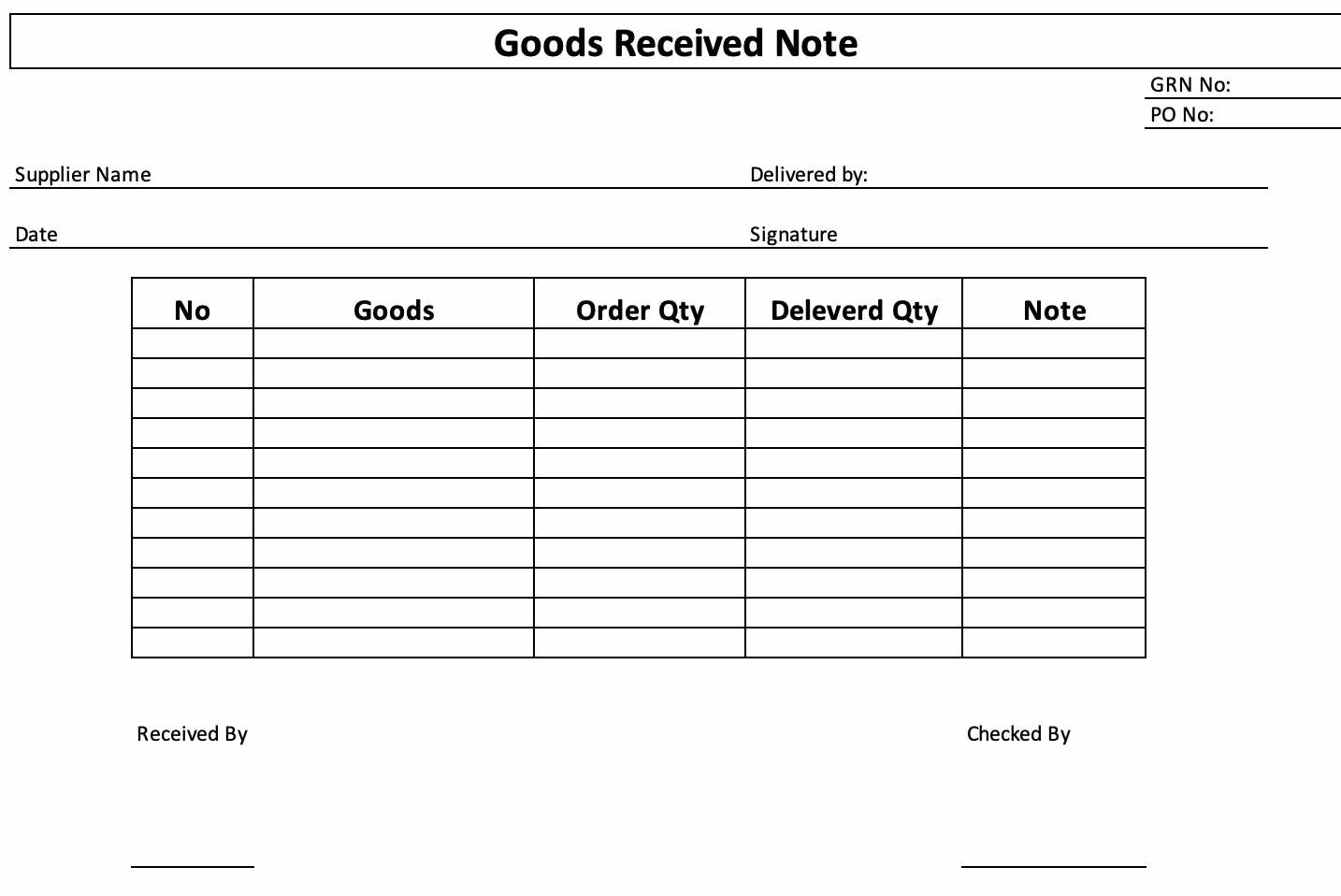

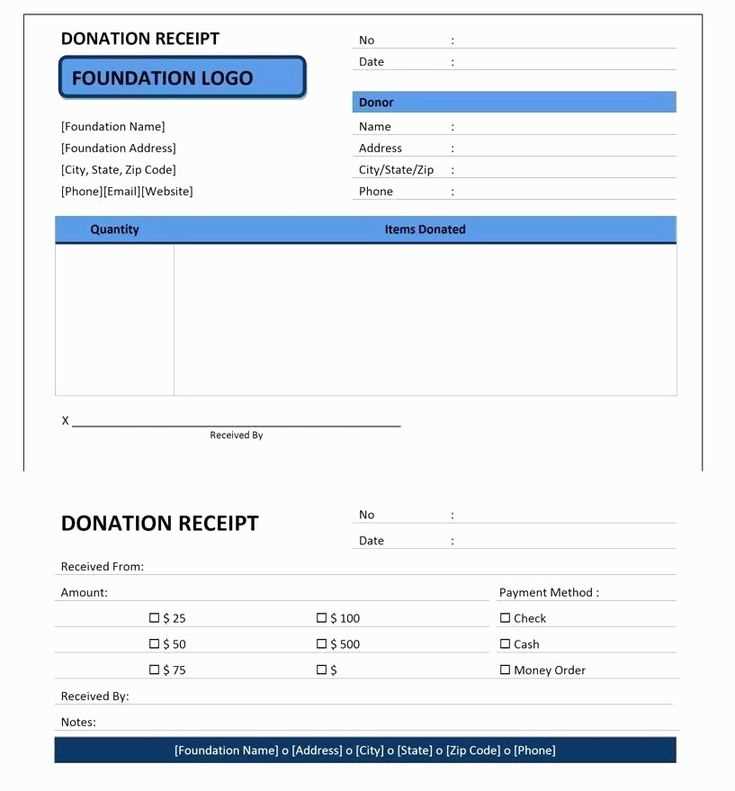

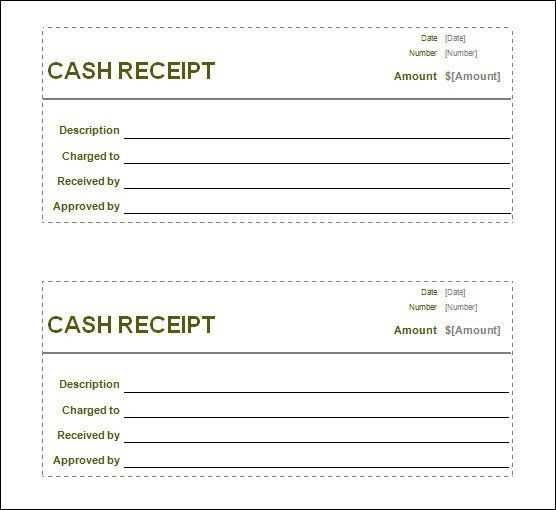

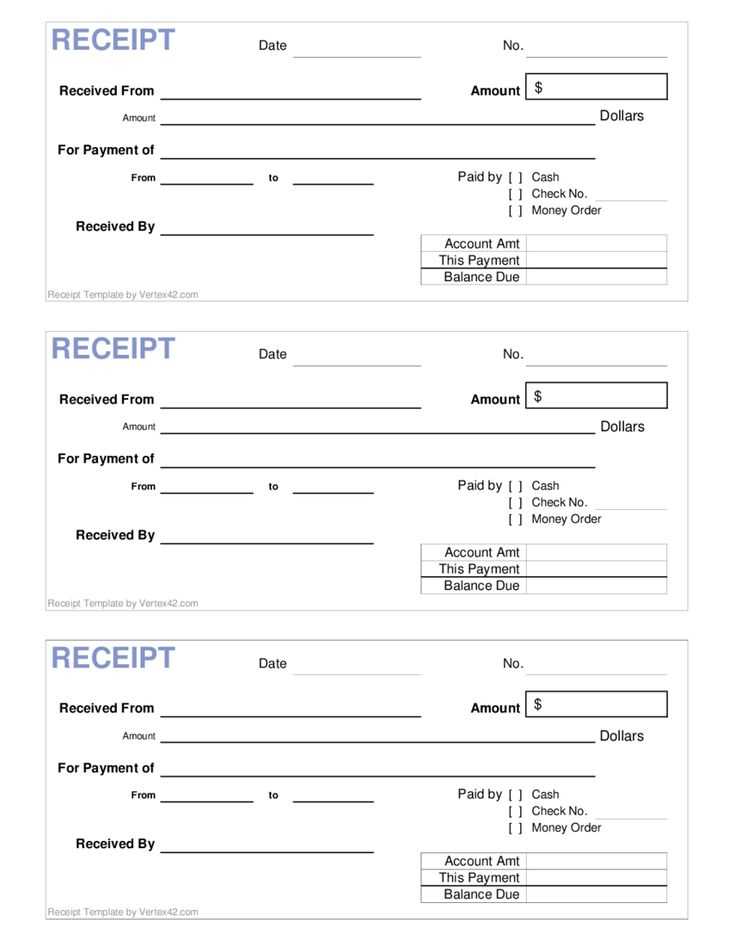

A well-organized fund receipt template simplifies tracking and acknowledging financial transactions. Use a clear and concise format to document each transaction, ensuring that both the donor and recipient understand the details. Include key information such as the donor’s name, the amount donated, the date of the transaction, and the purpose of the donation.

For added clarity, break down the receipt into sections. The first section should cover the donor’s contact details and the donation specifics, while the second part can provide a short description of how the funds will be used. This helps both parties maintain transparency and accountability. Be sure to include a space for any necessary signatures or authorizations to confirm the transaction.

Lastly, make your template adaptable to various fund types, whether for personal donations, corporate contributions, or charity drives. Adjust the fields as needed, but always ensure that the core elements–donor information, donation details, and receipt confirmation–are present. This keeps everything organized and ensures smooth communication between the parties involved.

Here are the corrected lines:

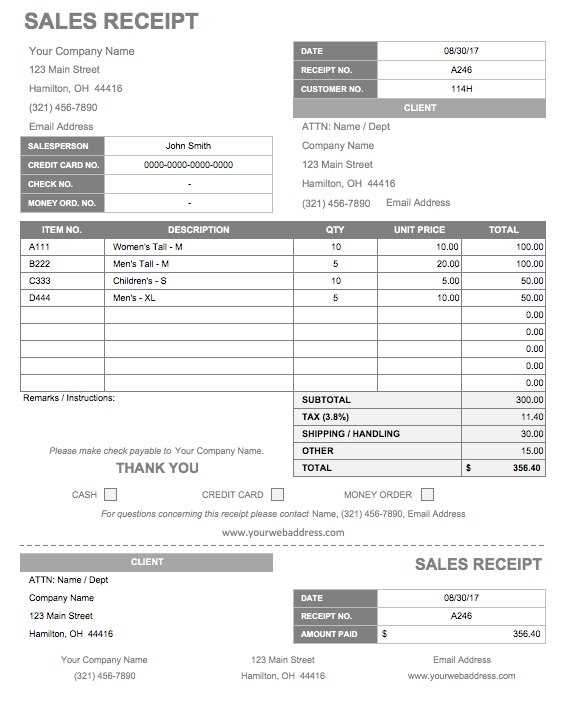

Make sure all entries are clearly labeled and consistently formatted. Adjust the date format to align with local preferences and ensure all fields are easy to identify. Each receipt should have a unique identifier for tracking purposes.

Important Adjustments:

Double-check that the recipient’s name and address are correctly listed. Incorrect details can delay processing and create confusion. Adjust the currency format to match the local currency standard, ensuring the amount is clear.

| Field | Correct Format |

|---|---|

| Date | MM/DD/YYYY |

| Amount | Currency Symbol followed by amount |

| Recipient Name | Full Name |

| Transaction ID | Unique Identifier |

Lastly, ensure that the footer includes the proper legal disclaimers or terms related to the receipt.

- Fund Receipt Template: Practical Insights

A well-organized fund receipt template is crucial for maintaining accurate financial records. Ensure the template includes the donor’s name, the date of the transaction, the amount received, and the method of payment. This provides clarity for both the recipient and the donor.

Specify the purpose of the funds in the receipt. This helps in differentiating between general donations and restricted funds that are meant for specific projects or causes. Include a brief description of the transaction for transparency and accountability.

Make sure the receipt includes a unique identifier, such as a receipt number or transaction ID, to prevent duplication and ensure easy tracking in case of any future inquiries. This adds a layer of organization to your financial records.

For electronic receipts, provide a downloadable PDF option or send it via email with the necessary details. Ensure that the format is accessible and easy to read on various devices.

Keep a backup of all issued receipts for future reference. Whether you store them digitally or physically, having these documents on hand can simplify the process if there are any discrepancies or audits.

Select a format that suits both the purpose of the receipt and the needs of the recipient. A clear and simple layout is key. Avoid clutter, and ensure all essential information is easy to locate.

Printable vs. Digital Formats

- Printable receipts: These are ideal for in-person transactions and provide a tangible proof of donation. Use a standard template that fits on letter-sized paper for easy printing.

- Digital receipts: Digital formats, such as PDFs or email confirmations, offer convenience for online donations. Ensure the format is easily readable on both desktop and mobile devices.

Key Elements to Include

- Donor’s name and contact details.

- Amount donated, including any special instructions or designations for the fund.

- Date of the transaction.

- Organization’s name, tax ID, and contact information for tax purposes.

By focusing on simplicity, clarity, and accuracy, you can create a receipt format that meets the donor’s needs while also serving organizational requirements.

Each fund type requires a tailored approach to receipt templates. For donations, highlight the donor’s name, amount, and donation method. Adding a thank-you note can enhance the donor’s experience. For grants, include project details and the disbursement breakdown. Make sure the fund’s purpose and relevant timelines are clearly visible. In the case of loans, specify the loan terms, repayment schedule, and interest rate to ensure clarity.

For each fund type, adjust the layout accordingly. Donations may benefit from a simple, clean design with an emphasis on the donor’s contribution. Grant receipts should focus more on project-related information and compliance details. Loan receipts should have a more formal tone with sections dedicated to the financial terms and conditions. Always include a clear reference number or transaction ID to help track the receipt for future audits or inquiries.

Adjusting the level of detail in each receipt template is key. Don’t overcrowd the design, but ensure all necessary information is easily accessible to the recipient. A well-organized template that matches the specific type of fund will enhance professionalism and transparency.

Check all entries for consistency before submitting the document. Double-check numerical data, dates, and signatures. Cross-reference each item with the original sources to ensure no discrepancies are present.

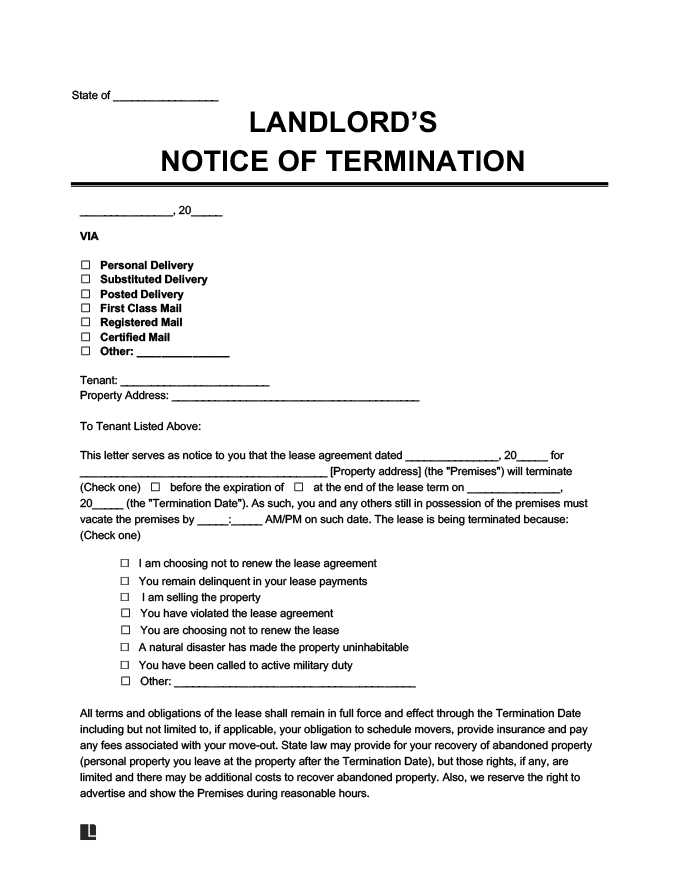

Verification of Legal Requirements

Review applicable regulations to confirm your document meets all legal obligations. Verify that the required fields are completed, and ensure that the correct format and language are used as per industry standards.

Audit Trails and Record Keeping

Maintain a clear audit trail to track any changes or updates made to the document. This can prevent errors and help resolve issues that might arise during later stages of processing. Keep organized records of all revisions, approvals, and communications.

Always retain copies of original receipts or transactions referenced in your document. This serves as backup in case of disputes or audits.

Minimize errors by using templates designed for consistency. Avoid last-minute alterations, as they often lead to mistakes. Stick to standardized practices to keep the process predictable and error-free.

For a clear and precise fund receipt template, it’s crucial to outline key details in a structured manner. Start with the amount received, followed by the payment method and date.

Key Components of a Fund Receipt Template

- Amount Received: Specify the total amount received, ensuring clarity.

- Payment Method: Indicate how the payment was made, whether via check, cash, bank transfer, or other methods.

- Date of Transaction: Include the exact date the payment was made.

- Payer’s Details: Record the name and contact information of the individual or entity providing the funds.

- Purpose of Payment: Clearly state the purpose for which the funds were provided, if applicable.

Additional Tips

- Ensure that all details are accurate and up-to-date.

- Consider including a reference or receipt number for easy tracking.

- In cases of partial payments, indicate the outstanding balance if any.