Track mileage and receipts accurately with a simple template that saves time and reduces errors. Keep a record of each trip, including distance traveled, dates, and the purpose of the trip. Input the rate per mile, whether it’s company-specific or IRS-approved, and calculate the total automatically.

For receipts, attach a digital copy or note the amount spent, date, and category of expense. Group similar items, like meals or travel, for easier reference. Use the template to easily categorize and sum up expenses, ensuring no detail is overlooked.

Tip: Include a section for notes to clarify any unusual expenses or exceptions. This will help when reviewing the report and prevent any confusion later on.

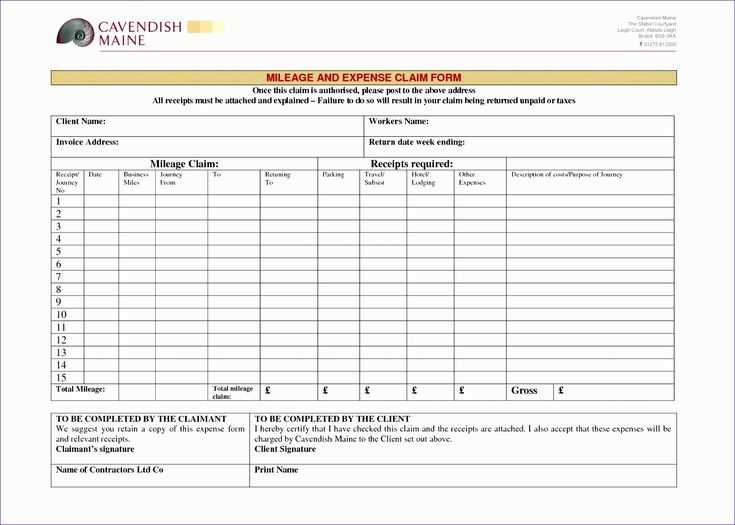

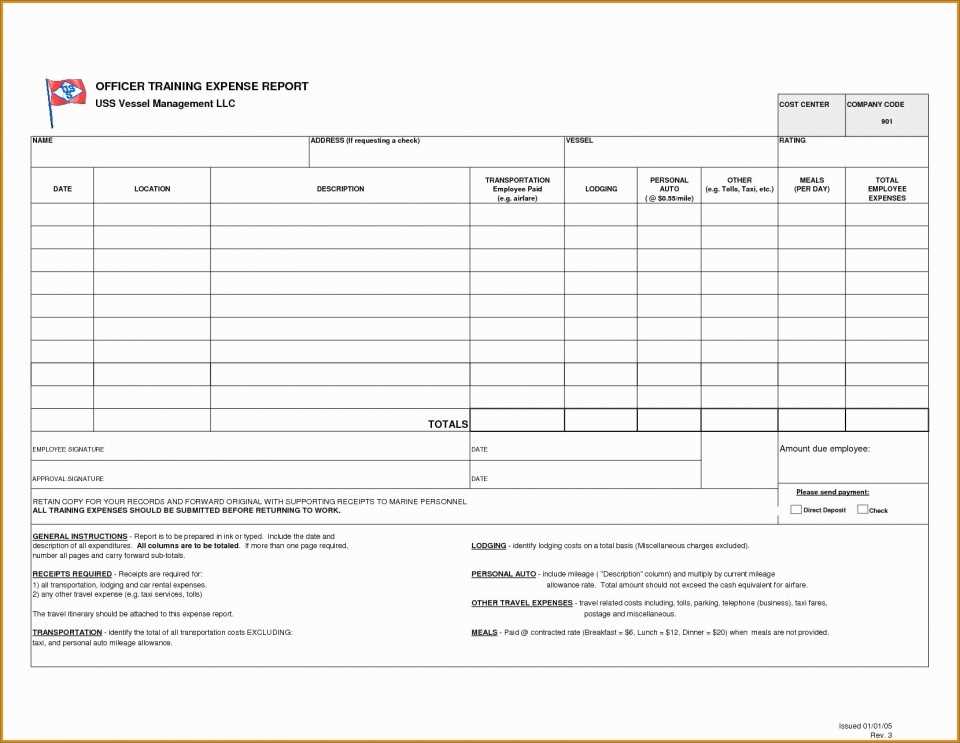

Expense Report Template: Mileage and Receipts

Track mileage and receipts with clear documentation to ensure accuracy and transparency. Here’s how you can structure your expense report:

1. Mileage Tracking

Include the following details for each trip to track mileage properly:

- Start Date and Time: Record the exact time you started the trip.

- End Date and Time: Note when you finished the trip.

- Starting and Ending Locations: Specify where the trip began and ended.

- Total Miles Traveled: Measure the exact number of miles driven.

- Purpose of Trip: Mention the business reason for the trip.

2. Receipt Submission

Ensure that all receipts are legible and itemized. Include the following elements for each receipt:

- Vendor Name: The name of the business or store.

- Date of Purchase: Clearly mark the date of the transaction.

- Amount Paid: Include the total cost paid for the item or service.

- Item Description: List what was purchased.

For a clear and concise report, categorize expenses into transportation, meals, and lodging. Double-check for any missing or duplicate entries to avoid discrepancies.

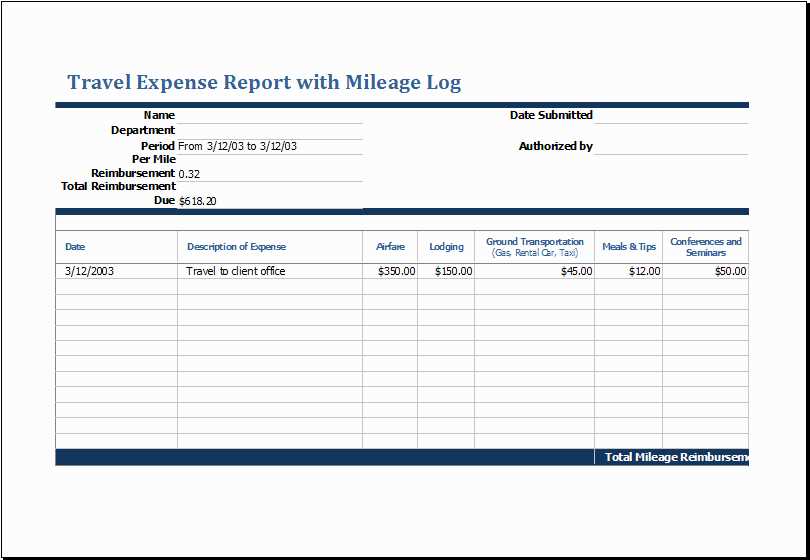

How to Track Mileage for Reimbursement

Use a mileage tracker app to record trips in real-time. These apps automatically capture your route, starting and ending locations, and the distance traveled. This method eliminates the risk of forgetting or inaccurately calculating miles. Many apps allow you to classify trips as business or personal, making reimbursement calculations easier.

Manual Tracking

If you prefer not to use an app, keep a logbook or spreadsheet. Write down the date, destination, purpose, and total miles for each trip. Make sure to calculate mileage from your starting point to the final destination, including any stops. This logbook can be a physical journal or a digital document for easy reference.

Reimbursement Guidelines

Check your company’s reimbursement policy to understand the rate per mile and the required documentation. Some companies may ask for additional proof, such as GPS logs or receipts for parking or tolls. Make sure to submit your mileage report within the designated time frame to avoid delays.

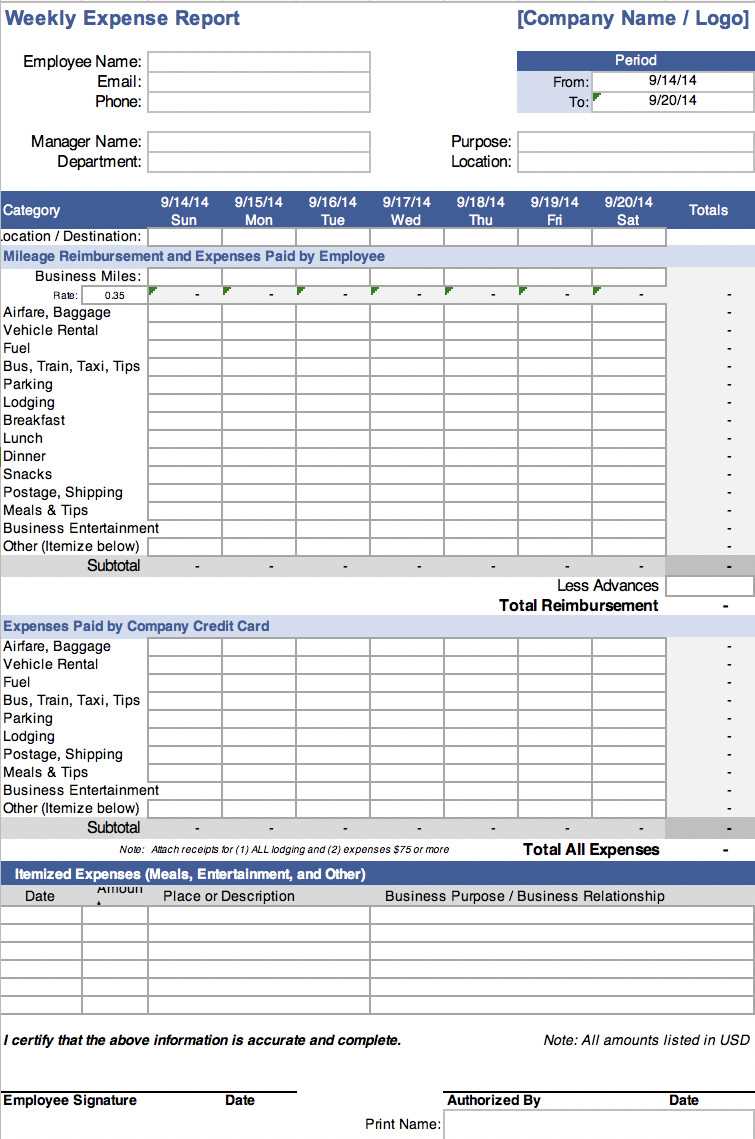

Organizing and Categorizing Receipts

Use folders or digital tools to separate receipts by category. For instance, create sections for transportation, meals, office supplies, and client meetings. Assign a clear label to each folder to avoid confusion later.

Use Digital Tools for Better Tracking

Scan or photograph receipts as soon as you receive them. Store them in a cloud-based service with tags for quick access. Tools like Expensify or Receipt Bank allow you to categorize receipts instantly, reducing the risk of losing them.

Implement a Regular Sorting Schedule

Set aside time weekly or monthly to organize receipts. During this time, scan physical receipts and add them to your digital storage. Keep your folders updated to reflect new purchases or expenses as they occur.

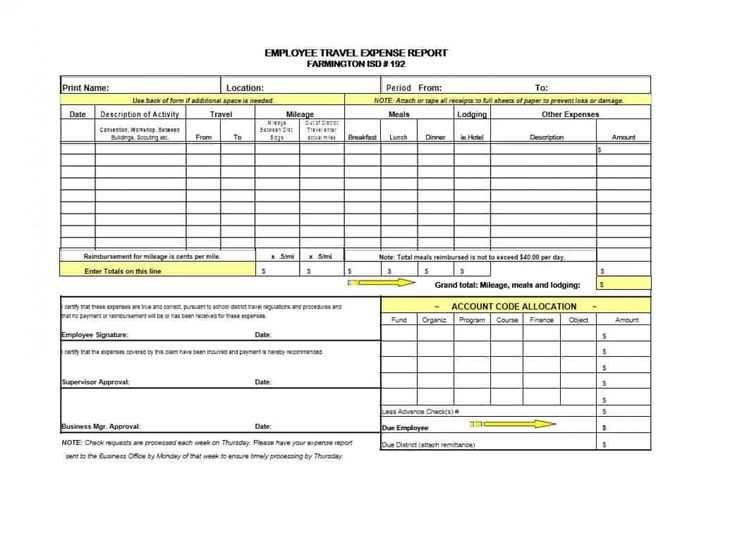

Common Mistakes to Avoid in Expense Reports

Incorrectly documenting mileage is a frequent mistake. Always ensure that the starting and ending locations are clear, and include the total distance traveled. Double-check that the vehicle used is specified, especially if multiple options are available.

Missing receipts can derail an otherwise accurate report. If you lose a receipt, note the transaction details, such as the amount, date, and purpose, and attach a written explanation. Ensure that all expenses, regardless of amount, are supported by receipts whenever possible.

Failing to categorize expenses correctly is another common error. Assign expenses to the appropriate categories, like meals, travel, or office supplies, to avoid confusion during review. Use consistent and logical groupings to make the report easier to process.

Submitting unapproved expenses leads to delays and denials. Always verify that each expense is in line with company policies before adding it to your report. If you’re unsure, ask for clarification in advance.

Neglecting to account for tax-exempt and non-reimbursable items can cause discrepancies. For example, some meals, travel insurance, or personal expenses may not be reimbursable. Review the guidelines to make sure you’re only submitting what’s eligible.