When creating a 501(c)(3) receipt, ensure it meets IRS guidelines. This template should clearly detail the donation amount, the date, and a description of the goods or services provided, if any. Always include the nonprofit’s name and tax identification number to validate the receipt for tax purposes.

Start with a brief statement confirming that the donor did not receive any goods or services in exchange for the donation. If goods or services were provided, be specific about their value. The IRS requires nonprofits to report the fair market value of any benefits received by the donor.

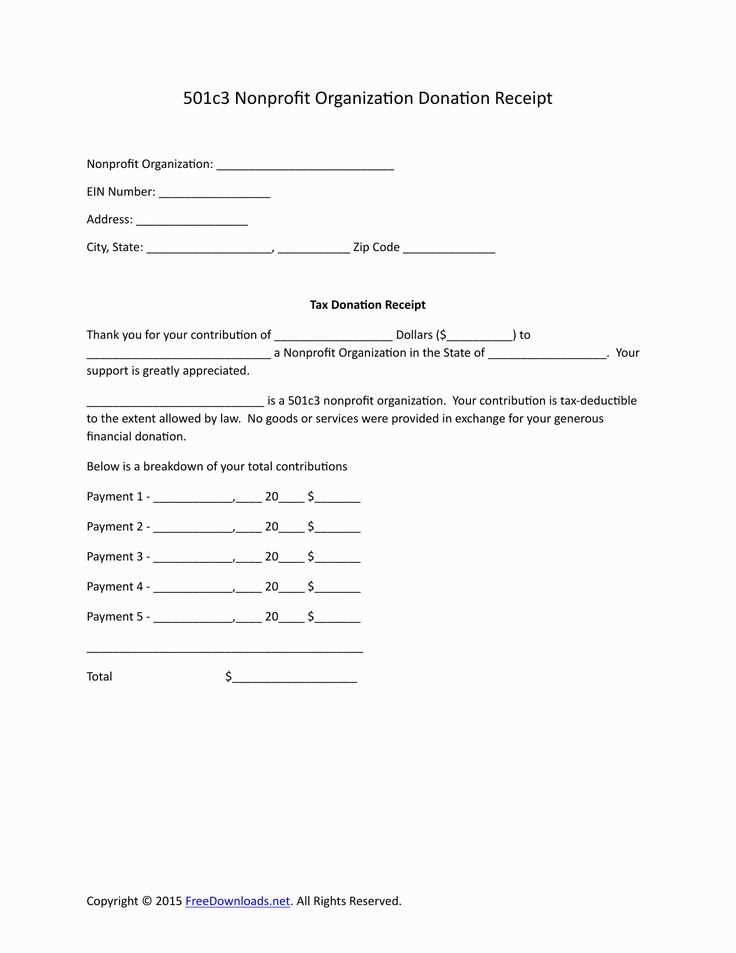

Template Sample:

Nonprofit Name: [Insert Name]

Tax ID Number: [Insert Tax ID Number]

Donation Amount: $[Insert Amount]

Date of Donation: [Insert Date]

Donor Name: [Insert Donor’s Name]

Note: Always keep accurate records of all donations and receipts issued for tax reporting. This will help maintain compliance with IRS regulations and ensure your nonprofit organization stays in good standing.

Example of a 501(c)(3) Receipt Template

Make sure your receipt includes all the necessary details required by the IRS for 501(c)(3) organizations. Here’s an example template you can use:

- Organization Name: [Your Organization’s Name]

- Tax-Exempt Status: 501(c)(3)

- Receipt Date: [Date of Donation]

- Donor Name: [Donor’s Full Name]

- Donation Amount: [Donation Amount]

- Description of Donation: [Description of Item Donated (if applicable)]

- Statement of Goods or Services: Acknowledge whether or not the donor received any goods or services in exchange for the donation. For example: “No goods or services were provided in exchange for this donation.”

- Organization Contact Information: [Organization’s Address, Phone Number, Email]

- Authorized Signature: [Signature of Organization Representative]

This template includes all necessary elements such as the donor’s details, donation amount, and the organization’s tax-exempt status. Customize this template for your specific needs and ensure you provide accurate records for both your organization and the donor.

Key Information to Include in a 501(c)(3) Receipt Template

For a 501(c)(3) organization to provide proper documentation for donations, it’s crucial to include specific details on the receipt template. This information ensures transparency and compliance with IRS regulations, as well as providing donors with the necessary data for tax deduction purposes.

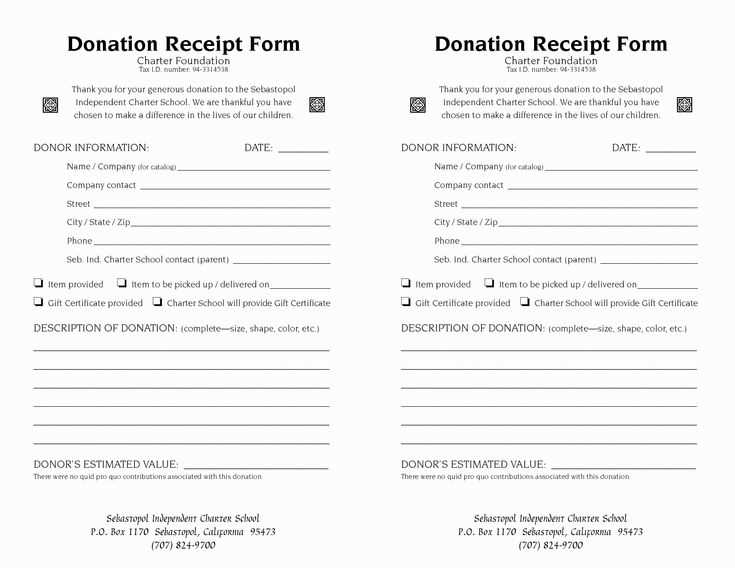

Donor Information

Clearly list the donor’s full name and address. This allows for easy identification and ensures that the receipt can be linked to the correct individual or entity in case of an audit or tax filing.

Donation Details

Specify the date of the donation and the total amount given. If the donation consists of non-monetary items, describe each item donated with its fair market value. For monetary donations, include the amount in both written and numerical form.

Organization Details

Include the legal name of the organization, along with its full address and tax-exempt status confirmation, such as the IRS Employer Identification Number (EIN). This verifies the organization’s status and assures the donor that the contribution is eligible for tax deduction.

Statement of Goods and Services

If the donor received anything in exchange for their contribution, such as a gift or benefit, this must be stated. The receipt should clarify whether the donation was fully deductible or if part of it was not, based on the value of goods or services received.

Signature

Though not always mandatory, including a signature from a representative of the organization can add credibility and make the receipt more formal. It also serves as an acknowledgment that the donation was received by the organization.

How to Format the Donation Amount and Donor Details on a 501(c)(3) Receipt

Clearly display the donation amount, specifying whether it was a monetary gift, goods, or services. For cash donations, include the exact dollar amount, while for non-cash gifts, provide a description of the item(s) donated along with an estimated value, if applicable. If the value of non-cash items is not determined by the donor, mention that the donor is responsible for the valuation.

For donor details, list the donor’s full name and address to verify their identity. This information helps both the donor and the nonprofit for tax purposes. Ensure you record the donor’s contact information accurately, which can be essential for sending acknowledgments and receipts for future donations.

Additionally, make sure to include the date of the donation and a statement about whether the donor received any goods or services in exchange for the donation. If they did, clearly state the value of those goods or services and subtract it from the total amount donated. This helps in compliance with IRS regulations for tax deductions.

Legal Requirements for 501(c)(3) Receipts: What You Must Know

To comply with IRS regulations, a 501(c)(3) organization must provide specific information on donation receipts. These receipts ensure donors can claim their contributions as tax deductions. Make sure your receipts include the following:

Details to Include on the Receipt

The receipt must list the name of your organization, the donor’s name, the date of the donation, and the amount or description of the donated property. If the donation is cash, the amount must be clearly stated. For non-cash donations, a description of the item must be provided, though an estimate of the item’s value is not required from the organization.

Special Considerations for Donations Over $250

If the donation exceeds $250, you must provide a written acknowledgment that includes a statement confirming whether the organization provided any goods or services in exchange for the donation. If goods or services were provided, their fair market value must be included. Donors need this acknowledgment to properly claim their deduction on tax returns.