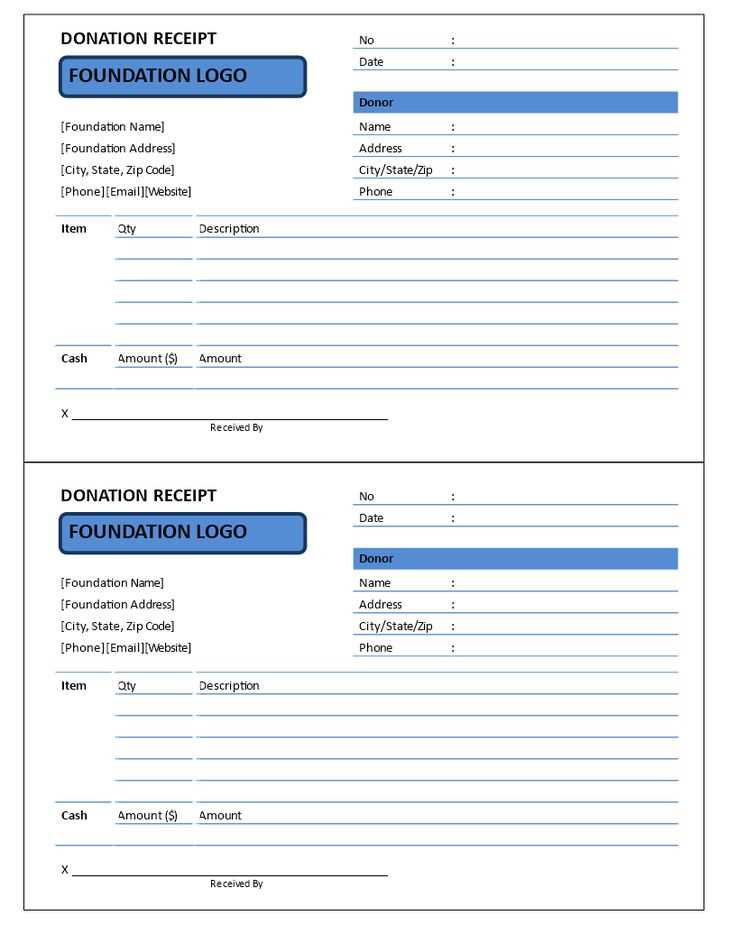

Format and Presentation

To make the receipt professional and easily readable, keep it simple and straightforward:

- Header: Place your organization’s name and logo at the top. This reinforces credibility.

- Receipt Body: Organize the details logically, starting with organization and donor information, followed by donation specifics and any legal disclaimers.

- Footer: Include your contact details and any additional tax disclaimers or acknowledgments required by local laws.

Example Template

Below is a basic donor tax receipt template that can be customized for your needs:

----------------------------------------- [Organization Name] [Address] [Phone Number] | [Email Address] [Tax ID Number] Donor Information: Name: [Donor Name] Address: [Donor Address] Donation Information: Date of Donation: [Date] Donation Type: [Cash/Goods/Services] Amount: [$Amount] Receipt Number: [Unique Receipt Number] Thank you for your generous donation! [Organization Name] affirms that no goods or services were provided in exchange for this donation. -----------------------------------------

Tax Compliance

Ensure that your receipt complies with local tax regulations. Some regions may require additional information or specific language to validate donations. Stay informed on these requirements to ensure that your receipts are legally valid and will be accepted by tax authorities.

Donor Tax Receipt Template: A Practical Guide

Key Elements of a Donor Receipt

How to Include Donor Details Correctly

Formatting Donation Amounts and Dates Properly

Receipts for Different Donation Types

Ensuring Compliance with Local Tax Regulations

Best Practices for Digital and Physical Receipts

When preparing a donor tax receipt, focus on accuracy and clarity. Start with essential donor details, including their full name and address. This information ensures that the receipt is traceable and supports tax deductions. For businesses, include the official business name and tax identification number.

How to Include Donor Details Correctly

Donor names should be written as they appear in official documents. For joint donations, list both names and specify the share of the donation each contributed, if necessary. Double-check spelling and formatting to avoid any issues when donors claim deductions. For international donations, include the country and any applicable regional codes for tax purposes.

Formatting Donation Amounts and Dates Properly

Clearly state the donation amount in both words and figures to avoid confusion. If the donor provided goods or services in exchange for the donation, specify the fair market value of these items. Record the donation date accurately, using the full date format to prevent misunderstandings during tax filing. For recurring donations, specify the donation frequency and the total amount given during the tax year.

Different types of donations require specific handling. Cash donations are straightforward, but if the donation is in-kind (such as goods or services), provide a description and estimated value. This helps donors claim the correct deductions. For non-cash donations, include the date the donation was received and clarify its value based on fair market assessments.

Ensure the receipt complies with local tax regulations, such as including an organization’s tax-exempt status number or relevant tax authority reference. The receipt must also be signed by an authorized individual from your organization to validate it as an official record for the donor.

Whether issuing digital or physical receipts, keep them accessible and easily retrievable. For digital formats, ensure the receipt is available as a PDF or another printable format, and include secure storage for both the donor and your organization’s records. For physical receipts, provide clear printing and mailing instructions to guarantee timely delivery.