If you’re looking to create a professional farm receipt template, you’ll want to focus on clarity and simplicity. A well-structured receipt ensures both the buyer and seller have accurate records, preventing any potential misunderstandings. Start by including essential details such as the farm’s name, address, and contact information. Be sure to list the items purchased with their respective quantities and prices, making it easy for both parties to refer back to if needed.

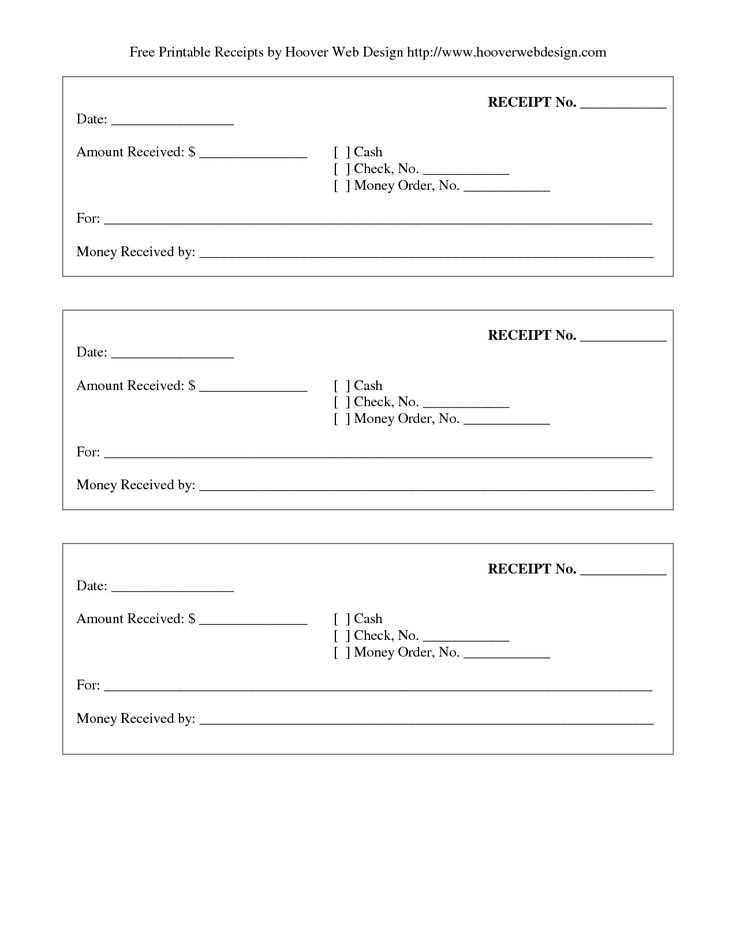

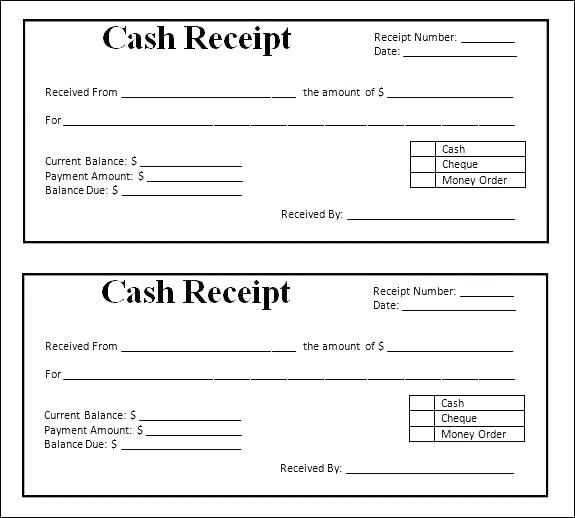

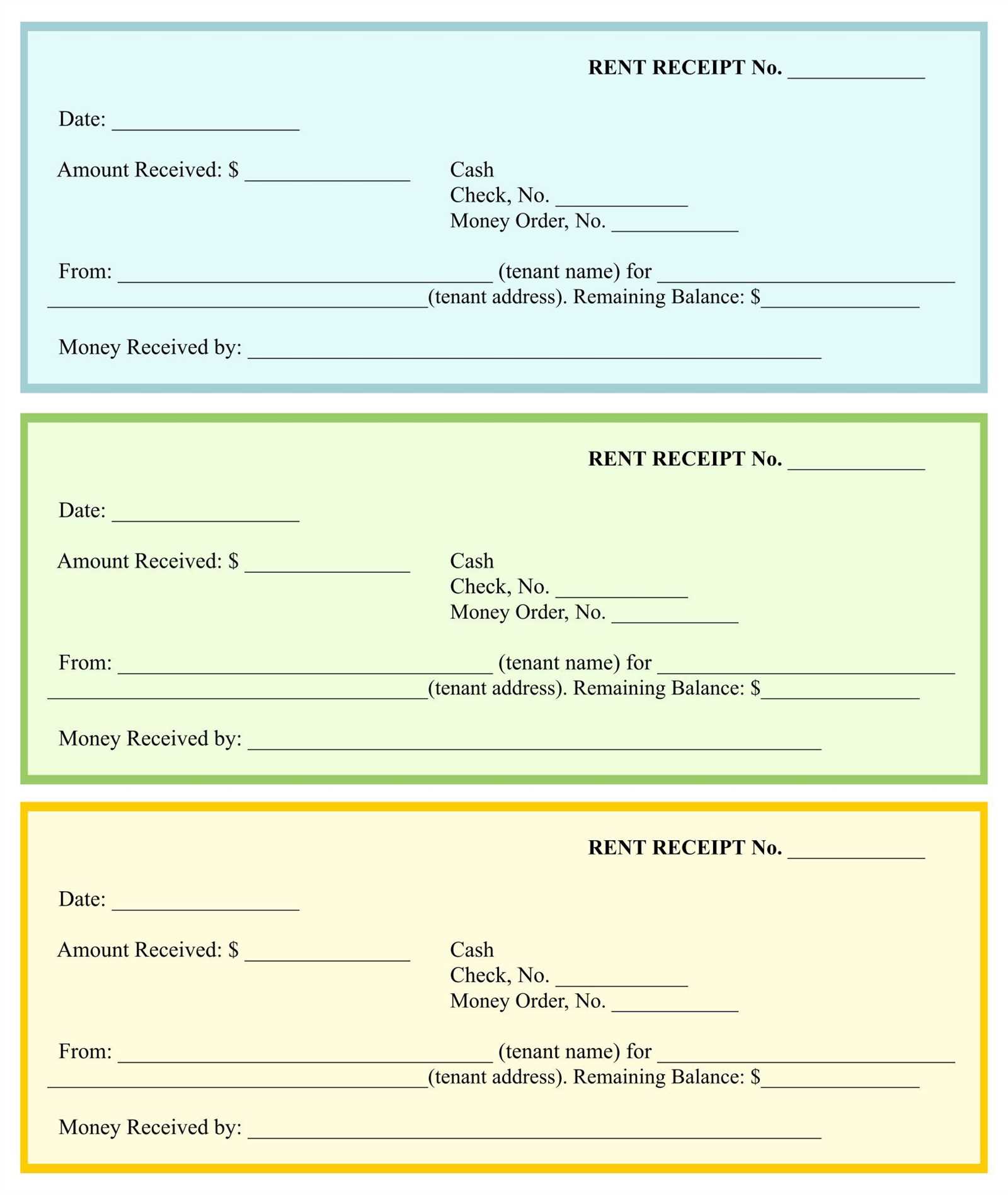

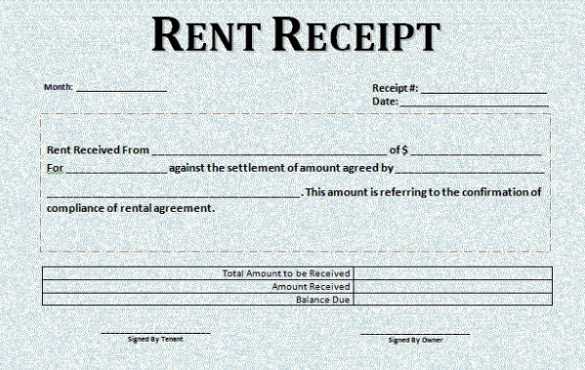

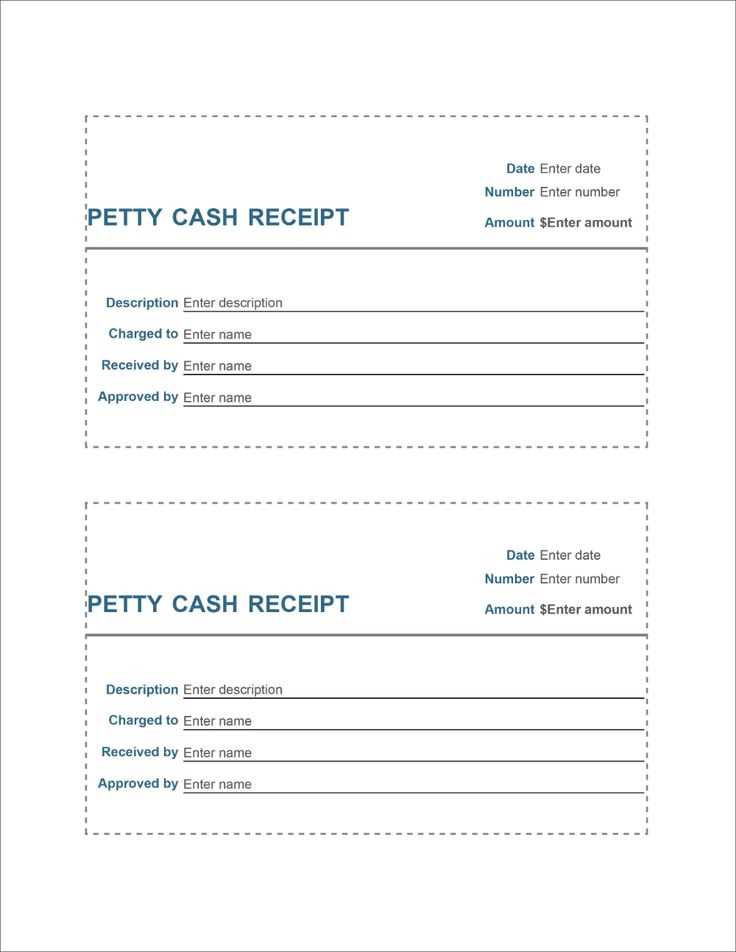

Another important element is the inclusion of payment terms. Specify whether the transaction is cash, check, or credit-based, along with any payment deadlines. Including the date of the transaction is crucial for record-keeping, ensuring both sides can track their purchases efficiently. Don’t forget to add a unique receipt number, which helps identify the transaction for both accounting and legal purposes.

By incorporating these straightforward elements, you can create a clear, professional, and easily understood receipt that will serve both you and your customers effectively. A well-designed farm receipt template reduces confusion and makes future transactions smoother.

Here’s the revised version with minimal repetition:

For better readability and efficiency, use this streamlined farm receipt template that minimizes unnecessary repetition. This layout keeps all essential details organized and clear without redundancy.

Receipt Layout Example

This template includes key fields that ensure accurate documentation of farm transactions. Each section is labeled to avoid confusion, so users can quickly fill in the necessary information.

| Item | Description | Quantity | Price | Total |

|---|---|---|---|---|

| Farm Produce | Fresh tomatoes | 10 kg | $2.00/kg | $20.00 |

| Equipment | Watering Can | 1 | $15.00 | $15.00 |

| Total | $35.00 | |||

Key Sections to Include

- Date: Include the date of transaction for accurate record-keeping.

- Seller & Buyer Information: Identify both parties clearly with names and contact details.

- Itemized List: Break down each product or service purchased with its description, quantity, price per unit, and total amount.

- Payment Details: Specify the method of payment, whether it’s cash, check, or electronic transfer.

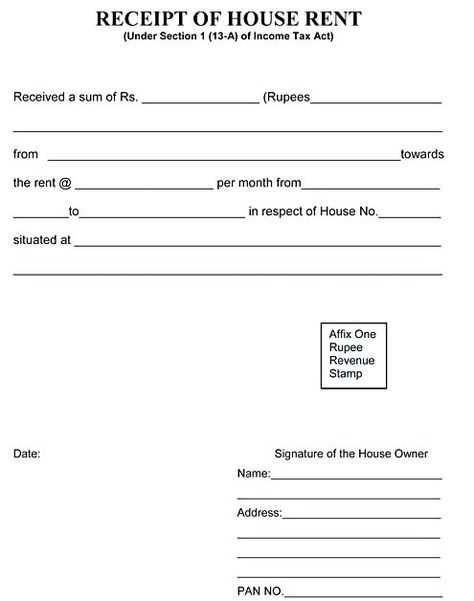

- Signature: Both buyer and seller should sign the document to confirm the transaction.

This layout is simple and minimizes repetitive entries, focusing on clarity and accuracy, which saves time for both the seller and buyer.

- Farm Receipt Template Guide

When creating a farm receipt, the goal is to provide clear and concise information about the transaction. A well-structured template ensures both the buyer and seller have a record that includes all necessary details. Below are key elements to include in your farm receipt template.

Key Components of a Farm Receipt

- Business Information: Include the name, address, and contact details of the farm or seller.

- Receipt Number: Assign a unique identifier to each receipt for tracking purposes.

- Transaction Date: Clearly state the date the transaction took place.

- Buyer Information: Include the buyer’s name and contact details.

- Item Description: List the items sold, including quantity, unit of measure, and detailed description.

- Price and Total: Indicate the price per unit and the total amount due for the transaction.

- Payment Method: Specify how the payment was made (cash, check, credit, etc.).

- Signature Line: Include a place for both parties to sign, confirming the transaction.

Formatting Tips

- Keep the layout clean and organized with clearly labeled sections.

- Use readable fonts and a simple design for easy understanding.

- Ensure the receipt is printed on a professional letterhead if applicable.

- Consider using bold text for headings and important details to make them stand out.

By incorporating these elements into your farm receipt template, you ensure a transparent and professional record of each transaction. A well-designed receipt not only simplifies record-keeping but also builds trust with your customers.

Creating a simple receipt template in Excel is quick and helps maintain organized financial records for your farm. Follow these steps to set up a basic template:

- Open Excel: Start by opening a new Excel worksheet.

- Create Header Row: In the first row, add the following column headers: “Date,” “Description,” “Quantity,” “Unit Price,” and “Total.” These categories will cover the basic details of each transaction.

- Enter Item Details: For each transaction, enter the date of the sale, a brief description of the item (e.g., “Fresh eggs,” “Tomatoes”), the quantity sold, and the price per unit. The “Total” column should be calculated by multiplying the quantity by the unit price. Use Excel’s formula functionality for automatic calculation (e.g., =C2*D2).

- Add Customer Information: Include a section at the top of the sheet for customer details such as name and address, especially if you want to track sales to specific buyers.

- Format for Clarity: Adjust column widths to make sure all information fits neatly. Apply bold formatting to the header row and use borders to separate sections.

- Include Payment Methods: Add a row at the bottom to record payment method (e.g., cash, check, card). This will help in reconciling payments at the end of the month or year.

Save the template, and it will be ready to use for all future transactions. Make sure to update it regularly to ensure accuracy in your farm’s financial records.

Include clear identification of the farm and the transaction in your receipt. This includes the farm’s name, address, and contact details. Make sure the receipt has a unique serial number to track each transaction easily.

1. Date and Time of Purchase

Always add the exact date and time of the transaction. This helps both the seller and buyer keep track of the purchase and ensures legal clarity in case of any disputes.

2. Buyer and Seller Information

Specify both the buyer and seller details. For the buyer, include full name and address, while for the seller, ensure that the farm’s name and contact information are accurate. This ensures traceability of the transaction.

3. Product Details

List all products being sold, including quantities, descriptions, and unit prices. Make sure to include any relevant details like crop type or breed if applicable, as well as any associated serial numbers for equipment or livestock.

4. Total Amount and Payment Method

Clearly show the total cost, including taxes if applicable. Specify the method of payment, whether it’s cash, card, or another form, to eliminate confusion about the transaction.

5. Terms and Conditions (Optional)

Include any relevant terms, like warranties, return policies, or agreements on the goods sold. If the sale involves goods that can spoil or deteriorate, state the condition of the items at the time of sale.

| Item | Quantity | Unit Price | Total |

|---|---|---|---|

| Tomatoes | 10 lbs | $2.50 | $25.00 |

| Eggs | 2 dozen | $3.00 | $6.00 |

| Milk | 1 gallon | $4.00 | $4.00 |

Ensure the receipt is signed by both parties to confirm the transaction details, giving it legal weight if needed.

Adjusting your farm receipt template for various agricultural products requires attention to product-specific details. Begin by identifying unique fields for each type of produce or livestock you sell. This allows you to capture essential information without cluttering the template with unnecessary sections. Below are practical steps to customize your template based on the agricultural product you’re working with:

For Fruits and Vegetables

- Product Type: Clearly state the type of fruit or vegetable, including variety, size, and weight per unit. For example, “Roma tomatoes, 10kg box” or “Honeycrisp apples, per dozen”.

- Harvest Date: Add a field for the date of harvest to indicate freshness.

- Quality Grades: Depending on market standards, include options to note product grade, such as “Grade A” or “C Grade” for defects or imperfections.

For Livestock

- Species and Breed: Specify the type and breed of livestock, such as “Angus cattle” or “Duroc pigs”.

- Age or Weight: Provide space to list the age or weight of each animal for better traceability.

- Health Status: Include a field to indicate whether the animal has been vaccinated or treated for diseases, especially for certification purposes.

By tailoring your template to suit the specifics of different products, you make transactions smoother and ensure that all relevant details are easily accessible for both you and your buyers. Always consider the local market’s needs and regulations when deciding which fields to prioritize in your receipts.

Make sure receipts issued by farms include all legally required information, such as the farm’s name, address, and tax identification number. Failure to provide these details may lead to tax reporting issues and complications during audits. The receipt should also clearly state the transaction date, the total amount paid, and a description of the goods or services provided. This ensures transparency and avoids potential disputes.

Tax Reporting and Compliance

Receipts must comply with local tax laws, including those related to sales tax. In some regions, farms are required to collect and remit sales tax for certain products or services. Always verify whether sales tax applies to your transactions and reflect this accurately on receipts. Keep thorough records of all receipts issued for tax filing purposes, as these may be required during audits.

Record Keeping and Documentation

Maintain organized records of receipts for at least the minimum period required by law, often ranging from three to seven years, depending on your jurisdiction. Having a reliable system for managing receipts will streamline tax reporting and make it easier to handle any legal disputes or customer inquiries regarding past transactions.

Automate receipt generation by selecting software that integrates with your sales system. Look for platforms that allow real-time data sync with your point-of-sale (POS) system or accounting software. This eliminates manual entry, reduces errors, and speeds up the process.

Implement cloud-based tools like QuickBooks, Xero, or Square to automatically create receipts once a transaction is processed. These tools allow for custom templates and can send receipts directly to customers via email or SMS, enhancing convenience and professionalism.

Use templates for uniformity. Customize receipt fields such as item names, prices, tax, and total amount. Ensure the software allows for adding farm-specific details like product type, harvest date, or quantity harvested to make your receipts more detailed and informative.

For more control, integrate automation with inventory management. This way, receipts can include real-time stock updates, helping you track items sold and manage inventory without extra input. Look for software with simple reporting features that can generate summaries of transactions, saving time during audits or financial reviews.

Choose software with a built-in security protocol. Ensure that customers’ data and transaction details are encrypted during transmission and storage to avoid any privacy breaches.

Lastly, ensure the software is user-friendly. It should provide a seamless experience for your team, requiring minimal training, while allowing for quick customizations and efficient operation. Once set up, this system will work continuously, saving you time and providing accurate, professional receipts with every sale.

Keep your farm documents in a secure, easy-to-access location. A locked filing cabinet or a dedicated storage room works best for physical documents. For digital records, use a secure cloud storage solution with password protection and two-factor authentication.

Label folders clearly and consistently. Separate documents by category such as financial records, equipment maintenance, crop management, and permits. Use color-coded labels or tabs to make finding what you need quicker. Create a consistent naming convention for digital files that includes the date and document type for easy sorting and searching.

Regularly back up digital records. Set up automatic cloud backups to ensure that your files are safe in case of computer failure. Keep physical copies of critical documents like land ownership and insurance policies in a fireproof safe for added security.

Review and discard outdated documents periodically. Set a schedule to go through old files, whether physical or digital, and eliminate any that are no longer needed. This helps maintain organization and reduces clutter.

Train your team to follow your document organization system. Ensure that everyone involved in managing farm operations understands how to store and access documents. This promotes consistency and reduces errors or misplaced paperwork.

Keep a digital backup of important handwritten notes or records. Scan them and store in a cloud-based system to ensure they are not lost over time. This adds an extra layer of protection to irreplaceable information.

To create a clear and organized farm receipt template, ensure that every section serves a specific purpose. Begin with including the date and invoice number at the top for easy reference. This helps to track transactions more effectively.

Next, list the seller’s and buyer’s details–such as names, addresses, and contact information–so both parties can be easily identified. This is important for accountability and traceability of the transaction.

In the next section, itemize the goods or services provided. Include a brief description, quantity, unit price, and total price for each item. Make sure all numbers are clear and easy to understand to avoid any confusion later on.

It’s also helpful to provide a subtotal, taxes, and total amount clearly marked. This ensures there are no misunderstandings about the total cost of the transaction.

Finally, add any necessary payment terms or instructions at the bottom of the receipt. This could include payment methods, deadlines, or account information for easier processing of the transaction.