Need a fake store receipt template for a personal project or business demonstration? The right template can help recreate an authentic-looking receipt with accurate formatting, realistic fonts, and professional layout. Whether you want to track expenses, create mock transactions for training, or replace a lost receipt, selecting the right design is key.

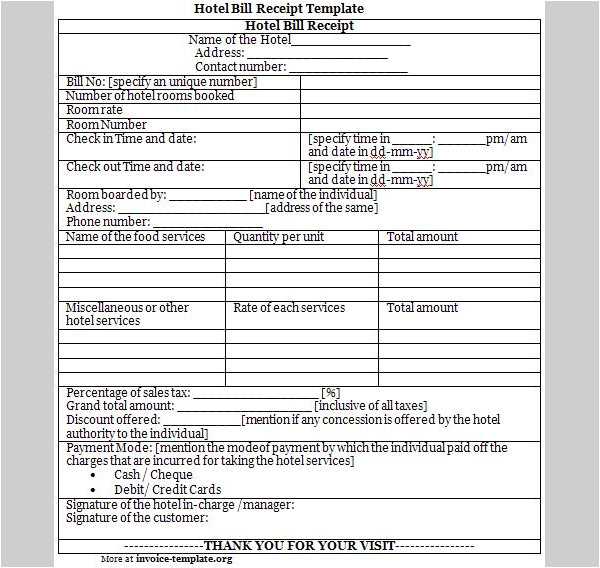

Start by identifying the receipt style you need. Different stores use varying formats, including thermal-printed receipts, inkjet-generated invoices, or digital PDF versions. Pay attention to details like store logos, itemized lists, tax calculations, and transaction timestamps to maintain authenticity. Many free and premium templates are available online, allowing you to customize them with specific store names, addresses, and product details.

When customizing a template, use a reliable editing tool like Photoshop, Microsoft Word, or online receipt generators. Adjust fonts to match real store receipts–common choices include Arial, Tahoma, and Courier New. Proper spacing and alignment are crucial for credibility. If your receipt includes barcodes or QR codes, use an online generator to create a scannable code that links to a relevant source.

Although fake store receipts can be useful for personal projects or presentations, ensure they are used ethically. Forging receipts for fraudulent returns or expense claims can have legal consequences. Always use templates responsibly, whether for budgeting, training, or creative purposes.

Fake Store Receipt Template: Practical Guide and Key Considerations

Choose a clear and legible font that mimics receipts from well-known stores. Arial, Courier, and Times New Roman are common choices. Adjust font size to match real receipts–typically between 8pt and 12pt.

Ensure accurate item descriptions and pricing. Use realistic tax rates based on the store’s location. Many regions apply specific percentages, so check official sources to avoid inconsistencies.

Align text properly. Store names usually appear bold at the top, followed by addresses, phone numbers, and transaction details. Use left-aligned formatting for product names and prices, while totals should be right-aligned.

Format dates and times correctly. Most receipts follow MM/DD/YYYY or DD/MM/YYYY formats, with timestamps in a 24-hour or 12-hour format, depending on the country.

Include transaction details such as payment method, authorization codes, and reference numbers. These elements add authenticity and make the receipt look legitimate.

Avoid unrealistic discounts or exaggerated figures. A receipt showing a $500 discount on a $550 purchase raises suspicion. Stick to typical promotional values seen in real transactions.

Use a receipt generator tool or a word processor with table functions to maintain structure. Ensure proper spacing, as cramped or overly spaced text looks unnatural.

Double-check spelling and formatting before printing. Even small errors, such as inconsistent spacing or missing punctuation, can make a receipt appear fake.

How to Create a Realistic Fake Store Receipt Template

Choose a common receipt format used by major retailers. Study real receipts to match fonts, spacing, and layout. Use a monospaced font like Courier New to mimic thermal printer text.

Key Elements to Include

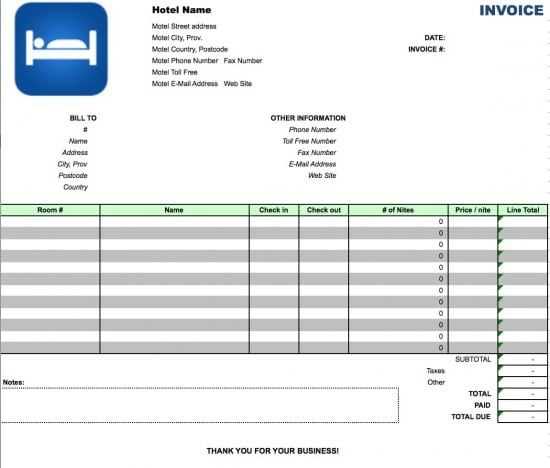

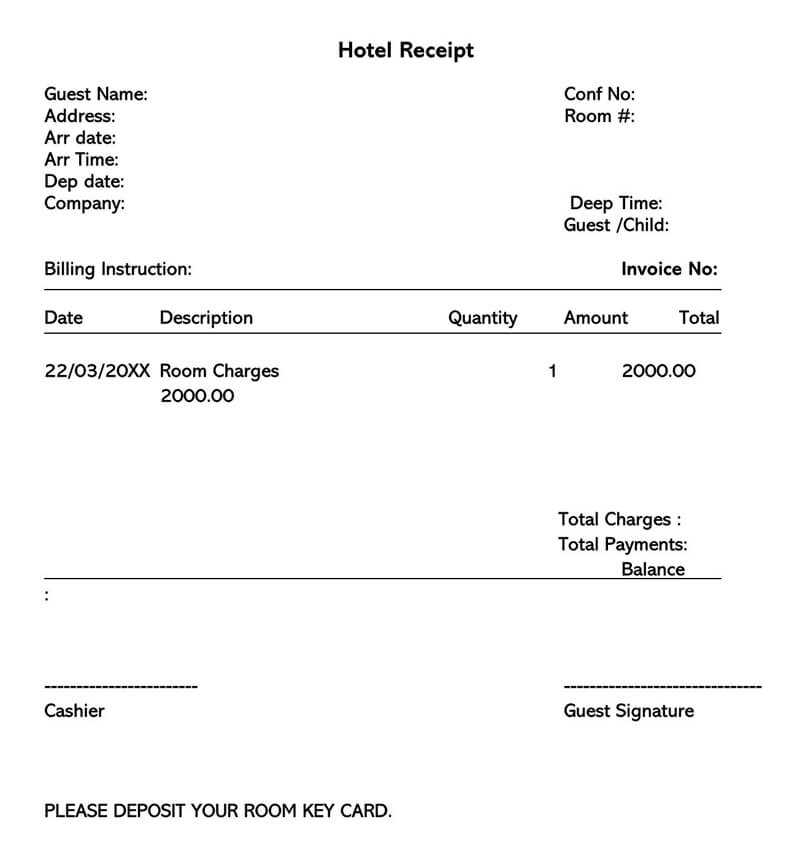

Ensure your template has essential details: store name, address, date, time, itemized list, subtotal, tax, and total. Use proper alignment and consistent column spacing to enhance realism.

Formatting and Printing

Use a light gray background with a subtle noise texture to replicate thermal paper. Set margins and line spacing to match real receipts. For authenticity, print on thermal paper using a receipt printer or lightly crumple standard paper before scanning.

Double-check details for accuracy. A well-structured template with correct formatting ensures a convincing result.

Common Design Elements Found in Store Receipts

A well-structured receipt ensures clarity and ease of use. Businesses follow a consistent format to provide customers with essential details. Here are the key design elements:

- Store Information: Business name, address, phone number, and website, usually at the top.

- Transaction Details: Receipt number, date, and time of purchase for reference.

- Itemized List: Product names, quantities, unit prices, and total cost, often aligned in columns.

- Taxes and Fees: Sales tax, service fees, or discounts, clearly separated from item prices.

- Total Amount: Bold or larger font to highlight the final cost.

- Payment Method: Cash, credit card, or other payment types, sometimes with the last four digits of the card.

- Return Policy: Brief guidelines on refunds and exchanges, usually at the bottom.

- Barcode or QR Code: Used for quick verification, digital storage, or loyalty programs.

Receipts vary by industry, but these elements remain standard. Simplicity and readability help customers review their purchases effortlessly.

Legal and Ethical Aspects of Using Fake Receipt Templates

Using fake receipt templates can lead to serious legal consequences, including fraud charges, financial penalties, and even imprisonment. Businesses and financial institutions have advanced verification systems that detect forged receipts, making deception a high-risk activity.

Legal Risks

Falsifying receipts for tax deductions, reimbursement claims, or warranty fraud violates laws in most jurisdictions. In the U.S., altering or fabricating financial documents can result in federal fraud charges, with penalties ranging from fines to lengthy prison sentences. Tax authorities conduct audits to identify discrepancies, and fraudulent claims can trigger severe penalties, including audits of previous years.

Ethical Considerations

Beyond legal issues, fake receipts undermine trust in business transactions. Retailers rely on authentic receipts for accurate inventory tracking, warranty claims, and financial reporting. Manipulating receipts disrupts these systems, leading to increased scrutiny on legitimate transactions. Ethical business practices protect reputations and prevent unnecessary legal exposure.

Instead of using fake receipts, consider legal alternatives such as requesting duplicate receipts from vendors or using digital expense management tools that ensure compliance with financial regulations.