Creating a simple yet precise FSA receipt template ensures clarity and accuracy in reporting expenses. Use clear labels for each field, such as “Date of Service,” “Provider Name,” and “Amount Paid,” to prevent confusion and ensure all required information is documented properly. This format helps both the recipient and the administrator understand the details at a glance.

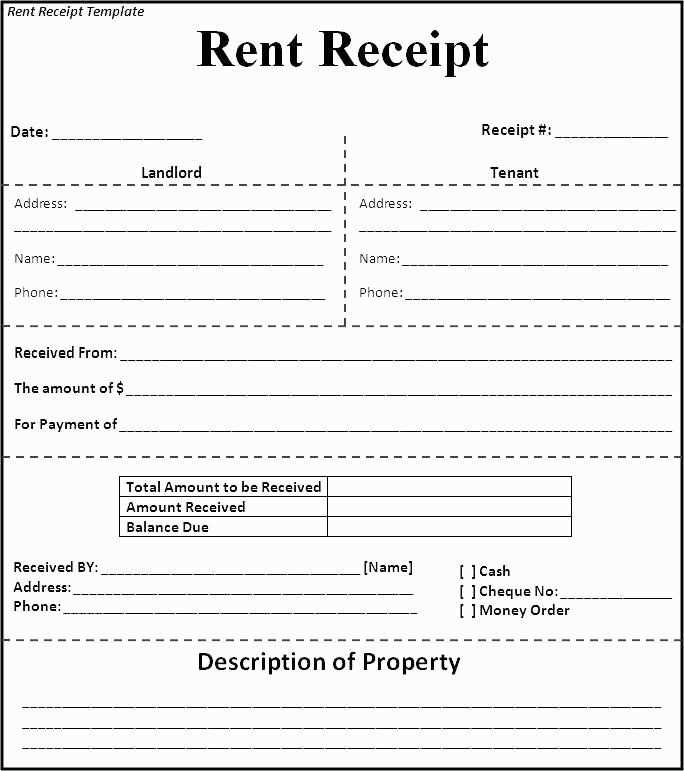

Ensure that the receipt includes a unique identifier for each transaction. This can be a transaction ID or receipt number. This small step adds a layer of organization that is especially useful when managing multiple reimbursements or transactions over time.

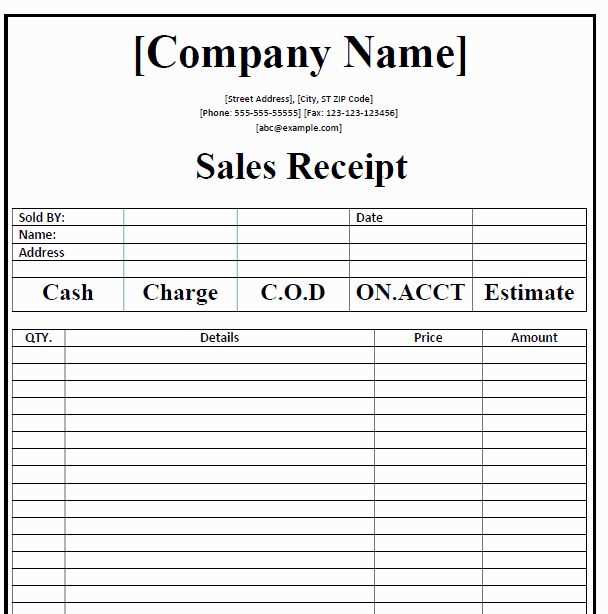

For convenience, allow room for any additional details that might be relevant to the specific service or product being reimbursed. This could include the nature of the service, the provider’s contact information, or any applicable taxes or discounts. Staying organized will streamline any future verifications and audits.

Lastly, use a simple format that’s easy to fill out and print. Many businesses use digital templates that allow for easy input and automatic calculation of totals. This approach not only reduces manual errors but also makes the process of submitting and tracking receipts more transparent.

Here’s the corrected version:

To create a clear and professional FSA receipt template, follow this structure:

1. Header Section: Include the title “FSA Receipt” and the organization or provider’s name at the top. This helps recipients immediately identify the document.

2. Receipt Number: Assign a unique receipt number for tracking purposes. This is essential for maintaining an organized record.

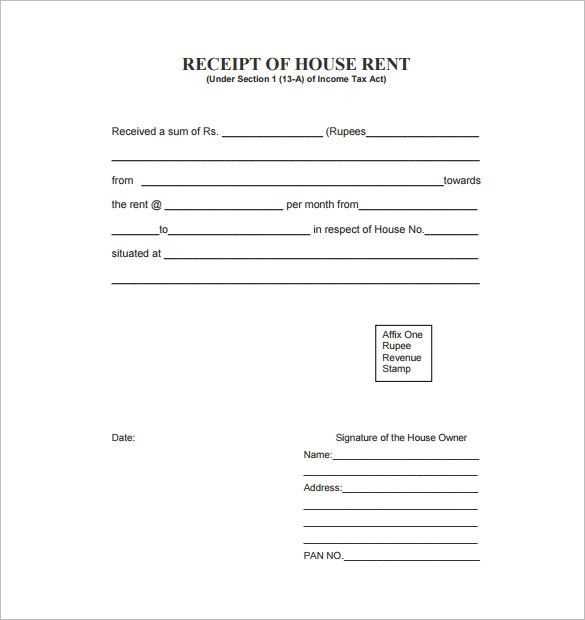

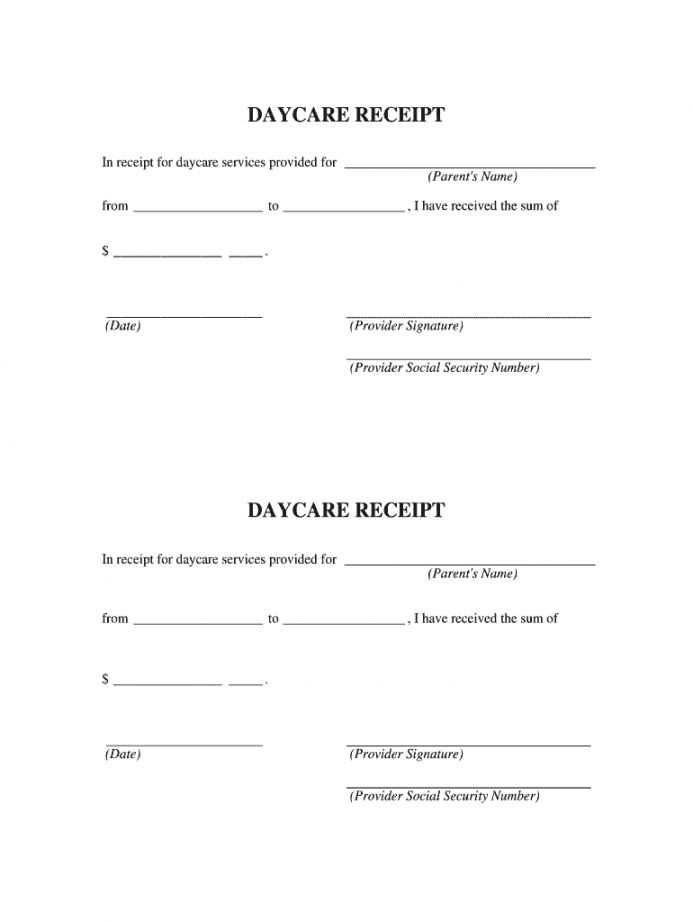

3. Date: Clearly indicate the date the service or purchase was made. This ensures that all expenses are accurately recorded.

4. Item Description: List the items or services purchased along with a short description. Specify the costs for each item individually to maintain transparency.

5. Total Amount: At the bottom of the receipt, include the total amount paid. This figure should reflect the sum of all items listed above.

6. Tax Information: If applicable, include any relevant tax or VAT information, indicating whether the amount listed includes tax or if it’s added separately.

7. Signature: Leave space for a signature or approval, confirming the validity of the receipt. This step adds a layer of formality and verification.

8. Contact Information: Provide contact details, such as a phone number or email, in case the recipient has any questions about the receipt.

By adhering to these guidelines, you ensure that your FSA receipt template is clear, professional, and suitable for record-keeping purposes.

FSA Receipt Template: Practical Guide

To customize your FSA receipt for personal use, ensure it includes all required details to meet both IRS and plan administrator requirements. Start with clear itemization of expenses, including dates, amounts, and descriptions of the products or services purchased. Don’t forget to include your name, the name of the provider, and the type of service or product related to your FSA. Additionally, ensure that any medical items are categorized correctly, as misclassification can lead to reimbursement delays.

Key elements to include in your FSA template are:

- Vendor or service provider name and contact information

- Purchase date and description of items or services

- Total cost and amount eligible for reimbursement

- Payment method or confirmation of payment

- Your name and any other necessary identifying details

Avoid common mistakes such as:

- Forgetting to list the itemized cost breakdown

- Missing or unclear service provider details

- Not verifying that the expense qualifies for FSA reimbursement

- Including unnecessary or unrelated information that could confuse the process