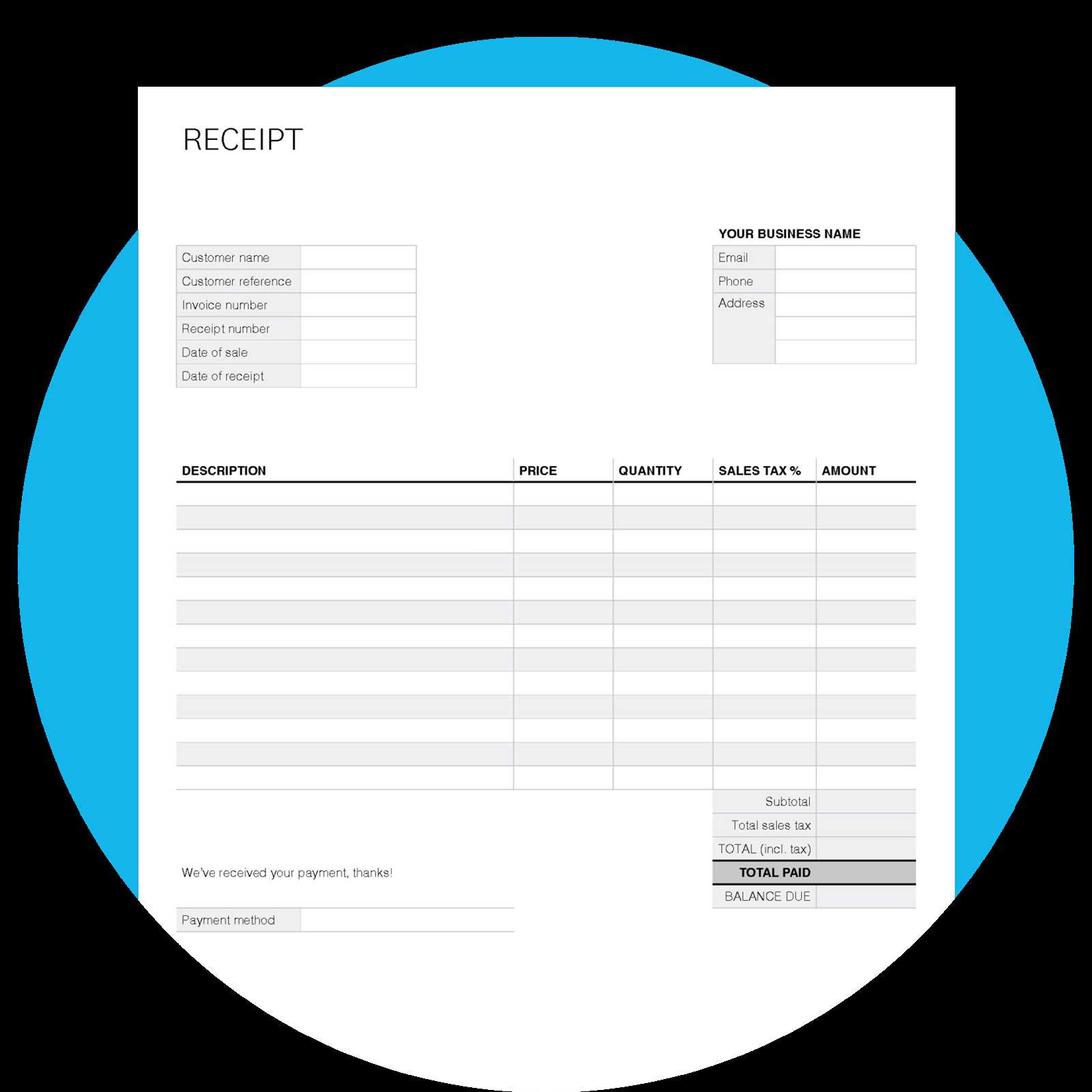

Using an EFT receipt template streamlines the process of issuing receipts for electronic funds transfers. It ensures clarity and consistency in documenting payment transactions. A well-designed template includes key details such as the payer’s name, the payment amount, date of transfer, and unique reference numbers.

Customize your template by adding fields for specific transaction details that matter to your business. For example, you might include information about the payment method, payment purpose, or the account involved in the transaction. This customization provides both you and the payer with accurate, useful records.

By using a ready-made EFT receipt template, you reduce the risk of errors and save valuable time. This is especially important in businesses handling frequent payments, as it ensures a smooth workflow and helps maintain organized financial records.

Here is the revised version with unnecessary word repetitions removed while keeping the meaning intact:

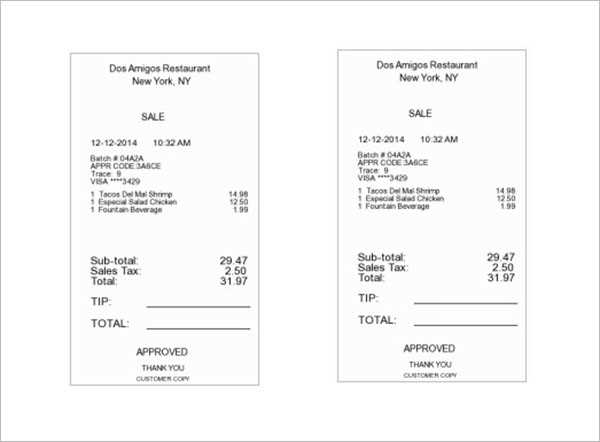

To design a clean and readable EFT receipt template, focus on essential details only. Ensure that all payment-related data such as the transaction amount, date, merchant, and payment method are clear. Avoid redundancy by removing any repetitive information like multiple mentions of the transaction ID or payment confirmation number. Make use of clear labels and maintain consistent formatting across the receipt. Only include what’s necessary for the transaction, and keep the design simple yet informative.

Key elements to include:

- Merchant name and contact details

- Transaction amount and currency

- Payment method (e.g., EFT)

- Transaction ID and date

- Recipient’s name (if applicable)

By maintaining clarity and focusing on relevant data, you can create an efficient receipt template that eliminates confusion and ensures that customers have all the information they need in one place.

- EFT Receipt Template: Key Aspects and Practical Use

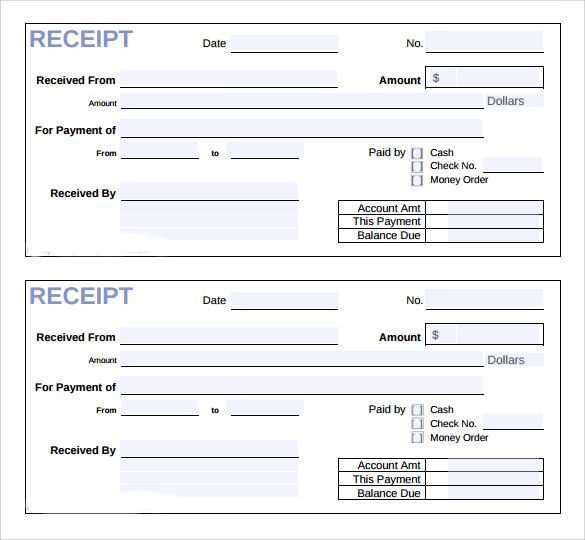

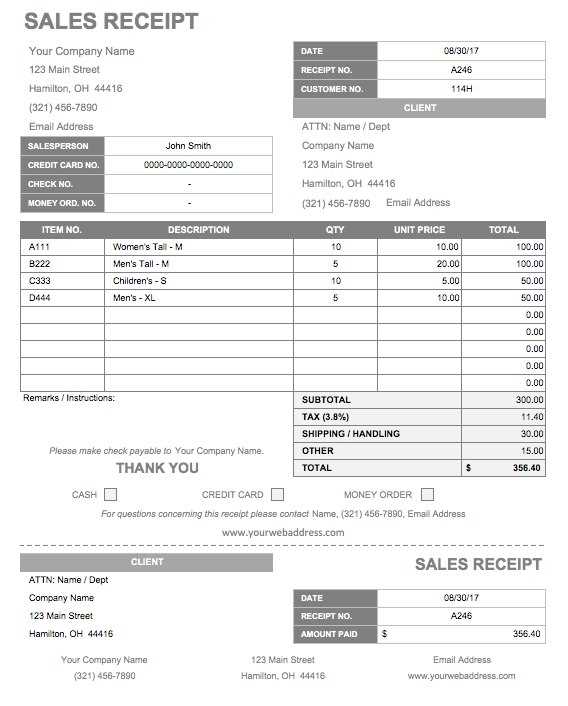

Creating a well-structured EFT receipt template is important for ensuring clarity and consistency in financial transactions. A well-organized receipt provides all the necessary details and serves as a reliable record for both the payer and the payee. Below are key components to include in an EFT receipt template and practical tips for its use:

Key Elements of an EFT Receipt Template

- Transaction Date: Include the date of the transaction to serve as a reference point for both parties.

- Sender and Receiver Information: Clearly specify the sender and receiver details, such as name, address, and contact information.

- Transaction Amount: Include the exact amount of money transferred, as well as the currency used.

- Payment Method: Indicate the method used for the transfer (e.g., bank transfer, online payment system). Include relevant transaction IDs if available.

- Payment Reference: Provide any reference number or unique code associated with the transaction for easy tracking.

- Bank Details: Include the bank name, account number (if applicable), and routing number to ensure clarity about where the funds are coming from and where they are going.

- Signature: Some templates may include a space for the sender’s or receiver’s signature to confirm the transaction details.

How to Use the EFT Receipt Template

- Record Keeping: Both parties should keep a copy of the EFT receipt for their personal records. This helps to avoid any disputes and provides a clear record of the transaction.

- Dispute Resolution: In case of discrepancies or errors, the receipt serves as a reliable document to verify the details of the payment.

- Tax and Accounting Purposes: The receipt can be used during tax filing or financial audits to provide a clear trail of transactions.

Each transaction record must include specific fields to ensure proper tracking and reporting. Start with the Transaction ID, which serves as a unique reference for each transaction, allowing for easy retrieval and verification. The Date and Time field follows, marking the exact moment the transaction occurred. This information is critical for time-sensitive processing and auditing purposes.

Key Transaction Information

Next, the Amount field is required, detailing the total value of the transaction. This should be precise and include the correct currency. Additionally, the Payment Method should be listed, specifying whether it was made via credit card, cash, or other methods. This helps in differentiating transaction types and understanding customer preferences.

Customer and Merchant Details

Don’t forget to include the Merchant ID and Customer ID, which identify the businesses and individuals involved. This information is necessary for identifying repeat customers, resolving disputes, and ensuring that funds are properly routed. Lastly, include a Transaction Status field to indicate whether the transaction was successful, pending, or failed.

| Field | Description |

|---|---|

| Transaction ID | A unique reference for the transaction. |

| Date and Time | The exact time the transaction was processed. |

| Amount | Total value of the transaction. |

| Payment Method | Method used for payment, such as credit card or cash. |

| Merchant ID | Identifier for the business receiving the payment. |

| Customer ID | Identifier for the individual making the payment. |

| Transaction Status | Status of the transaction (e.g., successful, pending, failed). |

Ensure readability by using a clean, organized layout. Use a consistent font and size for all text elements. Limit the number of fonts to two at most, and avoid using overly decorative ones.

Font Size and Alignment

- Choose a font size that is easy to read, usually between 10 and 12 points for body text.

- Align text to the left for consistency and to improve scanning for important details.

- Use bold and italics sparingly to highlight critical information like transaction amounts or dates.

Whitespace and Spacing

- Ensure enough space between lines and sections. This enhances readability and avoids a cluttered appearance.

- Use bullet points or numbered lists for transaction details to separate them clearly.

- Leave margin space on all sides to prevent text from feeling cramped.

Stick to a simple color palette. Use black or dark colors for text and lighter shades for backgrounds. Avoid bright colors that may cause discomfort or distraction.

Ensure that your EFT receipt template complies with local tax regulations and financial reporting standards. Depending on your region, specific information such as tax identification numbers, transaction codes, and business registration details may be mandatory. Review the applicable laws and integrate necessary data fields to meet compliance requirements. Failure to do so could lead to fines or legal complications during audits.

Data Retention and Accessibility

Store receipts in a secure, accessible format for a minimum period as required by your jurisdiction. Typically, this may range from 3 to 7 years. Digital receipts should be stored in an easily retrievable format to facilitate audits. Make sure to include the transaction date, amount, and payer details to align with the record-keeping standards enforced by tax authorities.

Auditing and Verification Processes

Ensure the data recorded in the template aligns with both internal financial statements and external audit requirements. Regular audits should verify that your receipts are accurately generated and that all mandatory information is included. Discrepancies between receipts and the general ledger could trigger audit issues. Conduct periodic internal checks to confirm compliance with both tax laws and accounting principles.

| Region | Tax ID Required | Retention Period | Audit Considerations |

|---|---|---|---|

| EU | Yes | 5-7 years | Ensure full traceability of transactions |

| US | Yes | 3-7 years | Must match financial statements |

| UK | Yes | 6 years | Verify transaction codes and amounts |

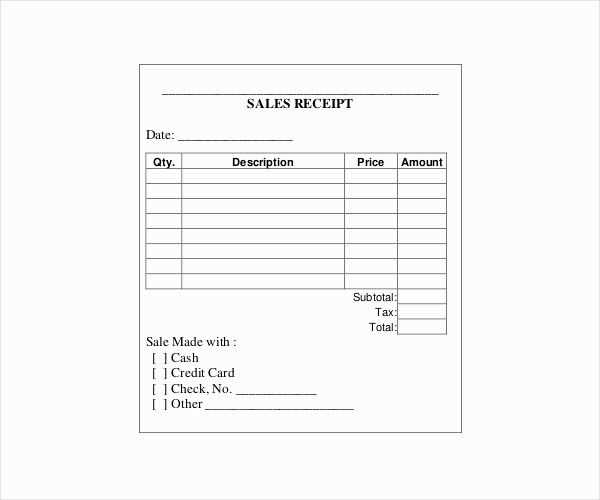

Adjust receipt formats to align with your business requirements. Focus on incorporating the most relevant details for your customers and operations, such as transaction types, loyalty points, or discounts. Include your business logo and contact information prominently to enhance brand visibility. Use clear, legible fonts and proper spacing to ensure receipts are easy to read and understand.

For businesses offering services, consider adding a section for service descriptions or itemized lists. This adds clarity and helps customers track their purchases. Include a field for custom notes or special instructions to personalize the experience further. Ensure receipt size is optimized to avoid waste while still accommodating all necessary details.

If you manage multiple locations, use unique identifiers for each store or outlet on the receipt. This allows for easy tracking and differentiates the receipts between branches. It is also beneficial to integrate payment method icons for quicker customer reference, which can simplify their record-keeping.

Adapt receipt templates for special events or promotions by adding promotional codes or limited-time offers. This keeps your receipts relevant to ongoing campaigns and can encourage repeat business.

Double-check the template format before generating the document. Ensure that all placeholders are correctly positioned and labeled. Missing or misplaced fields can lead to incorrect data insertion and formatting issues.

Don’t overlook the importance of accurate data input. Even small errors in the input, such as incorrect date formats or missing values, can cause inconsistencies in the final document.

Avoid relying solely on automated generation without a final review. Manual inspection helps catch formatting issues, such as text alignment problems or mismatched fonts, that may not be detected automatically.

Neglecting the document’s size or layout can lead to poor presentation. Make sure the document fits within the desired page count and follows consistent spacing for a clean and professional look.

Keep track of version control. Without proper documentation of edits or updates, it’s easy to generate outdated versions or mix up templates, leading to confusion or mistakes in the final document.

Store receipts in encrypted digital formats to ensure that sensitive information is protected from unauthorized access. Use strong, industry-standard encryption methods such as AES-256 to safeguard data both during storage and while in transit.

Use Strong Authentication Methods

Implement multi-factor authentication (MFA) for accessing receipt data. This can include a combination of passwords, biometric verification, or hardware tokens, adding an extra layer of security against unauthorized access.

Regularly Update and Monitor Access Controls

Review and update user permissions periodically to restrict access to those who need it. Implement logging and monitoring tools to detect and respond to suspicious activities in real-time, ensuring that any potential security breaches are identified immediately.

To create an Eft receipt template, focus on clear formatting and simplicity. Use a simple layout with clear sections for transaction details, including the merchant’s name, transaction amount, and date. Keep the font readable and the spacing consistent to ensure all information is easy to spot at a glance.

Start with a header that includes your business name and contact information. Below that, display the transaction details such as the payment method, transaction ID, and amount paid. Make sure the footer contains your return policy or any other necessary terms.

Key details to include:

- Merchant Name

- Transaction ID

- Amount Paid

- Payment Method

- Date and Time of Transaction

Use simple and consistent design elements like borders or lines to separate sections. Keep all text aligned and avoid clutter, ensuring that each detail is easily readable and well-spaced.

Best Practices:

- Choose a font that is easy to read, such as Arial or Helvetica.

- Limit the use of colors, using one or two for emphasis.

- Test your template to ensure it fits the required format for printing or digital sharing.