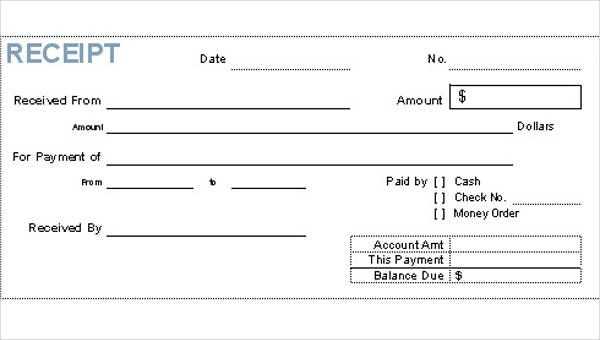

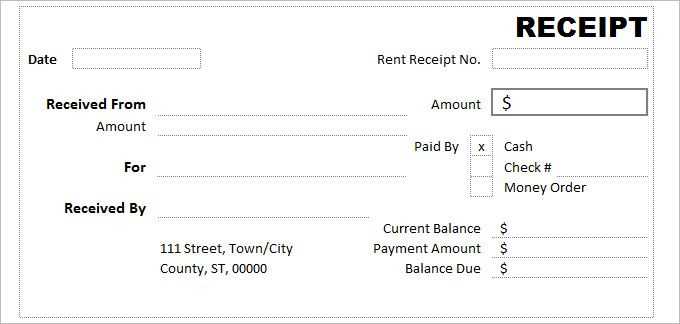

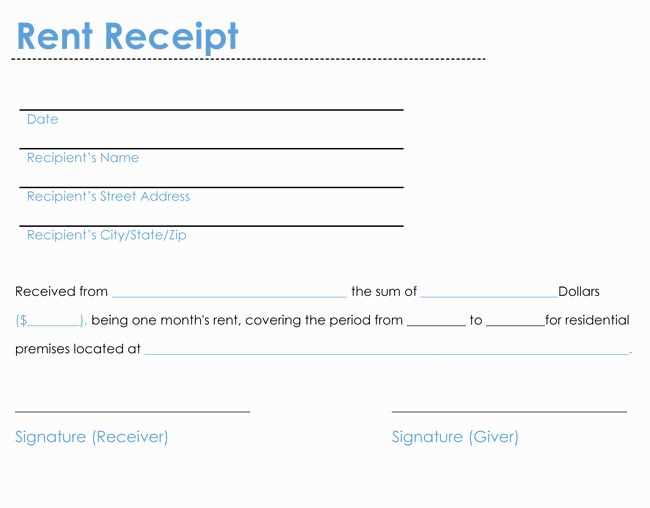

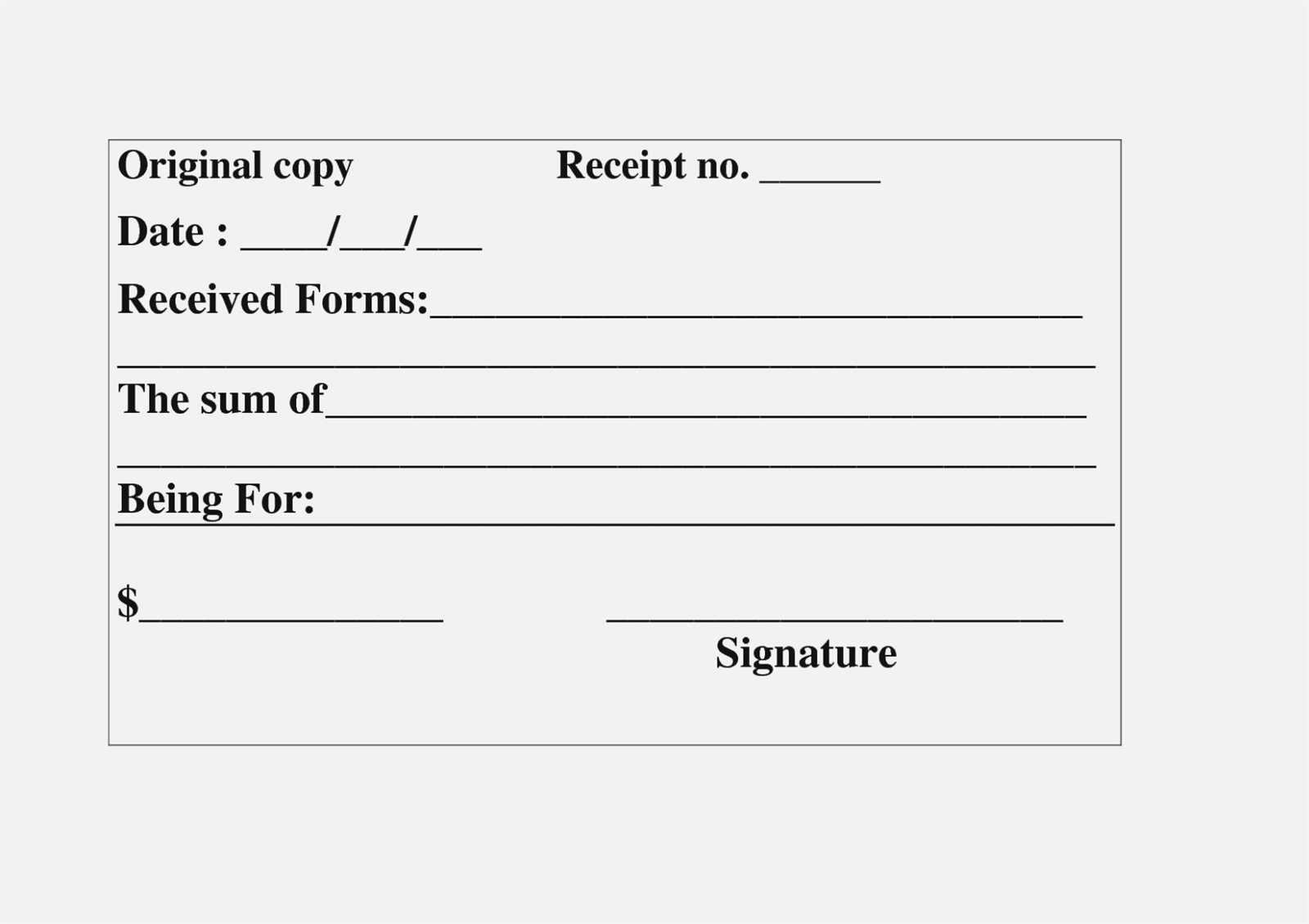

Use a clear and simple format for your receipts to ensure accuracy and easy comprehension. Start with the basic details: the business name, address, and contact information. These are vital for identification and follow-up if needed.

Include the date of the transaction and a unique receipt number. This helps track the transaction and simplifies record-keeping. Be sure to list each item purchased with a description, quantity, and price. This makes it easier for both the customer and business to verify purchases.

Don’t forget to calculate and clearly display the total amount, including any taxes or additional fees. If discounts were applied, highlight them to avoid confusion. Ensure the payment method is specified to reflect how the transaction was completed, whether by cash, credit card, or other means.

Lastly, provide a space for both the customer’s and the merchant’s signatures if required. This serves as confirmation of the transaction, offering security for both parties.

Here is a detailed plan for the article titled “Example Receipt Template” in HTML format, with six specific and practical headings:

Begin by introducing the key components of a receipt template. Focus on the required fields like date, company name, items purchased, and payment details. Ensure the template includes space for these essential pieces of information in a clear, organized manner.

Next, explain how to structure the layout to make the receipt user-friendly. Provide tips for arranging the elements, such as placing the company logo at the top, followed by transaction details, and finally, the total amount and footer with legal information.

Discuss the importance of consistent font sizes and spacing. Recommend using standard fonts that are easy to read, ensuring that critical information like prices and totals stand out. Make sure that the text is not crowded, allowing the receiver to quickly review the receipt.

Address the need for clear item descriptions. Encourage specifying quantities, individual prices, and a total for each item. Explain how this ensures transparency and prevents confusion for both the seller and the buyer.

Offer a solution for including tax calculations in the template. Explain how to include sales tax or other applicable fees. Provide an example calculation and highlight where this should appear on the receipt.

Lastly, emphasize the importance of saving the template in a format that can be easily edited and printed. Suggest using a tool that supports customization, so it can be adapted for different transactions without starting from scratch each time.

How to Include Item Descriptions in Receipts

To ensure clarity and avoid confusion, include concise yet informative descriptions for each item on the receipt. A clear description helps customers understand exactly what they purchased.

- Be specific and direct: Describe the item using its full name and relevant details. For example, instead of just “shoes,” write “Men’s leather boots, size 10.”

- Avoid abbreviations: Use full words, as abbreviations can confuse customers. For example, “Bluetooth speaker” is clearer than “BT speaker.”

- Include product variations: If an item comes in multiple colors, sizes, or models, specify these in the description. Example: “Blue wireless mouse, model XYZ.”

- Clarify quantities: Always list the quantity of each item purchased. If a customer buys multiple units, include this number. Example: “3 x T-shirts, size M.”

By following these tips, receipts become a helpful reference for customers and reduce the chance of misunderstandings or disputes. Keep descriptions brief but thorough, focusing on the key aspects of each item.

Formatting the Date and Time for Accuracy

Always use a clear and consistent format for the date and time on receipts. This reduces confusion and ensures accuracy. A common format is the ISO 8601 standard (YYYY-MM-DD) for dates and the 24-hour clock (HH:mm) for time. This is globally recognized and avoids ambiguity in international transactions.

Standard Date Format

For dates, it’s best to display them as follows: Year-Month-Day. This format is universally understood and avoids misinterpretation, especially in areas with different conventions for day and month order.

Standard Time Format

For time, using the 24-hour format is more accurate and practical, especially for receipts that may need to be processed at any time of day or night. For example, 2:30 PM should be written as 14:30.

| Date Format | Example |

|---|---|

| ISO 8601 | 2025-02-06 |

| 24-hour Time | 14:30 |

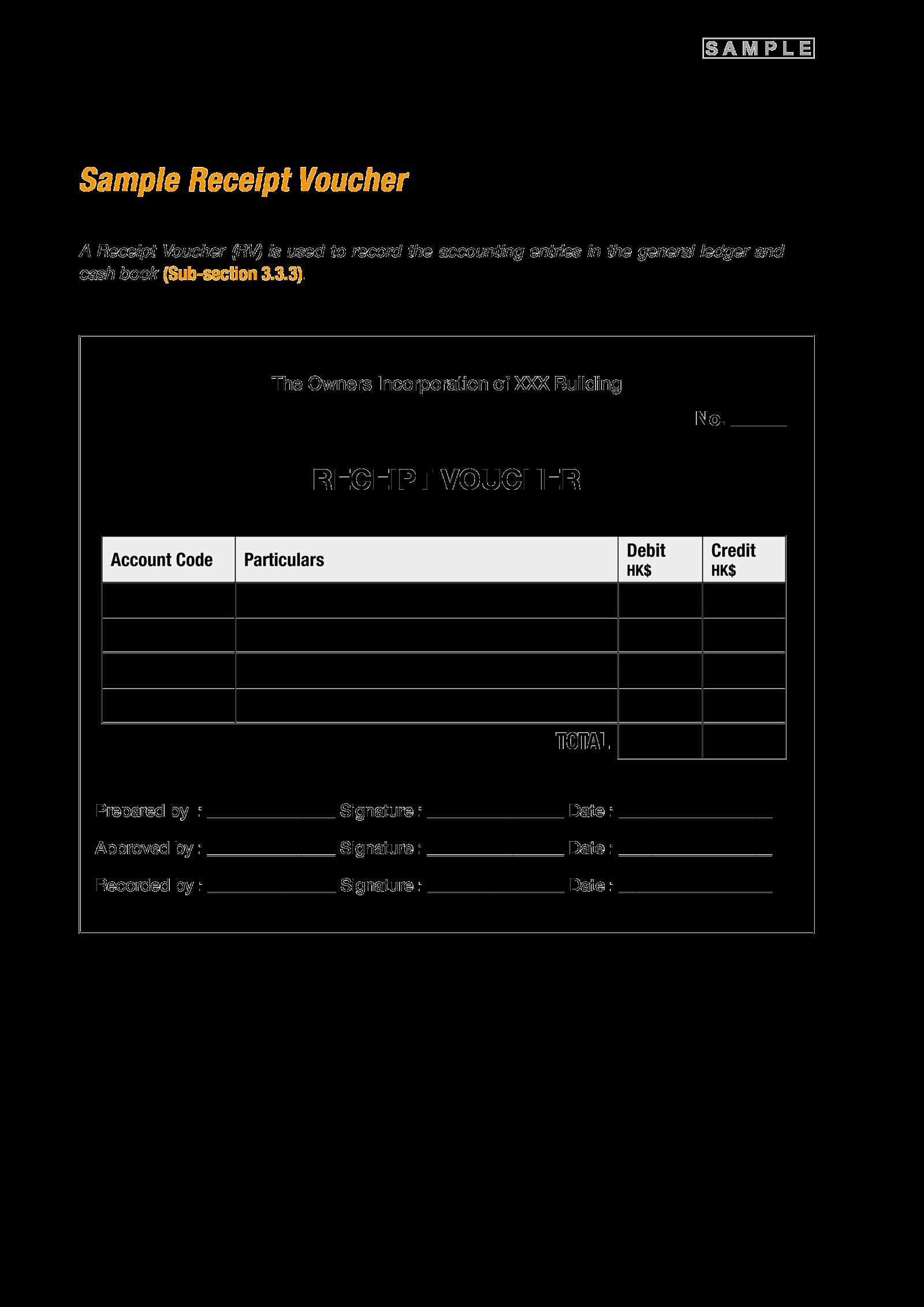

Key Information for Seller and Buyer Details

Ensure the seller’s full name, business name (if applicable), and contact details are clearly visible. Include the seller’s physical address, email, and phone number. This will establish clear communication channels for both parties.

Seller’s Information

Include any tax identification number or business registration details if required by local laws. This assures the buyer of the legitimacy of the transaction and provides legal protection for both sides. Make sure to update the information regularly to avoid errors in case of changes.

Buyer’s Information

Provide the buyer’s full name, contact information, and address. If applicable, include the buyer’s tax ID or membership number. This helps maintain proper records and makes future communication seamless.

Best Practices for Listing Payment Methods

Clearly identify each payment method by its official name. Avoid abbreviations or jargon that may confuse customers. This helps to ensure that users can quickly recognize their preferred option.

Organize payment options into logical groups, such as credit cards, digital wallets, and bank transfers. This keeps the list clean and intuitive.

Provide icons for each payment method. Visuals make it easier for customers to identify options at a glance, improving user experience.

Display the most popular payment methods first. Prioritize options that are frequently used to streamline the checkout process and reduce friction.

Ensure that all payment methods are listed with their transaction fees and any limitations clearly stated. Transparency will build trust with customers.

Update the list regularly to reflect new or discontinued payment options. Keeping the list accurate prevents frustration and confusion.

Ensure that payment options are accessible on all devices. Optimize the layout for mobile users, who may rely on different payment methods than desktop users.

Adding Taxes and Discounts to Your Receipt

To include taxes and discounts, ensure that your receipt is clear and transparent. Here’s how to properly display them:

Taxes

Taxes should be calculated and displayed as a separate line item. To do this:

- Include the tax rate (e.g., 8%) next to the tax amount.

- Clearly show the subtotal before taxes to avoid confusion.

- Label the tax line as “Tax” or “Sales Tax” for easy identification.

Discounts

Discounts are often a key part of receipts and should be shown clearly. Here’s how to present them:

- List the discount amount as a separate line, labeled “Discount” or “Applied Discount”.

- Ensure the discounted total is clearly marked to avoid misunderstandings.

- Specify the type of discount if relevant (e.g., percentage off or fixed amount).

Example Calculation

Let’s say the subtotal is $100, tax rate is 8%, and the discount is 10%:

- Subtotal: $100

- Discount: $10 (10%)

- Tax: $7.20 (8%)

- Total: $97.20

This format keeps the receipt organized and easy to read, ensuring customers understand their charges.

Legal Considerations When Issuing Receipts

Ensure that your receipt includes all necessary details, such as the business name, transaction date, amount, and a description of goods or services provided. These elements are required by law in many jurisdictions to validate the transaction and protect both parties.

Accurate Record-Keeping

Maintain clear and accurate records of all receipts issued. These records are important for tax reporting and may be requested by government agencies during audits. Keep digital or paper copies for the legally required retention period, which varies by location.

Tax Implications

Receipts serve as evidence for both parties when calculating taxes. Businesses must provide receipts that reflect the proper tax rates and amounts, especially if VAT or sales tax applies. Consumers rely on accurate receipts to claim tax deductions or rebates.

Ensure that any special conditions, such as refunds or exchanges, are outlined on the receipt to avoid potential disputes and clarify the terms of the sale.