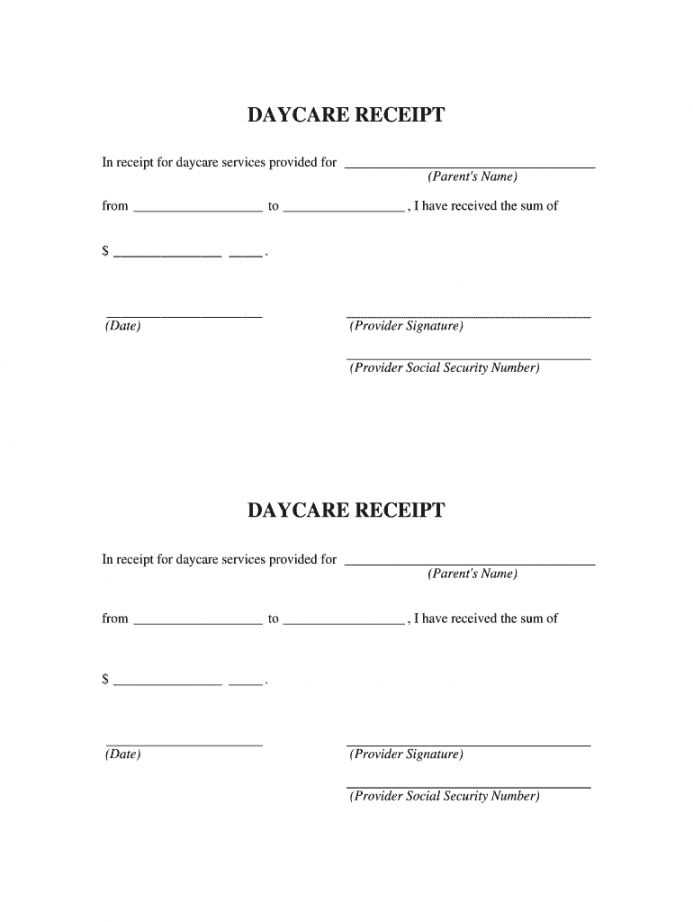

Key Details to Include

When submitting a receipt for reimbursement, ensure it contains all required details. Missing information may lead to delays or rejection. The receipt should include:

- Provider’s Name and Address: Include the full legal name and business address.

- Service Dates: Specify the start and end dates of care provided.

- Child’s Name: Clearly state the name of the child receiving care.

- Total Amount Paid: Break down costs if needed.

- Payment Confirmation: Indicate whether the payment was made in full or partially.

- Provider’s Signature: If required, ensure the provider signs the receipt.

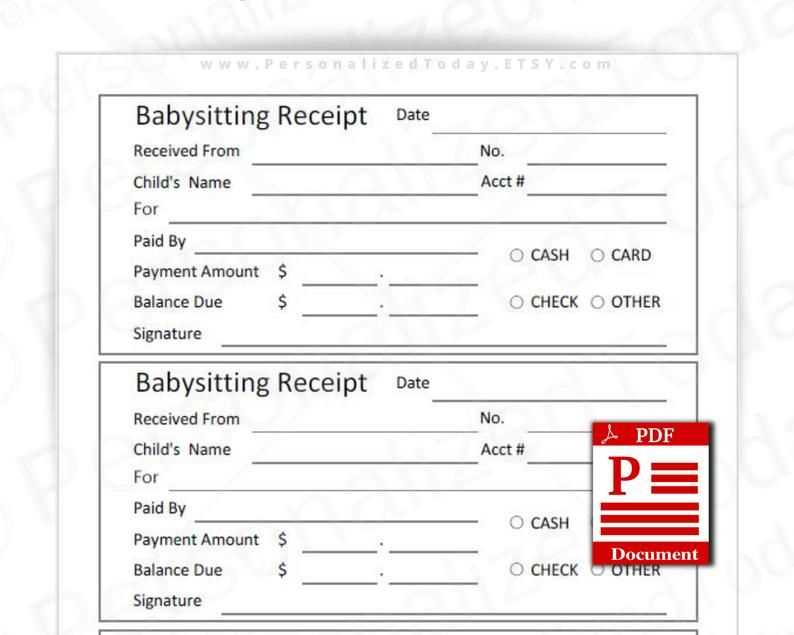

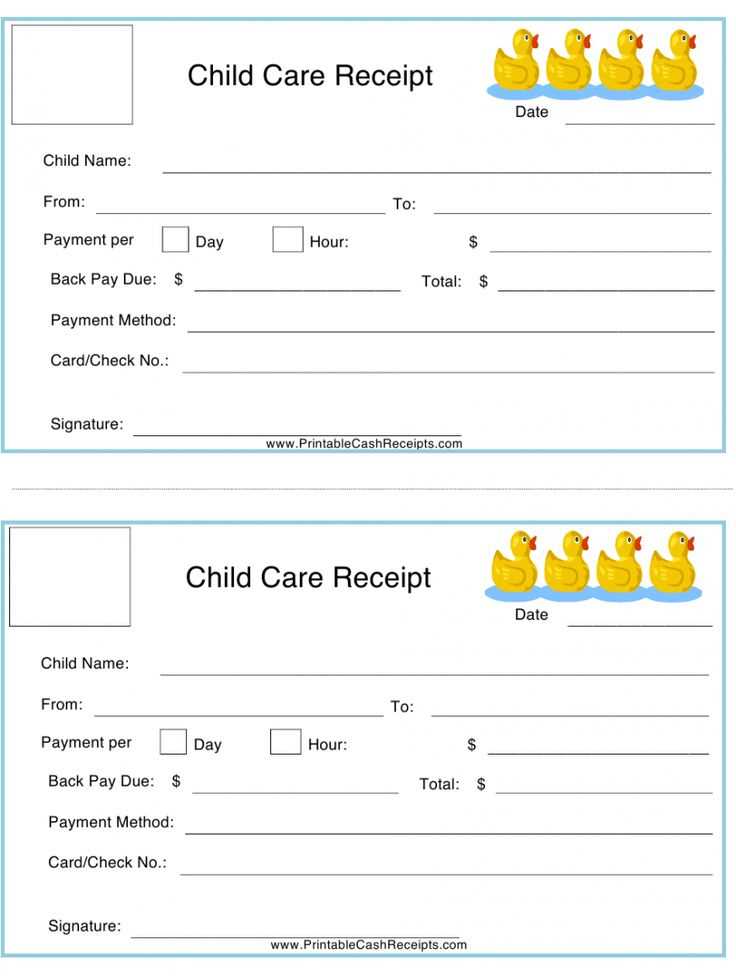

Simple Receipt Format

A structured format ensures smooth processing. Here’s an example layout:

| Provider Name: | [Daycare Center or Caregiver Name] |

| Provider Address: | [Full Address] |

| Service Dates: | [Start Date] – [End Date] |

| Child’s Name: | [Child’s Full Name] |

| Amount Paid: | $[Total Amount] |

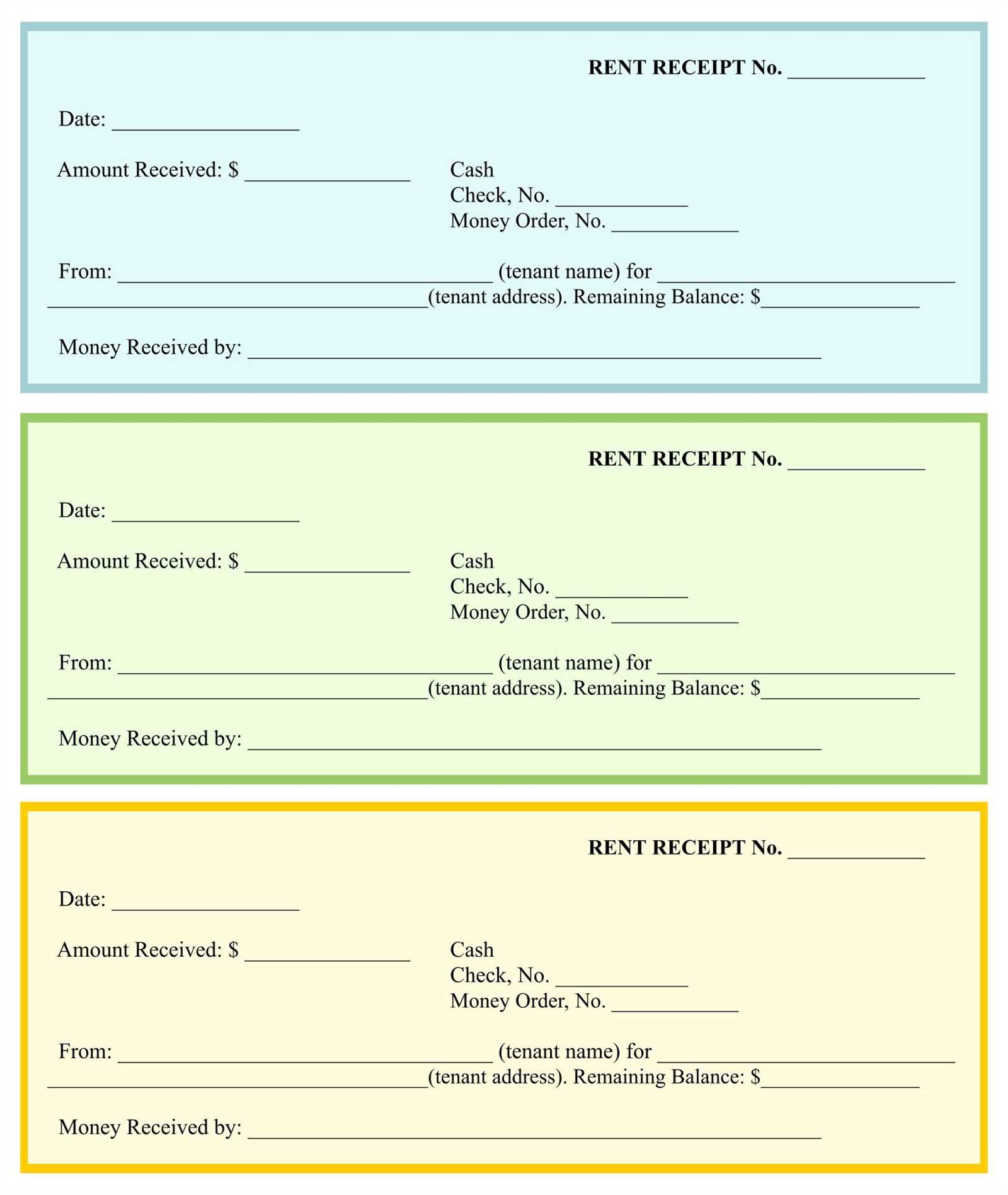

| Payment Method: | [Cash / Check / Credit Card] |

| Provider Signature: | __________________________ |

Additional Tips

Double-check that the receipt matches the provider’s records. If submitting electronically, ensure the file format is accepted by the FSA administrator. For recurring expenses, consider requesting a standing invoice to simplify future submissions.

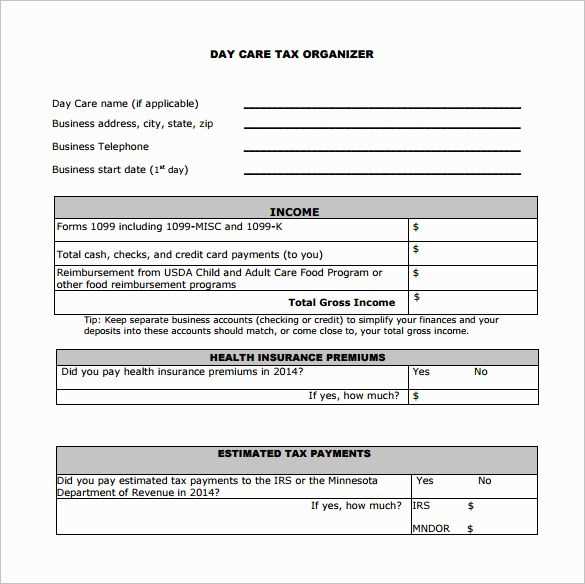

FSA Child Care Receipt Template

A valid FSA child care receipt must include the provider’s name, address, and tax identification number. It should specify the child’s full name, service dates, amount paid, and payment method. Any missing detail may lead to claim rejection.

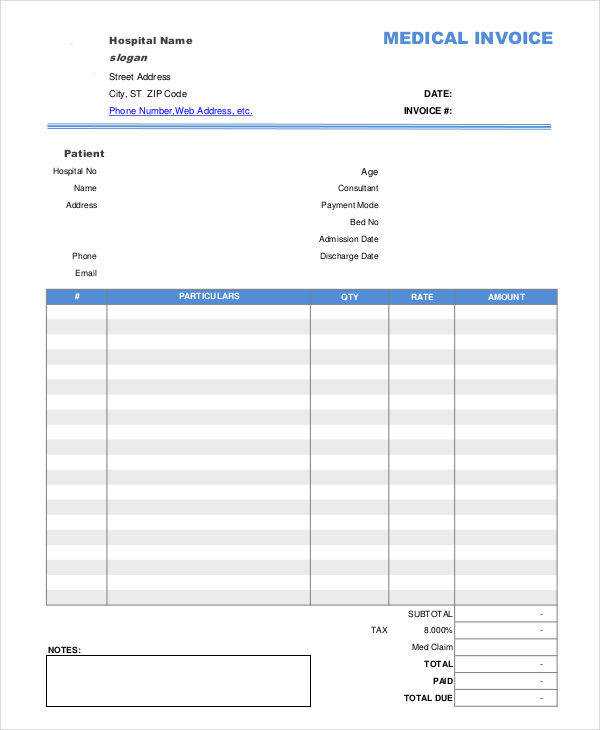

Formatting Rules for a Valid Receipt

Use a structured format with clear headings. List services separately with corresponding costs. Ensure the receipt is legible, dated, and signed by the provider.

Frequent Errors Causing Claim Rejection

Common mistakes include missing provider details, incorrect dates, or handwritten edits. Avoid abbreviations that might cause confusion. Always verify totals before submission.

How to Obtain Proof of Payment

Request a signed receipt from the provider immediately after payment. If using online transactions, print statements showing the provider’s name and payment details.

Digital vs. Paper Receipts

Digital receipts are easier to store and submit. However, ensure they meet FSA requirements. Paper receipts should be scanned and saved as backups.

Templates and Resources

Many FSA administrators provide pre-approved templates. If unavailable, create a structured document including all required details to prevent claim issues.