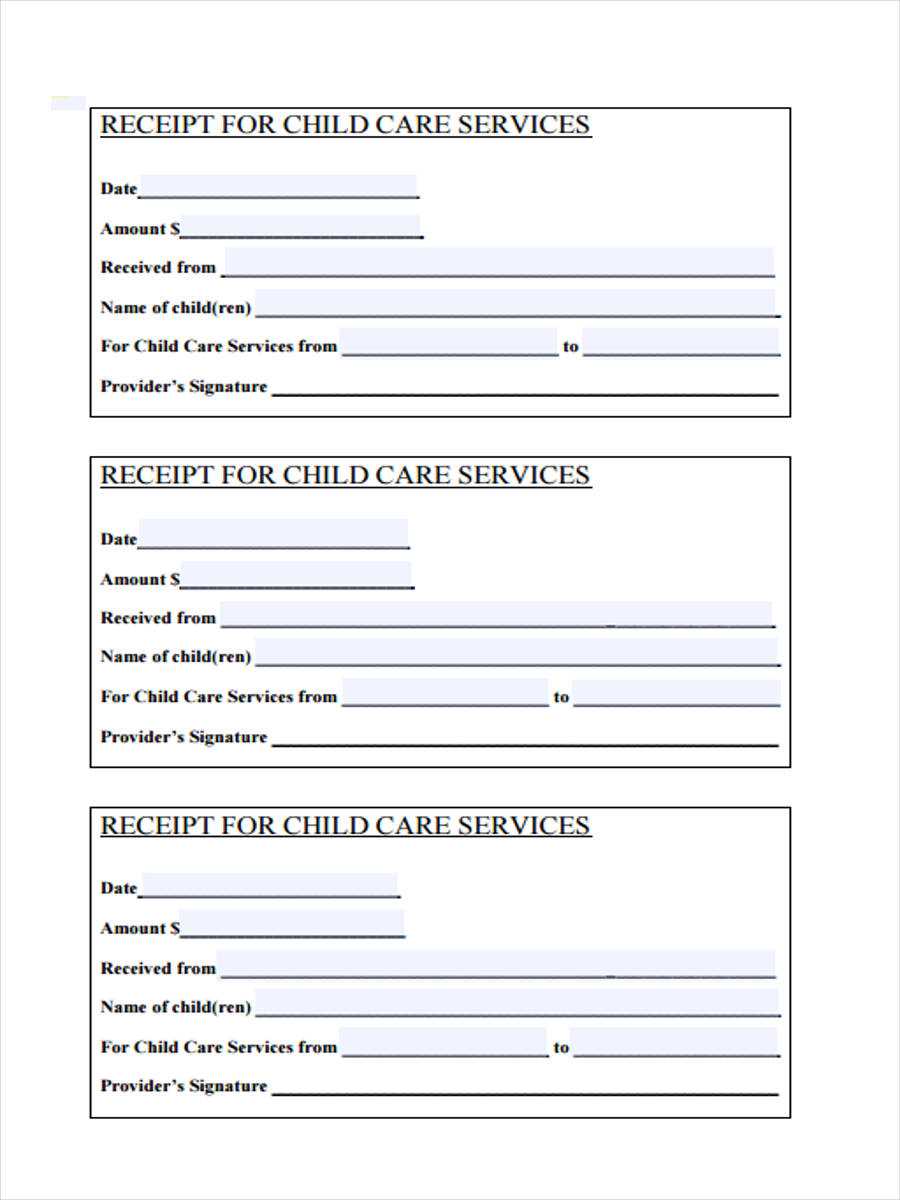

Ensure your dependent care expenses are properly documented by using an accurate and detailed receipt template. Many providers fail to include essential details, which can lead to delays or even rejection of reimbursement claims. A well-structured template eliminates these risks by including all required fields.

Key elements to include:

- Provider’s full name and contact information

- Dependent’s name and care period

- Detailed description of services provided

- Total amount paid and payment date

- Provider’s signature or business stamp

Many caregivers, such as babysitters or daycare centers, may not automatically provide a structured receipt. If that’s the case, create your own and request their signature for verification. A standardized format ensures compliance with Fsafeds requirements and minimizes back-and-forth communication with administrators.

Save copies of all receipts for at least three years in case of audits or additional verification requests. Digital versions are often accepted, but ensure they are clear and legible. By following this approach, you can streamline the reimbursement process and avoid unnecessary complications.

Fsafeds Dependent Care Receipt Template

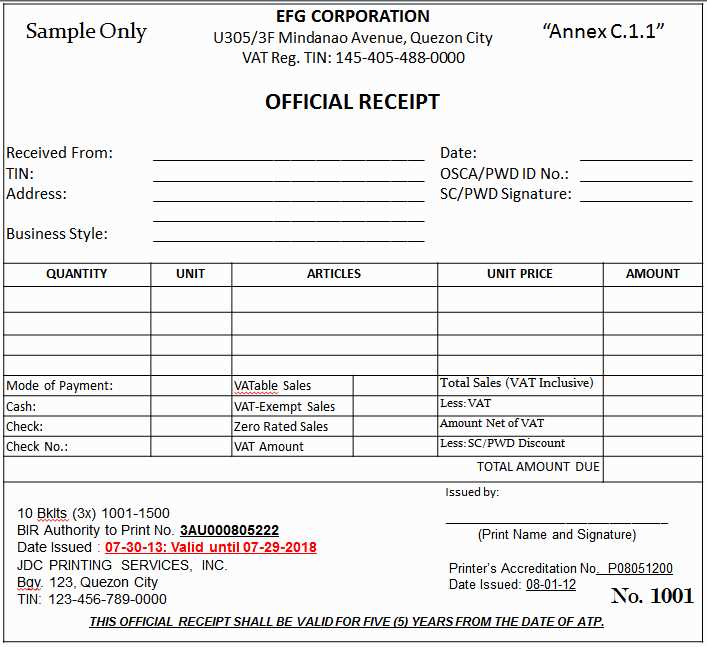

Ensure your dependent care receipt includes all required details to avoid processing delays. Provide the caregiver’s full name, address, and tax identification number. Specify the dates of service, total amount paid, and the dependent’s full name.

- Provider Information: Full name, address, and EIN or SSN.

- Service Details: Dates covered and description of care provided.

- Payment Confirmation: Amount paid and method of payment.

Use a structured format for clarity. If the caregiver cannot provide a receipt, complete a certification form instead. Submit all documents before the deadline to ensure reimbursement.

Required Information for a Valid Receipt

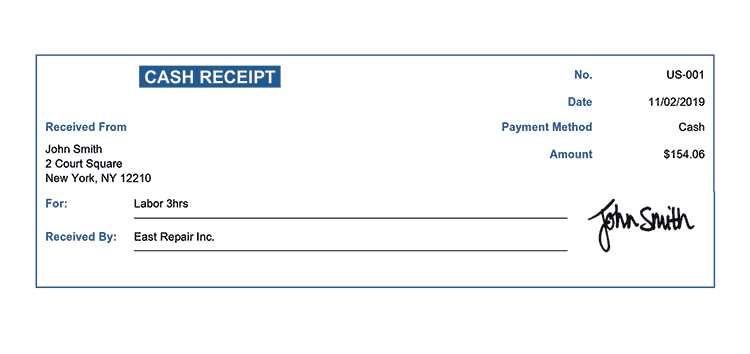

A valid receipt must clearly state the service provider’s name, business address, and contact details. The document should also include the caregiver’s tax identification number or social security number if they are an individual provider.

Ensure the receipt specifies the dependent’s full name and the dates of care. A generic “monthly service” description is not sufficient–detail the period covered and the type of care provided.

Break down the total amount paid, showing individual charges if applicable. The receipt should also confirm the payment method, such as check, bank transfer, or another traceable form. If the caregiver provides a handwritten receipt, they must sign and date it for authenticity.

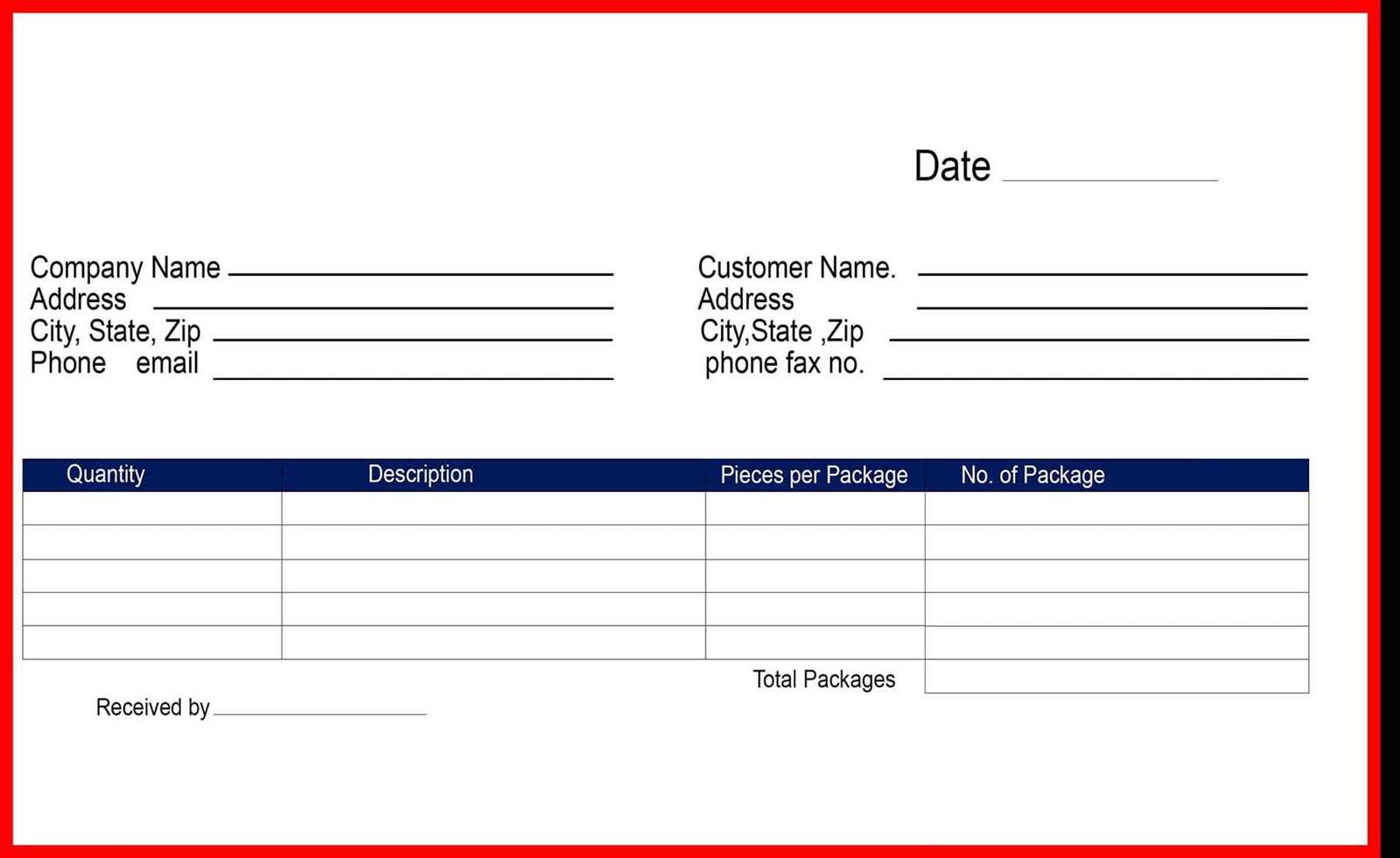

Formatting Guidelines for Submission

Ensure the document follows a standard structure with clear headings and consistent spacing. Use a legible font such as Arial or Times New Roman, size 12, with single or 1.5 line spacing. Margins should be at least one inch on all sides.

Required Information

Include the provider’s name, service dates, total cost, and a description of the care provided. If submitting a scanned receipt, ensure it is clear and free from distortions. Handwritten receipts must be legible and signed by the provider.

File Format and Naming

Submit receipts as PDFs or JPEGs. Avoid using uncommon formats that may not be supported. Name files clearly using the format: “LastName_FirstName_Receipt_YYYYMMDD” to prevent delays in processing.

Common Errors and How to Avoid Them

Incorrect or Incomplete Information

Providing inaccurate or missing details can delay processing. Double-check names, addresses, and identification numbers. Ensure all required fields are filled out completely before submission.

Illegible or Unreadable Receipts

Blurred, faded, or handwritten receipts can cause rejection. Use scanned or high-quality digital copies instead of photos taken at an angle. Verify that dates, amounts, and service descriptions are clear and legible.

Keep a consistent format for all submissions. If a receipt lacks necessary details, request a revised version from the provider before submission.

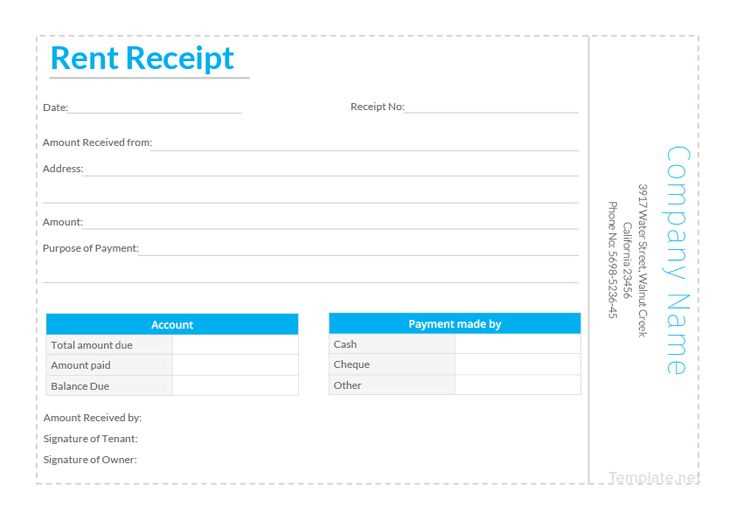

Verification Process and Documentation

Ensure that all dependent care expenses are supported by proper documentation. The provider must issue a receipt detailing the service dates, total cost, and their name and contact details. Handwritten receipts are acceptable if they include all required details.

Required Information

Every receipt should include:

- Dependent’s full name

- Service period (start and end date)

- Provider’s name, address, and tax ID (or Social Security number if applicable)

- Total amount paid

Missing information can result in claim denial. If the provider is an individual without a tax ID, their signature may be required.

Submission Guidelines

Upload receipts through the designated portal or send them via mail, ensuring all documents are clear and legible. Digital copies must be in PDF or image format.

| Submission Method | Processing Time |

|---|---|

| Online Upload | 3–5 business days |

| 7–10 business days |

Retain copies of all receipts for at least three years in case of an audit. If additional verification is needed, be prepared to provide bank statements or cancelled checks.

Acceptable and Unacceptable Service Providers

Only specific types of service providers qualify for dependent care reimbursement. Approved providers include licensed daycare centers, in-home babysitters, and after-school programs. Preschools and summer day camps also meet the requirements, as long as they primarily focus on care rather than education.

Approved Service Providers

Caregivers must operate legally and provide services that allow parents or guardians to work. Approved providers include:

- Licensed childcare centers meeting state regulations

- Home-based daycare providers with proper certification

- Nannies or babysitters who report their income for tax purposes

- Before- and after-school care programs

- Summer camps that focus on supervision rather than enrichment

Unacceptable Providers

Payments to certain individuals and organizations do not qualify for reimbursement. Disallowed providers include:

- Caregivers who do not report their earnings

- Private school tuition, including kindergarten

- Overnight camps

- Care provided by the child’s parent, step-parent, or sibling under 19

- Services that are primarily educational rather than custodial

When selecting a provider, ensure they meet the necessary requirements to avoid reimbursement issues. Always keep receipts and documentation to support claims.

Steps to Submit and Track Your Receipt

Follow these steps to submit and track your dependent care receipts effectively:

- Gather Your Receipts: Collect all receipts for dependent care services. Ensure they are itemized and clearly show the date, service provided, and the amount paid.

- Log Into the System: Access your receipt submission platform using your account credentials.

- Submit the Receipt: Upload the receipts in the required format, such as PDF or image file. Make sure the files are legible and meet the system’s guidelines.

- Enter Relevant Details: Fill in any required information, such as the name of the care provider, care dates, and any additional comments as needed.

- Track Your Submission: After submitting, you can check the status of your receipt through the submission portal. Look for any status updates or notifications regarding approval or required action.

- Verify and Approve: If the system asks for any corrections or additional information, address them promptly to ensure approval.

Stay on top of your submissions to avoid delays and ensure timely processing of your dependent care claims.