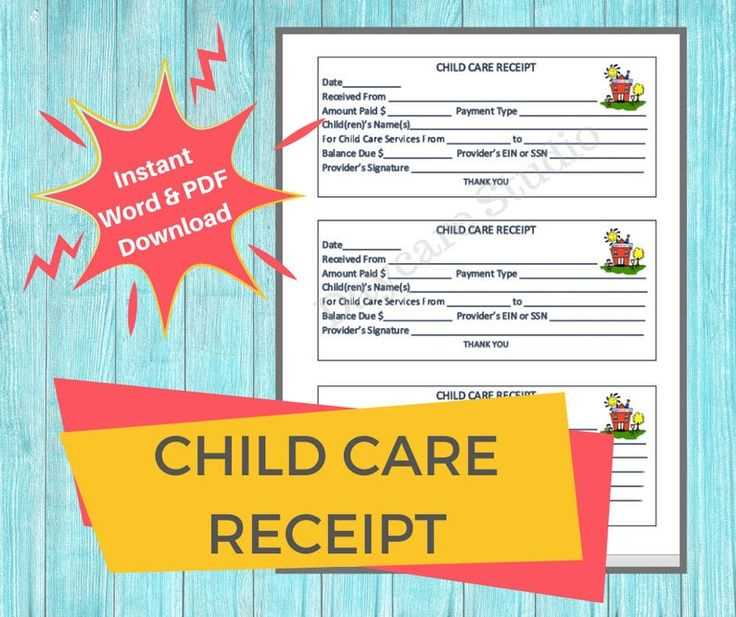

If you are looking for a simple way to track your child care expenses for the year, a child care receipt template can be a great tool. A well-organized receipt helps both parents and child care providers keep accurate records for tax purposes, reimbursements, and budgeting. With the end of the year fast approaching, creating or using an existing template ensures you don’t miss out on potential savings or documentation for the next tax season.

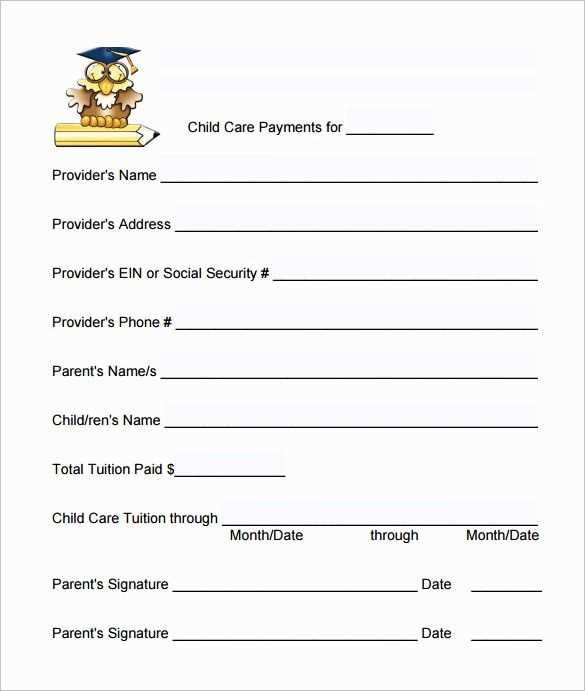

A good template should include key details such as the provider’s name, contact information, dates of service, and the amount paid for each period. It’s important that the receipt is clear and consistent, making it easy to reference during tax filing or any future financial planning. Be sure to include any discounts or credits that may apply throughout the year, as well as any additional fees or services that might have been provided.

Using a template can streamline your year-end tasks, leaving you with more time to focus on other aspects of your finances. By taking a few minutes to enter your child care payments into a pre-designed template, you’ll ensure that your records are up-to-date and ready for any potential audits or requests from tax authorities. You can find many customizable templates online that cater specifically to child care services, making this process even more manageable.

Here are the corrected lines:

Ensure accurate dates: Double-check that the child care service period is listed clearly, specifying the start and end dates. This avoids confusion and establishes a clear record for both you and the provider.

Clear breakdown of payments: Make sure each payment is detailed, showing the amount paid, the date of each transaction, and any discounts or credits applied. This helps ensure all charges are documented properly.

Provider’s contact information: Include the provider’s full name, address, phone number, and email address. Having this information on file allows you to easily reach out for follow-ups if needed.

Tax ID Number (TIN) or Employer Identification Number (EIN): Ensure the provider’s TIN or EIN is listed. This is crucial for tax reporting purposes, especially when you claim child care expenses on your tax return.

Hourly or weekly rates: If applicable, make sure the hourly or weekly rates are clearly listed. This ensures transparency and verifies that charges align with the agreed-upon terms.

Include both parent names: If the receipt is for multiple parents, ensure both names are listed. This will ensure that both parties can claim their portion of the child care expenses on their tax filings.

Details of care provided: Add specifics of the care provided, including the number of hours worked and any special services or activities that may have incurred additional costs. This will help you confirm that all services were rendered as expected.

Final amount paid: Ensure the final amount is listed at the bottom of the receipt. This figure should match the total of all payments made, helping to confirm that all charges have been accounted for.

- End of Year Child Care Receipt Template Guide

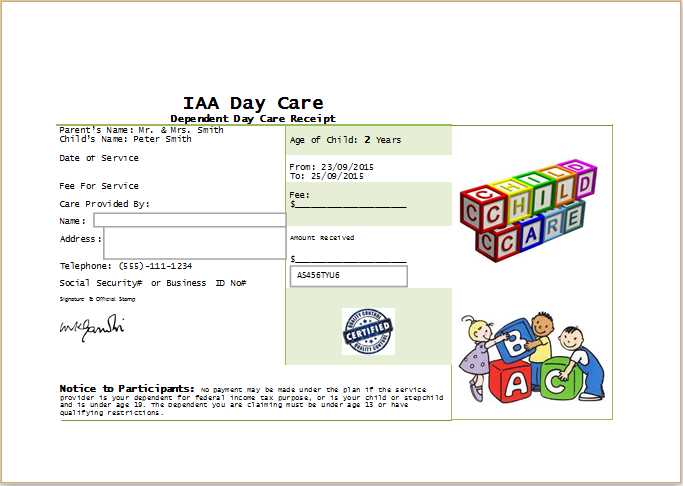

To create a child care receipt for the year, begin with the basic details: the provider’s name, address, and contact information. This ensures the document is identifiable and professional. Follow with the parent’s details, including their name and address. Include the child’s name and the time frame of services provided, such as the start and end dates of the care period.

Clearly list the total amount paid for child care services, specifying whether this amount is pre-tax or post-tax. It’s important to include any deductions or discounts that were applied during the year. Specify the hours of care provided and whether those hours were for regular care, extended care, or special events, as these can affect tax deductions.

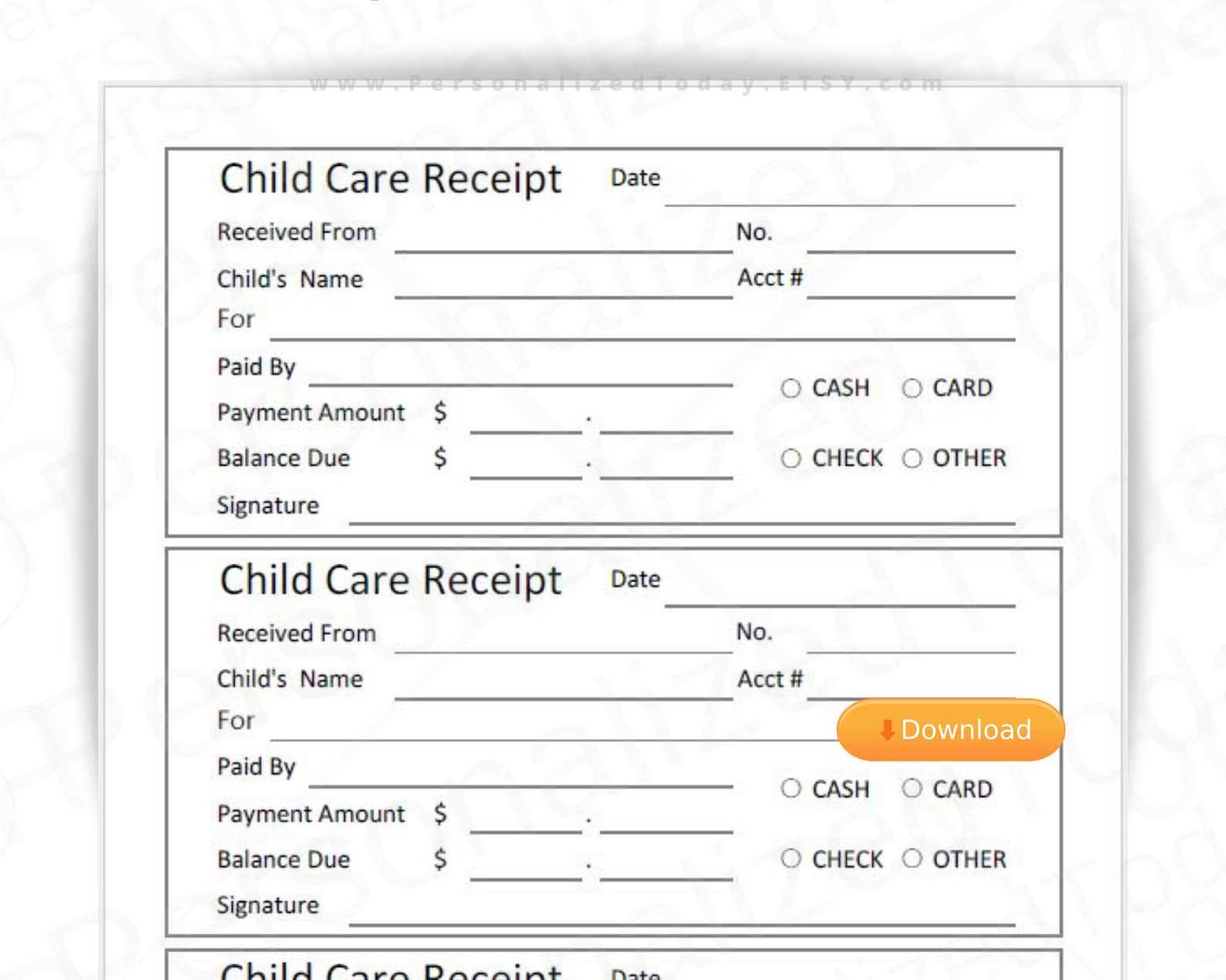

Ensure the receipt includes the payment method, whether cash, check, or electronic transfer. For electronic payments, provide a reference number or transaction ID to ensure the payment is traceable. If the payment was made in installments, indicate the amount paid during each transaction and the total sum paid by the end of the year.

Lastly, provide a clear statement indicating that the payment was made for child care services. This confirms the legitimacy of the receipt for tax purposes or potential audits. Keep the language straightforward and include all relevant details to make the receipt both accurate and useful.

To create a detailed receipt for tax filing, include the following key information:

- Provider’s Information: Clearly state the name, address, and contact details of the childcare provider.

- Parent’s Information: Include the parent’s name, address, and contact details.

- Child’s Information: List the child’s name and age, if applicable.

- Dates of Service: Specify the exact dates the childcare was provided. For clarity, break down services by day if necessary.

- Service Description: Describe the type of care, whether it’s full-time, part-time, or special care arrangements. Include any additional services provided, such as transportation or meals.

- Amount Paid: Clearly list the total amount paid, including the breakdown of hourly rates or any flat fees. Also, include taxes or discounts, if applicable.

- Payment Method: Note how payment was made–whether by check, credit card, or other methods.

- Tax Identification Number (TIN): Include the childcare provider’s TIN, which is necessary for tax filing purposes.

Organize this information in a clear, professional format, making it easy for tax authorities to verify your claims. This will help avoid delays and ensure you can claim your child care credits or deductions efficiently.

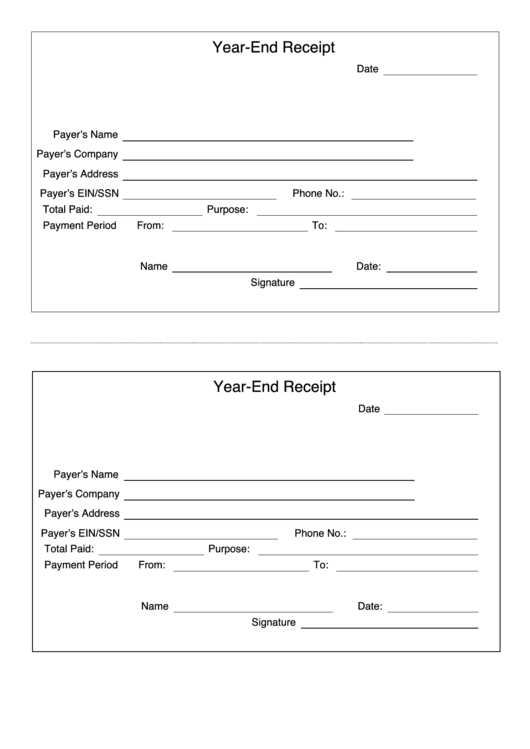

Ensure your year-end child care receipt includes the following details to guarantee accuracy for tax purposes and future reference:

- Provider’s Full Name and Contact Information: Include the name of the child care provider and their phone number or email address.

- Provider’s Tax Identification Number (TIN) or Employer Identification Number (EIN): This is necessary for tax deductions and to verify the legitimacy of the business.

- Child’s Name: List the full name of the child who received care during the year.

- Service Dates: Clearly state the range of dates the child care services were provided, indicating the start and end dates of care.

- Total Amount Paid: Provide the total amount you paid for child care during the year. If payments were made in installments, itemize each payment and the corresponding dates.

- Breakdown of Costs: Include a detailed list of services (e.g., full-time care, part-time care, before/after school programs) with corresponding charges for each service.

- Payment Method: Specify how payments were made, whether by check, cash, or credit card. This helps verify payment records for both the provider and the payer.

- Signature: A signature from the provider, verifying that the receipt is accurate, may be required for official purposes.

These elements provide clear documentation and support for any tax-related claims or reimbursements that may be needed later on. Keep your receipts organized for easy access when preparing tax forms like the Child and Dependent Care Credit or other applicable deductions.

Ensure the date is correct. Mistakes in the date can cause confusion and may lead to legal complications if audited. Always double-check that the transaction date matches the receipt issue date.

Don’t forget to include the service details. A vague description like “child care services” isn’t enough. Break down services provided, including hours worked or specific care tasks. This will make the receipt clear and accurate for both parties.

Make sure the amount paid is accurate. Simple errors like missing cents or incorrect totals can cause problems for both the issuer and the recipient. Always recalculate and verify the payment amount before issuing the receipt.

Use the correct payer’s information. Incorrect or incomplete information, like a misspelled name or wrong address, can create issues if the receipt needs to be referenced later. Verify the information before finalizing the receipt.

Provide contact details. Failing to include your business contact information can make it difficult for clients to reach you if questions arise. Include an email address, phone number, or website to offer easy follow-up.

Avoid leaving out the payment method. Whether it’s cash, check, or credit, specifying the method helps clarify how the transaction was processed, especially if a dispute arises.

| Common Mistake | Corrective Action |

|---|---|

| Incorrect Date | Always confirm the transaction and issue date. |

| Vague Service Description | Detail the services rendered (e.g., hours, specific tasks). |

| Incorrect Amount | Double-check the total payment and any applicable taxes. |

| Missing Payer Information | Verify and confirm correct details (name, address). |

| Omitting Contact Info | Include a phone number, email, or website. |

| Not Stating Payment Method | Always include the payment method (cash, check, etc.). |

To ensure your childcare receipts meet year-end requirements, start by including the total amount paid for care during the year. This should be clearly stated at the top of the document. Include the child’s name, the provider’s name, and their tax ID or Social Security number for verification purposes.

List each payment date along with the corresponding amount. Keep the details of each transaction concise but complete, ensuring accuracy. Add any applicable notes, such as periods when services were not rendered, for transparency.

Make sure the total payment sums match the year-end total, and offer a breakdown if needed for specific months or care types (e.g., full-day or part-time care). This format ensures clarity for both parents and tax professionals who will reference the receipt later on.