Key Elements of a Gift in Kind Tax Receipt

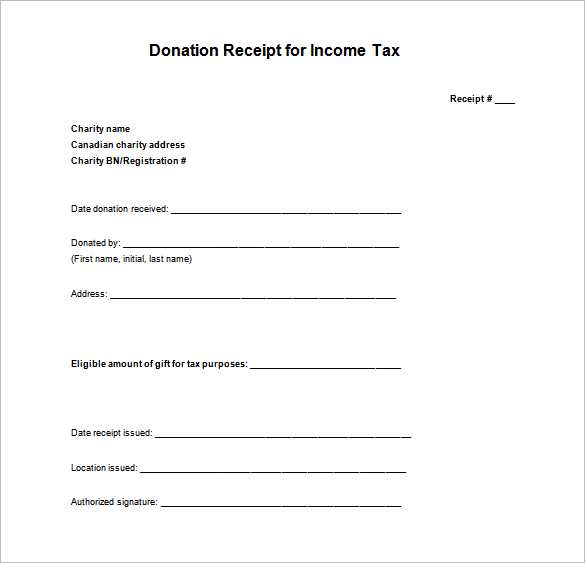

A Gift in Kind (GIK) tax receipt should include specific details to ensure it meets tax requirements and provides accurate records for both the donor and the organization. These elements are important for transparency and compliance.

- Donor Information: Name, address, and contact details of the donor.

- Organization Details: The name, address, and charitable registration number of the receiving organization.

- Description of the Gift: A clear and concise description of the donated item(s), including quantity, condition, and any relevant specifications.

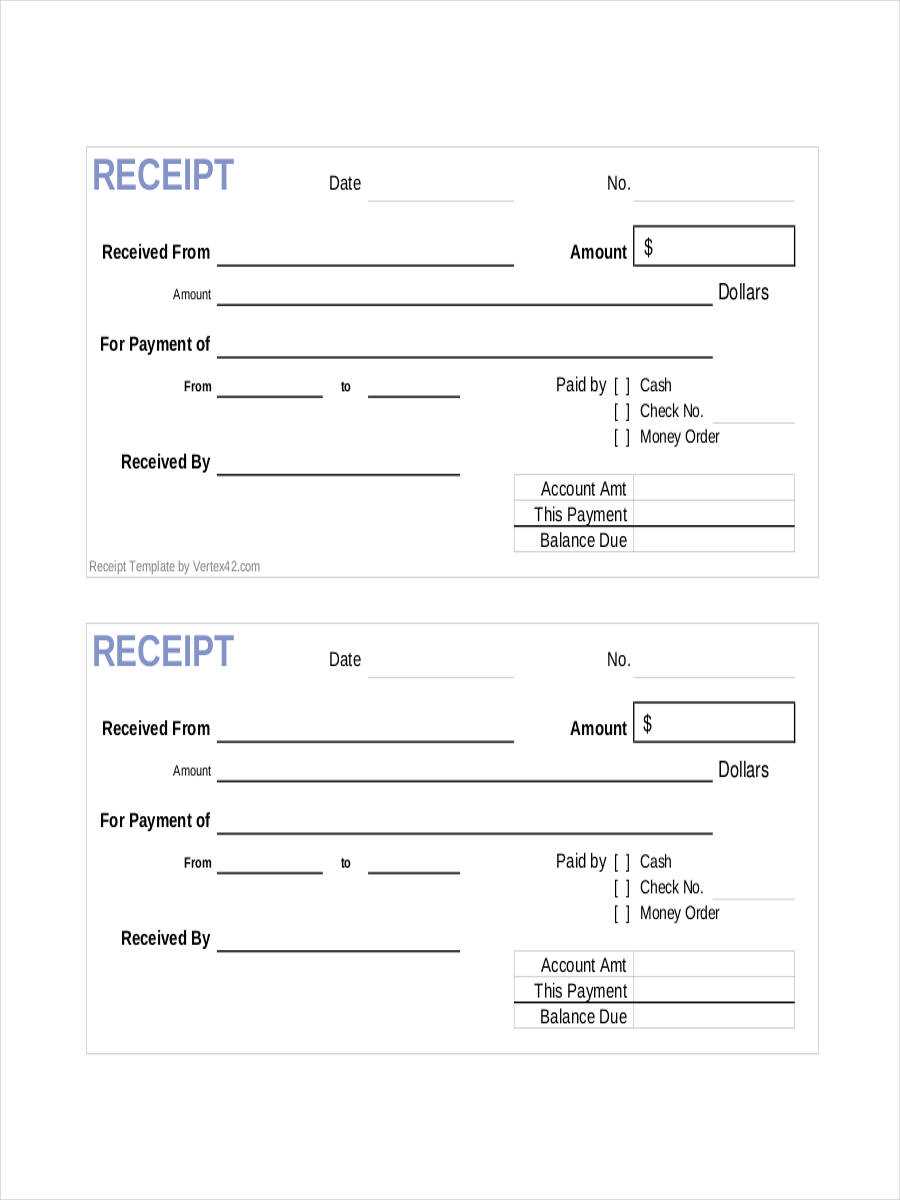

- Fair Market Value: The fair market value (FMV) of the item(s) at the time of donation. If it’s difficult to assess the FMV, include any relevant appraisal details or instructions for determining value.

- Date of Donation: The exact date when the gift was received by the organization.

- Signature: Authorized representative of the receiving organization, along with the date of signing.

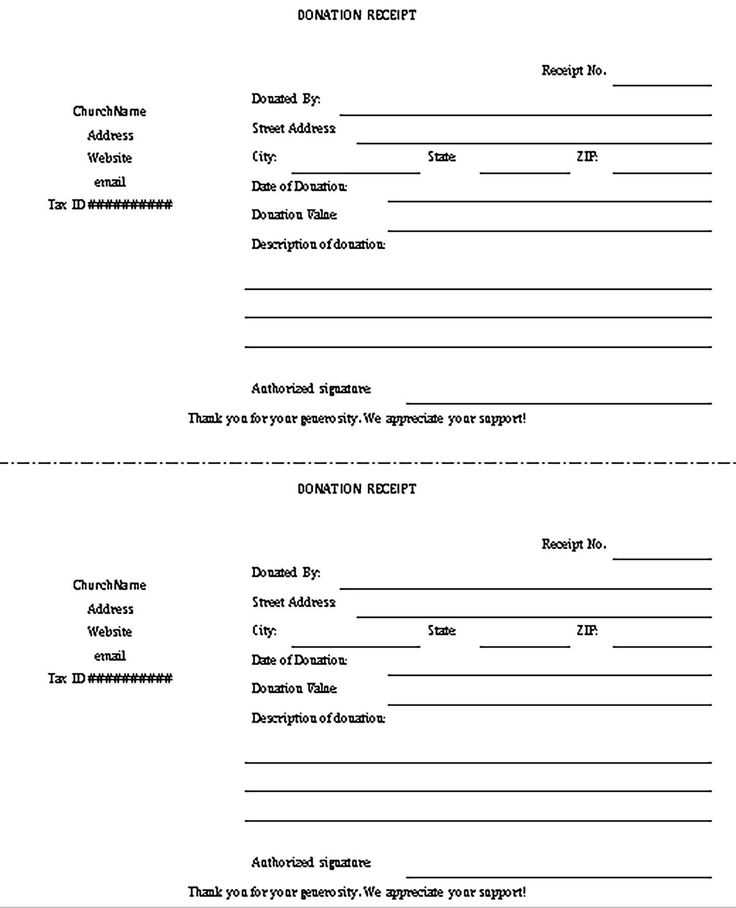

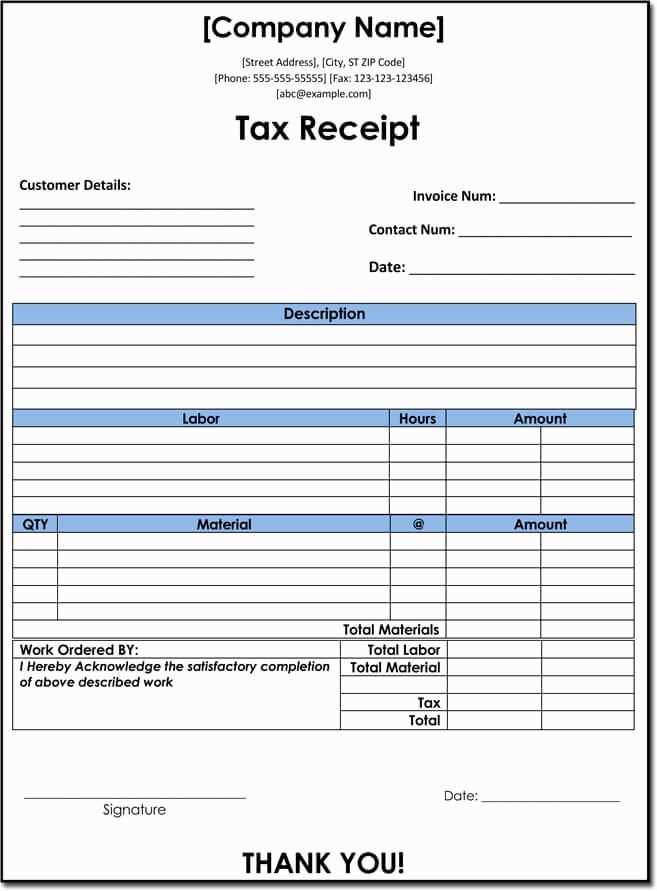

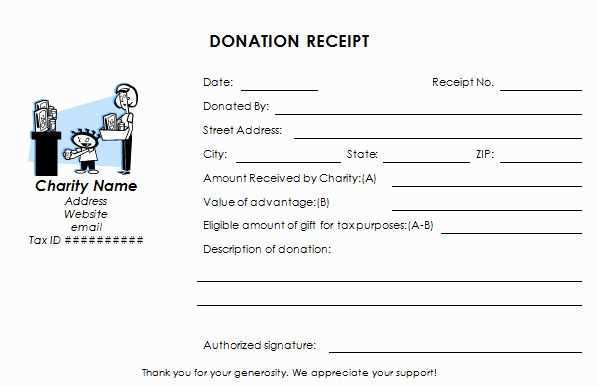

Example of a Gift in Kind Tax Receipt Template

Here’s a simple template for a Gift in Kind tax receipt:

----------------------------------------- Gift in Kind Tax Receipt ----------------------------------------- Donor Information: Name: [Donor’s Full Name] Address: [Donor’s Address] Contact: [Donor’s Phone Number/Email] Organization Information: Name: [Organization’s Name] Address: [Organization’s Address] Charitable Registration Number: [Organization’s Charitable Registration Number] Description of Gift: Item(s): [Detailed Description of the Gift] Condition: [Condition of the Gift (New, Used, etc.)] Quantity: [Number of Items] Fair Market Value: [FMV of the Gift] Date of Donation: [Donation Date] Authorized Signature: Signature of Representative: ____________________________ Date: ____________________________ -----------------------------------------

Providing an Accurate Fair Market Value

Determining the Fair Market Value (FMV) of a donated item is necessary for both the donor’s tax records and the receiving organization’s filings. This value should reflect the price the item would sell for in an open market. If unsure, it’s best to consult a professional appraiser or refer to reputable resources that list the current value of similar items.

Important Considerations

- Documentation: Always keep detailed records of any appraisals or evaluations used to determine the FMV.

- Donor’s Responsibility: While the organization can issue the receipt, the donor must ensure the value is accurately reported on their tax return.

- Goods vs. Services: Only tangible items can be included in a GIK receipt. Services, time, or labor are not eligible for tax receipts.

By adhering to these guidelines, both organizations and donors can ensure the Gift in Kind tax receipt is valid and meets legal requirements for charitable donations.

Got it! How can I assist you today?

If you’re looking for a gift-in-kind tax receipt template, I recommend starting with a clear structure. Include details like the donor’s name, description of the gift, its fair market value, and the date of donation. Be sure to state that no goods or services were provided in return for the donation to maintain compliance with tax laws.

Key Elements of a Gift-in-Kind Tax Receipt

Ensure the receipt contains the donor’s full name and address, a description of the donated item(s), the donation date, and a statement confirming no exchange took place. If applicable, include the charity’s name, registration number, and the amount (if valuation is needed).

Helpful Tips for Accurate Reporting

Make sure to double-check the valuation of the gift. For non-cash items, it’s essential that both the donor and the organization agree on the item’s fair market value. This helps prevent any discrepancies during tax filing.