Ensure your Gift Aid receipts meet the necessary requirements by including key details like the donor’s full name, donation amount, and a statement confirming that Gift Aid applies. This helps streamline the process for both the donor and your charity.

First, include a clear declaration that the donor is a taxpayer and confirms the Gift Aid status. This typically reads as: “I confirm I am a UK taxpayer and wish to apply Gift Aid to my donations.” Adding this helps avoid any confusion and ensures compliance.

Next, make sure to state the date of the donation and the amount donated. This not only provides clarity but also allows the donor to keep track of their contributions for tax purposes. Don’t forget to mention that the donor’s details will be processed according to data protection laws.

Lastly, include the name and charity registration number of your organization. This provides transparency and assures the donor that the funds are being directed to a recognized charity. With these elements in place, the template will be ready to serve both the donor and your organization effectively.

Here’s a refined version of your text with reduced repetition while preserving the meaning and structure:

To create a simple and clear gift aid receipt, ensure it includes the donor’s details, the amount donated, and the declaration of Gift Aid. Follow these guidelines:

Key Elements of the Receipt

- Donor’s full name and address

- Amount donated (either a total or individual donations)

- Confirmation that Gift Aid applies to the donation

- Statement that the donor is a taxpayer

- Date of the donation

- Your charity’s details (name, charity number, contact information)

Additional Recommendations

- Ensure clarity in the wording of the Gift Aid declaration.

- Indicate whether the donation was one-off or regular.

- Make sure the donor understands their obligation to notify you of any changes to their tax status.

- For regular donations, specify the frequency of the contributions.

By incorporating these details, you will ensure compliance with Gift Aid regulations while providing the donor with a transparent and informative receipt.

Here’s a detailed HTML plan for the informational article on “Gift Aid Receipt Template,” focusing on practical aspects and specific tasks related to the topic:

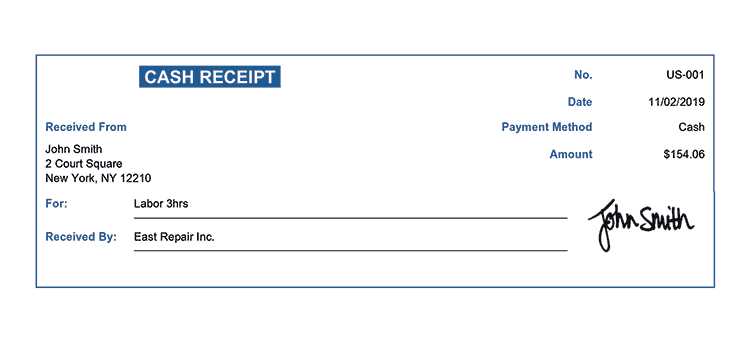

Start by providing a clean, easy-to-read template with all necessary fields for a Gift Aid receipt. Ensure the layout includes donor details such as name, address, and donation amount. The date of the donation should be clearly visible, along with a brief statement confirming that the donation qualifies for Gift Aid.

Key Elements to Include

The receipt should specify the total value of the donation and explicitly mention that the charity will claim Gift Aid. Clearly state that no goods or services were received in exchange for the donation. Make sure to include the charity’s name, registration number, and contact details.

Step-by-Step Instructions

Offer a simple guide on how to fill out the receipt. For example, begin by entering the donor’s name and contact information, then move on to the donation details. Finish with a clear statement confirming the Gift Aid eligibility. This ensures the template is easy for both the charity staff and donors to understand.

End with a reminder to keep a copy of the receipt for records, especially when preparing tax filings. The receipt should be dated and signed by an authorized charity representative.

- How to Structure a Gift Aid Receipt

Begin with the name of your charity or organization, clearly displayed at the top of the receipt. Include the charity’s registration number and address to verify its authenticity.

Include Donor Information

Provide the donor’s name and address. This helps to identify the individual and ensures proper acknowledgment for tax purposes.

Donation Details

Clearly specify the amount donated, the date of the donation, and whether the donation is a one-time payment or recurring. If relevant, mention if the donation was made through a specific method (e.g., online, cheque, or cash).

Don’t forget to include the statement: “I confirm that I am a taxpayer and I want the charity to reclaim Gift Aid on all donations I make now and in the future.” This confirms the donor’s agreement to the Gift Aid scheme.

Finally, add a thank-you note for the donor’s contribution. Make the wording personal and appreciative without being overly formal.

Ensure that your gift aid receipt includes the donor’s full name and address. This is required for both the donor’s and your organization’s records. You must confirm that the donation is voluntary, with no conditions attached, and that the donor has paid at least as much tax as the amount of gift aid you’ll reclaim. Clearly state that the donation qualifies for gift aid, and include the date of the donation.

The receipt must specify whether the donor’s gift was a one-time donation or part of a regular payment plan. If it’s part of a larger fundraising initiative, this should be outlined. Make sure that the receipt indicates whether any goods or services were provided in exchange for the donation. If so, you must provide an accurate estimate of the value of those goods or services, as this could impact the gift aid claim.

It’s also essential to keep accurate records of all gift aid claims, including details about the donations and the individuals who made them, for a minimum of six years. This ensures compliance in case of an audit by HMRC or other tax authorities.

Ensure the donor’s full name is included on the gift aid receipt. This helps to accurately match donations to the correct individual in your records. Include the donor’s address for verification and to comply with regulations for tax purposes. It’s also recommended to provide the donor’s postcode for easier identification.

Donation Amount and Date

List the exact amount donated. If the donation is a regular contribution, specify the frequency of payments, such as monthly or annually. Additionally, include the date the donation was made to track donations for tax reporting periods.

Charity’s Information

Include the full name of your charity, along with its registration number. This assures the donor that the gift aid claim is legitimate. It’s also helpful to note your charity’s contact details for transparency.

Ensure you collect accurate tax information from your donors. This is necessary for generating a valid Gift Aid receipt. Follow these steps to include the donor’s tax details correctly:

- Ask for the donor’s full name and address. These are required to verify their tax status and to ensure compliance with the Gift Aid scheme.

- Request the donor’s tax reference number if applicable. This helps confirm they pay enough tax to cover the donation.

- Indicate the donor’s confirmation of their tax status. A simple statement such as “I am a taxpayer and pay enough tax to cover my Gift Aid donations” is sufficient.

What to Include in the Tax Section

- Donor’s name and address.

- Confirmation of tax payment for the tax year.

- Tax reference number, if relevant.

- Date of donation.

Make sure the tax details are clear and easy to understand, as they’re essential for processing the Gift Aid claim accurately. This ensures the donor can benefit from Gift Aid on their donation and that your organization remains compliant with tax regulations.

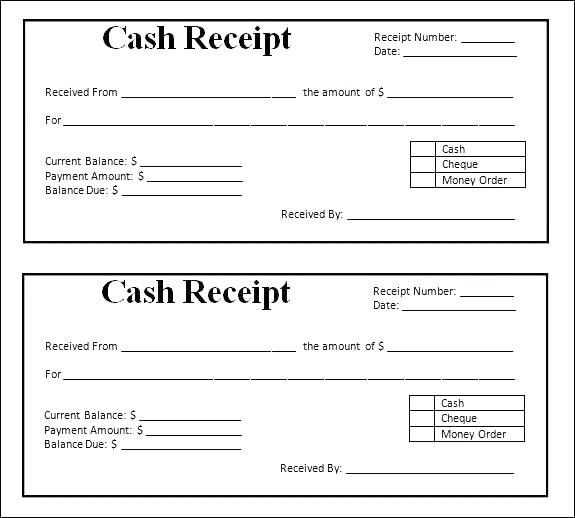

Ensure legibility by choosing a simple, readable font like Arial or Helvetica. Stick to a font size that is neither too small nor too large, usually between 10 and 12 points.

Use bold for headings and important information such as the donation amount and donor name. This makes it easy to scan and find key details quickly.

Organize information in a clear, logical order. Place the donor’s details at the top, followed by the donation amount, date, and any other necessary information such as the organization’s details and tax ID.

Incorporate sufficient spacing between sections. Avoid cramming information into a small area to ensure readability and prevent confusion.

Use bullet points or numbered lists to separate different sections. This helps donors quickly locate their donation details without hassle.

Include a clear title or label for the receipt, such as “Donation Receipt” or “Gift Aid Receipt.” This helps avoid any misunderstandings, especially if the document is shared or stored.

For clarity, align amounts and dates to the right or in a tabular format to make them easy to read at a glance.

Always double-check donor information. Mistakes like misspelled names or incorrect addresses can lead to confusion and affect the validity of your Gift Aid claim. Ensure that all details match official records, as discrepancies can delay or nullify the claim.

Incorrect Donation Amounts

Be specific with donation amounts. If you list a general value (e.g., “generous donation”), the claim could be rejected. Record the exact sum donated, as this is necessary for compliance with tax regulations.

Failing to Sign or Date the Form

Neglecting to sign or date the Gift Aid form is a frequent error. A signed and dated form is a legal requirement for the donation to be eligible for Gift Aid. Make sure both sections are completed before submission.

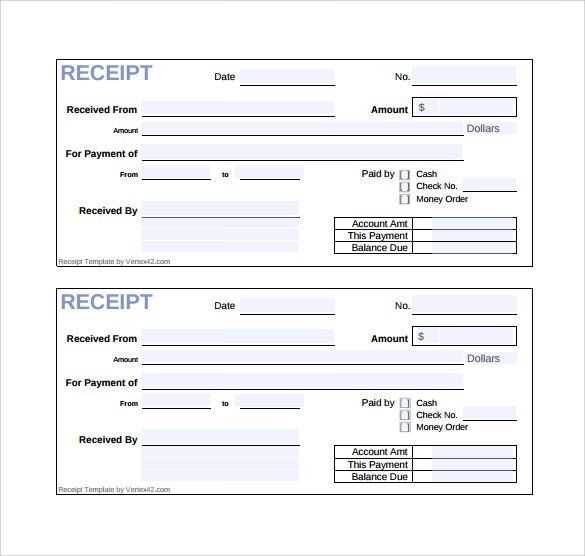

Ensure your Gift Aid receipt includes the following details to meet legal requirements:

| Item | Description |

|---|---|

| Donor’s Name | Full name of the donor who made the donation. |

| Donation Amount | Exact amount donated, whether cash or value of the gift. |

| Gift Aid Declaration | Statement confirming the donor agrees to Gift Aid being claimed on their donation. |

| Charity Name | The legal name of your charity. |

| Charity Registration Number | The charity’s registration number with the relevant authority. |

| Donation Date | The date when the donation was made. |

Always verify that the receipt reflects all necessary details for both clarity and legal compliance.