A well-structured receipt helps general contractors maintain clear financial records and ensures transparency with clients. A proper template should include essential details such as the contractor’s name, client information, services provided, and payment terms.

Key elements of a receipt: Include the date of service, a unique receipt number, and a breakdown of labor and material costs. Specify the payment method and any applicable taxes. If the project involves multiple phases, outline completed work and pending charges.

Why standardization matters: Using a consistent template simplifies tax reporting, minimizes disputes, and provides a professional appearance. Digital formats, such as PDFs or spreadsheets, make record-keeping easier and reduce paperwork.

Whether issuing receipts for one-time jobs or long-term projects, a structured template ensures clarity and professionalism. Customizing it to fit your business needs will improve financial management and client trust.

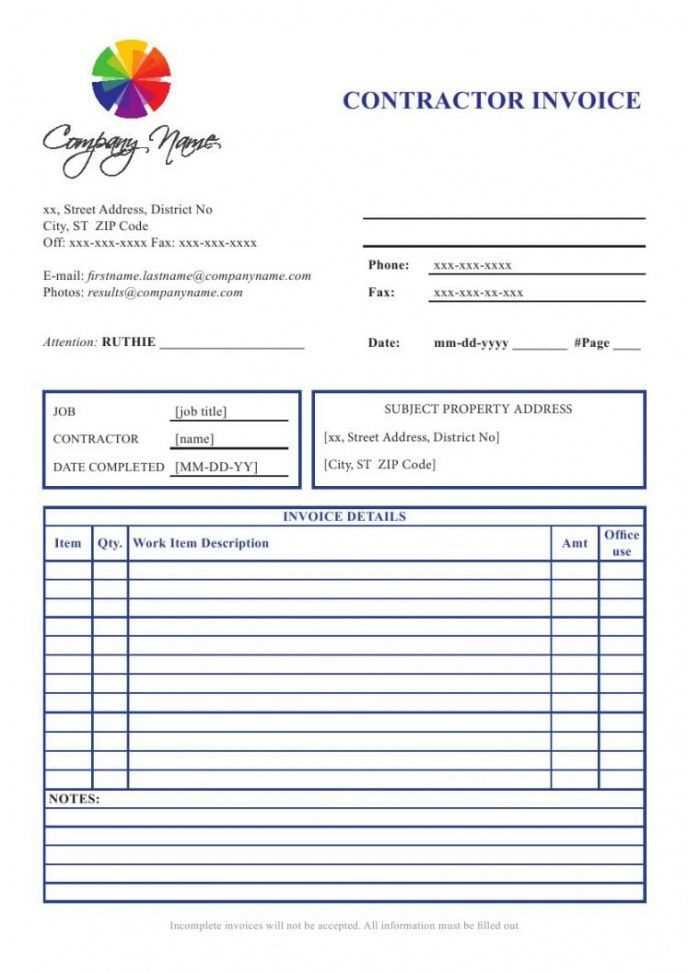

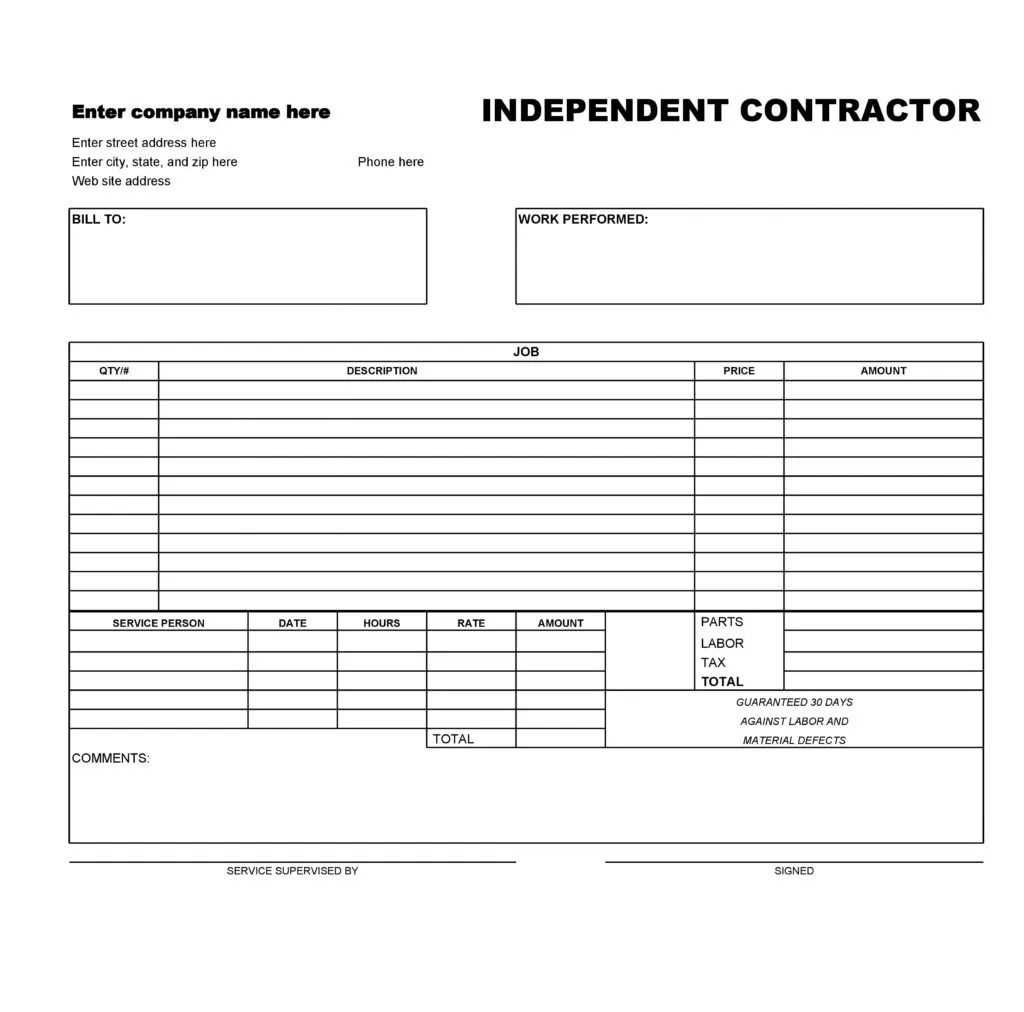

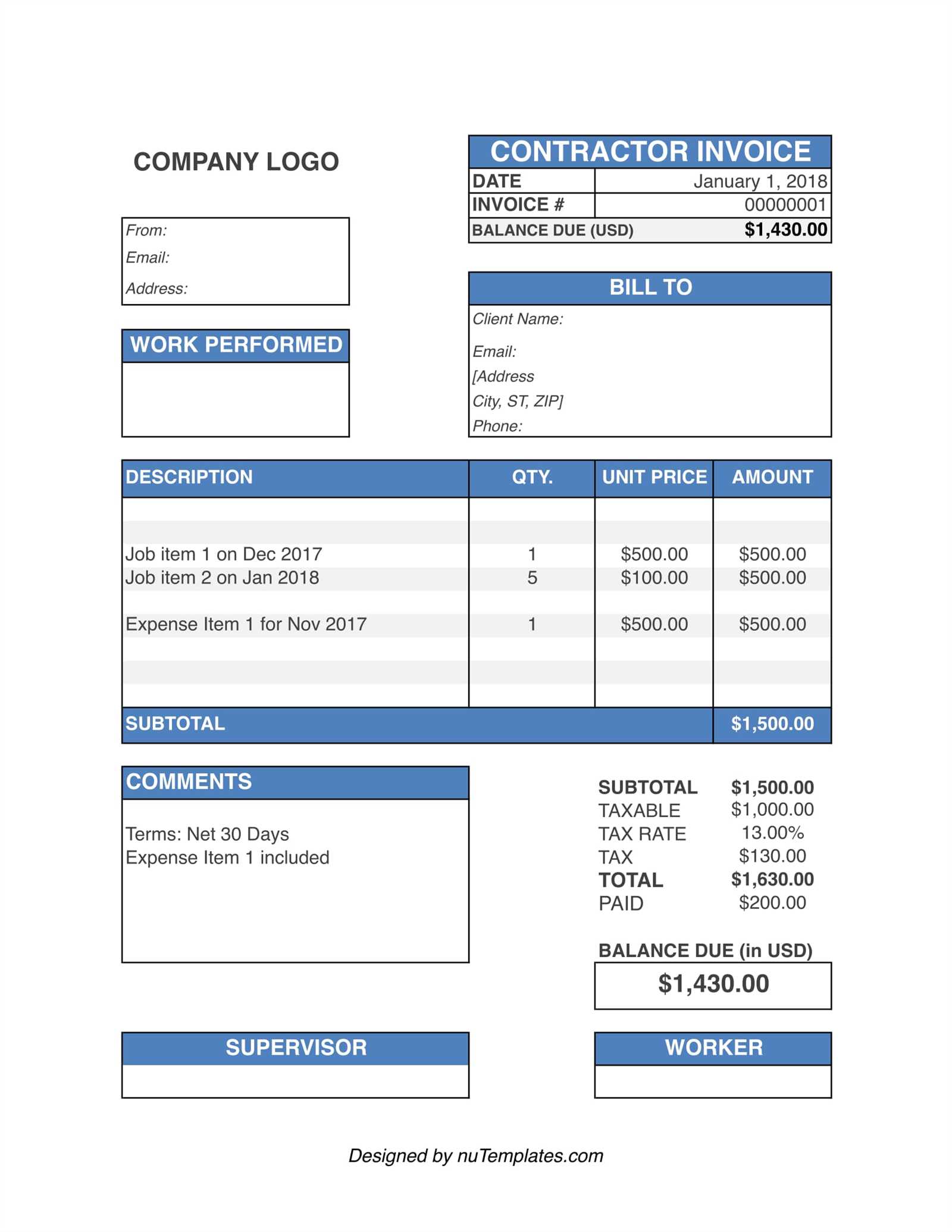

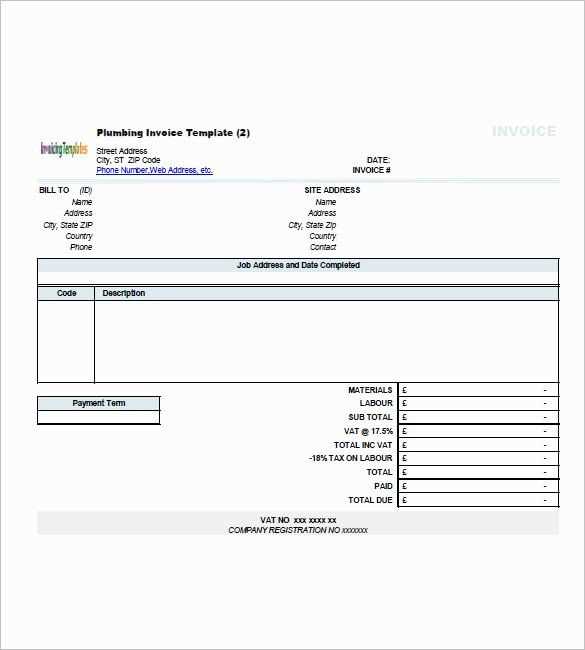

General Contractor Receipt Template

A well-structured receipt helps contractors document payments and avoid disputes. Include contractor details such as name, address, and contact information at the top. Below, specify the client’s information to ensure clarity.

Essential Receipt Components

Break down the charges in a clear and itemized format. List labor costs, materials, and any additional fees separately. Add a subtotal before applying taxes and discounts to prevent confusion.

Payment and Authorization

Indicate the payment method (cash, check, or electronic transfer) and include a unique receipt number. A signed authorization by both parties adds credibility and serves as a formal acknowledgment of the transaction.

Using a structured template streamlines accounting and ensures compliance with tax regulations. Keep digital and printed copies for accurate record-keeping.

Key Elements of a Contractor Receipt

Every contractor receipt should include clear details to ensure transparency and proper documentation. Omitting key elements can lead to disputes or payment delays.

Essential Information

- Contractor’s Details: Full name, business name (if applicable), address, phone number, and tax identification number.

- Client Information: Name, contact details, and project location.

- Receipt Number: A unique identifier for tracking payments.

- Date of Issue: The day the receipt is created.

Payment Breakdown

- Services Provided: Detailed list of work performed, including descriptions and hours worked.

- Materials Used: If applicable, specify materials and associated costs.

- Total Amount: Breakdown of costs, taxes, and the final sum.

- Payment Method: Cash, check, bank transfer, or other accepted forms.

A well-structured receipt protects both parties and simplifies financial record-keeping. Including all relevant details minimizes misunderstandings and ensures compliance with tax regulations.

How to Format a Professional Receipt

Include the business name, address, and contact details at the top. If applicable, add a company logo for branding. Below, clearly state the word “Receipt” and assign a unique receipt number.

List the date of issue and the client’s information, including name and address. Specify the payment method used, such as cash, check, or bank transfer.

Provide a detailed breakdown of the services rendered. Use a table or structured format to include descriptions, quantities, unit prices, and total amounts. Ensure all amounts are correctly calculated and include applicable taxes.

Highlight the total amount paid in bold. If necessary, note any outstanding balance and payment terms. End with a professional closing, thanking the client and providing any relevant disclaimers or refund policies.

Legal and Tax Considerations for Receipts

Include essential details. A valid receipt must show the contractor’s name, business address, tax identification number, date of transaction, description of services, and total amount paid. Missing information can lead to disputes or tax issues.

Keep receipts for audits. Tax authorities may request documentation to verify income and expenses. Store copies for at least seven years to avoid penalties and ensure compliance.

Specify tax charges. If applicable, indicate sales tax separately. Failure to do so can result in underpayment or legal complications.

Use digital records. Electronic receipts simplify tax filing and prevent loss. Many jurisdictions accept scanned or digital copies as official records.

Avoid common mistakes. Handwritten receipts can be challenged if they lack proper details. Ensure all documents are legible, accurate, and aligned with tax regulations.