When creating fake receipt templates, focus on precision. A well-designed template should mimic the style and layout of genuine receipts while being adaptable for different scenarios. Start by choosing a clean and clear structure that includes essential details like store name, date, and items purchased. The spacing should be consistent, and fonts should be legible to make the document appear authentic.

Key Details should include the store’s name, contact information, item descriptions, prices, and total amounts. Make sure the tax rate is calculated correctly, and the formatting of numbers aligns with local standards. Adjust the font size and line spacing to maintain a professional look while ensuring the receipt isn’t too cluttered.

Don’t forget to include a disclaimer or minor details that make the receipt less likely to be flagged as suspicious. Consider adding a unique reference or receipt number that varies with each generated document. This small touch can make the template feel more authentic.

Fake Receipts Templates

Using fake receipt templates is a common practice in many situations, but it’s crucial to ensure that their use is aligned with legal requirements. Templates can help in recreating receipts for testing purposes or for simulations in business environments. However, using them for deceptive or fraudulent purposes can lead to serious consequences.

What to Look for in a Fake Receipt Template

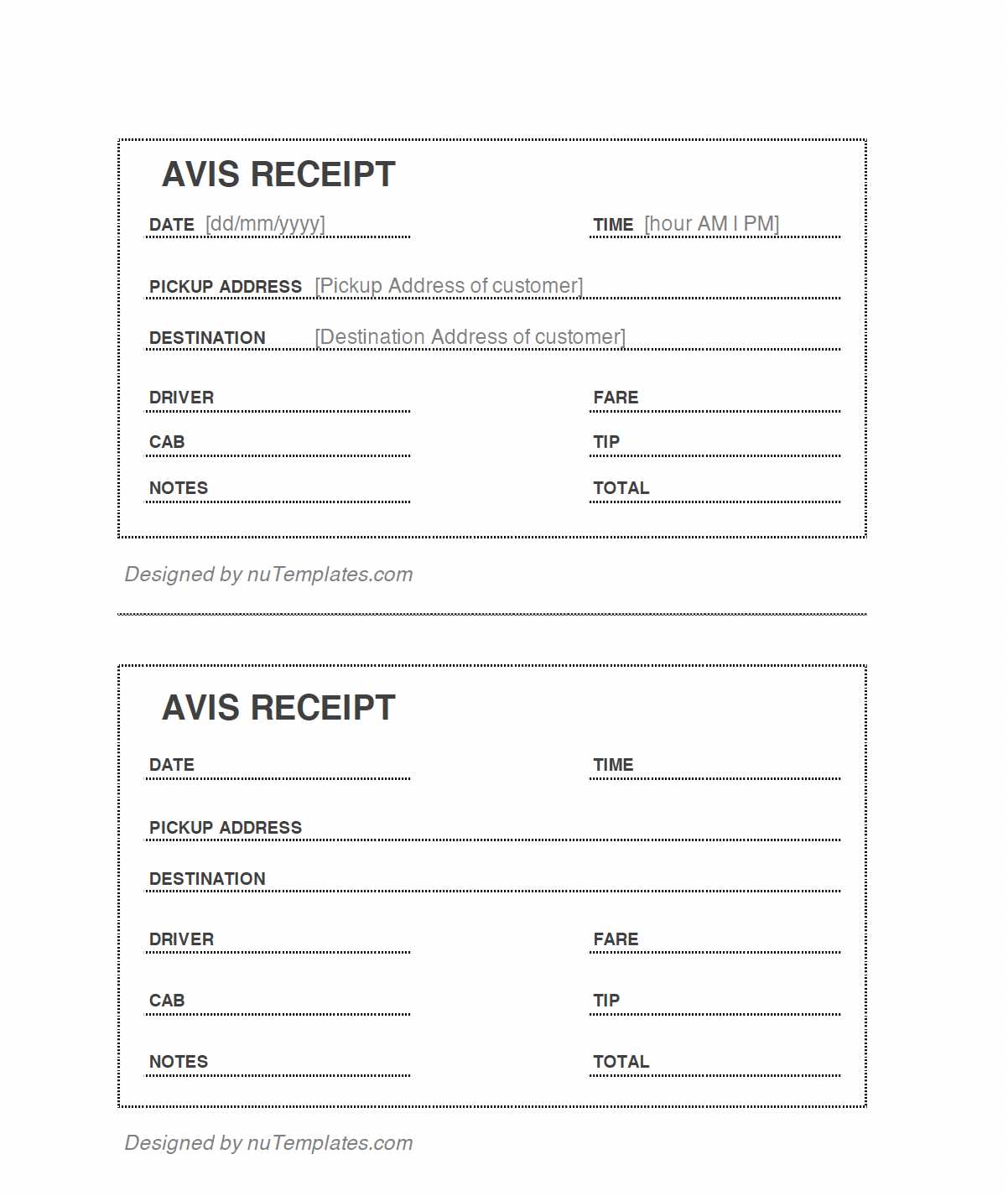

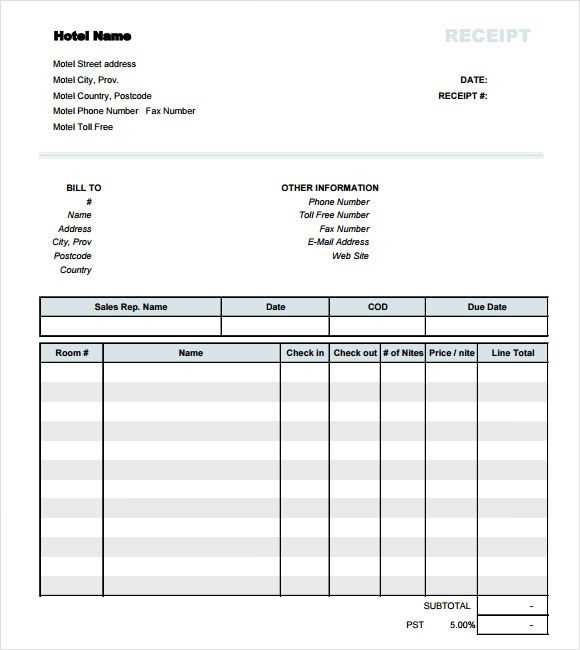

- Realistic Layout: The template should have a professional and clear layout that mimics actual receipts. Include details like store name, items purchased, and prices.

- Editable Fields: A good template should allow for easy modifications to adjust product names, prices, taxes, and other essential information.

- Legal Disclaimers: It’s advisable to add a disclaimer indicating that the receipt is a simulation to avoid misunderstandings.

Common Uses of Fake Receipt Templates

- Product Testing: Developers often use fake receipts to test their software systems, especially for retail or financial applications.

- Education: Teachers or instructors might use templates for teaching purposes, helping students understand transaction processes or accounting practices.

- Event Planning: Event organizers may use fake receipts for budgeting or creating examples for participants to better understand pricing structures.

How to Spot Fake Receipts and Avoid Common Pitfalls

Check the fonts carefully. Fake receipts often use inconsistent or odd fonts that don’t match the company’s usual style. Look for any jarring mismatches between the title, date, and items listed.

Examine the logo. A legitimate receipt will have a high-quality logo, while a fake one might have a blurry or poorly aligned image. Pay attention to details like the size and color of the logo as well.

Review the date and time. Fake receipts might have unrealistic or irregular timestamps. Make sure the date corresponds with store hours and that the format matches the regional standards.

Check the item list. Fake receipts sometimes show products that don’t match what was actually purchased. Look for inconsistencies, such as an unexpected price or a product category that doesn’t fit with your typical shopping habits.

Inspect the total amount. If the total seems off, verify the individual prices and ensure they match what you would expect for that product or service. Any discrepancies could be a red flag.

Look for transaction numbers. Fake receipts might not include a valid transaction number or may feature a series of random digits that don’t correlate with any real purchase logs.

Verify contact information. Official receipts typically include accurate store details–address, phone number, website. Ensure that the contact details match the official ones listed on the company’s website or business card.

Don’t ignore the barcodes or QR codes. Scanning them should lead you to a valid webpage or prompt you for relevant purchase info. Fake receipts may have broken or non-functioning codes.

Lastly, trust your instincts. If something feels off about the receipt–whether it’s the format, the layout, or the general appearance–take a second look before accepting it as genuine.

Legal Consequences of Using Fake Receipt Templates

Using fake receipt templates can result in severe legal repercussions. Falsifying receipts, whether for personal gain or fraudulent business activities, is considered a criminal offense in many jurisdictions. The legal system treats such actions as fraud, punishable by fines, penalties, or imprisonment.

Criminal Liability

Creating or using fake receipts is classified as a form of fraud. In most legal systems, fraud is a criminal act that can lead to significant legal consequences. If caught, individuals may face criminal charges ranging from misdemeanors to felonies, depending on the severity of the offense. A conviction can result in imprisonment, community service, or both.

Financial Penalties and Compensation

In addition to potential jail time, individuals may be required to pay restitution or compensation to the victims of their fraudulent actions. This could involve reimbursing the financial losses incurred by businesses or individuals affected by the fake receipts. Additionally, courts may impose heavy fines, which can financially burden those involved in such activities.

Beyond the immediate legal consequences, using fake receipts can severely damage one’s personal or professional reputation. Rebuilding trust after being caught in a fraud case is a challenging and often long-term process.

Tools and Resources for Generating Legitimate Receipts

Use reliable receipt generator tools like “Invoice Generator” or “Zoho Invoice” to create professional and accurate receipts. These platforms offer customizable templates where you can input business details, item descriptions, and payment information, ensuring each receipt is tailored to your needs.

If you prefer offline tools, Microsoft Word and Google Docs offer receipt templates that can be easily edited. While they are simple, they allow for quick customization and can be saved in various formats for future use.

Online Platforms

Web-based tools like “FreshBooks” and “QuickBooks” automate receipt generation. These platforms not only create receipts but also track payments and manage invoices, offering a streamlined experience for business owners. Many of these tools offer free trials, making them accessible without upfront costs.

Invoice Software for Businesses

For companies that require a more robust solution, software such as “Xero” or “Wave” provides advanced receipt generation features. These tools integrate with accounting systems, keeping track of receipts and transactions in real-time, making them ideal for businesses with frequent invoicing.