Creating an Escrow Receipt

To create an escrow receipt, start by including the basic details of the transaction: the parties involved, the escrow agent, and the amount placed in escrow. This ensures transparency for all parties and a clear record of the transaction. A good template covers the following:

Key Components

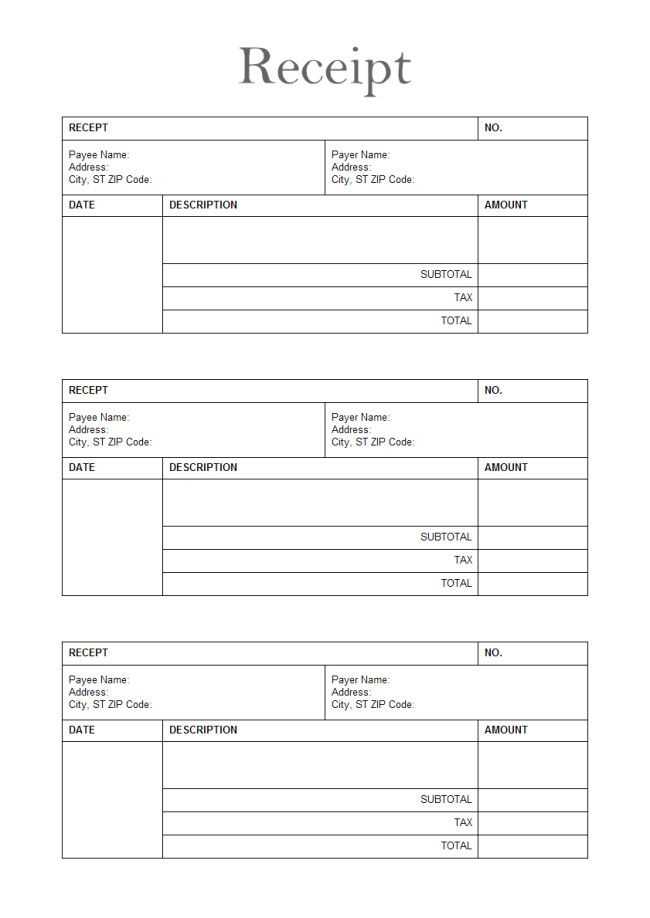

- Escrow Agent Information: Name, address, and contact information of the agent responsible for holding the funds.

- Buyer and Seller Details: Full names, addresses, and contact information of both the buyer and the seller.

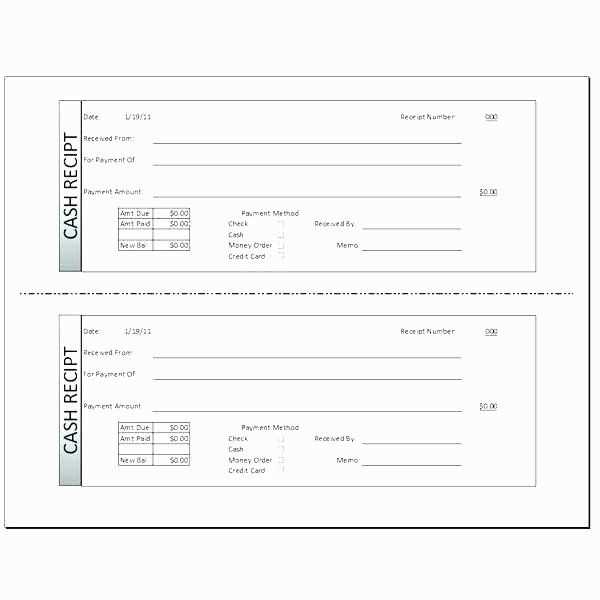

- Escrow Amount: Exact amount being held in escrow. Specify the currency.

- Transaction Date: Date when the funds are placed in escrow.

- Terms and Conditions: Conditions under which the escrow agent will release the funds to the buyer or seller. Be specific about the milestones or requirements that must be met.

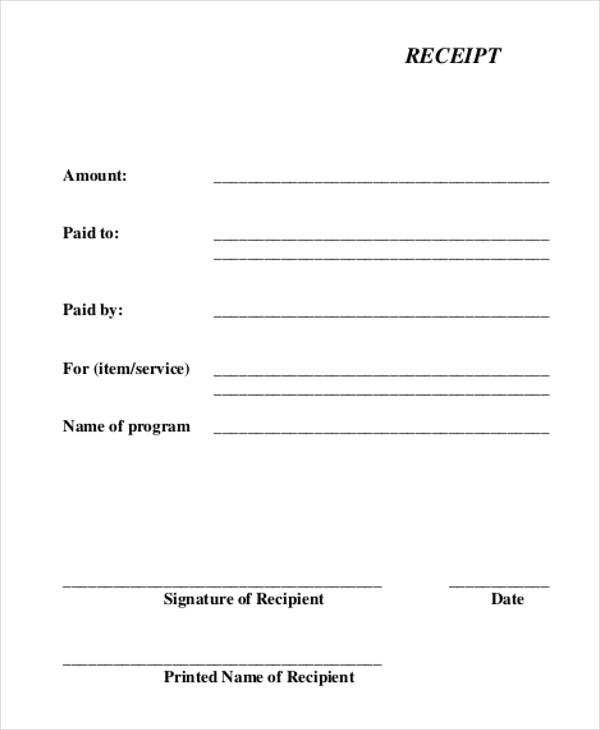

- Signatures: Ensure both parties and the escrow agent sign the receipt to make it valid.

Sample Template

Escrow Receipt

This is to acknowledge that [Escrow Agent’s Name] has received funds in the amount of [Amount] from [Buyer’s Name] for the purpose of completing the transaction outlined in the purchase agreement between [Buyer’s Name] and [Seller’s Name].

The funds are being held under the following conditions:

- Condition 1: [Condition details]

- Condition 2: [Condition details]

The escrow agent will release the funds to the [Buyer or Seller] upon successful completion of the agreed conditions as outlined in the purchase agreement. Any dispute shall be resolved in accordance with the terms set forth in the agreement.

Signed,

[Escrow Agent’s Name]

[Escrow Agent’s Contact Information]

[Buyer’s Name]

[Buyer’s Contact Information]

[Seller’s Name]

[Seller’s Contact Information]

Additional Tips

For added clarity, specify the date by which the escrow funds should be released. Include any applicable penalties or fees for delayed releases. Always have the terms of the escrow arrangement reviewed by legal professionals to ensure compliance with local laws and regulations.

Escrow Receipt Template: A Detailed Guide

How to Draft an Escrow Receipt for Real Estate Transactions

Key Elements to Include in Your Escrow Receipt

Common Mistakes to Avoid When Creating an Escrow Receipt

Start with a clear statement identifying the parties involved in the transaction. Specify the buyer, seller, and the escrow agent, along with their contact details. The purpose of the escrow receipt should be clearly outlined–this is typically the holding of funds or documents during the real estate process until all conditions are met.

Key Elements to Include in Your Escrow Receipt

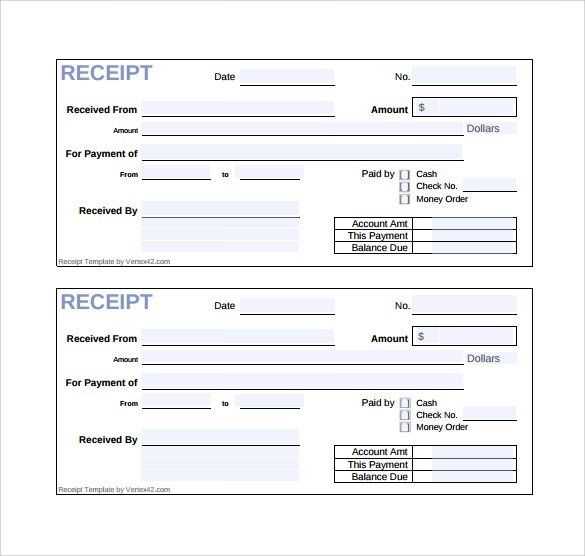

1. Amount Held in Escrow: Clearly state the amount of money or property being held. This could include the deposit or other funds tied to the transaction. Specify whether it’s a fixed amount or variable, based on the terms of the agreement.

2. Escrow Terms: Define the terms under which the escrow agent will release the funds or property. This includes the specific conditions, such as the completion of inspections, the signing of closing documents, or other contingencies that must be satisfied.

3. Timeline: Indicate any timeframes involved, such as deadlines for fulfilling conditions or the expected closing date. This helps ensure all parties are clear on the schedule.

4. Dispute Resolution: If a disagreement arises, include a clause that explains how the situation will be handled, whether through arbitration, mediation, or legal action. Specify how disputes will be resolved before funds are released.

Common Mistakes to Avoid When Creating an Escrow Receipt

1. Vague Language: Avoid using unclear or ambiguous terms in the receipt. Ensure every condition, amount, and date is precisely defined to prevent misunderstandings later.

2. Missing Signatures: The receipt must be signed by both the buyer and the seller, as well as the escrow agent. Without proper signatures, the document may not hold legal weight.

3. Omitting Contingency Clauses: Be specific about the contingencies required for the release of escrowed funds. This ensures both parties know what is expected to complete the transaction.