If you’re managing payments for drivers in India, having a clear and professional salary receipt template is a must. A well-structured salary receipt helps maintain transparency and ensures both employers and employees have a record of payments made. It also serves as an important document for accounting and tax purposes.

The template should include key details such as the driver’s name, payment period, total salary, deductions (if any), and the final amount paid. Ensure it specifies the mode of payment (cash, cheque, or bank transfer) and the date of payment. By providing this clarity, you help the driver confirm the terms of the payment and ensure accuracy in financial records.

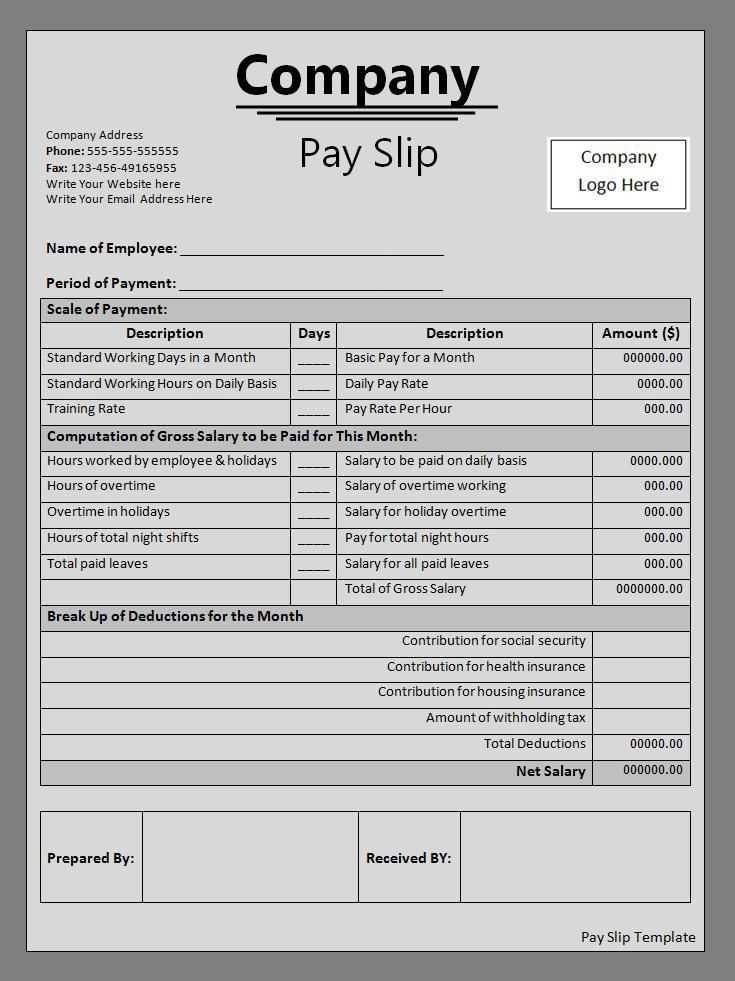

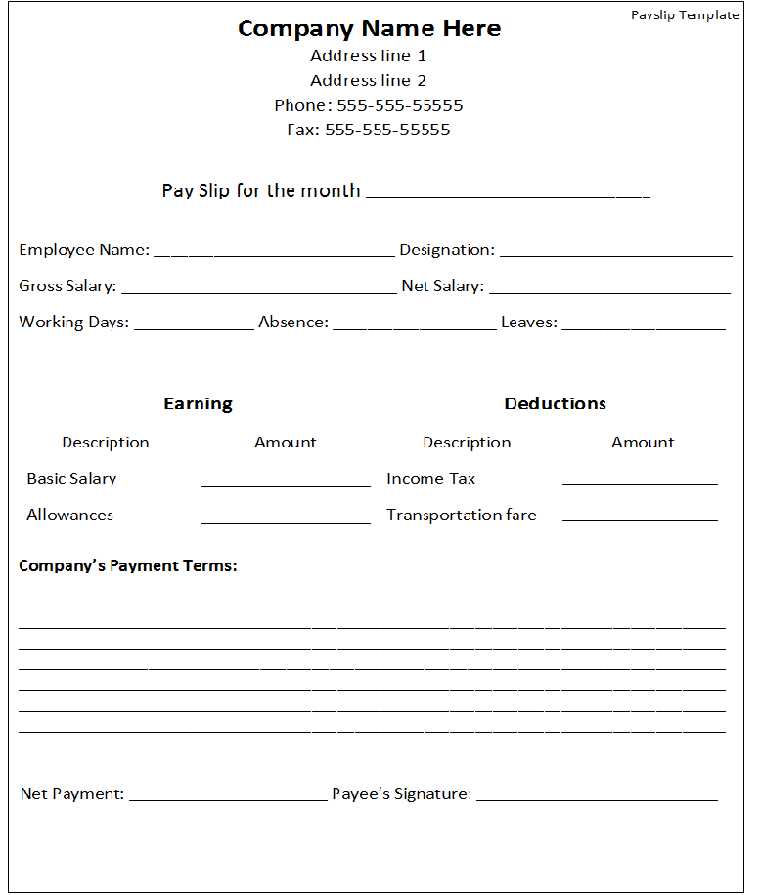

For a smooth experience, you can use a simple format with clearly labeled sections. Include a section for any allowances or overtime payments, along with mandatory statutory deductions such as Provident Fund (PF) or Employee State Insurance (ESI), if applicable. Adding a space for the employer’s signature will also give the receipt an official touch.

Whether you are a small business owner or part of a larger organization, using a consistent and professional driver salary receipt template will streamline your payment process, prevent misunderstandings, and provide a transparent transaction record for both parties.

Here are the corrected lines with minimal repetition:

Ensure the salary receipt includes all necessary fields. Here’s a sample format to follow:

| Field | Description |

|---|---|

| Date | The date of payment |

| Driver Name | Name of the driver receiving the payment |

| Vehicle Number | Registration number of the vehicle |

| Hours Worked | Total hours worked during the payment period |

| Basic Salary | Fixed salary before any deductions |

| Incentives | Any bonuses or performance-related incentives |

| Deduction | Any deductions such as taxes or fines |

| Total Salary | The final amount after adding incentives and deducting any costs |

| Signature | Both the driver’s and the employer’s signature for verification |

Make sure to include all these elements for clarity and transparency. This format helps both the employer and the driver stay aligned on the payment details.

- Driver Salary Receipt Template India

Creating a driver salary receipt template for India requires including key details that make it easy to track and verify payments. The receipt should clearly outline the payment amount, deductions, and any applicable taxes, along with the driver’s basic information.

Key Components to Include:

- Driver Details: Full name, contact details, and employee ID (if applicable).

- Employer Information: The company name, address, and contact number.

- Payment Date: The date the salary is issued.

- Breakdown of Salary: Basic salary, overtime pay, bonuses, allowances (such as fuel, travel), and any other applicable payments.

- Deductions: Provide details on deductions such as provident fund (PF), professional tax (PT), or any other deductions.

- Net Salary: The final amount after all deductions.

- Signature: Both the employer and employee’s signature for verification.

Use a simple table format for easy reading, ensuring that every section is clearly visible. Make sure the net salary figure is prominent to avoid confusion. It’s advisable to use clear labels for each category to prevent misunderstandings.

To create the receipt, you can use software like Microsoft Word or Excel, or even generate it using online templates. Ensure that the format is easy to customize in case any changes to salary structure or deductions are made in the future.

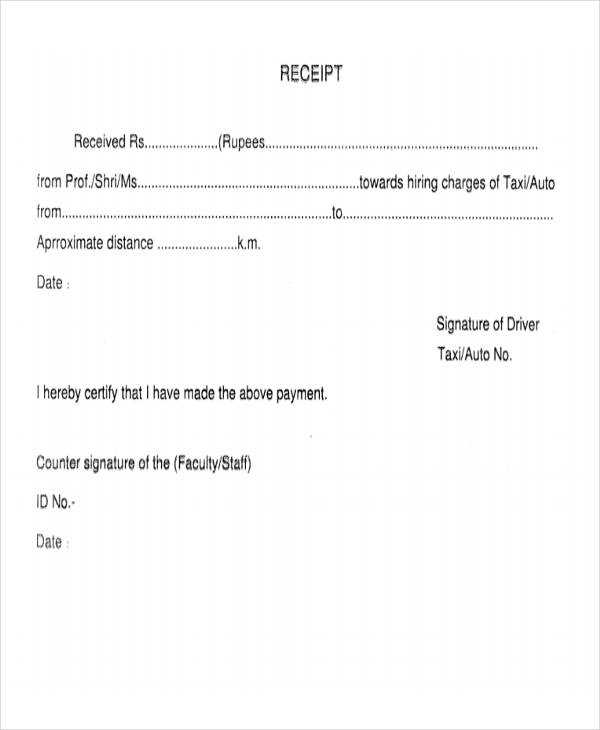

To create a driver salary receipt in India, begin with the employer’s name, address, and contact details at the top of the document. Clearly mention the salary month, payment date, and the driver’s name. List the total salary amount, breaking it down into basic pay, allowances, and deductions if applicable. Include any additional payments, such as overtime or bonuses, in separate lines for clarity.

Ensure you mention the payment method, whether it’s cash, cheque, or bank transfer. Also, provide a unique receipt number for record-keeping. If the driver is subject to any deductions like PF (Provident Fund) or taxes, make sure to list those amounts and explain the purpose of each deduction.

Sign the receipt at the bottom with the employer’s signature and include a space for the driver’s signature to confirm receipt of the payment. This step avoids any confusion in case of future disputes over salary payments.

Lastly, keep the receipt format simple but thorough, ensuring it complies with any local regulatory requirements or tax regulations for transparency and accuracy.

A salary receipt for drivers in India should include specific details to ensure transparency and accuracy. Here are the key elements that should be present:

- Driver’s Name: Include the full name of the driver receiving the payment.

- Company/Employer Details: Mention the name, address, and contact details of the employer or company providing the salary.

- Salary Date: Clearly state the date when the salary is being paid.

- Salary Breakdown: List the different components of the salary, such as basic pay, allowances (fuel, overtime, etc.), and deductions (taxes, insurance, etc.).

- Gross Salary: Show the total salary before any deductions.

- Deductions: Clearly itemize any deductions made from the salary, such as taxes, provident fund, or loan repayments.

- Net Salary: Provide the final amount after all deductions have been made.

- Payment Method: Indicate whether the salary was paid in cash, bank transfer, or any other method.

- Employer’s Signature: Include a space for the employer’s signature to validate the payment.

- Driver’s Acknowledgment: Provide a section for the driver to sign or acknowledge the receipt of the salary.

Ensure that the salary receipt is clear, concise, and free of any errors. This helps maintain good employer-employee relations and ensures compliance with labor regulations in India.

Salary receipts for drivers in India must comply with key legal standards to ensure transparency and prevent disputes. The receipt should clearly state the gross salary, deductions, and net payment. It must also mention any bonuses or allowances that are part of the compensation package.

Key Details to Include in a Salary Receipt

A salary receipt must list the following information:

- Driver’s name, designation, and employment ID.

- Payment period (weekly, bi-weekly, or monthly).

- Gross salary, detailing the basic pay and any other allowances.

- Details of statutory deductions like Provident Fund (PF), Employee State Insurance (ESI), and Tax Deducted at Source (TDS), if applicable.

- Net salary after all deductions.

- Overtime payments, if applicable, with the number of hours worked and the rate.

Legal Compliance

Under the Payment of Wages Act, 1936, employers must pay wages to employees, including drivers, on time and in full. Salary receipts must reflect these payments accurately. The receipt should also align with the provisions of the Minimum Wages Act, 1948, which ensures that the salary paid meets or exceeds the minimum wage set by the government for the region.

Employers must issue salary receipts regularly, ensuring that no payments are delayed beyond the legally stipulated time frame. Failure to provide accurate salary receipts may lead to legal challenges from drivers, particularly in cases involving unpaid wages or disputes over deductions.

Driver Salary Receipt Template in India

Ensure clarity and transparency in your driver’s salary receipt with these key elements:

- Company Information: Include the company’s name, address, and contact details at the top of the receipt.

- Driver’s Information: Add the driver’s name, ID number, and contact details for reference.

- Salary Breakdown: Specify the salary components such as base salary, overtime, bonuses, and deductions.

- Payment Date: Clearly mention the date the salary is being paid, as well as the salary period it covers.

- Signatures: Both the employer and driver should sign the receipt to confirm mutual agreement on the details.

Additional Details to Include

- Bank Details: If payment is made via bank transfer, include the bank name, account number, and transaction reference.

- Leave Adjustments: Mention any unpaid or paid leave adjustments if applicable.

Make sure the format is professional and easy to read, offering all necessary details without clutter.