If you lose a receipt, having a structured template can help you quickly recreate the details for your records. The template should include all the necessary information for accurate documentation and potential reimbursement. Start by clearly listing the date of purchase, the store or vendor name, and a brief description of the purchased items or services.

Next, provide an estimate of the total amount spent, breaking it down into individual item costs if possible. Include any relevant details such as payment method, transaction number, or order number to support the authenticity of the purchase. This information ensures that even without the original receipt, you can still provide a reliable record of the transaction.

Keep the template simple and to the point. Include a space for your signature or confirmation to validate the document if necessary. It’s also helpful to attach any supporting evidence, like bank statements or email receipts, to reinforce the accuracy of the details you’ve recreated.

Here are the revised lines with minimized word repetition:

Use clear, direct phrasing for receipt information. Avoid unnecessary redundancy. For example, instead of writing “The purchase of this item was completed and finalized,” simplify it to “This item was purchased.” This keeps the statement precise and to the point.

Receipt Details

Include all necessary transaction information: product name, quantity, price, and date of purchase. Use short, simple sentences to list these details without repeating terms like “order,” “payment,” or “transaction.” For example, “Purchased: 2 x Coffee Mugs, $15 each, on 02/12/2025” is concise and clear.

Transaction Confirmation

Rather than stating “This is to confirm your payment was successfully completed,” a more concise line could be: “Payment received on 02/12/2025.” This reduces wordiness while maintaining clarity.

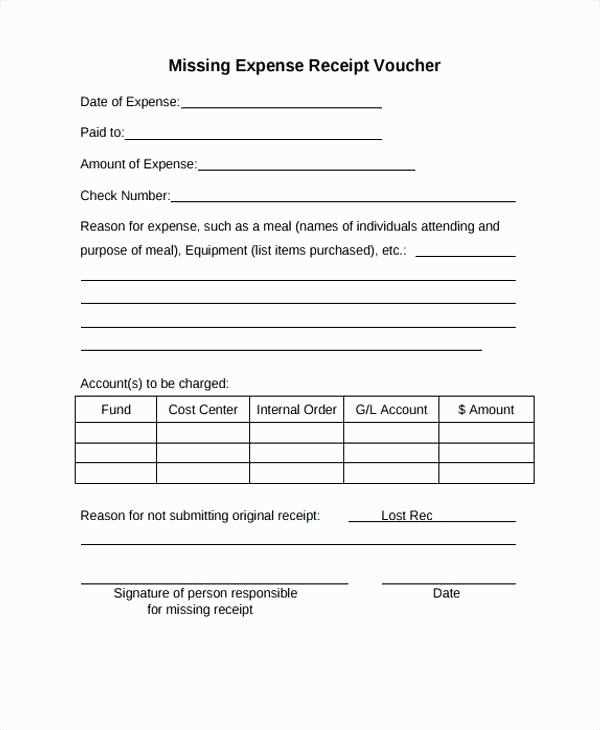

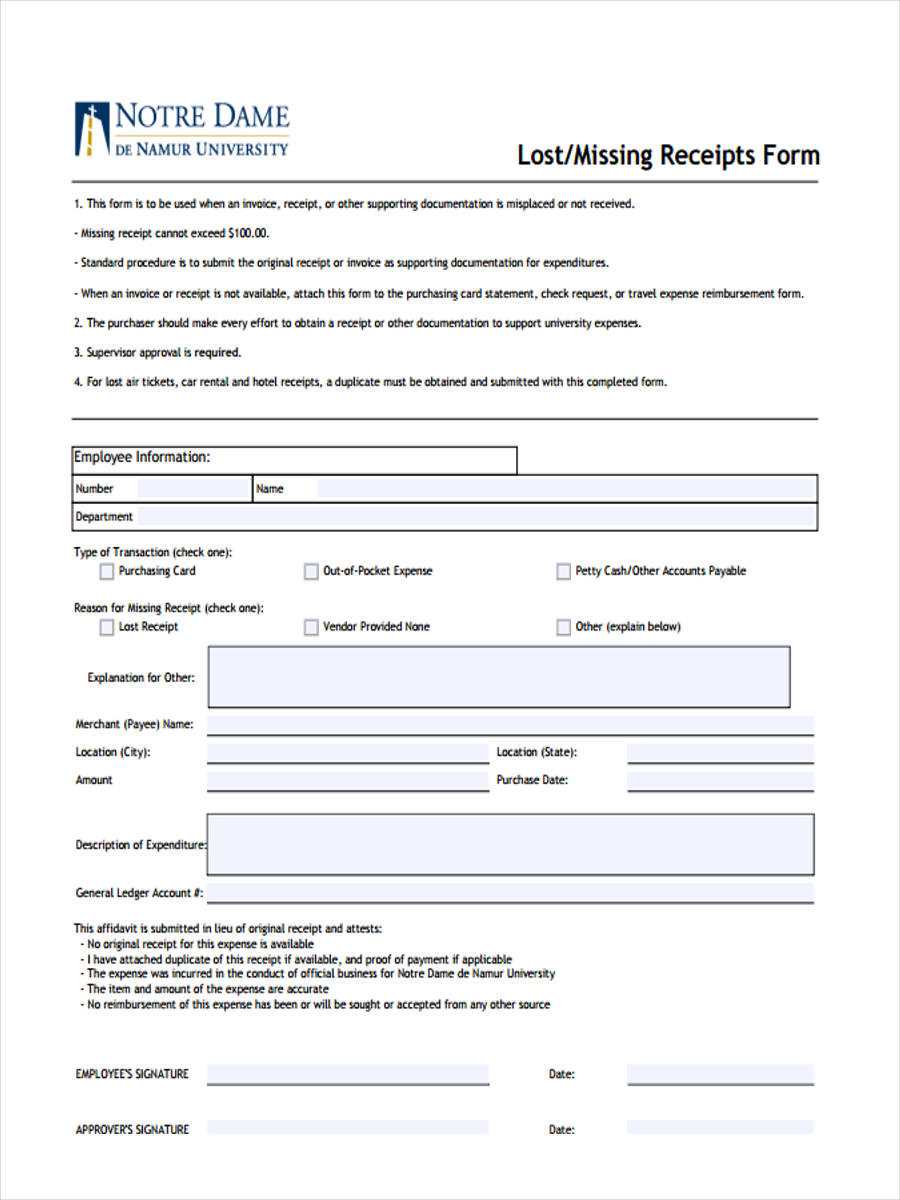

- General Lost Receipt Form

If you’ve lost a receipt, fill out the General Lost Receipt Form to request a replacement or submit details for record-keeping. The form should include the following key elements:

- Full name – Provide your legal name as registered with the vendor.

- Purchase details – Include the date, time, and location of the transaction, if known.

- Payment method – Specify whether the purchase was made via credit card, debit card, cash, or other means.

- Item description – List the items or services purchased, including quantities and price per unit.

- Reason for lost receipt – Briefly explain why the receipt is unavailable.

- Vendor’s information – Name and contact details of the store or service provider, if applicable.

Once completed, submit the form directly to the vendor or service provider’s customer service department. Some may require additional documentation, such as bank statements or order confirmation emails, to verify the transaction.

Keep a copy of the submitted form for your records. If further information is needed, the company will typically reach out within a few business days.

If you’ve lost a receipt that you need for tax purposes, create a lost receipt document to replace it. This document should include key details about the transaction, such as the vendor’s name, the date of purchase, the amount spent, and the items or services acquired. Be as specific as possible to ensure the tax authority has all the information needed to verify the expense.

Start by including the date of the transaction. If you’re unsure about the exact day, try to estimate based on your records or memory. Next, provide the business name, address, and contact information to verify where the purchase occurred. If you have a copy of the bank statement or credit card transaction, reference it to confirm the amount spent.

List the items or services purchased and, if applicable, their costs. If the receipt was for a business-related expense, include a brief explanation of the purpose, such as office supplies or business travel. This context helps make the document more credible.

Finally, sign and date the document, confirming that the details provided are accurate. It may also be helpful to include a statement that you made every effort to retrieve the original receipt but were unable to do so. Keep the document along with any supporting evidence, like bank statements or email confirmations, in case the tax authority asks for further verification.

First, state clearly that the receipt is lost. Provide details of the purchase, such as the date, amount, and location where the transaction took place. Include any reference number or invoice if available to help identify the transaction.

Provide Transaction Details

Include the name of the store or service provider, the items or services purchased, and the total amount paid. Mention the payment method used, such as credit card or cash. If the transaction was online, include the order number or email confirmation.

Describe Efforts Made to Locate the Receipt

Explain any steps taken to find the receipt. This might include checking email confirmations, searching physical locations, or contacting the retailer. If applicable, mention if you have reached out to customer service for assistance.

Close by requesting an alternative proof of purchase if necessary, such as a transaction history or receipt reprint. Express your appreciation for their assistance in resolving the matter.

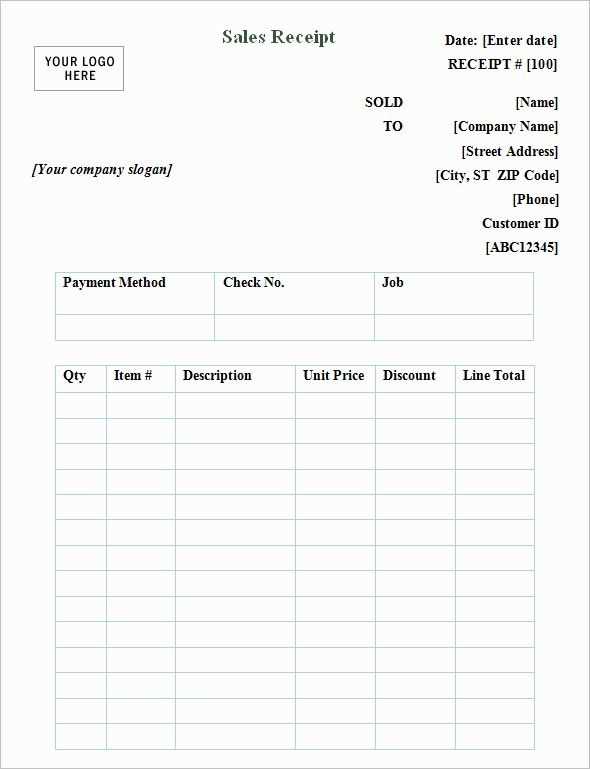

One of the most frequent errors is failing to include the correct date of the transaction. The date ensures that the receipt aligns with the transaction record, preventing confusion or disputes. Always double-check that the date is accurate.

Another common mistake is not listing the exact items or services purchased. Without clear descriptions, it can be difficult to verify what was bought. Make sure the template has a detailed breakdown of each item, including quantities and prices.

Leaving out the buyer’s and seller’s contact details is a mistake that can complicate future communication. Both parties should have their names, addresses, and phone numbers included. This prevents any issues if the receipt needs to be referenced later.

Be cautious about misplacing or omitting the payment method. Whether it’s cash, credit, or another form, specifying the payment method is important for accurate record-keeping and for resolving any payment-related questions.

Avoid vague language in the description of the transaction. Use specific terms, especially when referring to products or services, to avoid misunderstandings. For example, instead of writing “item”, write “blue leather wallet” or a similar detailed description.

Not including a total amount paid is another mistake. The total should be clearly stated, along with any applicable taxes or discounts. This is key for both parties to verify the accuracy of the payment.

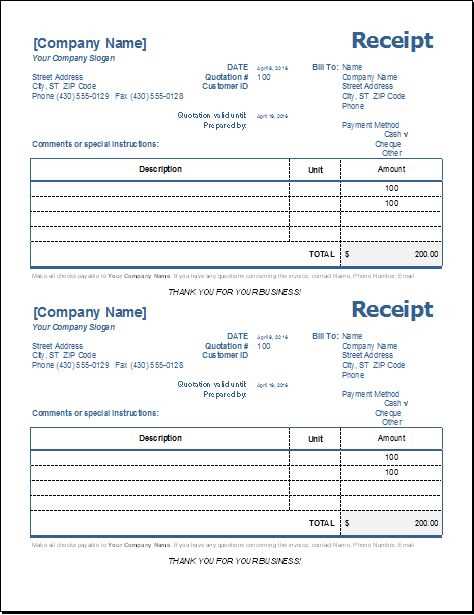

Using the Wrong Template Format

Make sure the receipt template you use is appropriate for the transaction type. Different types of sales (e.g., services vs. goods) might require different formats. Using a template that doesn’t fit the situation can cause confusion and might not meet legal requirements.

Overlooking Additional Required Information

Sometimes, people forget to add specific legal or regulatory information, such as VAT numbers, business registration details, or refund policies. These can be crucial, depending on the jurisdiction and nature of the transaction.

Lost Receipt Template

To create a template for a lost receipt, start by including the basic details needed for the transaction. This ensures clarity and proper documentation. Include the following sections:

Transaction Details

List the date of purchase, the name of the store or vendor, and the items or services purchased. Be as specific as possible, including quantities, prices, and any relevant identifiers such as transaction numbers or reference codes. If available, include any details that could verify the transaction, such as payment method or the last four digits of a credit card used.

Additional Information

If you have any supporting documents or communications related to the purchase, such as email receipts or bank statements, include these in your template. This can help confirm the validity of the transaction and make it easier for the company to locate the purchase record.