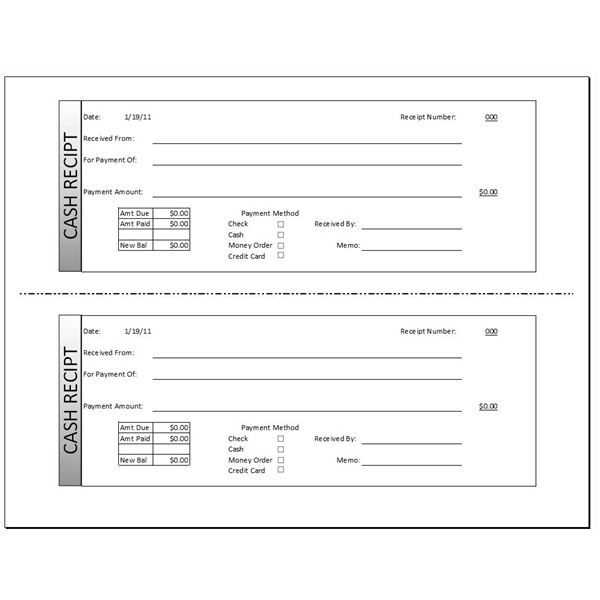

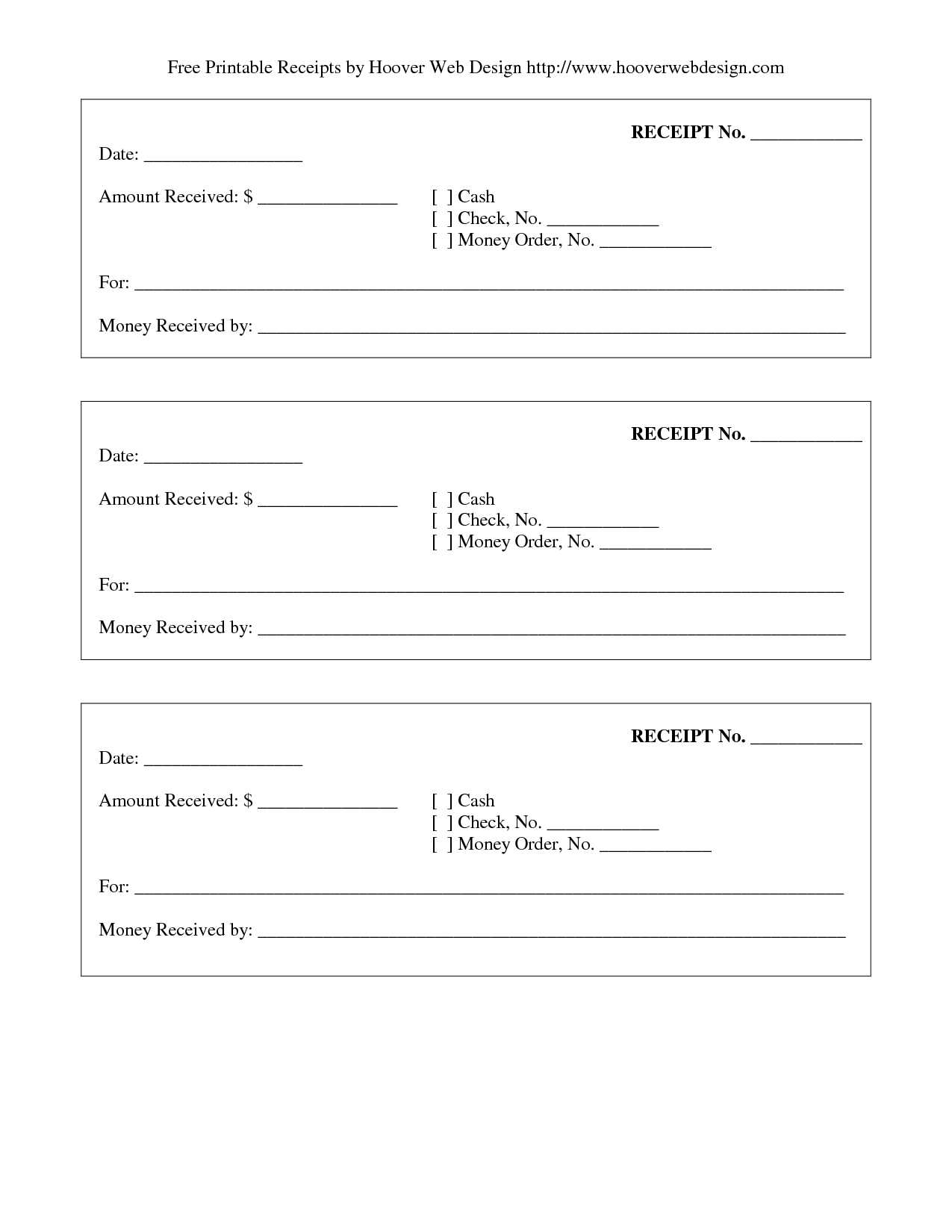

Choose a flexible receipt template that allows quick modifications to transaction details. An ideal template includes fields for merchant name, transaction date, total amount, and payment method. Ensure it supports text adjustments to correct errors or add missing information.

A well-structured format should also include sections for tax calculations, gratuity, and itemized purchases. If the receipt needs to comply with specific business standards, verify that the template follows legal and accounting requirements. For digital use, consider a format that supports electronic signatures and PDF exports.

For businesses handling frequent transactions, a customizable template saves time by automating repetitive data entry. Many options come with preset formulas, automatic date generation, and structured layouts for easy readability. Whether used for internal records or customer invoices, a properly designed receipt template ensures clarity and accuracy.

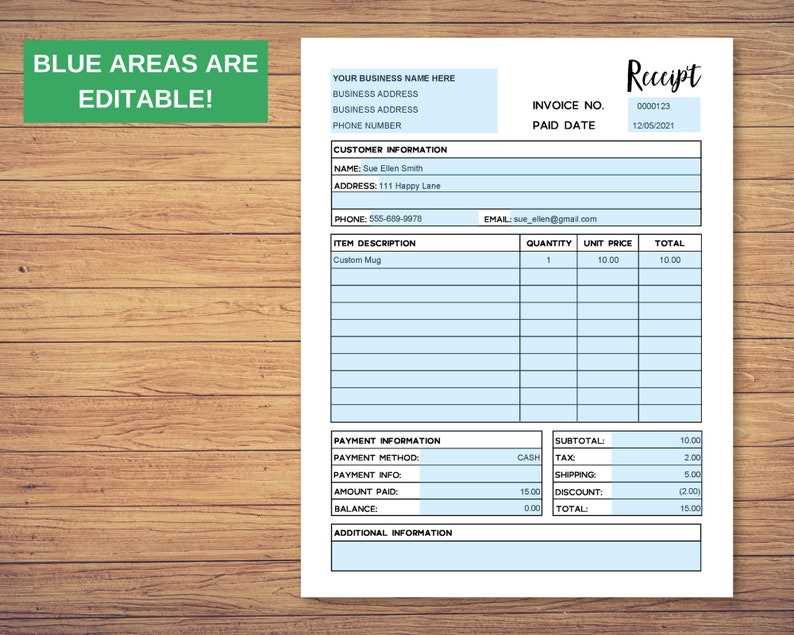

Editable Credit Card Receipt Template

Ensure clarity and accuracy by structuring the receipt with well-defined sections. Clearly separate transaction details, business information, and customer data to enhance readability.

- Business Details: Include the company name, address, contact number, and tax ID if applicable.

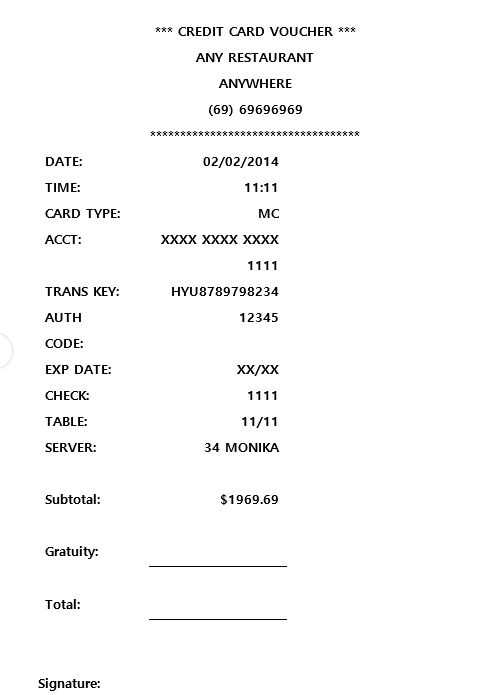

- Transaction Information: Display the date, time, receipt number, and payment method to ensure easy reference.

- Itemized List: Break down purchased items or services with descriptions, quantities, and prices for transparency.

- Tax and Total: Calculate applicable taxes separately and present the final amount clearly.

- Authorization and Signatures: If required, leave space for customer signatures or authorization codes.

Use a structured layout with editable fields to streamline modifications. Ensure fields for amounts automatically update calculations when values change. A well-designed template saves time and minimizes errors.

Key Elements to Include in a Customizable Receipt

Ensure the receipt clearly displays the merchant’s name, address, and contact details. This information establishes trust and helps with future inquiries.

Include a unique transaction ID to facilitate tracking and dispute resolution. A sequential or randomly generated number prevents duplication.

Specify the date and time of the transaction. Accurate timestamps are useful for bookkeeping and resolving discrepancies.

List purchased items with descriptions, quantities, and individual prices. Summarizing total costs with applicable taxes and discounts enhances clarity.

Provide payment method details, such as the last four digits of a card number or confirmation of cash payment. This reassures customers and simplifies record-keeping.

Offer space for custom notes, return policies, or legal disclaimers. Tailoring receipts to business needs improves communication and customer satisfaction.

Choosing the Right Format for Your Needs

PDF ensures consistency across devices and printers, preserving the original layout. If you need a polished, unalterable version for professional use, this format is the best choice.

Word and Google Docs allow easy editing, making them ideal for receipts that require frequent updates. Use these formats if customization is a priority.

Excel provides structured data with automated calculations, useful for receipts that include tax, discounts, or itemized breakdowns. Choose this format for managing numbers efficiently.

HTML offers flexibility for online use, allowing integration with digital records or automated systems. If your workflow involves web-based solutions, this is a practical option.

Select a format based on how often you need to modify receipts, the level of customization required, and whether digital or print compatibility matters most.

Ensuring Compliance with Legal and Business Standards

Verify that all required details, such as merchant name, transaction amount, date, and authorization code, appear on the receipt. Missing or incorrect information can lead to disputes and chargebacks.

Meeting Tax and Financial Regulations

Include applicable tax breakdowns to align with regional tax laws. Ensure storage policies comply with financial regulations, keeping records for the mandated period to support audits or customer inquiries.

Protecting Sensitive Customer Data

Limit displayed card details to the last four digits, following PCI DSS guidelines. Avoid storing full card numbers and CVV codes to reduce fraud risks and maintain compliance with data protection laws.

Customization Options for Branding and Readability

Adjust the layout to reflect your brand’s identity while maintaining clarity. Use a legible font, ideally sans-serif, with a minimum size of 10pt. Avoid overly stylized typefaces that may hinder readability.

Brand Elements

Integrate your logo at the top-left or center for immediate recognition. Ensure it has a transparent background for seamless integration. Stick to brand colors but maintain sufficient contrast between text and background.

Structured Information

Organize details in a clear hierarchy. Group transaction details separately from customer information. Use bold or slightly larger text for key elements like total amount and date.

| Element | Customization Tip |

|---|---|

| Font | Sans-serif, at least 10pt |

| Logo Placement | Top-left or center with transparency |

| Color Scheme | Brand colors with high contrast |

| Key Information | Bold or larger font for total and date |

Use spacing effectively to prevent clutter. Increase line height slightly for better legibility. Keep unnecessary elements to a minimum, ensuring a clean, professional look.

Best Practices for Digital and Printed Versions

Ensure that the layout is clean and easy to read. Use clear fonts with appropriate spacing for both digital and printed versions. For digital formats, optimize for screen size and resolution, ensuring elements remain legible across devices.

Incorporate essential transaction details in a structured format, such as date, amount, and payment method, to improve clarity. Keep the design simple–avoid excessive logos or complex patterns that can distract from the information.

For print versions, select high-quality paper to maintain clarity, ensuring text and graphics remain sharp. Use black or dark-colored ink for better contrast, especially on colored backgrounds.

Enable adjustable fields for easy updates in editable templates, allowing users to quickly modify the necessary details. Provide space for customization, but avoid overcrowding the document with unnecessary fields.

For digital receipts, ensure that hyperlinks (if applicable) are functional, leading to relevant information such as payment verification or customer support. Test compatibility across different browsers and devices.

Common Mistakes to Avoid When Creating a Template

Start with clear, concise sections. Avoid cluttering the template with unnecessary elements that might confuse the user. Limit the use of excessive fonts, colors, or icons. A clean design ensures that important information stands out.

Don’t forget to account for different data formats. For example, ensure date formats, currency symbols, and tax fields are adaptable to different regions. This will help make the template versatile and reduce errors when users input data.

Leave space for customization, but don’t make it too complex. Overloading a template with too many customizable options can overwhelm the user and lead to mistakes. Focus on making essential areas adjustable, such as company name, address, and transaction details.

Ensure the alignment is consistent. Misaligned text, logos, or fields can make a receipt look unprofessional. Check that all elements are evenly spaced and visually balanced, creating a polished, professional appearance.

Test the template across multiple devices and software. Sometimes, elements that look fine on one platform may not translate well to another. Make sure the template works as expected on different screen sizes and formats.

Avoid hardcoding fixed data. Leave placeholders for dynamic content like transaction numbers or payment methods. This ensures that the template remains adaptable for various transactions and uses.