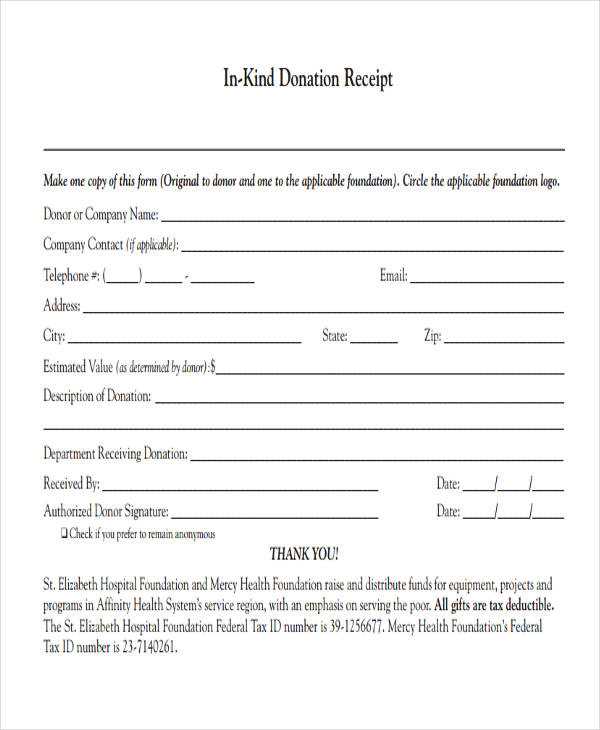

A valid gift in-kind tax receipt must include the donor’s name, a clear description of the donated item, the fair market value, and the date of donation. If the item is valued at more than $5,000, an independent appraisal may be required. Charities should also include their name, registration number, and a statement confirming that the gift was received.

When determining the fair market value, use recent sales data or a professional appraisal. For common items like electronics or furniture, reference prices from reputable retailers. If the donor provides an appraisal, keep a copy for records.

The receipt should specify whether the donor received any benefits in return. If so, deduct the value of those benefits from the donation amount. For example, if a donor gives a painting worth $2,000 and receives a gala ticket worth $200, the tax-deductible portion is $1,800.

Keep digital and physical copies of all receipts for compliance. Many tax authorities require charities to issue receipts within the same fiscal year. A well-structured template ensures consistency and prevents errors, helping both donors and organizations with tax reporting.

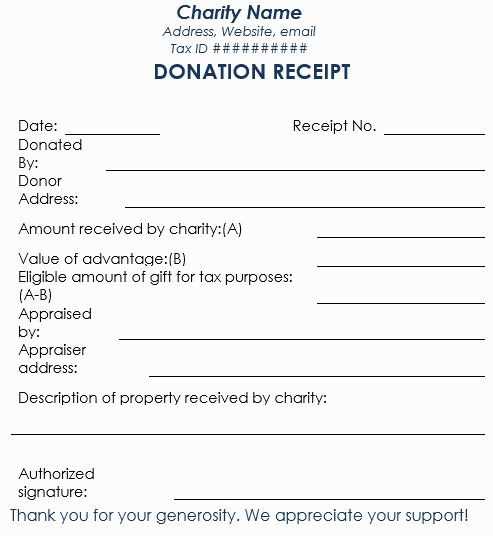

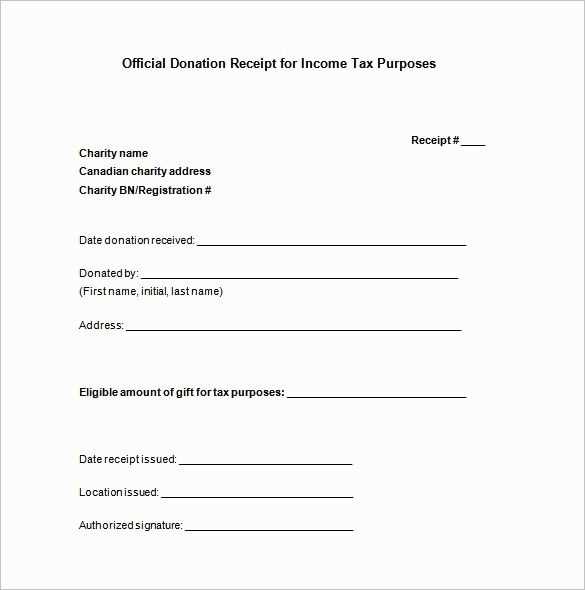

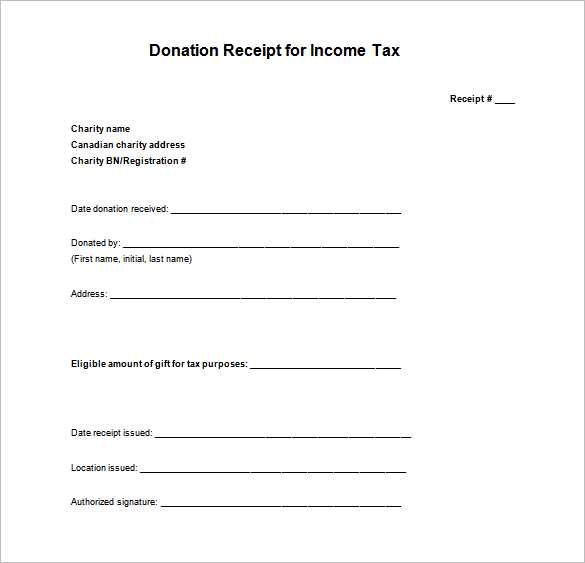

Gift In-Kind Tax Receipt Template

A proper gift in-kind tax receipt includes key details to meet tax requirements and provide transparency for donors. Use the following structure to ensure accuracy.

Required Information

- Donor’s Name and Address: Identify the individual or organization making the donation.

- Recipient Organization: Include the full legal name, address, and charitable registration number if applicable.

- Description of the Gift: Provide a clear, specific description of the donated item(s), but avoid assigning a value unless professionally appraised.

- Date of Donation: Indicate when the gift was received.

- Acknowledgment Statement: Confirm whether goods or services were provided in return.

- Authorized Signature: Ensure the receipt is signed by an official representative of the organization.

Sample Template

Use this format as a guide:

[Organization Name] [Organization Address] [City, State, ZIP Code] [Phone Number] [Email Address] [Charity Registration Number (if applicable)] Date: [MM/DD/YYYY] Donor: [Donor’s Name] Donor Address: [Street, City, State, ZIP] Description of Gift: [Detailed description] Estimated Value: [If applicable, appraised value] Received By: [Authorized Representative’s Name] No goods or services were provided in exchange for this donation. [Authorized Signature] [Title]

Ensure all receipts comply with local tax regulations before issuing them to donors.

Required Information for a Valid Gift In-Kind Tax Receipt

A valid gift in-kind tax receipt must include specific details to meet legal requirements and ensure transparency. Missing or incorrect information can make the receipt invalid, so double-check all entries before issuing it.

- Donor’s Full Name and Address: Include the legal name and mailing address of the donor.

- Charity’s Legal Name and Registration Number: Use the exact name registered with the tax authority and provide the official registration number.

- Date of the Gift: Record the exact date the item was donated.

- Detailed Description of the Donated Item: Be specific about what was donated, including brand, model, serial number (if applicable), and condition.

- Fair Market Value: Provide a reasonable estimate of the item’s value at the time of donation. If an independent appraisal is required, note the appraiser’s details.

- Statement Confirming No Advantage Was Received: Include a declaration that the donor did not receive anything in return for the gift.

- Receipt Number: Assign a unique number for tracking and record-keeping.

- Authorized Signature: Ensure the receipt is signed by a representative of the charity.

Keep a copy of each receipt for records. If the value is high or appraisal is needed, attach supporting documents. Clear and accurate receipts help both the donor and the charity avoid tax issues.

How to Determine Fair Market Value for Non-Cash Donations

Use the price that similar items sell for in the current market. Check online marketplaces, auction sites, and classified ads to find recent sales of comparable items. For antiques, collectibles, or unique assets, consult an appraiser.

Common Valuation Methods

Retail Price Comparison: Find identical or similar items in secondhand stores, thrift shops, or online resale platforms.

Appraisals: If an item is rare, high-value, or difficult to price, a professional appraisal may be required, especially for donations over $5,000.

Depreciation: For used electronics, furniture, or equipment, apply standard depreciation formulas or check resale values on trade-in websites.

Special Cases

Vehicles: Use guides like Kelley Blue Book or Edmunds to estimate value based on make, model, year, condition, and mileage.

Real Estate: A formal appraisal or recent comparable sales in the area determine market value.

Stocks and Bonds: Use the average market price on the donation date.

Always keep records, including photos, descriptions, and valuation sources, to support the fair market value in case of an audit.

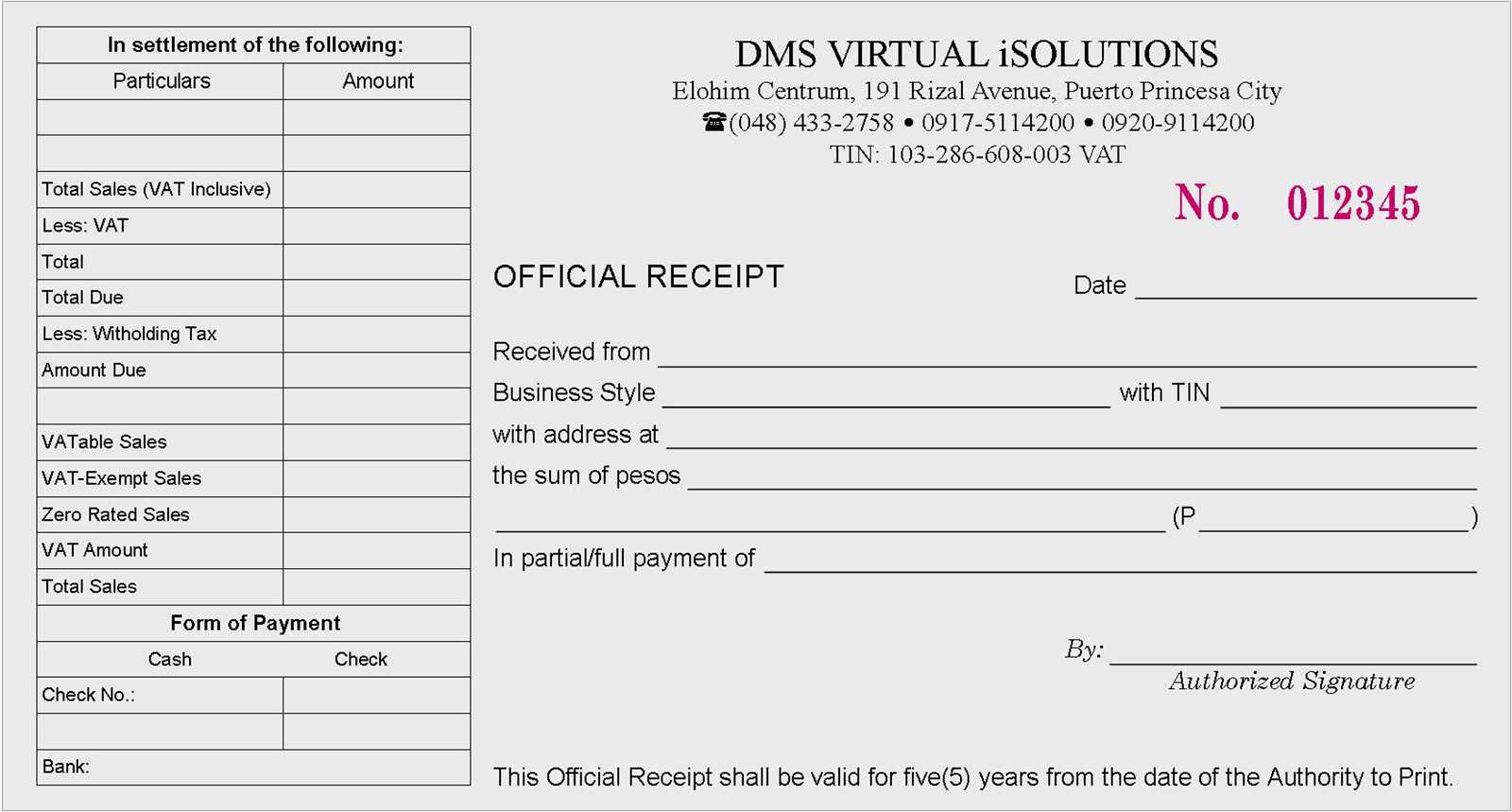

Formatting and Compliance Guidelines for Tax Authorities

Ensure that the tax receipt follows the specific format required by the relevant tax authority. Include the organization’s legal name, registration number, and full address at the top. Clearly label the document as a “Gift In-Kind Tax Receipt” to avoid confusion.

Required Details

List the donor’s full name and address as recorded in the organization’s records. Provide a detailed description of the donated item, including its condition and any relevant specifications. Do not assign a monetary value unless a qualified appraisal is attached or the organization has a valuation process that meets legal standards.

Include the date the donation was received, not just the date the receipt was issued. If the donation involves services, discounts, or use of property, indicate that these do not qualify for a tax deduction.

Compliance Requirements

Use clear language to state that the receipt is issued for tax purposes and that no goods or services were exchanged for the donation unless a partial benefit applies. If applicable, specify the fair market value of any benefits received by the donor.

Sign the receipt with an authorized representative’s name and title. Some jurisdictions may require an actual signature rather than a digital stamp. Keep a copy of the receipt for internal records, ensuring it aligns with retention policies set by tax authorities.

Check current regulations before issuing receipts, as requirements vary by country and can change periodically.