A well-structured food receipt template ensures accuracy in transactions, simplifies tax reporting, and improves record-keeping. Whether you manage a restaurant, catering business, or meal delivery service, having a clear and detailed receipt format helps maintain transparency with customers and vendors.

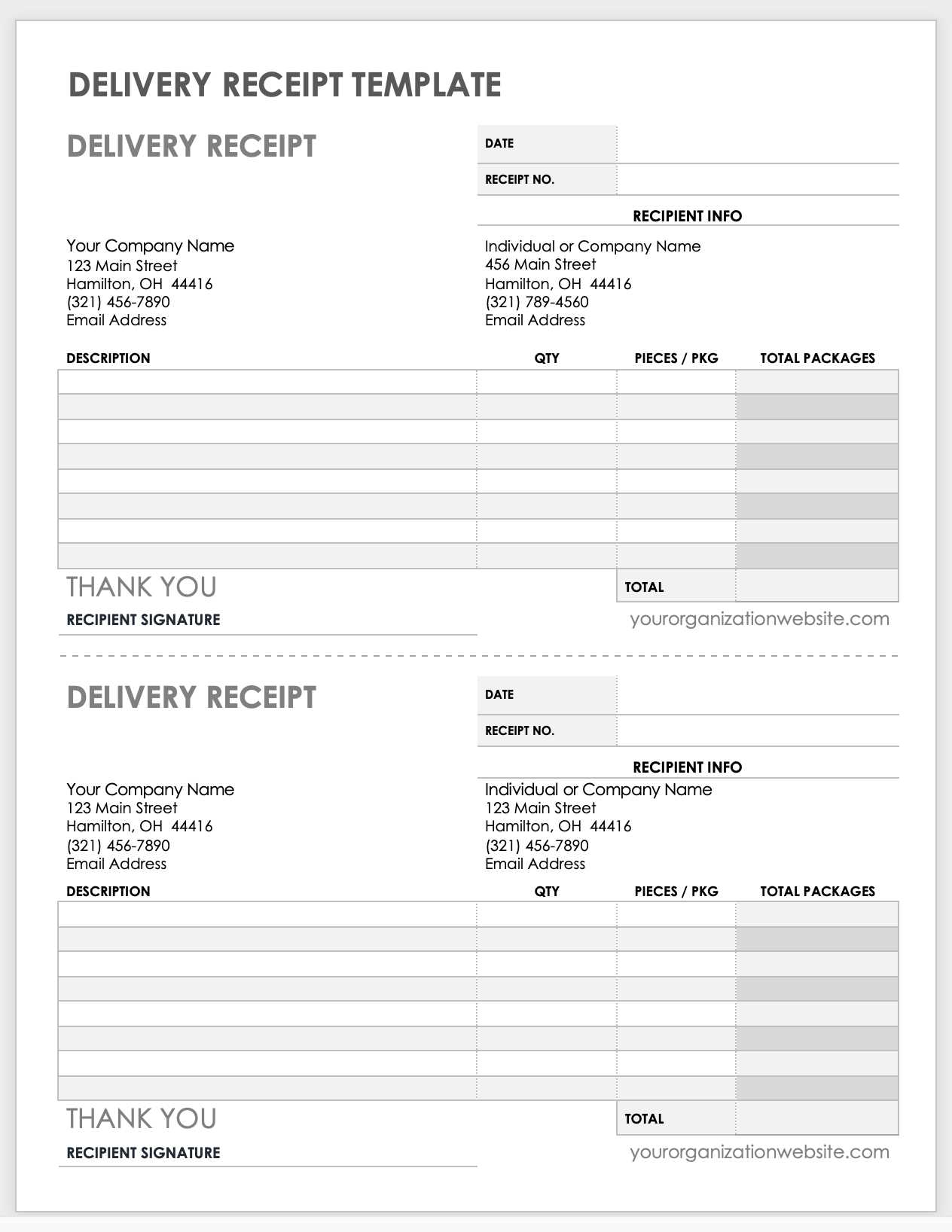

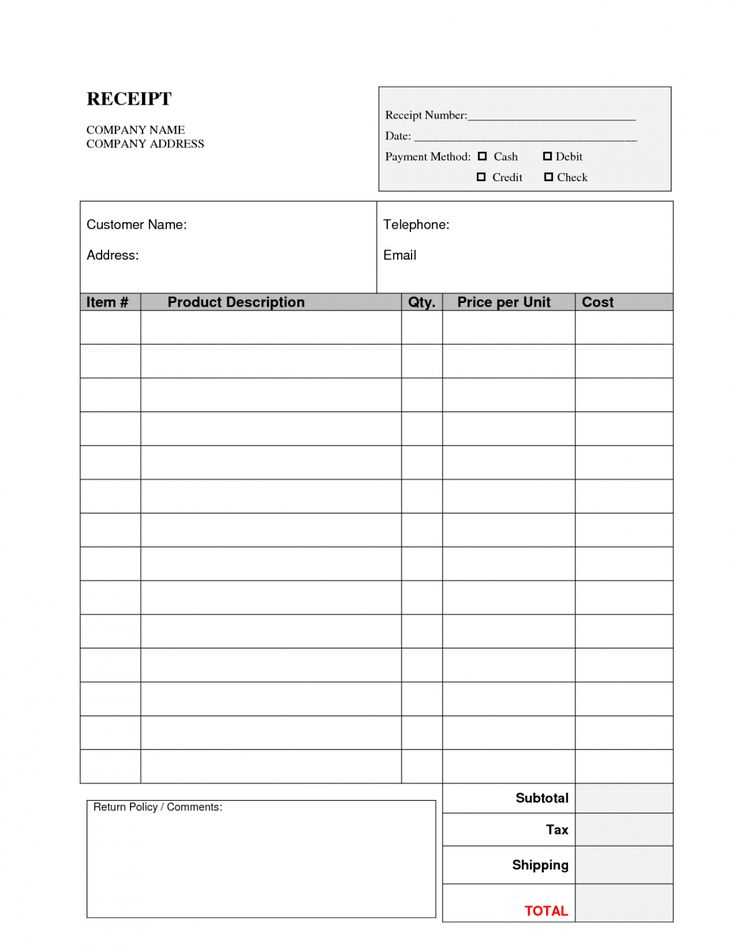

Include key details such as purchase date, itemized list of food and beverages, prices, taxes, and payment method. Adding business information–name, address, and contact details–reinforces professionalism and helps customers with inquiries or returns.

For digital receipts, use PDF or Excel formats to ensure easy access and secure storage. Automated templates with built-in calculations save time by eliminating manual entry errors. If printing is necessary, opt for a layout that is clear and compact to fit standard paper sizes.

Customization is crucial. Adapt the template to include discounts, loyalty points, or additional notes like dietary information. If your business operates internationally, consider adding multiple currencies and tax rates.

Avoid common mistakes such as missing tax breakdowns, unclear descriptions, or incorrect calculations. Regularly updating and reviewing your template ensures compliance with legal requirements and enhances customer trust.

Here’s the revised version with redundant “Food Receipt” mentions removed:

To create a clear and concise receipt, focus on essential details without repeating unnecessary terms. Below is a structured template that ensures clarity:

| Date | Receipt Number | Vendor | Item | Quantity | Unit Price | Total |

|---|---|---|---|---|---|---|

| 2025-02-09 | #123456 | Healthy Bites Café | Avocado Toast | 2 | $5.50 | $11.00 |

| Subtotal: | $11.00 | |||||

| Tax (8%): | $0.88 | |||||

| Total: | $11.88 | |||||

Ensure each receipt includes accurate pricing, tax calculations, and a clear layout. This avoids confusion and improves readability.

- Food Receipt Template: A Practical Guide

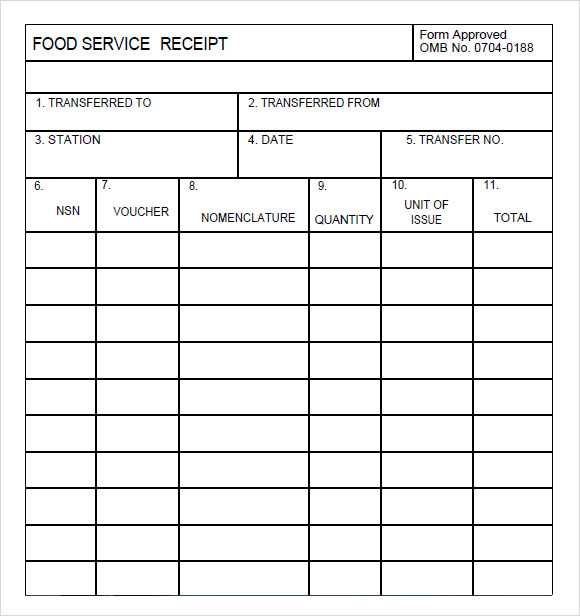

Include the date, business name, and contact details at the top of the template. These elements are necessary for tracking and managing receipts. Directly under, list the items purchased, with clear breakdowns of quantities and prices. For each item, display the unit cost, total price per item, and any relevant description to avoid confusion.

Itemized Breakdown

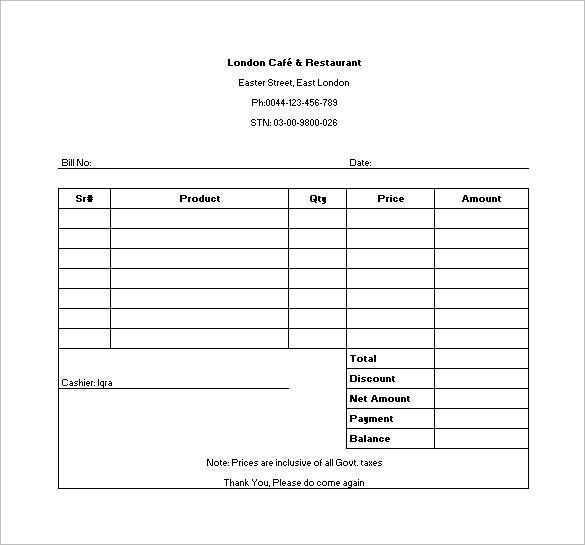

Clearly separate the subtotal from taxes and any discounts. Highlight taxes as a separate line to ensure transparency. If applicable, indicate payment method at the bottom, making sure to include the total amount after all adjustments. This helps with bookkeeping and simplifies any possible returns or disputes.

Simple Layout

Keep the layout simple and logical. Group the most critical information (items, prices, and totals) in a clean, easy-to-read table format. Avoid excessive text and focus on making the details easily identifiable for both customers and businesses.

A well-crafted food receipt template must include specific elements that ensure clarity and usability. Start by focusing on the following key components:

- Clear Header: Include the restaurant or business name, address, contact details, and logo. This gives the receipt a professional appearance and helps customers easily identify the source.

- Itemized List: Break down each item purchased with its quantity, unit price, and total cost. This transparency ensures customers understand what they are paying for.

- Tax Information: Display applicable taxes separately, indicating the tax rate and the total amount. This prevents confusion and supports legal requirements.

- Payment Method: Indicate how the payment was made (e.g., credit card, cash). This helps clarify the transaction details and serves as proof of payment.

- Total Amount: Clearly highlight the total cost of the transaction, including taxes and tips. Make it easy to identify at a glance.

- Transaction Date and Time: Include the date and time of the transaction for record-keeping purposes. This is crucial for both customers and businesses.

- Order Number or Reference: Provide a unique reference number to assist with tracking and future inquiries. It enhances the receipt’s role in customer service.

- Footer with Legal Details: If required, include return policies, disclaimers, or business terms in the footer. These statements protect both parties in case of disputes.

By incorporating these elements, a receipt template becomes a functional and professional document that benefits both customers and businesses.

Tailor receipts based on your business type to enhance the customer experience and reinforce your brand identity. The key is to match the design and content with your specific needs, whether you’re in retail, food service, or another industry.

1. Retail Stores

- Include a clear breakdown of the items purchased, including descriptions, prices, and applicable discounts.

- Offer space for loyalty program points or rewards.

- Include return policies or instructions for easy returns or exchanges, if relevant.

- Brand the receipt with your store’s logo and colors, making it instantly recognizable.

- Provide contact details and social media links to encourage customer engagement.

2. Restaurants and Cafés

- Display the items ordered along with itemized pricing, taxes, and tips.

- Include clear information about service charges or tipping policies.

- Design the receipt with the business’s theme, featuring elements of your décor or logo.

- Offer promotional information such as upcoming events or discounts on future visits.

- For fast food or quick-service, emphasize speed and simplicity to avoid cluttering the receipt.

3. Service-Based Businesses

- Break down services with individual prices, time spent, or products used.

- Provide clear payment terms or next steps if follow-up is required.

- Consider adding a thank-you note or personalized message to create a stronger connection with the customer.

- Make sure your contact details, including website and email, are easy to find in case of questions or feedback.

By customizing your receipts to fit the business type, you improve customer satisfaction and encourage repeat business. Focus on clarity, consistency, and personalization to make a lasting impression.

Accurate documentation is crucial for meeting legal and tax requirements in food transactions. Businesses must ensure that receipts comply with local laws and tax regulations. The following points outline key considerations for creating and managing documentation effectively:

1. Tax Identification and Reporting

Ensure that every receipt includes the correct tax identification number (TIN) and reflects applicable tax rates. The document should clearly state whether sales tax is included or excluded from the price. If you are required to report taxes, keep copies of all receipts for a set period, as stipulated by tax authorities. This period typically spans from three to seven years, depending on local laws.

2. Legal Requirements for Documentation

Food businesses must comply with specific legal requirements for invoices and receipts. This includes showing clear descriptions of the goods or services provided, the date of the transaction, and the total amount paid. Be mindful of any specific food labeling laws or regulations that may apply in your region, such as ingredients or allergens listed on receipts. These legal obligations help protect both consumers and businesses from disputes.

Failure to provide proper documentation can lead to fines, penalties, or issues during audits. Always stay updated on local regulations and seek professional advice when necessary to avoid legal complications.

Choosing between digital and paper receipts depends on your priorities. Digital receipts are easy to store and access, saving space and eliminating the risk of losing them. They can be stored in cloud services or apps, ensuring that they’re always available when needed for returns or tracking expenses.

Digital Receipts

Digital receipts allow for quick retrieval and environmental benefits by reducing paper waste. They can be easily organized and searched, making them ideal for managing finances. For businesses, digital receipts eliminate the need for printing, reducing operating costs. However, they require a smartphone or email access, and security measures are important to protect sensitive data.

Paper Receipts

Paper receipts are tangible, making them useful for individuals who prefer physical documentation. They don’t rely on technology, ensuring that everyone has access to them. However, paper receipts take up physical space and can easily be lost or damaged. They also contribute to environmental waste. Businesses may face higher operational costs due to the need for printers and paper supplies.

Each option has clear advantages and drawbacks, so the best choice depends on your specific needs, whether that’s easy storage and access with digital receipts or the reliability of physical receipts for those who prefer hard copies.

Ensure text is legible by using consistent fonts, sizes, and spacing. Mixing multiple font styles or sizes creates confusion and detracts from the professionalism of your receipt. Stick to one or two fonts and keep the font size readable for all parts of the document.

1. Inconsistent Alignment

Aligning text improperly can make the receipt look cluttered. Use left-alignment for descriptions and right-alignment for prices or totals. Centering text may work for headers, but avoid it for critical information like amounts or dates, as it can create unnecessary visual tension.

2. Overloading the Receipt with Information

Too much text on a receipt overwhelms the reader. Be concise with your wording, and only include necessary details. Avoid adding excessive promotional text or irrelevant data that can make the receipt look crowded and hard to follow.

Keep amounts and totals highlighted with bold or larger text so they stand out. This simple change ensures clarity, allowing users to quickly spot important financial details.

Finally, test your receipts on different devices to make sure the formatting remains consistent across platforms. What looks great on one device may appear misaligned on another, so always preview the final product for a seamless user experience.

Zoho Invoice offers an intuitive platform with customizable templates, perfect for creating professional-looking receipts quickly. It’s a solid option for businesses looking for flexibility in design and automated features like tax calculation and payment reminders.

Wave Accounting is another excellent tool, offering free receipt creation capabilities. Its simplicity allows users to generate receipts with ease, while also managing invoicing, expenses, and even bookkeeping, making it great for small businesses and freelancers.

Square Receipts stands out for its seamless integration with payment systems. It allows users to create receipts directly after a transaction, which can be customized with company logos and relevant details. Ideal for retail and service businesses that require on-the-spot receipt generation.

FreshBooks offers both invoicing and receipt tools with a focus on ease of use. Its user-friendly interface and ability to automatically convert expenses into receipt entries make it a good choice for entrepreneurs and businesses looking for time-saving automation.

Receipt Generator provides a straightforward web-based service, enabling quick and easy receipt creation without sign-ups. This no-frills tool is perfect for personal or small-scale use, allowing users to download receipts in PDF format immediately after creation.

QuickBooks is a comprehensive solution, combining accounting features with receipt creation tools. It’s particularly beneficial for larger businesses or those with more complex accounting needs, offering detailed reporting and integration with various payment systems.

For those looking for a more design-focused tool, Canva’s receipt templates offer a wide range of visually appealing layouts. While primarily known for graphic design, it allows users to create receipts with custom fonts, colors, and logos for a unique touch.

Meaning is preserved, but unnecessary repetitions are removed. If a more precise version is needed, I can refine it.

Keep your receipt template concise. Focus on the most important elements: item names, quantities, and prices. Avoid adding redundant details such as excessive descriptions or multiple lines for similar products. Clear formatting will make the receipt easy to read and understand. Use bullet points or tables for structured information, allowing users to quickly locate what they need.

If you are using a digital format, consider using dynamic fields that adjust based on the content. This minimizes clutter while ensuring every receipt remains accurate. Stick to a simple font and maintain consistent margins to prevent visual overload.

In case of special offers or discounts, include them clearly but briefly, mentioning only the necessary details to avoid unnecessary complexity. Always double-check for any redundant language or duplicate information before finalizing the receipt layout.