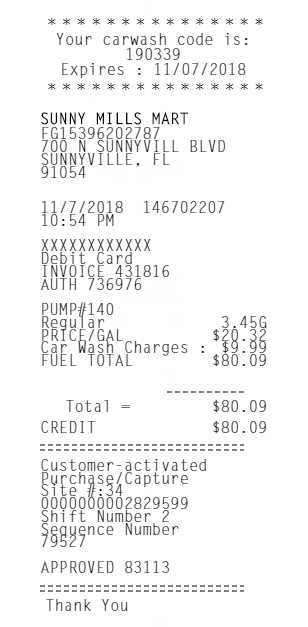

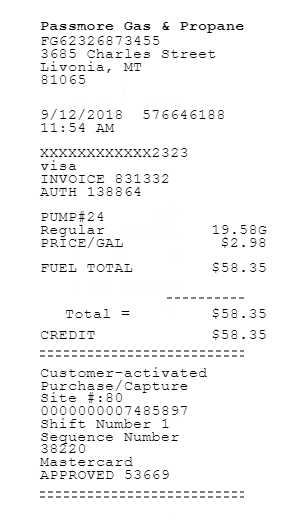

Key Elements of a Fuel Receipt

A well-structured fuel receipt ensures accurate record-keeping and simplifies expense reporting. Include the following details:

- Date and Time: Clearly indicate when the transaction occurred.

- Fuel Station Information: Name, address, and contact details.

- Vehicle Details: Optional but useful for fleet management.

- Fuel Type and Quantity: Specify the type (e.g., gasoline, diesel) and amount purchased.

- Price per Unit: Helps in tracking fuel cost fluctuations.

- Total Cost: Sum of all charges, including taxes.

- Payment Method: Cash, credit card, or company account.

Printable Fuel Receipt Template

Use the following template to generate a professional fuel receipt:

Fuel Station Name

Address: [Station Address]

Date: [MM/DD/YYYY] Time: [HH:MM AM/PM]

Receipt No: [Unique ID]

Vehicle Information

License Plate: [Optional]

Odometer Reading: [Optional]

Transaction Details

Fuel Type: [Gasoline/Diesel]

Quantity: [X] Gallons/Liters

Price per Unit: [$X.XX]

Subtotal: [$XX.XX]

Taxes: [$X.XX]

Total Amount: [$XX.XX]

Payment Method: [Cash/Card/Company Account]

Digital vs. Paper Receipts

For easy storage and retrieval, consider using digital receipts. Many fuel stations offer email or app-based receipts, reducing paper waste and improving accessibility.

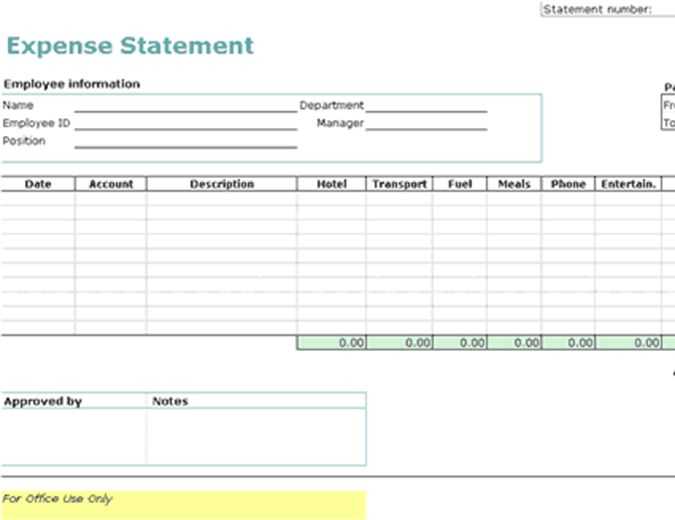

Best Practices for Receipt Management

- Store receipts digitally to prevent loss.

- Use expense tracking apps to categorize and organize purchases.

- Check receipts for accuracy before leaving the station.

- Save fuel receipts for tax deductions or reimbursement claims.

By maintaining detailed fuel receipts, businesses and individuals can streamline accounting, track expenses efficiently, and ensure compliance with financial regulations.

Fuel Receipt Template: Practical Guide

Key Elements to Include in a Receipt

Legal and Tax Compliance for Fuel Documents

Digital vs. Paper Receipts: Pros and Cons

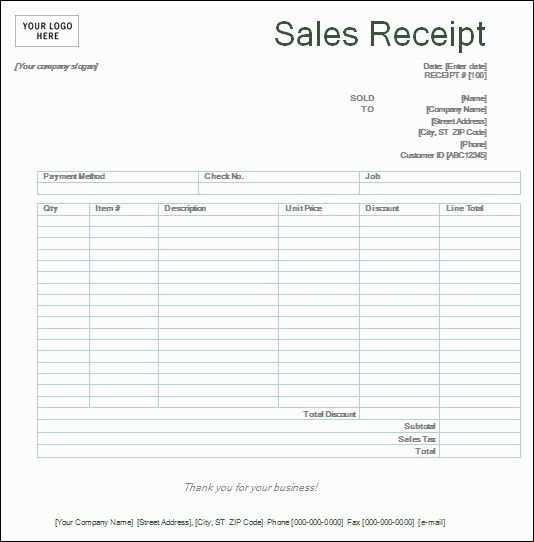

Customizing a Template for Business Needs

Common Mistakes When Creating Receipts

Best Software and Tools for Generating Documents

A well-structured fuel receipt must include the date, time, fuel type, price per unit, total cost, payment method, and vendor details. Missing any of these elements can lead to disputes or compliance issues.

For tax and legal compliance, ensure receipts contain the business name, address, and tax identification number. Many jurisdictions require a breakdown of fuel taxes and VAT for proper expense reporting.

Digital receipts simplify record-keeping and reduce paper waste, but they require secure storage and compatibility with accounting software. Paper receipts remain useful for instant verification but are prone to loss and damage.

Custom templates should align with business branding and regulatory standards. Including a unique invoice number, company logo, and digital signature enhances credibility and prevents fraud.

Common mistakes include omitting transaction details, using vague descriptions, and failing to record payment confirmations. Double-checking entries ensures accuracy and avoids reimbursement delays.

Reliable software for receipt generation includes QuickBooks, Wave, and Zoho Expense. These tools automate formatting, tax calculations, and export options, making financial tracking more efficient.