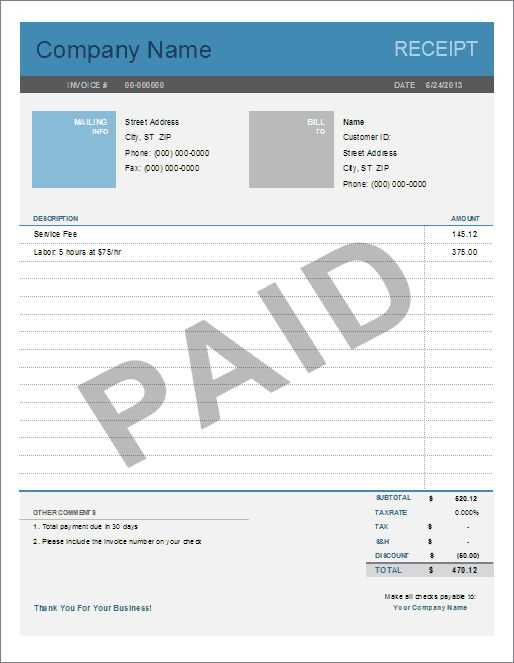

To create a simple and clear electrical receipt template, include key details that ensure accuracy and compliance. Start with the company name and contact information at the top of the receipt. This provides immediate identification and makes communication easier if the customer needs follow-up. Below that, include the date and a unique receipt number for tracking purposes.

Next, list the purchased electrical items, specifying their descriptions, quantities, and prices. Be sure to clearly state any taxes or additional fees in a separate section. For transparency, include a breakdown of the total amount, including the subtotal and final amount after taxes. It’s also useful to provide payment method information, whether it’s cash, card, or another form.

Finally, ensure your receipt has a section for customer signatures, if required, and a thank-you note for the transaction. This adds a personal touch and can enhance customer satisfaction. With a well-structured template, both you and the customer will have a clear record of the transaction.

Electrical Receipt Template

Designing an electrical receipt template requires clarity and organization. Focus on providing detailed information such as the service or product provided, the cost, the date of transaction, and any applicable taxes. Ensure all relevant details are easy to read and comprehend.

Key Elements to Include

Start with the company name and contact details at the top, followed by the customer’s name and address. List the electrical services or products sold, with descriptions and individual prices. Add taxes separately and clearly to avoid confusion. Provide a total amount at the end, including any discounts if applicable.

Layout Considerations

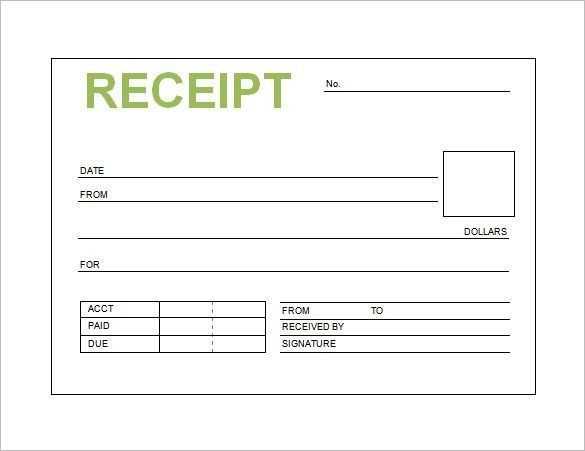

A clean and structured layout helps in presenting information logically. Use clear headings and adequate spacing between sections to prevent clutter. Include a unique receipt number for tracking purposes and make sure your template is adaptable to different screen sizes and printing formats.

Choosing the Right Template for Your Business

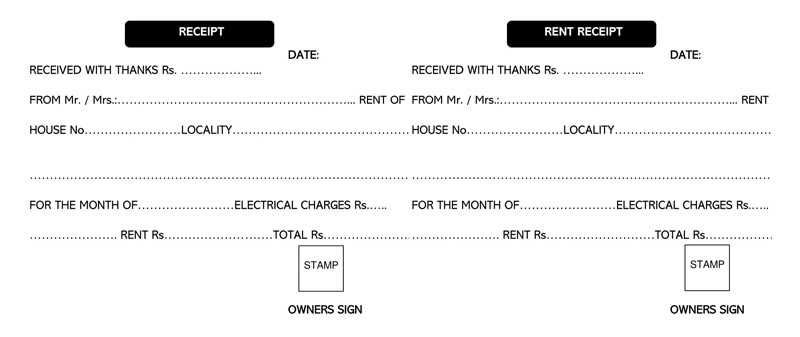

Pick a template that matches your brand’s tone and the type of transactions you handle. For example, a minimalist design is suitable for tech startups, while a more formal layout works well for financial services. Customize it to include all necessary details like company name, contact information, tax rates, and itemized costs, ensuring it reflects your specific business needs.

Consider templates with customizable fields for flexibility. This will help you adjust layouts as your business grows or diversifies. Look for features that allow quick editing and easy inclusion of discounts or taxes. Templates with clear, organized sections will improve readability and streamline your invoicing process.

Evaluate whether the template supports integration with accounting software. Templates that can sync with accounting systems can save time by automating calculations and reducing human errors. Additionally, choose a template that ensures compliance with local tax laws and invoicing standards.

Key Elements to Include in an Electrical Receipt

Ensure your electrical receipt contains the following critical details for clarity and transparency:

- Service Date – Clearly list the date the electrical work was completed or services provided.

- Service Description – Provide a concise description of the work carried out, including materials used and any other relevant details.

- Labor Charges – Specify the hourly rate or flat fee for labor, along with the total time spent on the project.

- Parts and Materials – Itemize all materials and parts supplied, including their individual prices.

- Taxes and Fees – List any applicable taxes, fees, or other charges separately to avoid confusion.

- Total Amount – Clearly state the final amount due, including all services, materials, taxes, and fees.

- Payment Method – Indicate the method used for payment (e.g., cash, credit card, check).

- Business Information – Include your business name, contact details, and license number (if required by local regulations).

Formatting and Readability

For better readability, use a clear, organized layout with sections for each type of information. Group similar items together and use bullet points or tables to break down costs.

Additional Details

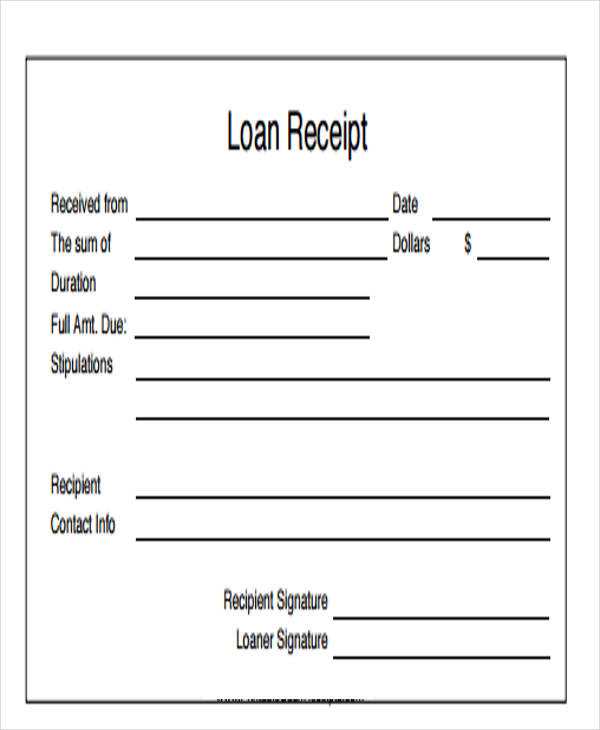

Adding a receipt number or invoice number helps with tracking and referencing. If applicable, include warranty information for parts or services provided.

How to Customize Your Template for Different Services

Adjust your template by adding specific fields that match the service you’re offering. For instance, if you’re providing technical support, include sections for service type, issues addressed, and resolution details. For product sales, you’ll need fields for product names, quantities, and prices. Each service has unique needs, so review your template’s structure regularly to match the service’s requirements.

Modify the layout to emphasize information that’s most relevant. Use bold text for key details like service dates or amounts. For services involving hourly rates, include a time tracking section that automatically calculates costs based on hours worked. This helps maintain clarity and reduces manual input.

Don’t forget to adapt the branding of the template to suit the service. If your service is in a more formal industry, use a professional font and a neutral color palette. For creative or tech services, a modern, visually engaging template with bold fonts and colors may work better. Tailoring the template to the feel of your service keeps it relevant and enhances the user experience.

Integrating Payment Methods and Tax Information

To seamlessly incorporate payment methods and tax details into your receipt template, first focus on compatibility with various payment gateways. Ensure that your receipt design includes a section to display the payment method used, such as credit cards, PayPal, or mobile payments. This allows the recipient to clearly identify the transaction source.

Payment Method Section

For each payment option, display relevant details like transaction ID, payment processor, and last four digits of the card, if applicable. This transparency helps customers confirm the payment method and verify their transaction. You can create dynamic fields that automatically populate based on the chosen payment method.

Tax Information

For tax accuracy, include a separate line item for tax charges. Specify the tax rate applied and calculate the tax amount based on the subtotal. It’s important to consider the local tax regulations to ensure your tax details are correct and up to date.

| Payment Method | Transaction ID | Tax Rate | Tax Amount |

|---|---|---|---|

| Credit Card | 1234567890 | 8% | $2.40 |

| PayPal | 9876543210 | 8% | $2.40 |

Ensuring Compliance with Local Electrical Regulations

Review local electrical codes before drafting or issuing any receipts related to electrical work. These codes dictate how installations must be documented and the information that needs to be included on receipts. In some regions, specific details such as the type of work performed, materials used, or safety inspections may be required. Always include a clear description of the work completed to prevent misunderstandings or legal complications.

Adhere to Reporting Standards

Follow industry standards for reporting electrical services. Depending on the location, the receipt may need to list specific permit numbers or compliance certification references. Check with local authorities or consult regulatory guidelines to confirm the required documentation for electrical projects.

Update Templates Regularly

Keep electrical receipt templates updated to reflect any changes in local regulations. By staying informed about local code modifications, you can adjust your templates to meet new legal requirements and ensure your business remains compliant with the latest standards.

Printing and Digital Distribution of Receipts

For businesses aiming to streamline receipt handling, printing and digital distribution options provide effective solutions. To ensure accessibility and convenience, implement both physical and digital formats for receipt delivery.

Printing Receipts

When opting for printed receipts, ensure high-quality printers are used to avoid legibility issues. Thermal printers are widely favored due to their speed and cost-effectiveness. Choose durable paper to prevent fading over time. Consider customizing receipts with brand logos or details like store addresses for added professionalism.

- Opt for thermal printing for efficiency and durability.

- Use quality receipt paper to avoid smudging or fading.

- Ensure clear formatting for easy readability.

Digital Distribution

Digital receipts can be distributed via email or through mobile apps, offering customers quick access without the need for physical storage. Keep digital receipts organized by using clear subject lines and including all necessary transaction details. Provide options for customers to download or store their receipts in their accounts for future reference.

- Offer email or app-based distribution for faster delivery.

- Make receipts easily accessible and downloadable from user accounts.

- Ensure privacy by securing digital receipts with encryption or password protection.