If you need a quick and reliable way to create receipts, using a downloadable template is the most practical option. These templates provide a ready-to-use structure, allowing you to simply fill in the details without worrying about formatting or design. You can choose from various templates that suit your business or personal needs.

Most receipt templates are designed with the core elements you need, such as the transaction date, product/service description, amount, and payment method. Some templates even include additional features like tax calculations or the option to include custom logos. This ensures that you can provide a professional and consistent record of transactions.

Many downloadable templates come in different formats, including Word, Excel, and PDF, giving you flexibility in how you manage your receipts. Whether you’re handling a one-time transaction or ongoing payments, these templates are easy to use and can save you significant time.

Here’s the revised version:

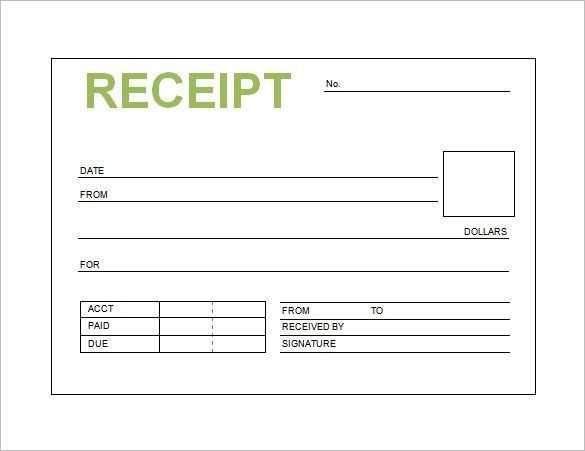

To create a professional receipt, begin by including the essential details: the company name, contact information, and a clear invoice number. Ensure the date is accurate, as it helps both parties track the transaction.

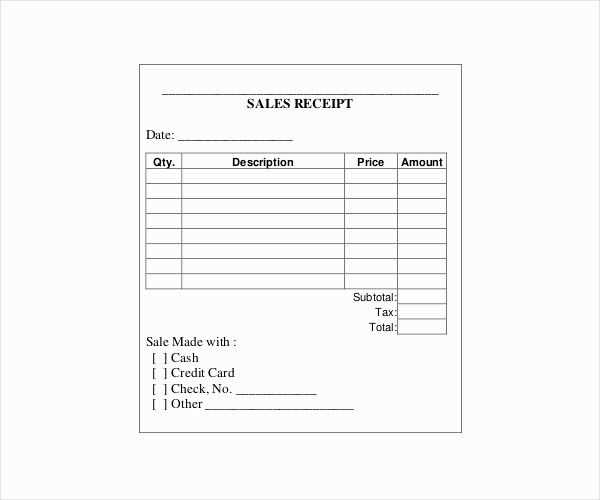

Key Sections to Include

In the receipt, clearly list the products or services provided, along with their corresponding prices. Make sure taxes, discounts, or additional fees are included in a separate line for transparency. Add the total amount to avoid confusion.

Final Steps

After filling out the necessary information, check for any mistakes. It’s a good idea to add payment method details (e.g., credit card, cash) for completeness. Conclude with a thank-you note or a simple “Payment Received” statement.

- Downloadable Receipt Design Template

Use a clean, professional layout that includes all the necessary details: company name, receipt number, date, item description, quantity, unit price, total amount, and payment method. Ensure proper alignment and spacing to improve readability.

- Choose a simple, easy-to-read font like Arial or Helvetica. Avoid overly decorative fonts that can hinder clarity.

- Design sections with clear headers for each category (e.g., “Item Details,” “Total Payment”). Use bold text to highlight key information.

- Ensure there’s enough white space between sections to give the design a clean, uncluttered look.

- Incorporate your company’s logo and contact details at the top for professional branding.

- Leave space at the bottom for optional notes or special offers, giving room for customization without overwhelming the main content.

Downloadable templates should be in a widely accessible format like PDF or Word to ensure compatibility across devices. Make sure the template is customizable so users can fill in their specific information easily.

Adjusting your receipt design is a straightforward process that can significantly impact your customer experience. Begin by including your business name and logo at the top of the receipt. This not only builds brand recognition but also makes the receipt feel official and personalized for your customers.

Focus on Clarity and Simplicity

Keep the layout clean and organized. Avoid overcrowding the receipt with unnecessary information. List purchased items, quantities, prices, and any discounts clearly. Use a simple font that’s easy to read, even on smaller screens or paper. This helps customers quickly review their transactions.

Incorporate Your Contact Details

Include a section with your business’s contact information at the bottom. Add your website, phone number, or email for customers to reach out in case of issues. You can also add social media handles or links to your customer service page to promote engagement.

PDF is the most widely used file format for downloadable receipt templates. It ensures consistent layout across all devices and platforms, making it easy to print and share. PDFs can be filled out electronically or printed out for manual entry, offering great versatility.

Why Choose PDF?

With its universal compatibility, PDF guarantees the receipt will appear exactly as intended, without worrying about font changes or layout issues. Most users can view PDF files without needing additional software, as they are supported by default on most operating systems.

Other Suitable Formats

Excel (XLSX) is another viable option for receipts that require calculations or customizable data fields. It allows for easy editing and dynamic adjustments but may cause formatting issues when viewed on unsupported software.

CSV is a lightweight format for receipts that focus on transaction data. While it lacks advanced formatting, it’s easy to import into other applications, particularly for tracking purchases or integrating into accounting software.

Word (DOCX) files offer some flexibility with formatting, but they are more prone to rendering inconsistencies, especially if opened in different word processing applications. This format is less secure than PDF, making it a less ideal choice for sensitive transaction data.

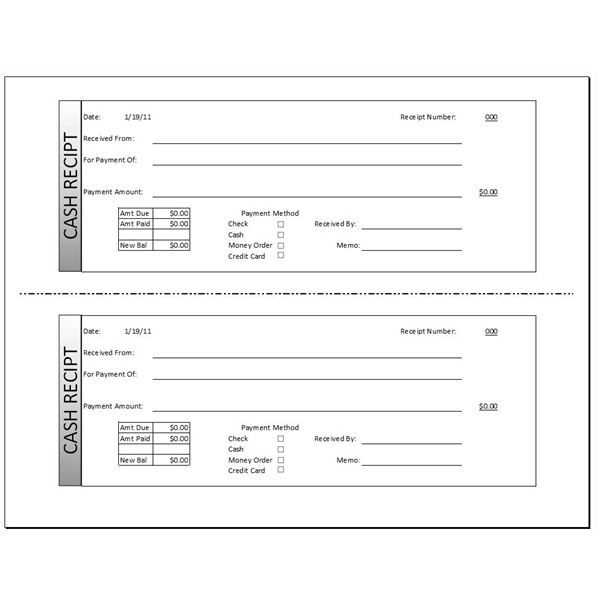

First, identify the payment method used by your customer. This could be a credit card, bank transfer, cash, or any other form of payment. Make sure to specify this clearly on the receipt.

Next, include the transaction amount. Indicate the exact total paid, breaking it down if necessary (e.g., subtotal, taxes, discounts). This will ensure transparency and clarity for both parties.

Then, add the date of the payment. Include the precise date and time, ensuring it aligns with the transaction record. This serves as a reference for both the customer and your business.

Provide any relevant transaction details. For credit card payments, include the last four digits of the card number or a payment ID for verification. For bank transfers, list the reference number or the account involved.

Finally, include any additional information that might be helpful, such as the method of payment authorization (if applicable) or any special conditions tied to the transaction.

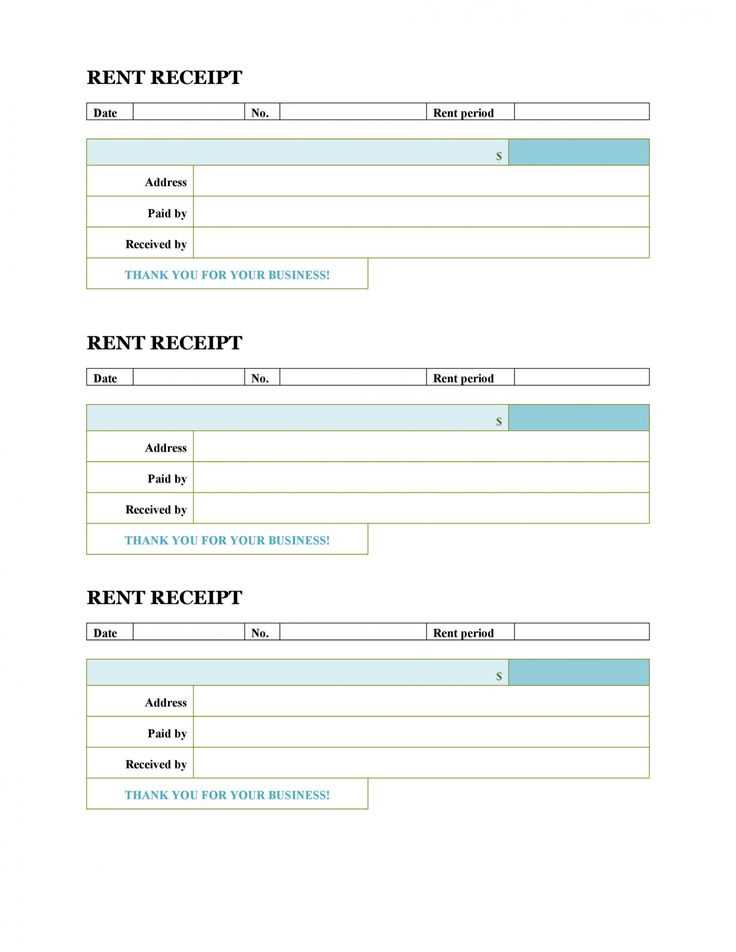

Always include clear tax information on your receipts to ensure transparency for your customers. This includes specifying the tax rate, the total amount of tax charged, and whether the tax is included in the price or added separately.

Displaying Tax Rate and Total Tax

State the percentage of the tax rate clearly. For example, “Sales Tax: 7%”. If the tax is applied to individual items, include the specific amount for each item as well as the total tax at the bottom of the receipt.

Indicating Tax Inclusion or Addition

Be explicit about whether the tax is already included in the listed price or added separately at the checkout. For example, “Price includes tax” or “Tax added at checkout”. This prevents confusion and ensures compliance with tax regulations.

Include clear terms and conditions in your receipt template. Specify what the document represents and ensure that it complies with local tax laws and industry standards. For example, include your business name, address, tax identification number, and any necessary licensing information to avoid potential legal issues. Also, ensure the template allows for accurate reporting and auditing by including required fields such as the transaction date, amounts, and item descriptions.

Check your jurisdiction’s requirements for electronic receipts. Some regions require electronic versions of receipts to meet specific standards for legal validity. If you offer downloadable templates, ensure they align with these requirements, especially if used for tax reporting or customer disputes. Some businesses may also need to include an e-signature or digital timestamp to authenticate receipts.

| Required Information | Why It Matters |

|---|---|

| Business Name and Address | Confirms the legitimacy of the transaction and provides a point of contact for the customer. |

| Tax Identification Number | Ensures compliance with tax authorities and verifies your business status. |

| Transaction Date | Important for audit trails and tax purposes. |

| Item Descriptions and Amounts | Needed for both financial accuracy and potential dispute resolution. |

Lastly, confirm that your receipt template includes a clause that addresses how customer information is handled. This can prevent issues related to data protection laws such as GDPR or CCPA, ensuring that your template respects customer privacy and complies with data regulations.

Save your customized receipt design in a format that suits your needs, such as PDF or PNG. These formats ensure that your design remains intact, whether printed or sent digitally.

- Saving as PDF: This format preserves your layout and makes it easy to share via email or print. Most receipt design tools allow you to export directly to PDF.

- Saving as PNG: A good option for image-based receipts, particularly for online or digital transactions. PNG ensures the highest quality, especially for logos and detailed graphics.

After saving, sharing your receipt is straightforward. You can attach the saved file to an email, upload it to cloud storage for easy access, or integrate it into your website’s automated system. Choose the method that works best for your business or personal preferences.

- Sharing via Email: Attach the saved receipt to an email. This works well for individual transactions or one-off sales.

- Using Cloud Storage: Upload your receipt to a platform like Google Drive or Dropbox. Share the link for easy access from any device.

- Integration with Payment Systems: Some online stores or payment platforms allow you to automatically send receipts to customers. This can simplify the process and improve customer experience.

For a well-organized and clear downloadable receipt template, begin with a simple structure that includes the following fields:

- Company or business name

- Receipt number for tracking

- Date of purchase or transaction

- Item description and quantity

- Total amount due

- Payment method

Clear and Concise Formatting

Organize the data in a clean, legible format. Use bullet points for item details, ensuring that the total is prominently displayed. This helps users quickly review their purchase details without unnecessary clutter.

Customizing for Your Needs

If you’re creating a template for specific business needs, adjust the sections accordingly. For example, you might add taxes or apply discounts to the total. This will provide both the sender and receiver with a transparent breakdown of charges.