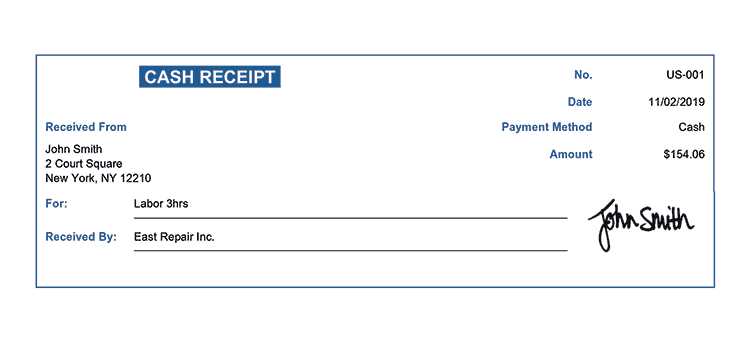

Creating a final receipt template can simplify transaction management, ensuring clarity and consistency for both businesses and customers. Start by including all essential details like the business name, contact information, date of purchase, and a unique receipt number. This basic structure will provide a clear record for any future reference.

Be sure to list purchased items or services with clear descriptions, quantities, and prices. Including taxes, discounts, or any other adjustments to the total amount is necessary for transparency. This helps avoid misunderstandings and provides customers with a complete breakdown of their transaction.

To make the process even more straightforward, consider adding payment method details such as credit card or cash. This will enhance the professional look of the receipt and make it easier for accounting purposes. A well-structured final receipt template ensures smooth transactions and a positive customer experience.

Here are the corrected lines, with minimal repetition:

To create a final receipt template that minimizes repetition, consider these key adjustments:

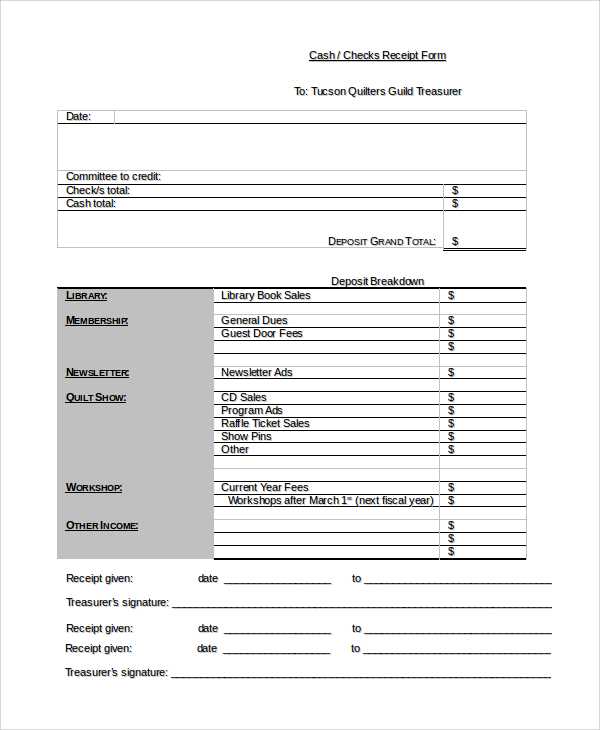

Streamline the Itemization

Consolidate item descriptions when possible. Instead of repeating similar phrases, group related items under a single line with a clear breakdown. For example, instead of listing “item 1”, “item 2”, and “item 3” on separate lines, combine them under a heading like “Purchased Items” and list them with bullet points for clarity.

Avoid Redundant Payment Sections

If the template includes separate sections for payment methods, eliminate repetition by consolidating them. For instance, a “Payment Method” section can cover all the modes of payment (credit card, cash, etc.) in one paragraph or table, rather than repeating the header for each method.

Keep text concise by focusing on relevant details. Remove unnecessary phrases such as “Total Amount Due” if the total is already clearly displayed. The goal is to maintain clarity without overloading the user with repeated terms.

- Final Receipt Template

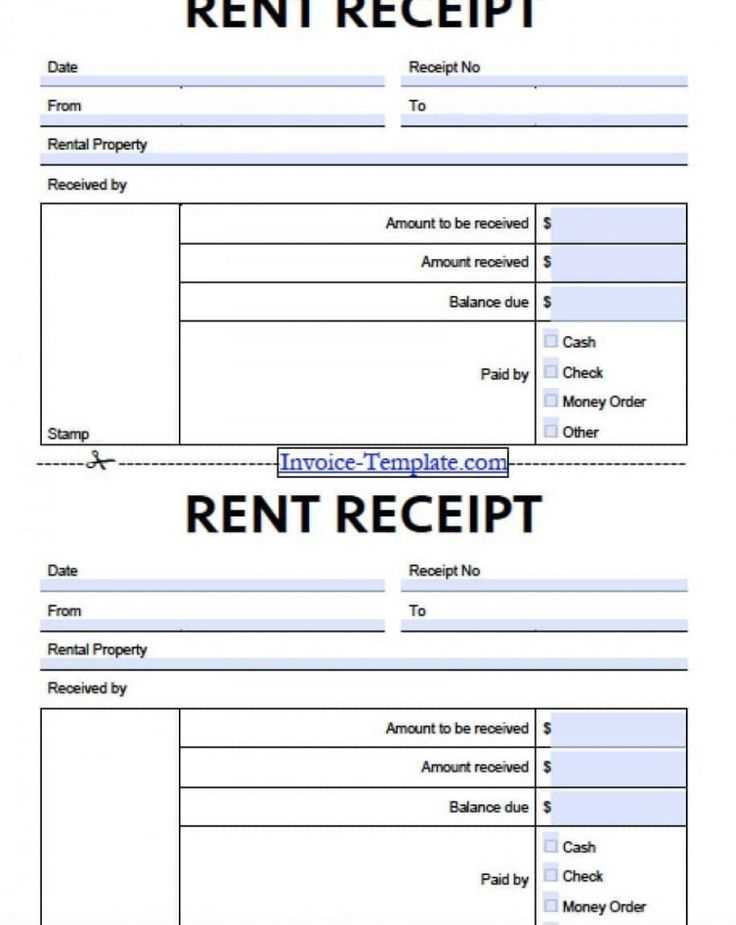

Design a clear and concise template that outlines all the necessary transaction details. A final receipt should include the following:

Key Elements of a Final Receipt

- Receipt Title: Label it clearly as “Final Receipt” to distinguish it from other documents.

- Transaction Date: Include the exact date of the transaction for future reference.

- Itemized List: Provide a detailed list of purchased items or services, along with their prices.

- Total Amount: Clearly state the final amount due or paid, including applicable taxes or discounts.

- Payment Method: Specify the method used for payment, such as credit card, cash, or online transfer.

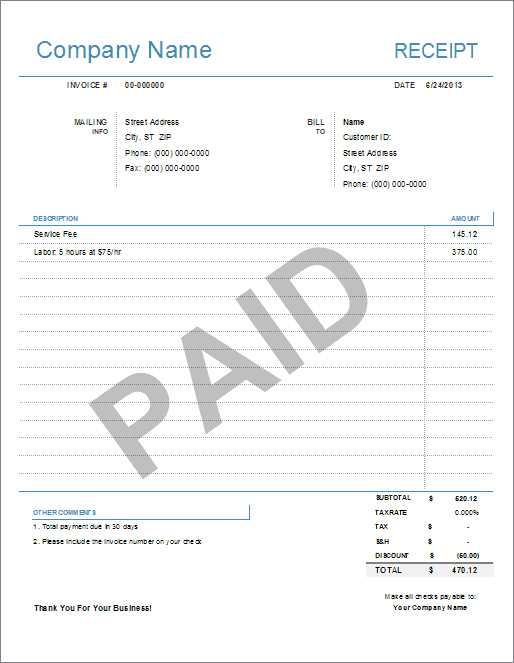

Formatting Tips

- Simple and Clear: Use readable fonts and a structured layout to ensure all details are easy to spot.

- Organized: Align the information neatly and ensure there’s enough space between sections to avoid clutter.

- Optional Notes: Include any special instructions or additional details that might be relevant for the recipient.

To create a custom receipt template, follow these steps:

- Choose a Format: Decide if your receipt will be printed on paper or sent digitally. This affects your layout and design choices.

- Design Layout: Structure your template with clear sections for business details, items purchased, total amount, payment method, and date of purchase.

- Include Key Information: Add business name, address, contact details, and tax information. Include a unique transaction number for tracking.

- Select Fonts and Colors: Use readable fonts and colors that align with your brand. Avoid clutter and ensure all text is legible.

- Add Branding: Insert your logo and any relevant branding elements to make the receipt reflect your business identity.

- Enable Editing: If creating a digital template, ensure it can be easily edited for various transactions, either through a word processor or custom software.

- Include Payment Details: Specify the payment method (e.g., credit card, cash) and any relevant transaction details like authorization number or payment processor info.

- Test and Adjust: After creating the template, test it by filling in sample data. Adjust the layout and formatting as needed to ensure it looks professional.

This approach ensures your receipt template is practical, professional, and aligned with your business needs.

These tools make receipt generation quick and simple:

1. Online Receipt Generators

- Invoice Generator: A free, easy-to-use tool for creating simple receipts. You can add business information, items, and payment details with ease.

- Receipt Generator: Another simple option for customizable receipts, offering templates that can be downloaded or printed directly after completion.

- Zoho Invoice: A comprehensive invoicing tool with options for automatic receipt generation. It allows customization and integrates well with accounting software.

2. Accounting Software with Receipt Features

- QuickBooks: A well-known tool that automatically generates receipts as part of its accounting system. It allows customization and tracks payments in real time.

- FreshBooks: Ideal for small businesses, FreshBooks offers customized receipt templates and organizes transaction data seamlessly.

- Wave: A free tool with receipt scanning capabilities, helping you manage finances and generate receipts efficiently.

These tools make the process smooth and save time by automating repetitive tasks while offering customization options to meet your needs.

Each region has specific regulations that govern the issuance of final receipts, ensuring compliance with local tax laws, business practices, and consumer protection standards. These regulations vary depending on the country or even the state, requiring businesses to tailor their receipt formats accordingly.

European Union

In the European Union, the final receipt must clearly outline the total amount paid, including taxes, as per the VAT (Value Added Tax) rules. Businesses must include the VAT number, the rate of VAT applied, and any exemptions if applicable. The receipt should also specify the payment method, such as credit card or cash. The use of electronic receipts is becoming more common, with some EU countries mandating their inclusion in specific sectors, such as hospitality or retail.

United States

In the United States, the legal requirements for final receipts can vary significantly from state to state. For example, in California, receipts for sales must show the total price, taxes, and a breakdown of individual items purchased. Some states also require receipts for refunds to include the original transaction details, like the date of purchase. It’s important to check local state regulations, as requirements differ for different types of transactions, such as in-person versus online purchases.

As with the EU, electronic receipts are increasingly being accepted, but they must still contain all necessary details, such as tax information and the total amount paid. In some states, like New York, businesses must provide paper receipts unless the customer opts for an electronic one.

The use of a closing receipt template should focus on clarity and consistency. Keep the formatting simple but informative. The final receipt should include the following elements:

- Transaction date and time

- Vendor’s contact information, including business name, address, and phone number

- Itemized list of products or services purchased, including quantities and unit prices

- Total amount paid, including any taxes or additional fees

- Payment method (e.g., credit card, cash, electronic transfer)

Ensure the receipt meets all local legal requirements, such as tax identification numbers, VAT numbers, or any industry-specific regulations. Keep the format consistent with other receipts issued by the business for easy recognition and reference. This approach helps both customers and businesses to easily verify transactions and ensures proper documentation for any potential disputes or returns.