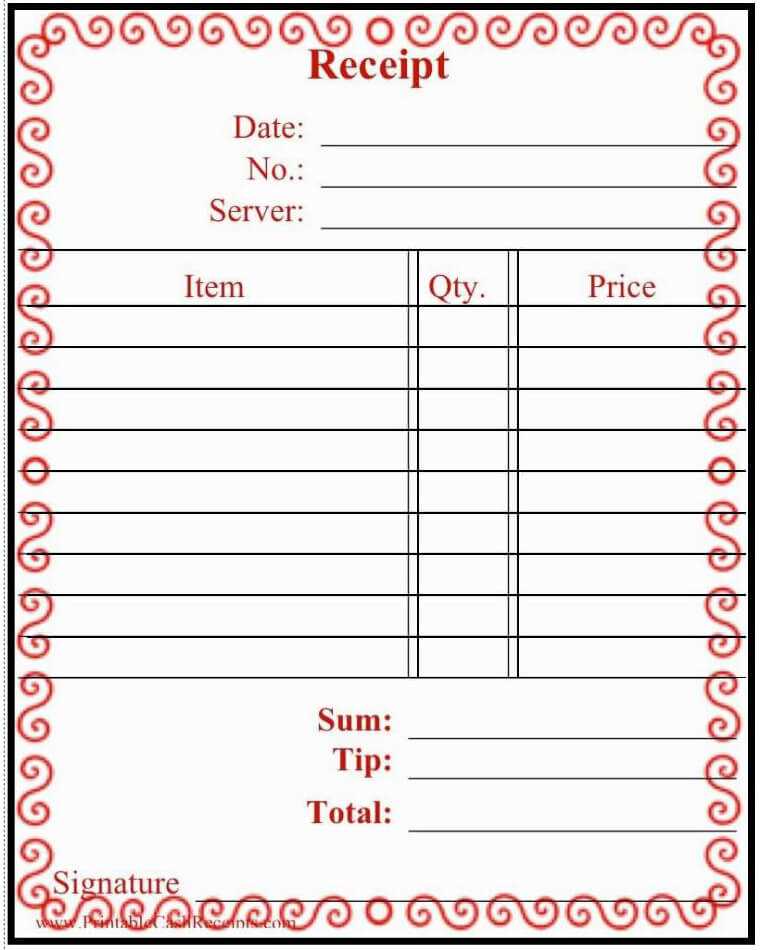

Adjusting your bill receipt template is simple, but it can make a significant impact on your business’s professionalism. To begin, focus on ensuring that the most important details, such as the company name, contact information, and transaction breakdown, are clearly visible. This will help clients easily understand their purchases.

Make sure to include customizable fields for client names, addresses, and dates. This flexibility makes it easier to tailor each receipt to the transaction. Avoid cluttering the template with unnecessary information. Keep it clean and organized, prioritizing readability.

Don’t forget to add a section for tax calculations if applicable. A clear breakdown of taxes will help avoid confusion and ensure transparency in your billing process. Use consistent formatting for each line item to maintain a professional appearance. Simple and straightforward designs tend to be the most effective.

Edit Bill Receipt Template

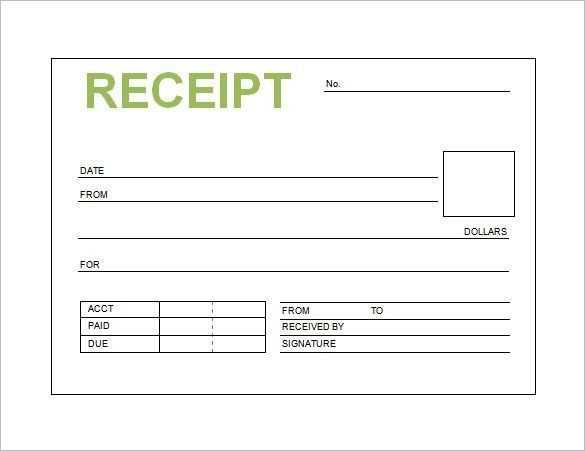

To edit a bill receipt template, begin by opening the template file in your preferred text editor or word processor. Ensure that you have the correct software to edit the document, whether it’s a .docx, .pdf, or any other format.

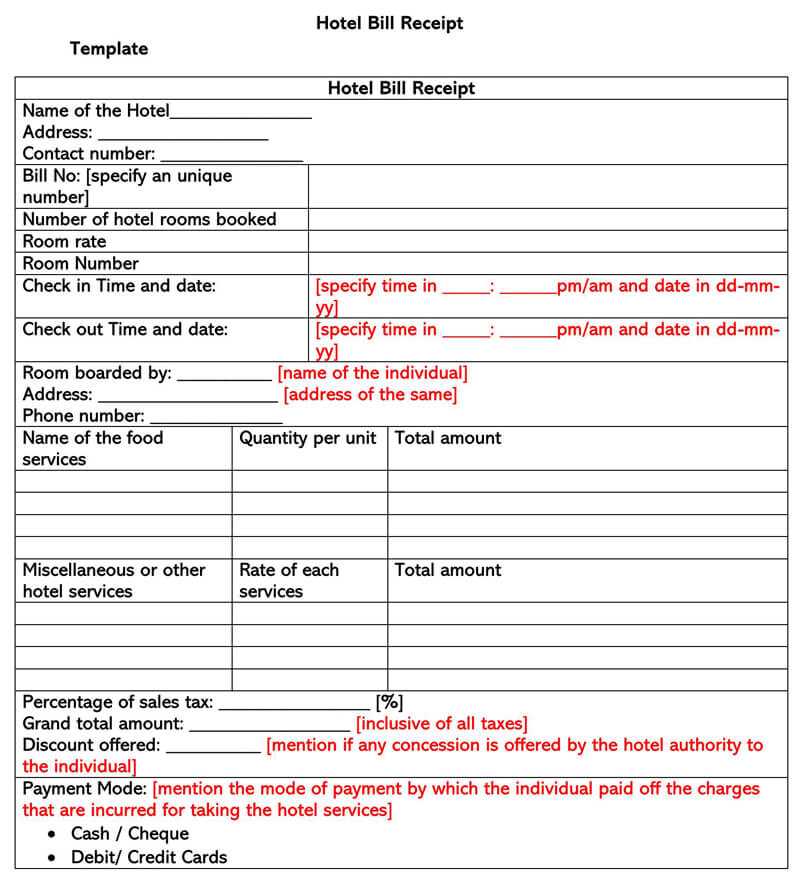

Modify the header section by including company details such as the name, address, contact information, and logo. This allows for consistent branding and ensures clarity for the customer.

In the body, adjust the fields for the transaction details. These typically include the item or service description, quantity, unit price, and total cost. Make sure the layout is clean and that each line is easily readable. You can add or remove columns based on your specific needs, such as taxes or discounts.

If necessary, include additional fields for payment methods, due dates, and any notes or terms. Double-check that all amounts are correctly calculated and that the receipt reflects the correct tax rates or fees applicable to the transaction.

Finally, save the template in an editable format so it can be used repeatedly without losing the layout or important details. If you plan to share the receipt electronically, save a copy in a .pdf format to maintain its formatting across different devices.

Customize Header Information for Better Branding

To make your bill receipt template stand out, focus on personalizing the header section with key brand elements. Include your company logo in a prominent position, ensuring it’s clear and high-quality. Select a color scheme that matches your brand’s visual identity. This consistency will build recognition and trust with customers.

Logo and Contact Details

Place your logo at the top left or center of the header. Keep it proportional to the space to avoid overwhelming other content. Directly beneath the logo, include your contact details, such as phone number, email, and website. Use a readable font size to make sure customers can easily reach out if needed.

Company Name and Tagline

Your company name should be prominent in the header, typically in a larger font. If your brand uses a tagline, consider placing it underneath the name in a smaller, italicized font. This reinforces your brand message and adds personality to the receipt.

Adjust Itemized List Layout for Improved Clarity

Focus on structuring the itemized list in a way that makes each entry easy to read and understand at a glance. Organize the content so that important details stand out, while minimizing clutter. A well-organized layout enhances the user experience and reduces confusion.

1. Use Clear and Descriptive Labels

- Ensure each list item is labeled clearly with concise, descriptive titles.

- Avoid vague terms that may cause uncertainty about the item or charge.

- Use consistent terminology throughout the document to maintain coherence.

2. Align Items Logically

- Group related items together to make the list easier to follow.

- Consider separating goods and services or different types of charges into distinct sections.

- Align prices, quantities, and other numeric data in a way that minimizes the need for additional mental calculations.

By simplifying the structure and focusing on clarity, you’ll create a more user-friendly receipt layout that improves readability and reduces the potential for errors.

Integrate Payment Details and Taxes for Accurate Records

Ensure that payment details and taxes are accurately reflected in your bill receipt template. Begin by clearly specifying the payment method, transaction ID, and payment date. This information helps track financial records and provides transparency for both parties.

Include Tax Breakdown

List applicable taxes separately, including any local or national tax rates. This breakdown simplifies auditing and clarifies how the final amount is calculated. Include fields for both pre-tax and post-tax totals for a complete view of the transaction.

Link Payment and Tax Information

Integrate payment amounts with the corresponding tax calculations to avoid discrepancies. Ensure your system automatically updates totals based on tax rates, ensuring consistency in records. Double-check that your template calculates taxes in real-time, reducing errors.