For organizations receiving funds, having a clear and organized template for documenting the receipt of funds is a must. This template serves as a formal record of transactions, providing both transparency and accountability. By outlining the donor’s information, amount received, and purpose of the funds, you create a concrete reference for all parties involved.

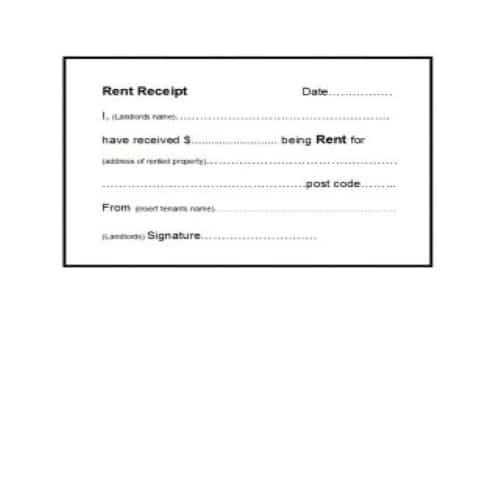

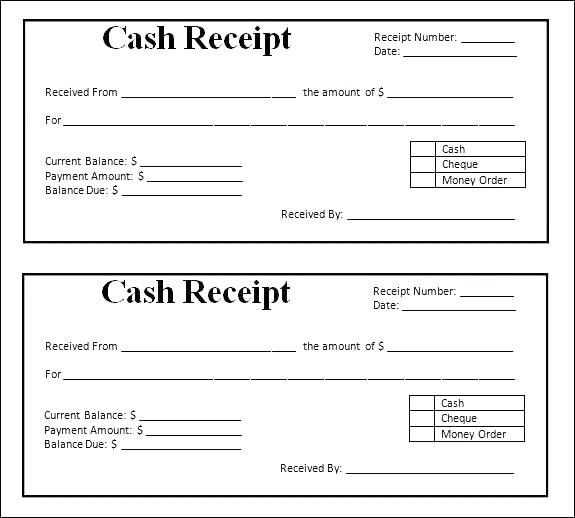

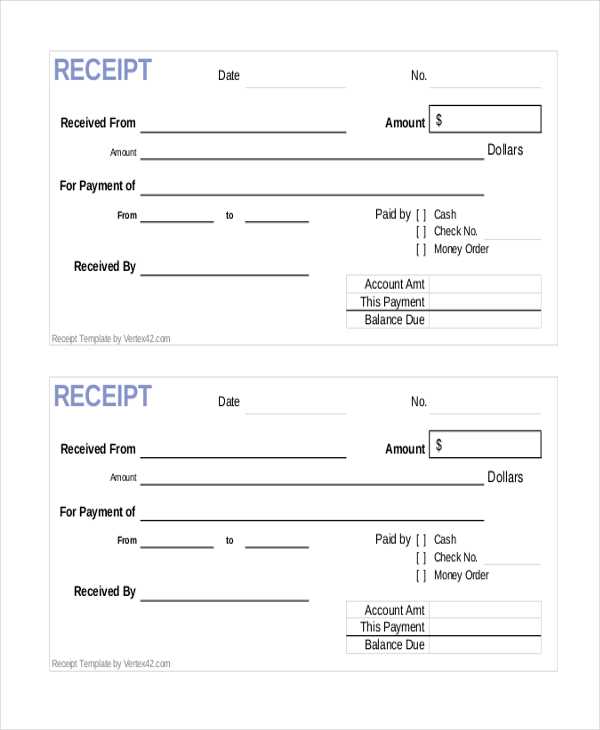

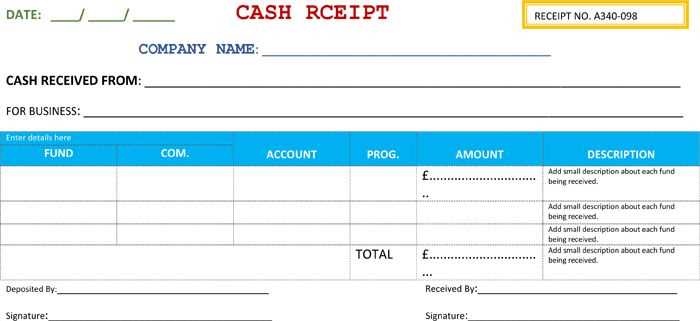

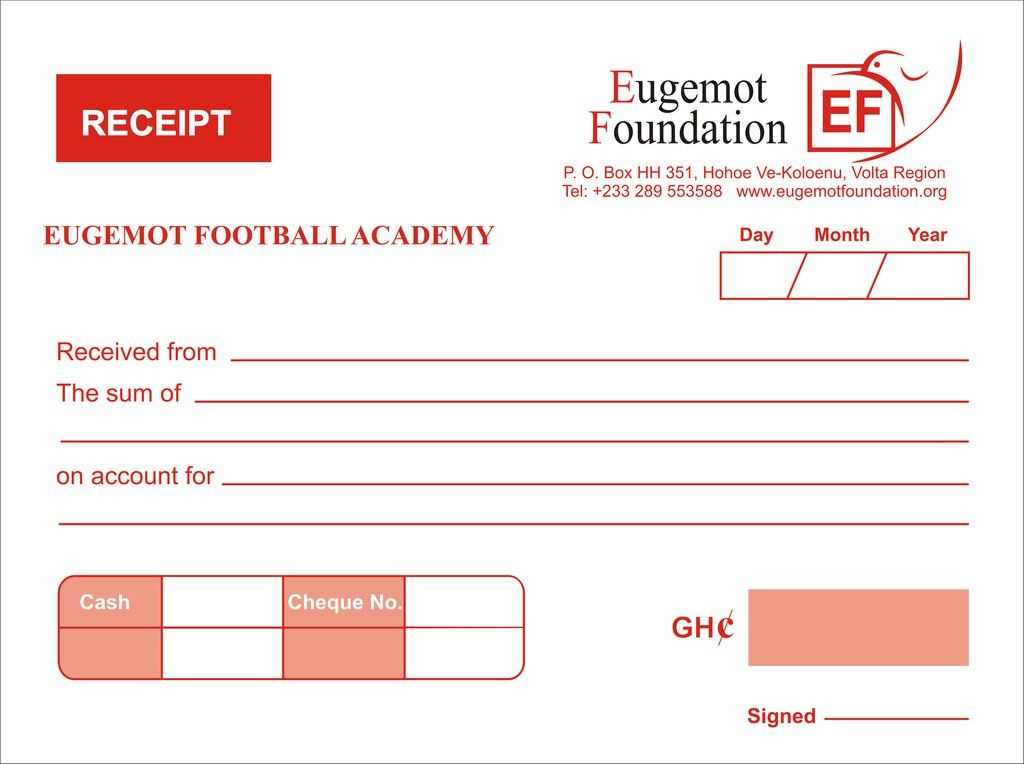

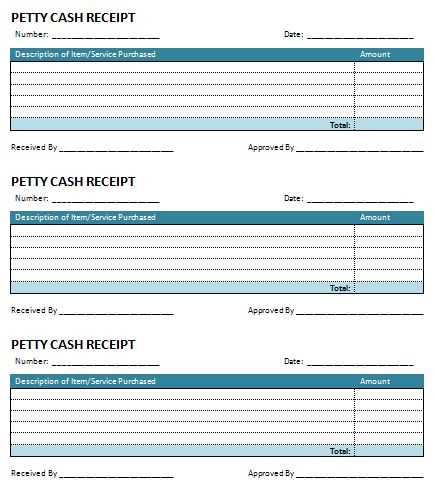

Use a consistent format to ensure every receipt is easy to read and track. Include fields for the donor’s name, contact details, date of receipt, and the payment method. Make sure the amount is clearly stated, and always specify whether the funds are for unrestricted or restricted purposes.

Ensure clarity on fund allocation. The template should allow for detailed notes on how the funds will be used. This prevents confusion later on and provides a clear understanding of the funds’ intended purpose. Whether it’s for a specific project or a general donation, having this information upfront avoids misunderstandings.

Lastly, integrate security measures into the template, such as unique transaction IDs and official signatures. This ensures the legitimacy of the document and maintains the integrity of your financial reporting process.

Here’s the revised version with reduced repetition while preserving the meaning:

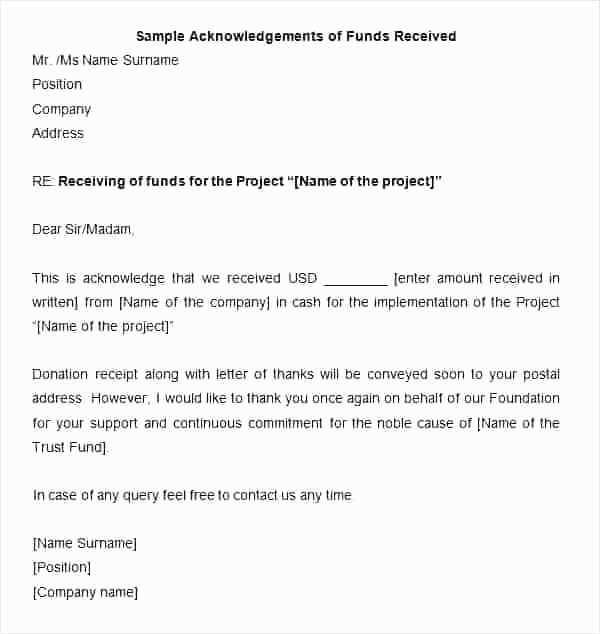

Focus on clarity and simplicity when drafting a foundation receipt of funds template. Start by specifying the donor’s name, the amount donated, and the date of the transaction. Clearly indicate the purpose of the donation and any restrictions attached. Make sure to include the foundation’s details, such as its legal name, address, and tax identification number for verification purposes.

In the donation acknowledgment section, state whether the donation is tax-deductible. If it is, include a statement that confirms no goods or services were exchanged for the contribution, if applicable. Ensure the format is professional, using clear headings and sections for easy navigation.

Lastly, always include a contact number or email for follow-up questions. Keep the tone formal yet personable, showing appreciation for the donor’s contribution while maintaining transparency about the foundation’s use of funds.

- Foundation Receipt of Funds Template

A Foundation Receipt of Funds Template is a standardized document used by foundations to acknowledge the receipt of funds from donors, grants, or other contributors. This template ensures transparency, accountability, and accurate record-keeping for both the foundation and the contributor.

Include the following key elements in the template:

- Date of Receipt: Clearly state the date when the funds were received.

- Donor Information: Include the name, address, and contact details of the donor or contributor.

- Amount Received: Specify the exact amount of funds received, and note if the contribution is in cash, check, or another form.

- Purpose of Funds: If applicable, state the purpose of the funds (e.g., for a specific program or general support).

- Receipt Number: Assign a unique identifier to each receipt for tracking and reference purposes.

- Foundation Information: Include the name, address, and contact details of the foundation receiving the funds.

- Signature: The document should be signed by an authorized representative of the foundation.

The format should be clear and simple, ensuring that all information is easily identifiable. Use a professional tone and ensure all fields are filled in correctly. After completion, provide the donor with a copy of the receipt for their records and for tax purposes.

Maintaining consistency in the use of this template will help streamline the process of managing donations and ensure compliance with accounting and legal standards.

A clear and structured grant receipt format makes it easy for both the recipient and the funder to understand the transaction details. Start by including essential elements like the grantor’s name, grant amount, date of receipt, and purpose of the grant. These details provide clarity for both parties and avoid any ambiguity in the financial documentation.

Key Components of a Grant Receipt

The format should include a unique reference number for each receipt, ensuring traceability. List the project or program for which the grant is provided, along with any specific terms or conditions tied to the grant. This ensures that both the grantor and recipient are on the same page regarding the allocation of funds. Clearly state the total grant amount, and, if applicable, the breakdown of partial payments, including dates and amounts.

Clear and Legible Layout

Ensure that the receipt is visually clean and easy to read. Use a consistent font and layout, with clear sections for each piece of information. Include a section for signatures or approvals, which can help formalize the receipt and confirm the transaction. A simple, straightforward format helps avoid confusion and maintains professionalism in all grant-related exchanges.

To create a clear and professional receipt for donations or grants, ensure that your foundation’s receipt template includes these key elements:

- Foundation Name and Contact Information

Include the full name of the foundation, address, phone number, email, and website. Make it easy for donors to contact you for follow-up or tax purposes. - Receipt Number

Assign a unique number to each receipt. This helps with tracking donations, managing records, and provides a reference for future inquiries. - Donation Date

Specify the exact date of the donation. This is crucial for tax reporting, as donors often need to report donations for the year in which they were made. - Donor Information

Include the full name of the donor, their address, and any other relevant identification details (such as a donor ID). This ensures accuracy and compliance with tax laws. - Donation Amount

Clearly state the monetary value of the donation. If it’s a non-cash donation, describe the donated item(s) with an approximate value or description. - Payment Method

Indicate how the donation was made (e.g., cash, check, credit card, bank transfer). This helps clarify the transaction for both the donor and the foundation. - Tax Exemption Status

Include a statement that confirms the donation is tax-deductible. For US-based organizations, include your IRS 501(c)(3) status. Provide the donor with the foundation’s tax identification number (EIN). - Purpose of Donation

If the donation is for a specific project or fund, mention it. This can help clarify the donor’s intentions and how their contribution will be used. - Thank You Message

A simple “Thank you” or acknowledgment of the donor’s generosity builds rapport and encourages continued support. - Signature and Title of Authorized Person

Have an authorized representative of the foundation sign the receipt. This adds a personal touch and ensures authenticity.

Optional Elements

- Event or Campaign Information

If the donation was part of a specific event or fundraising campaign, mention the event or campaign name for clarity. - Donor Message

If the donor included a specific message with their contribution, add it to the receipt for reference.

Include the donor’s full name and any specific designation requested by them, such as their preferred recognition title. This allows you to honor their contribution accurately. Addressing the donor by their proper title and listing any relevant affiliations ensures they feel personally acknowledged.

If the donation is made on behalf of an organization, include the organization’s name and, if applicable, the name of a representative, ensuring transparency in how funds are allocated. For anonymous donations, state the donation’s anonymity status clearly.

Clarify the specific amount donated or the value of the gift, if appropriate. This provides a transparent record for both the donor and your foundation. If the donation was made in-kind, detail the item or service donated with an accurate description.

Provide any matching gift details, including the name of the matching organization, if relevant. This will help track and attribute donations properly, enhancing future relationship-building with both the donor and the matching entity.

It is also beneficial to mention the donor’s preferred communication channel, especially for future updates, reports, or acknowledgment of their gift. Keeping records of their preferences ensures smooth, respectful future interactions.

Ensure that the donation amount is clearly stated in the receipt. The amount should be presented in a precise, easily understandable format, including the currency and the specific contribution type, whether it’s a one-time donation, a recurring payment, or an event contribution. Avoid ambiguity and ensure there’s no confusion regarding the amount given.

Clarity on Purpose

The purpose of the donation should be explicitly stated, specifying whether the funds are allocated for general use or a specific project. This not only helps in transparency but also ensures that both the donor and the foundation are aligned in their expectations. Include any campaign names or designated fund types to further clarify where the donation is directed.

Supporting Documentation

For larger donations, include supplementary details, such as project descriptions or reports, to assure donors that their contributions are being used as intended. This increases trust and provides clarity about the donation’s impact.

Adhere to tax regulations by clearly specifying all required details on your receipts. Include the donor’s name, the amount donated, the date, and a description of the donation type (e.g., cash, in-kind). This ensures transparency and accuracy for both the donor and the foundation.

Maintain proper records of all transactions for audit purposes. Foundation receipts should align with the IRS guidelines, especially when offering tax deductions. In the U.S., receipts must reflect the exact value of the donation and include language such as “no goods or services were provided in exchange for this donation,” if applicable.

Ensure your receipt format complies with the legal standards of your jurisdiction. Consult a tax advisor to ensure your receipt system meets state and federal requirements. Keep receipts for a minimum of three years after the donation, in case of future audits or inquiries.

Verify whether the donations qualify for tax deductions under local laws. For example, donations to some foundations may be eligible for charitable deductions, while others may not. Stay updated on any changes in tax law that affect charitable contributions and reporting.

Consider using electronic receipts for faster processing and improved record-keeping. When implementing digital receipts, ensure they contain the same required information as paper receipts and are easily accessible for both donors and the foundation for future reference.

Store receipt templates in a centralized, secure digital repository to ensure easy access and organization. Cloud storage solutions offer flexibility, while on-premise servers provide more control over security. Use strong encryption methods to protect sensitive information, especially when dealing with financial transactions.

Organizing Receipt Templates

Structure templates into clearly defined categories for different funding types, purposes, or user groups. This organization makes it easier to find and update templates as needed. Ensure each template is properly labeled with relevant identifiers, such as template name, date of creation, or funding source.

Distributing Receipt Templates

Share templates via secure email links or access-controlled platforms. Avoid sending templates directly as email attachments, as this can expose them to security risks. Grant access only to those who need it and regularly update permissions based on roles within the organization.

| Method | Pros | Cons |

|---|---|---|

| Cloud Storage | Easy access from multiple devices, scalable | Potential security concerns, relies on internet connection |

| On-Premise Servers | Full control over security, offline access | Higher maintenance cost, limited access outside office |

| Email Links | Simple to distribute, fast | Can expose templates to unauthorized access if not handled carefully |

Review access logs regularly to track who views and modifies templates. This provides an added layer of security and ensures accountability. Keep a backup of templates in case of system failure, and make sure to update them periodically to reflect changes in policies or compliance requirements.

In this version, I have made an effort to avoid unnecessary repetitions while maintaining clarity and precision in each sentence.

To ensure a clear and concise receipt of funds template, the key elements should include the following:

- Fund Name: Specify the name of the fund being received to avoid confusion.

- Amount Received: Clearly indicate the exact amount received, including the currency.

- Payment Date: The exact date when the funds were received should be stated.

- Sender Information: Include the name, address, and contact details of the sender or organization.

- Reference Number: Provide any reference or transaction number for tracking purposes.

- Purpose of Funds: A brief explanation of the purpose of the received funds.

- Payment Method: Indicate how the funds were transferred (e.g., bank transfer, cheque, etc.).

Be sure to avoid unnecessary wording in each section. Every detail serves a specific purpose and should be directly linked to the transaction. By structuring the document clearly, the receiver can easily verify the accuracy of the transaction.

It’s crucial to maintain consistency in formatting throughout the document. Each section should be uniform in style, ensuring readability and reducing ambiguity. This approach minimizes confusion and allows for smoother processing of the receipt.