If you’re managing a fund for teachers, having a clear and well-structured receipt template is key for transparency and smooth record-keeping. A receipt should include all the necessary details that confirm the transaction, ensuring accountability and trust for both the fund administrators and the teachers receiving the support.

Your receipt template must contain specific fields like date, amount received, purpose, and signature. These elements are fundamental in providing an accurate record of each transaction. Additionally, it’s useful to include the fund name and contact information of the fund manager for any follow-up or inquiries.

For convenience, set up a section where the teacher’s name and the purpose of the receipt can be easily filled in. This ensures that all entries are clear and easy to track. By creating a standard template, you streamline the process, saving time while keeping everything in order for audits or future reference.

Here is the corrected version:

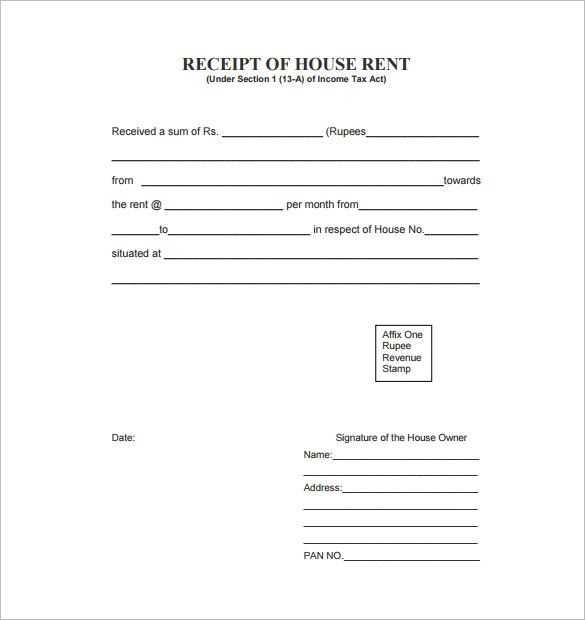

Design the receipt template with key elements in mind. First, include the date of the transaction and the amount received. Always provide both the numerical and written form of the amount for clarity. Specify the purpose of the fund, detailing whether it’s for materials, professional development, or other educational expenses.

Next, include the teacher’s full name and the name of the school or institution. This will ensure both parties are easily identified. If applicable, add a reference number to help with internal tracking.

Make sure to allocate space for both the signature of the person issuing the receipt and the recipient’s signature. This confirms that both parties acknowledge the transaction.

Finally, add contact information at the bottom of the receipt for both parties. This makes it easier to follow up on any future questions or adjustments. By clearly presenting these details, the receipt will serve its purpose without confusion.

- Fund for Teachers Receipt Template

To create an efficient receipt template for a teacher fund, include the following key components:

1. Header Information

Begin with the title “Receipt for Teacher Fund” at the top. Below it, include the full name of the school or institution, its address, phone number, and email for contact purposes. Ensure these details are clearly visible to establish the credibility of the receipt.

2. Teacher’s and Donor’s Information

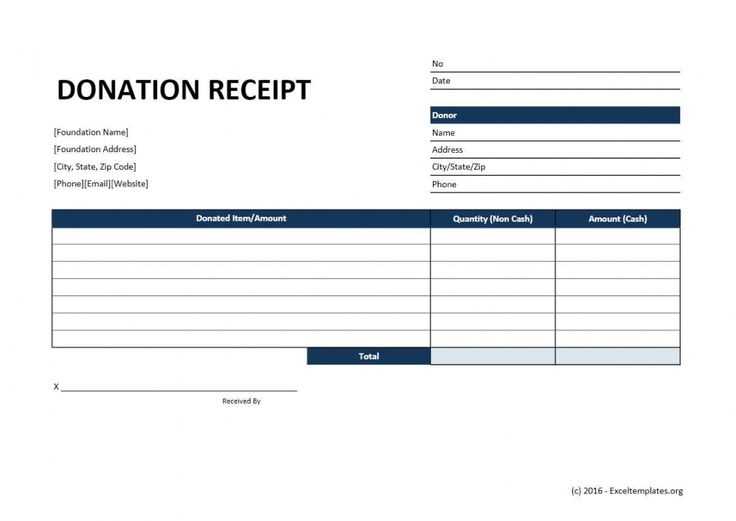

List the recipient teacher’s full name, position, and department. Also, provide details of the donor, including their name, address, and any other identifying information. This ensures transparency and allows for accurate record-keeping on both ends.

3. Fund Details

Include a brief description of the purpose of the fund (e.g., classroom supplies, professional development, etc.) and the specific amount donated. State the total amount in words and numbers to avoid confusion.

4. Date and Receipt Number

Assign a unique receipt number for easy reference. Record the date of donation or transaction to keep track of contributions over time.

5. Acknowledgement Statement

Include a statement of acknowledgment confirming that the donation has been received and that the funds will be used for the designated purpose. This can also specify whether the donation is tax-deductible if applicable.

6. Signature and Footer

Finish with a space for the authorized signature of the school representative and the teacher. Below, include a footer with the school’s legal disclaimers or any relevant notes regarding the donation process.

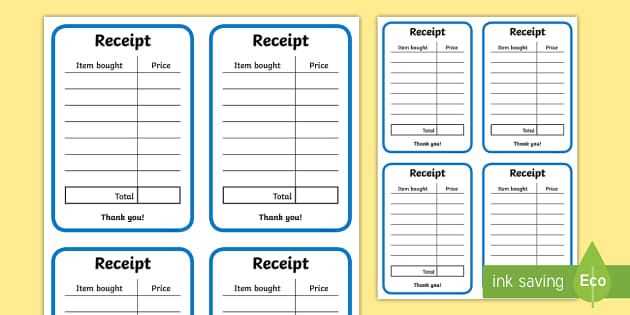

Create a clear and concise template for teacher fund disbursements that tracks all necessary details. Start by including a section for the teacher’s full name, position, and the specific purpose of the funds. This helps identify who the funds are for and why they are being distributed. Add a column for the total amount to be disbursed, ensuring transparency in the allocation process.

Next, list the date of disbursement and payment method (e.g., check, direct deposit) to provide a clear timeline. A section for signatures from both the approving authority and the teacher receiving the funds is important for accountability. Include a place to record any deductions or adjustments made, which will help avoid confusion and ensure accuracy.

Don’t forget to add a reference number or ID for each disbursement. This allows easy tracking of payments over time. You can also include a notes section for additional details, such as specific conditions attached to the funds, or any pending approvals.

Once you have the template set up, test it to make sure it covers all necessary information and allows for smooth data entry. Keep the format simple and easy to read, as this will help streamline future disbursements and minimize mistakes.

A teacher fund receipt should clearly outline all necessary details to maintain transparency. Start by including the date of the transaction, ensuring both parties have a clear reference for when the payment occurred.

Next, include the amount received. This should be the exact sum contributed, without rounding or estimates, to avoid confusion. It helps both the teacher and donor keep track of financial contributions.

Indicate the name of the teacher and the donor. The names should be written as full legal names to avoid any ambiguity. If the receipt is issued for a specific event or fund, specify the purpose of the contribution, such as “classroom supplies” or “school project fund.”

Provide a receipt number for easy identification and reference. This number should be unique to each transaction to prevent duplicates.

Lastly, make sure to include any necessary signature or authorized stamp to validate the document, ensuring the receipt is official and trustworthy.

One common mistake is neglecting to include the date of the transaction on the receipt. Without the date, the receipt may lose its validity, especially if it’s used for accounting or tax purposes. Always ensure that the exact date of payment or donation is clearly stated.

Another issue is providing an unclear description of the purpose of the funds. If you simply label the payment as a “donation,” it may confuse the receiver or the organization handling the funds. Be specific: list the exact use, such as “school supplies,” “workshop fees,” or “classroom equipment.” This clarity helps both the teacher and the donor track the fund’s use.

- Do not forget to include a unique receipt number. This serves as a reference for future inquiries or audits. Without it, tracking specific transactions can become cumbersome.

- Missing the donor’s contact information can be another error. Always list the name and contact details of the donor to avoid any confusion or miscommunication in case follow-up is required.

- Ensure that the amount is written correctly in both numbers and words. Any discrepancies between the two could lead to issues with the receipt’s legitimacy.

Additionally, be careful not to forget to mention if the donation was made in kind rather than in cash. In-kind donations need specific acknowledgment, including the nature and value of the items given.

- Double-check that the teacher’s name and details are clearly stated. This will help identify the recipient of the funds quickly, which is especially useful in cases of refunds or queries.

- Avoid vague language like “miscellaneous” when categorizing expenses. Instead, use precise terms to describe how the funds were used or allocated.

Lastly, ensure that the receipt is signed, either by the teacher or an authorized representative. An unsigned receipt may be dismissed or questioned later, especially during financial audits.

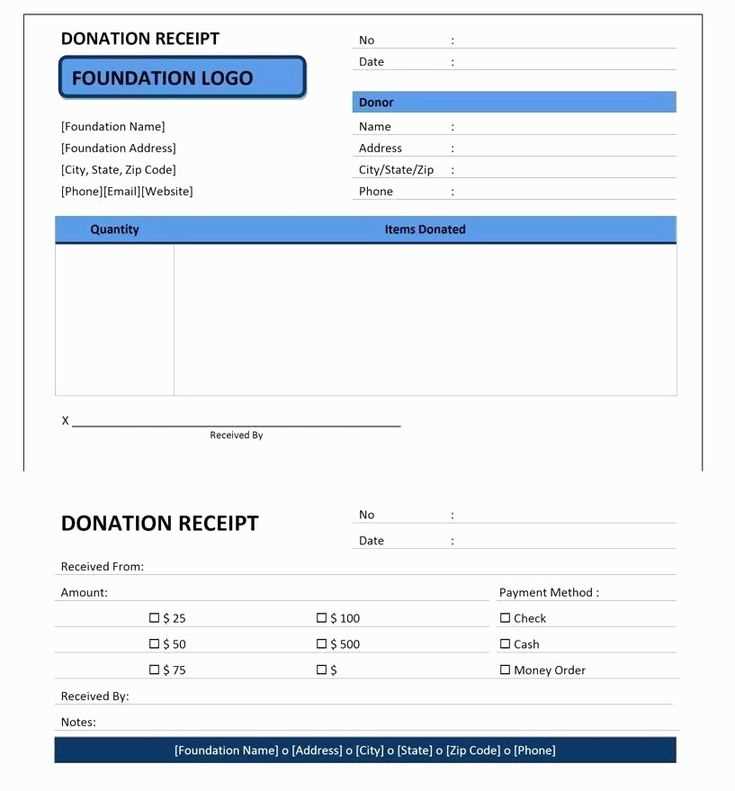

Start by creating a clear and simple template for the teacher fund receipt. Use a clean layout that clearly displays all necessary information, such as the donor’s name, the amount donated, and the date of the transaction. This ensures transparency and makes it easier for teachers to track funding sources.

Include a unique receipt number for every transaction. This will help organize records and avoid confusion when tracking multiple donations. The receipt number should follow a sequential order to keep things organized and easy to search through.

It’s important to add a short description of how the donation will be used. This reassures donors that their contribution is going directly toward helping teachers. Be specific about the purpose, whether it’s for classroom supplies, training programs, or other educational needs.

Make sure to include the contact information of the organization managing the fund. This should include an email address, phone number, and the website, if applicable. This gives donors an easy way to follow up or ask for further clarification on their donation.

Lastly, provide a space for the donor’s signature (if necessary). This adds an extra layer of accountability and ensures that all parties have a record of the donation made. For digital receipts, an electronic signature or checkbox confirmation can serve as a substitute.