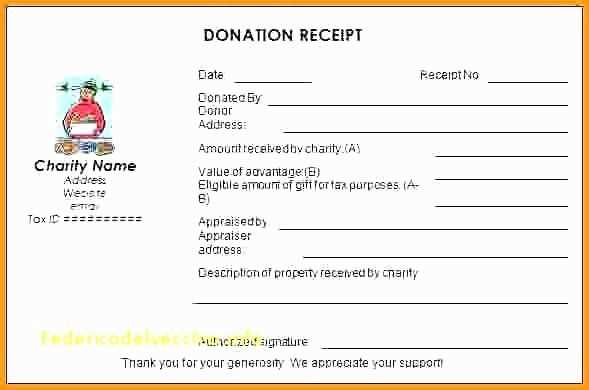

Provide your donors with a clear and professional receipt by using a fundraiser receipt template. This document is key to confirming their contributions and can be used for tax deduction purposes. Make sure the template includes details like the donor’s name, donation amount, and the date of the contribution.

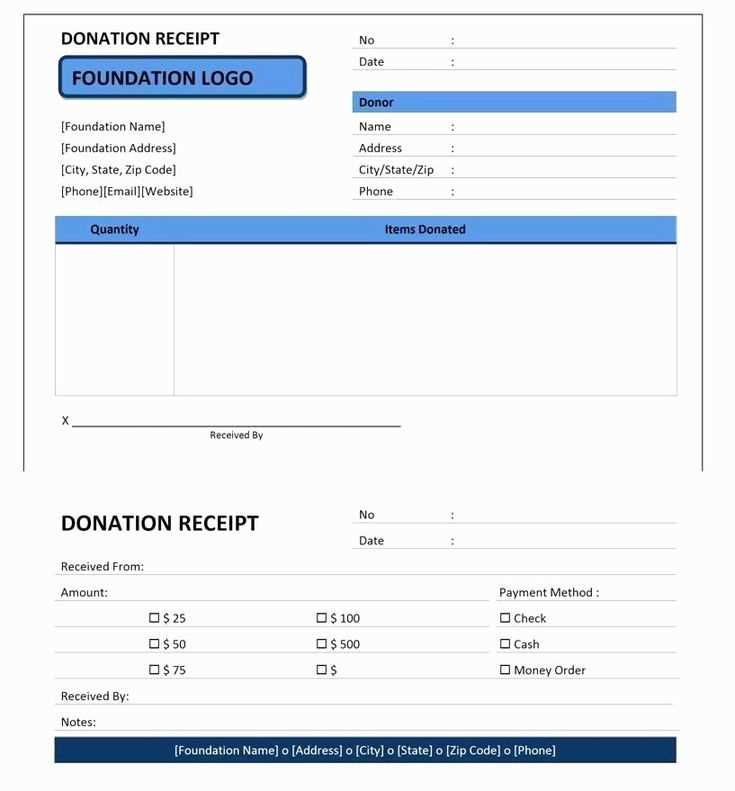

Start by including your organization’s name and contact information at the top of the template. Then, clearly list the donor’s details, including any relevant identification number if applicable. Don’t forget to add the total donation amount and a statement confirming the gift is tax-deductible, if applicable.

Lastly, make sure to include a unique receipt number for tracking purposes and a thank-you note for their generosity. A well-structured receipt not only helps donors but also ensures your records are organized and transparent.

Here are the revised lines without repetitions:

Ensure the receipt includes the full name of the donor to maintain clarity. This helps both the organization and the donor with record-keeping. Include the donation amount along with a description of the fundraiser. This provides transparency and makes it easier to track individual contributions.

The date of the donation is a key detail to include, ensuring the record is time-specific. A unique receipt number is necessary for proper organization and future reference. Don’t forget to add the charity’s name and contact information to the receipt. This helps donors confirm the legitimacy of the organization and offers them a way to get in touch if needed.

Clearly state whether the donation was monetary or in-kind to avoid confusion. For in-kind donations, include a brief description of the items received. Make sure to mention if the donation is tax-deductible to help the donor understand their potential benefits.

Incorporate a thank-you message to show appreciation for the donor’s contribution. This small gesture can go a long way in building ongoing relationships with supporters. Provide clear instructions on how the donor can contact your organization for questions about their donation.

- Fundraiser Receipt Template

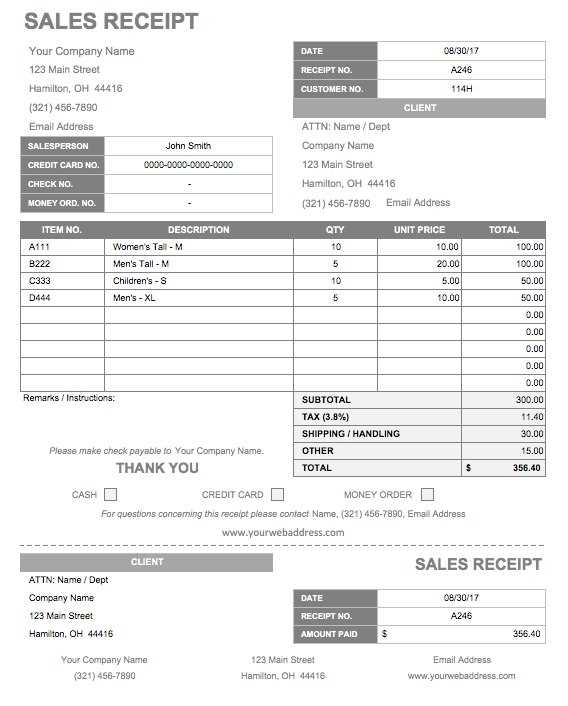

Include the donor’s name, donation amount, and the date of donation. Specify the campaign or cause the funds are supporting. Clearly mention whether any goods or services were exchanged and the fair market value of any items provided. This helps the donor understand the deductible portion of their donation.

Ensure your organization’s name, address, and tax-exempt status are included. State the organization’s EIN for tax reporting. If the donation was made online, add any transaction IDs or reference numbers for verification.

Express gratitude for the donation with a brief thank-you note. Acknowledge the donor’s impact on your cause and provide contact information in case they need further assistance or clarification.

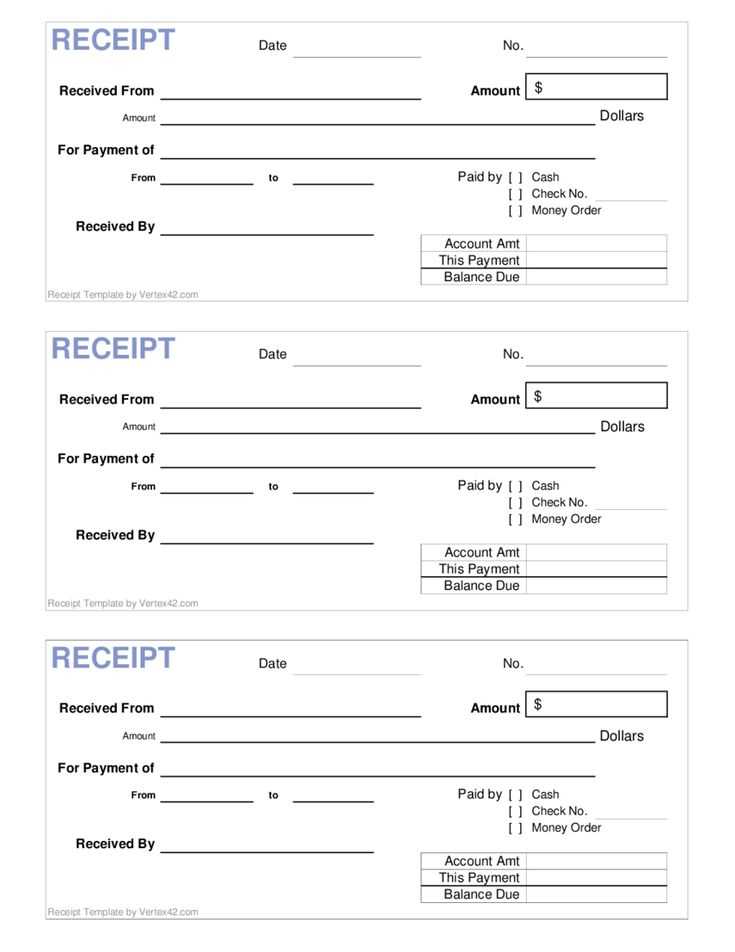

Begin with a clear header that includes the name of your organization or fundraiser and the word “Receipt” prominently displayed. This helps recipients easily identify the purpose of the document.

Next, include the donor’s full name and contact information. This allows for easy reference and follow-up if needed. Be sure to include the date of the donation for record-keeping purposes.

Clearly state the donation amount and specify the currency. If the donation is made in-kind, describe the items or services donated with sufficient detail.

It’s important to include a statement of gratitude. A simple sentence expressing appreciation for the donation can go a long way in strengthening the donor relationship.

If the donation is tax-deductible, make sure to include a note indicating this. If applicable, include the organization’s tax identification number or 501(c)(3) status information for U.S.-based donations.

Ensure that there is space for your signature or an authorized representative’s, adding a personal touch to the receipt.

- Header with organization name and “Receipt” label

- Donor’s name and contact info

- Date of donation

- Donation amount and/or description of in-kind donation

- Appreciation statement

- Tax-deductible information and tax ID (if applicable)

- Authorized signature space

Keep the design clean and straightforward. Avoid unnecessary clutter or complicated elements. A simple layout ensures the recipient can quickly access the necessary information.

Key Information to Include in Your Receipt for Fundraisers

Include the donation amount clearly on the receipt. This will help both the donor and the organization keep track of contributions for tax purposes.

Details to Mention:

| Information | Description |

|---|---|

| Donor’s Name | Make sure to mention the donor’s full name for proper record-keeping and tax documentation. |

| Donation Amount | State the exact dollar amount received, ensuring it matches the donor’s contribution. |

| Date of Donation | Include the exact date the donation was made for accurate tracking and reporting. |

| Tax-Exempt Status | If your organization is tax-exempt, include this information to allow donors to claim deductions. |

| Organization’s Details | List the name of your organization, its address, and any relevant contact information. |

| Donation Type | Clarify if the donation is monetary, goods, or services for clarity and tax purposes. |

Special Notes

If the donation was in-kind, make sure to note that and describe the item(s) donated. This helps in maintaining accurate records for both the donor and your organization.

Maintain a clear, structured layout with readable fonts. Use consistent spacing, making it easy for donors to read the information. This helps them locate key details quickly.

1. Use a Clean and Simple Design

Avoid clutter. Stick to a minimalist design that focuses on key elements: donor information, donation amount, and the organization’s details. Ensure each section is visually distinct using headings and adequate white space.

2. Include All Required Information

Each receipt should list the donor’s full name, address, date of donation, donation amount, and the organization’s tax ID. Don’t forget a thank-you note to show appreciation. Here’s an example of a well-organized layout:

| Field | Details |

|---|---|

| Donor Name | John Doe |

| Address | 1234 Elm Street, City, State, 12345 |

| Date of Donation | February 7, 2025 |

| Donation Amount | $100.00 |

| Tax ID | 12-3456789 |

| Thank You Message | Thank you for your generous donation! |

Place the donation amount in a prominent position, ideally near the top of the receipt. This makes it easy for the donor to confirm the transaction. Including both the total and individual amounts for multiple donations, if applicable, helps ensure clarity.

How to Ensure Tax Compliance in Donation Receipts

Include the donor’s name, the donation date, and the amount donated. Ensure the receipt clearly states if the donation was monetary or non-monetary, specifying the value of goods donated when applicable.

State the non-profit’s tax-exempt status, including the relevant IRS designation (e.g., 501(c)(3)). Mention that donations are tax-deductible, and clarify any goods or services provided in exchange for the donation, as this impacts the deductibility.

For non-cash donations, provide a description of the items donated but avoid assigning a value unless you have an appraisal. Donors should be reminded to obtain their own valuations for such items.

Ensure that receipts are issued within the calendar year of the donation. Keep a record of all receipts for tax reporting and audit purposes. Adhere to IRS guidelines for required elements to ensure compliance and avoid penalties.

For cash donations, provide the exact donation amount, donor’s name, and donation date. Include a statement that the receipt serves as proof for tax purposes. For in-kind donations, describe the donated items without assigning a monetary value. Clearly state that the donor is responsible for determining the value of the goods. When dealing with recurring donations, include the frequency and total contribution to date. Mention that a year-end receipt will reflect the full donation amount after all payments have been processed.

If the donation comes from a business, use the company name and contact information. Specify the type of contribution, whether it’s a direct donation or part of a matching gift program. If the donor is receiving goods or services in return for their contribution, clarify the amount that qualifies as a donation after deducting the value of these benefits. For event-related donations, such as gala tickets or auction purchases, break down the payment into the cost of the ticket or item and the charitable portion.

Make sure to distribute receipts quickly after donations are made. This helps donors keep track of their contributions and ensures that they can claim tax deductions promptly.

1. Use Clear and Concise Information

- Include donor details such as name, donation amount, and date of contribution.

- State whether the donation is tax-deductible, and if applicable, specify any non-cash items.

- If the donor requested anonymity, make sure this is reflected in the receipt.

2. Offer Multiple Distribution Methods

- Allow donors to choose between email, postal mail, or online accounts for receiving their receipts.

- Consider sending receipts via email as a standard option for faster delivery.

For large or recurring donations, ensure that the receipts are sent out consistently, either after each donation or as part of a summary at the end of the year.

3. Maintain Consistency and Branding

- Use the same format for all receipts to ensure clarity and recognition.

- Include your organization’s logo and contact information to establish trust and ensure recipients know who issued the receipt.

To structure a fundraiser receipt, ensure that the list of donations is clear and well-organized. Start by detailing the donor’s name and the amount they contributed. Each entry should include the donation date and a reference number to help with tracking. For transparency, if the donation was in-kind, specify the type and value of the item donated. Clearly note whether the donation is tax-deductible. Make it easy for donors to understand which parts of the receipt apply to their contribution type.

Using an ordered list for donations offers several advantages. It helps donors see the exact breakdown of their contribution and provides an easy reference for future follow-ups or tax purposes. Ensure that the layout is clean and legible, avoiding clutter. Keep the focus on the donor’s information and the amount contributed to maintain clarity. You can also add a section at the bottom for any additional remarks, such as specific fund usage or event-related details.

Include a thank you note at the end to express gratitude for the donor’s generosity. This not only acknowledges their contribution but also strengthens the relationship between your organization and the donor. Don’t forget to include your organization’s contact information for any follow-up inquiries.