For quick and seamless transaction documentation, an editable receipt template is a practical tool. This template can be customized to fit various business needs, allowing you to generate receipts with accurate details in no time. You can input customer names, dates, items, prices, taxes, and payment methods, tailoring the document as required.

Using an editable receipt template saves time, reduces errors, and ensures consistency across transactions. Many templates are designed to be intuitive, so you don’t need any special skills to fill them out. Simply adjust fields, update values, and print or send the receipt digitally. It’s a convenient solution for freelancers, small businesses, or anyone managing payments.

Choose a template that aligns with your business style and branding. Most templates allow you to modify fonts, logos, and colors, ensuring a professional look for your receipts. Whether you’re offering products or services, an editable receipt template streamlines the process while maintaining clarity and accuracy in your records.

Editable Receipt Template: A Practical Guide

To create an editable receipt template, focus on flexibility and simplicity. Begin by choosing software that allows for easy customization, like Microsoft Word, Google Docs, or specialized receipt generator tools. This way, you can adjust the template to match your branding or specific requirements with minimal effort.

Design and Layout Considerations

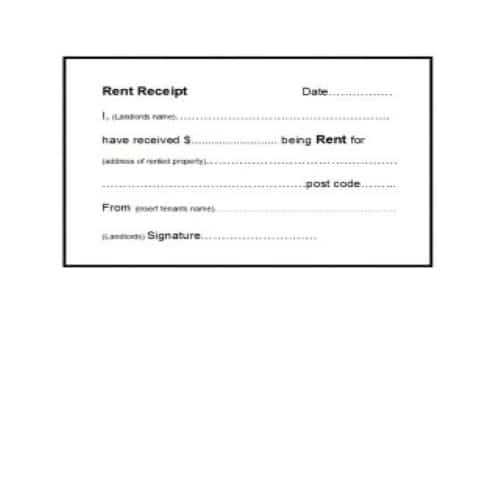

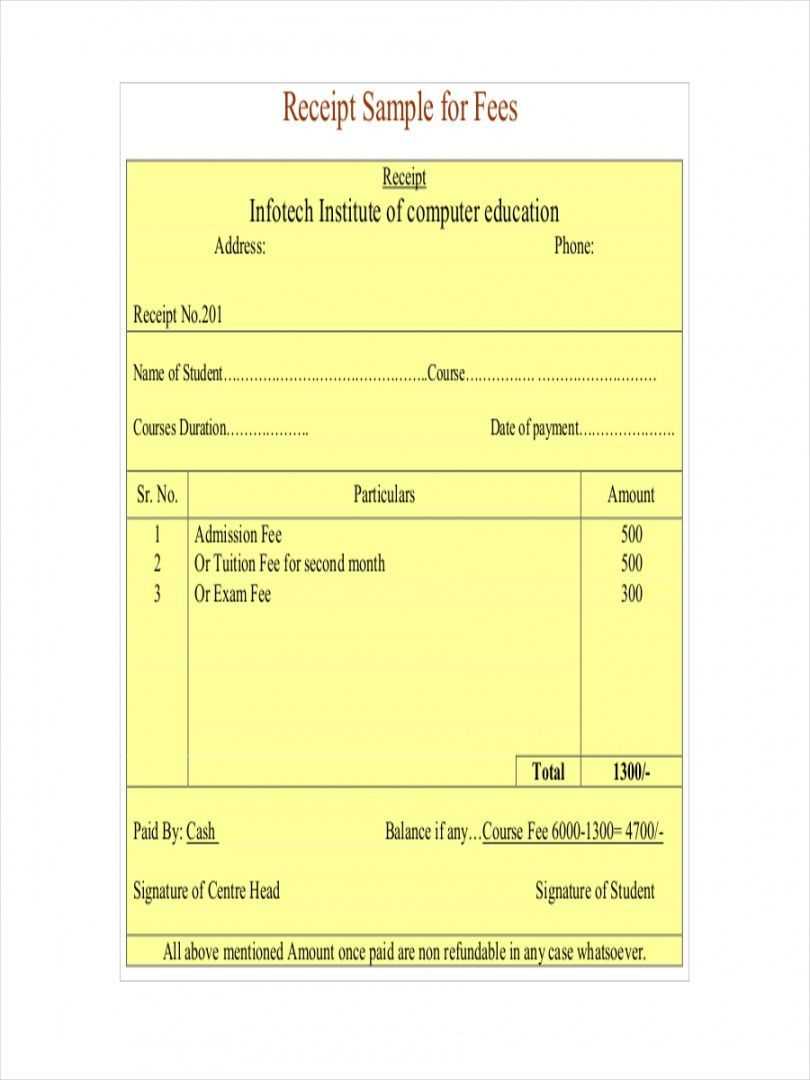

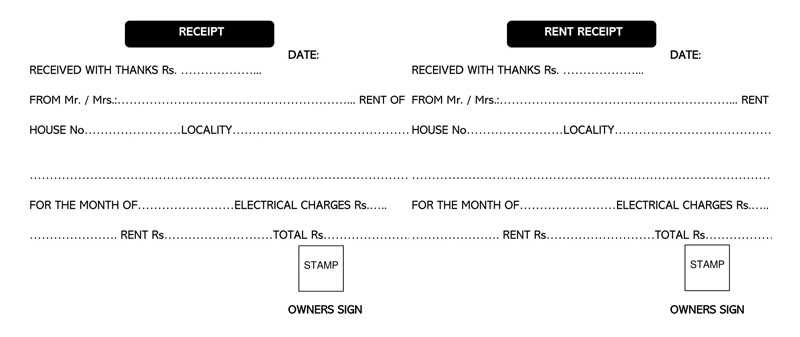

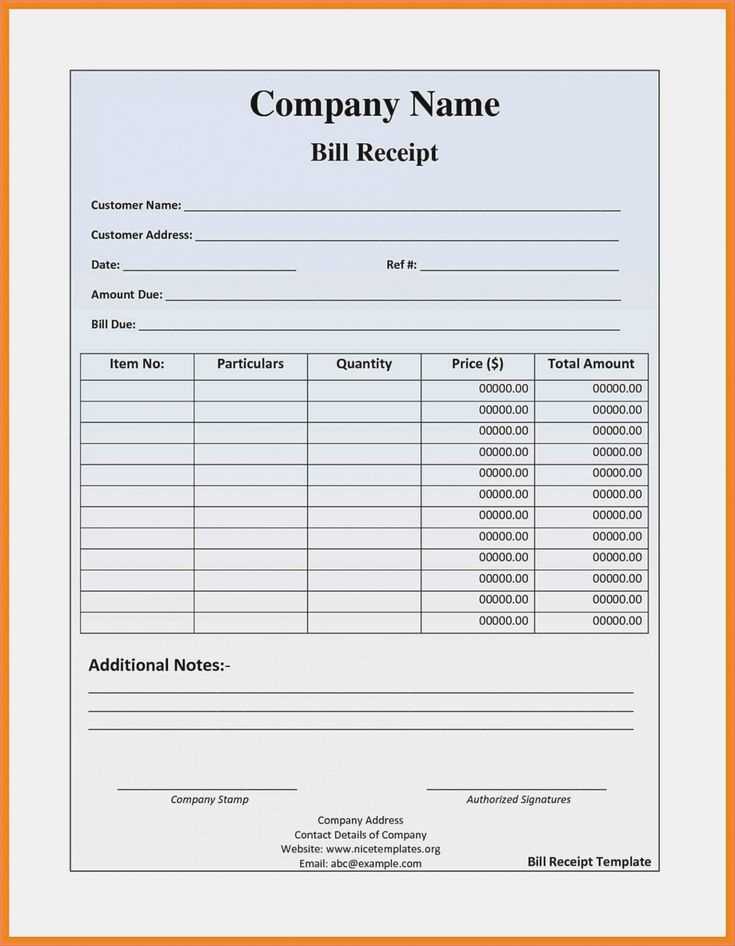

Ensure the layout is clean and easy to modify. The top section should include your business name, logo, and contact details. Below, add space for transaction information like the itemized list, price, and total amount. Incorporate lines or borders to separate sections, making it visually organized.

Customizable Fields

Editable templates should have designated fields for the customer’s name, address, date, and any other relevant details. These fields should be easily fillable, either as text boxes or blanks that can be typed into. A section for payment method and any taxes or discounts should also be included for clarity.

| Field | Purpose |

|---|---|

| Business Name & Logo | Personalizes the receipt and identifies the business |

| Item List | Details products or services provided |

| Total Amount | Summarizes the cost of the transaction |

| Payment Method | Indicates how the customer paid |

| Customer Info | Records customer details for future reference |

By focusing on these design principles, you can easily customize receipts to fit different business needs, all while maintaining a professional appearance. This approach saves time and ensures consistency in your transactions.

Choosing the Right Software for Editing Templates

Select software that supports flexible design tools and integrates easily with your workflow. Look for a program that offers drag-and-drop functionality, customizable text fields, and the ability to import logos and graphics seamlessly. Make sure it provides advanced formatting options, such as font customization and color schemes, to maintain your brand’s consistency.

Consider software with pre-built templates for receipts, as this saves time and offers a professional starting point. A good editor should also allow for quick adjustments, whether you’re editing fields, adding new sections, or aligning elements perfectly. Additionally, choose a program that exports files in common formats like PDF or PNG, ensuring compatibility with different platforms and printing services.

Software with cloud-based features can help you collaborate with team members in real time, making edits across devices whenever needed. Prioritize ease of use, especially if you’re working with a team that may not be tech-savvy. Testing a few options with free trials is a great way to determine which software meets your needs most effectively.

How to Customize Layout and Design Elements

Adjusting the layout of a receipt template requires careful attention to both the positioning and structure of key elements. Begin by deciding where to place the business logo, contact information, and itemized list. Ensure that these sections are clearly visible and balanced within the template.

Aligning Content for Clarity

For a clean look, align text and images to a grid. This improves readability and gives the receipt a more organized feel. You can choose either left or center alignment depending on the design goal, but avoid overuse of center alignment as it can create unnecessary spacing.

Customizing Typography

Choose fonts that complement the style of your brand. Stick with no more than two fonts to maintain visual consistency. Use larger text sizes for headings, such as the store name or transaction total, and smaller sizes for item descriptions. Make sure to adjust line spacing for easy reading, especially in itemized lists.

To highlight specific information, such as discounts or total amounts, use bold or italic text. These changes draw the eye to important areas without overwhelming the overall design.

Incorporating Taxes and Discounts into the Template

To include taxes and discounts in your receipt template, first create separate fields for both. For taxes, define the percentage rate that applies to the total amount. Use a calculation that multiplies the subtotal by the tax rate and displays it clearly as “Tax” or “VAT” on the receipt.

For discounts, decide whether they will be applied as a fixed amount or a percentage of the subtotal. Display the discount clearly and subtract it from the total before calculating taxes. If you offer different discount types (e.g., seasonal discounts or promotional offers), ensure these are listed separately, so customers can easily identify them.

Both taxes and discounts should be clearly labeled, and the final total should reflect the adjustments. Ensure the template dynamically updates to reflect changes in prices, taxes, or discounts automatically based on the inputs, making it easy for both you and your customers to track the financial details.

Ensuring Compatibility with Different Payment Systems

To achieve smooth integration with various payment systems, ensure your receipt template supports multiple transaction formats. This ensures accurate data capture across different methods of payment.

- Use standardized fields: Include common fields such as transaction ID, payment method, and total amount. This makes it easier to integrate with different payment providers.

- Ensure currency support: Design your receipt template to handle multiple currencies. This allows compatibility with international payment systems that may operate in different regions.

- Offer customizable tax rates: Different payment systems may apply taxes differently, so make sure the template can adjust tax calculations based on the system used.

- Integrate secure payment data: Always ensure encryption is enabled when processing payment information through external systems to meet compliance requirements.

- Test for compatibility: Before finalizing the receipt template, test it with various payment processors to confirm the layout and fields display correctly.

By following these guidelines, you’ll minimize issues and ensure smooth transactions across various payment systems.

Saving and Exporting the Edited Receipt

After editing your receipt, you can save and export it easily by following these steps:

- Click on the “Save” button located at the top-right corner of the screen. This will save your changes to the current session.

- If you want to create a copy for future use, select “Export” from the menu. Choose your preferred format (PDF, PNG, etc.) for the file.

- For further customization, you may select “Save As” to rename the file or store it in a different folder on your device.

- Make sure to verify that the export settings match your needs before confirming the export. For instance, you can adjust the resolution for image files.

- Once you’ve confirmed the settings, click “Export,” and the file will be downloaded to your device or cloud storage.

If you are working with multiple receipts, organizing them in categorized folders can help manage your files effectively. Always ensure that your exported files are properly labeled to avoid confusion later on.

Tips for Legal Compliance and Accuracy in Receipts

Ensure that receipts include all required details such as the seller’s name, address, and VAT number if applicable. These are legally necessary for businesses in many regions. Double-check that the itemized list clearly outlines the products or services sold, along with their individual prices and any applicable taxes.

Include Accurate Dates and Times

The date and time of the transaction should always be precise. Receipts with missing or incorrect timestamps may be questioned by customers or regulatory bodies. Make sure your template includes space for both the transaction date and time, and that these details are automatically generated for each sale.

Clearly State Payment Methods

Always specify the method of payment on the receipt, whether it’s cash, credit card, or another form. If a credit card is used, include the last four digits of the card number to avoid confusion. This not only helps in case of disputes but also supports legal requirements related to payment verification.

Regularly update your receipt template to reflect any changes in local tax laws or other legal requirements. This minimizes the risk of non-compliance and ensures your receipts meet all necessary standards.