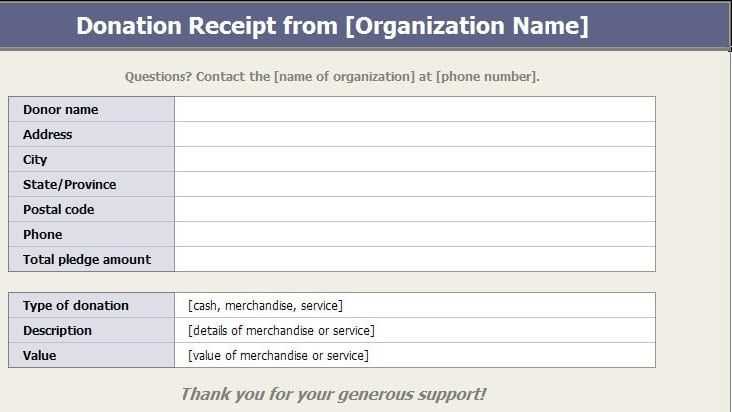

Ensure that your fundraiser receipt template is clear, concise, and includes all necessary details. The receipt should reflect the exact donation amount, date, and the name of the donor. Include your organization’s contact details, and make it easy to read for both record-keeping and tax purposes.

Each receipt must also contain a description of what the donor has contributed, whether it’s a monetary gift or goods. Specify if any part of the donation is tax-deductible. A detailed receipt not only keeps everything organized but also builds trust with contributors.

Lastly, consider offering digital receipts. They are not only environmentally friendly but also convenient for both donors and your team. Keep the format simple, user-friendly, and professional for the best impact.

Here is the corrected version with repeated content removed:

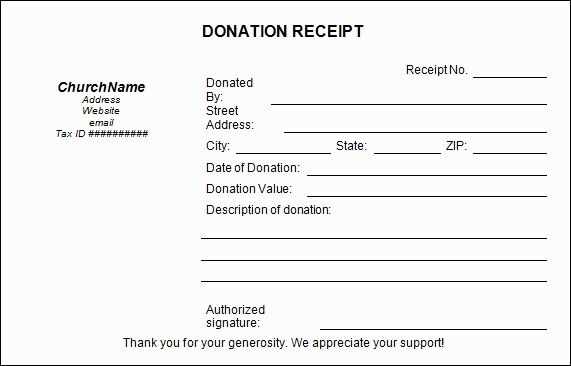

Ensure that the receipt clearly states the name of the organization and the purpose of the fundraiser. Include the donor’s full name, address, and contact details. Specify the exact donation amount, whether it is in cash, check, or other forms of payment. Always include the date of the donation for accurate record-keeping.

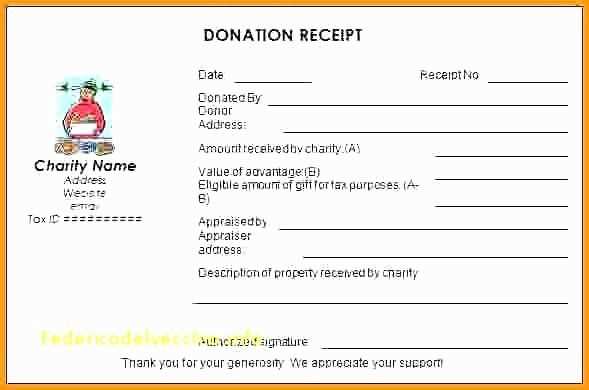

It is essential to provide a unique donation ID number, especially for large campaigns, to help both the donor and organization track contributions. A brief statement about the organization’s tax-exempt status can be included if applicable, along with instructions on how the donor can use the receipt for tax purposes.

Don’t forget to sign the receipt, either manually or digitally, to confirm its validity. Keep a copy of the receipt for your records. Finally, ensure that the receipt format is easy to read and includes clear sections for each piece of information.

- Fundraiser Receipt Template Guide

A well-structured fundraiser receipt should include the following details to ensure clarity and compliance:

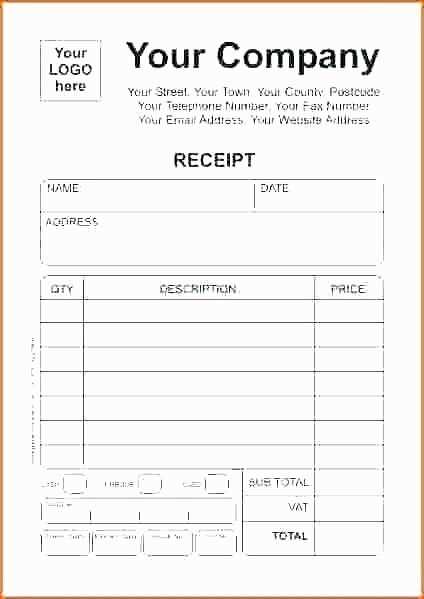

- Organization Information: Add the organization’s name, physical address, and contact details to verify the source of the receipt.

- Donor Information: List the donor’s full name and address to correctly match the donor’s record.

- Donation Type: Specify the type of donation (monetary or in-kind), including the value of cash donations and a description of non-cash contributions.

- Donation Amount or Value: Clearly show the amount or value of the donation. If an item was donated, include a brief description and estimated fair market value.

- Date of Donation: Indicate the date the donation was received for tax and accounting purposes.

- Tax-Exemption Status: Include a note confirming whether the donation is tax-deductible and provide relevant tax-exemption details, if applicable.

- Receipt Number: Include a unique identification number for easy reference.

- Signature: Include the signature or name of an authorized person within the organization to validate the receipt.

Keep the template simple, organized, and professional to ensure donors can use it for tax filing purposes with confidence.

Include the organization’s name, address, and contact details at the top of the receipt. This helps to identify the source of the donation. Clearly state the purpose of the donation and include the date of the transaction. A donor should easily identify the time of their contribution for record-keeping and tax purposes.

Provide Donation Details

Indicate the amount donated, whether it’s in cash, check, or other form of payment. If the donation includes any goods or services, ensure the value of these is noted separately. It’s important to specify if the donation was a one-time contribution or a recurring one to avoid confusion for both the donor and the organization.

Legal Language and Tax Information

Include a statement about the organization’s tax-exempt status. For instance, note that the organization is a 501(c)(3) entity, if applicable, so the donor can claim the donation for tax deduction. Acknowledge that no goods or services were provided in exchange for the donation, or if they were, specify their fair market value to comply with IRS regulations.

Conclude with a clear signature or authorization from a representative of the organization, confirming the receipt. This adds authenticity and legal validity to the document.

Include the donor’s name and donation amount prominently at the top of the receipt. Make sure this information is clear and easy to locate for personal acknowledgment.

Provide a personalized thank-you message. Tailor it to reflect the donor’s specific contribution, whether it’s a general or special gift. A short, heartfelt sentence can make a big difference in how appreciated the donor feels.

Include the organization’s logo or branding to create a connection between the donor and the cause they supported. This helps reinforce the mission and values behind the donation.

If applicable, mention the donor’s specific contribution purpose, such as supporting a particular project or event. This adds a layer of clarity and shows the impact of their generosity.

Offer details on any matching gift programs that may apply, if relevant. This gives the donor an opportunity to check whether their employer provides additional contributions to their donation.

Don’t forget to include the date of the donation. This helps for record-keeping and provides a timely reminder of the donor’s support.

Clearly state the name of the organization receiving the donation at the top of the receipt. Ensure this is legible and easy to identify.

List the donor’s full name, address, and contact information to establish the connection between the receipt and the individual.

Provide a detailed description of the donation. Include the donation amount and specify whether it is in cash, check, or another form (e.g., goods or services).

Include the date of the donation. This helps track donation activity and ensures proper record-keeping.

State whether the donation is tax-deductible, and mention the organization’s tax-exempt status. Provide the IRS or local tax number if relevant.

If applicable, include information on any goods or services provided in exchange for the donation. This helps the donor understand what portion, if any, is deductible.

Include a thank you message to show appreciation for the donation. This fosters goodwill and encourages future support.

| Key Information | Example |

|---|---|

| Organization Name | Example Charity Organization |

| Donor Name | John Doe |

| Donation Amount | $100 |

| Donation Date | February 11, 2025 |

| Tax-Exempt Status | IRS Tax ID: 123456789 |

| Goods or Services | None provided |

Fundraiser Receipt Template Details

Ensure that each receipt you create is clear and includes the following key components:

- Donor’s Information: Include the full name and contact details of the donor. If applicable, add their organization name.

- Date of Donation: Specify the exact date of the transaction. This is important for tax purposes.

- Donation Amount: Clearly state the dollar value of the contribution. Specify if it’s a cash or non-cash donation.

- Donation Method: Indicate how the donation was made (e.g., check, credit card, online platform).

- Tax-Exempt Status: Mention your organization’s tax-exempt status number, if relevant, to ensure the donor can claim the contribution on their taxes.

Detailed Breakdown of Non-Cash Donations

- For non-cash donations, provide a brief description of the items or services donated.

- If possible, include an estimate of the fair market value of these donations.

Additional Notes

- If the donation is part of a pledge, indicate the total amount and any future payments.

- Ensure to include your organization’s contact information, website, and physical address.