To create a goodwill receipt, follow these simple steps for a clear and professional approach. A goodwill receipt confirms the transfer of goods or services to a charitable organization or individual. It’s important to include key details for transparency.

Key Information to Include

The receipt should contain the following elements:

- Date of donation: This helps track when the donation was made.

- Donor’s name: Ensure the dono

Goodwill Receipt Template Guide

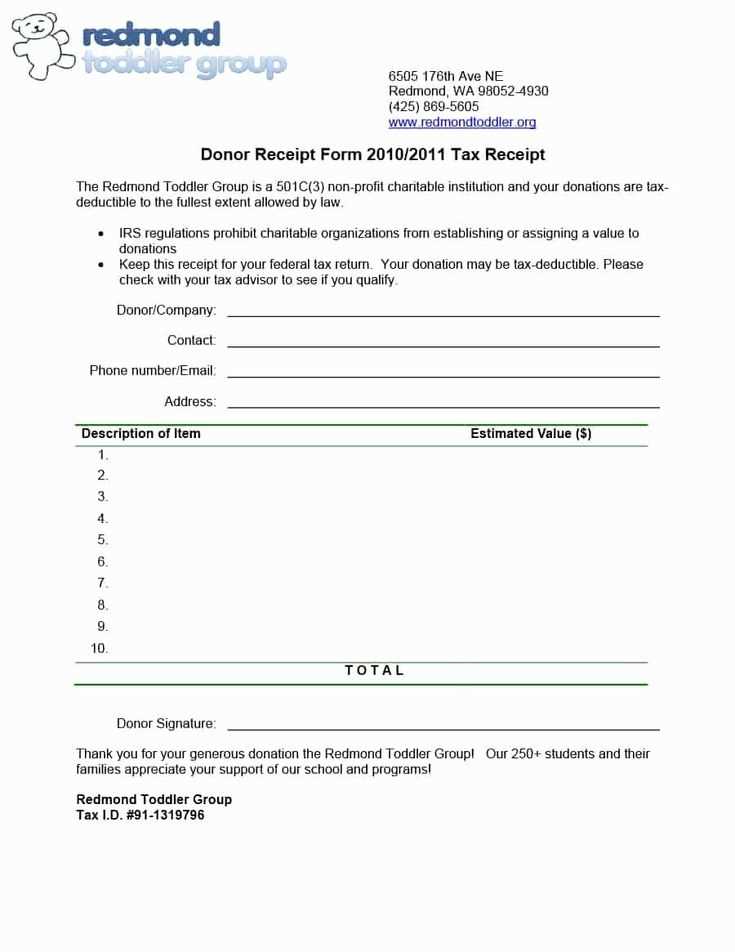

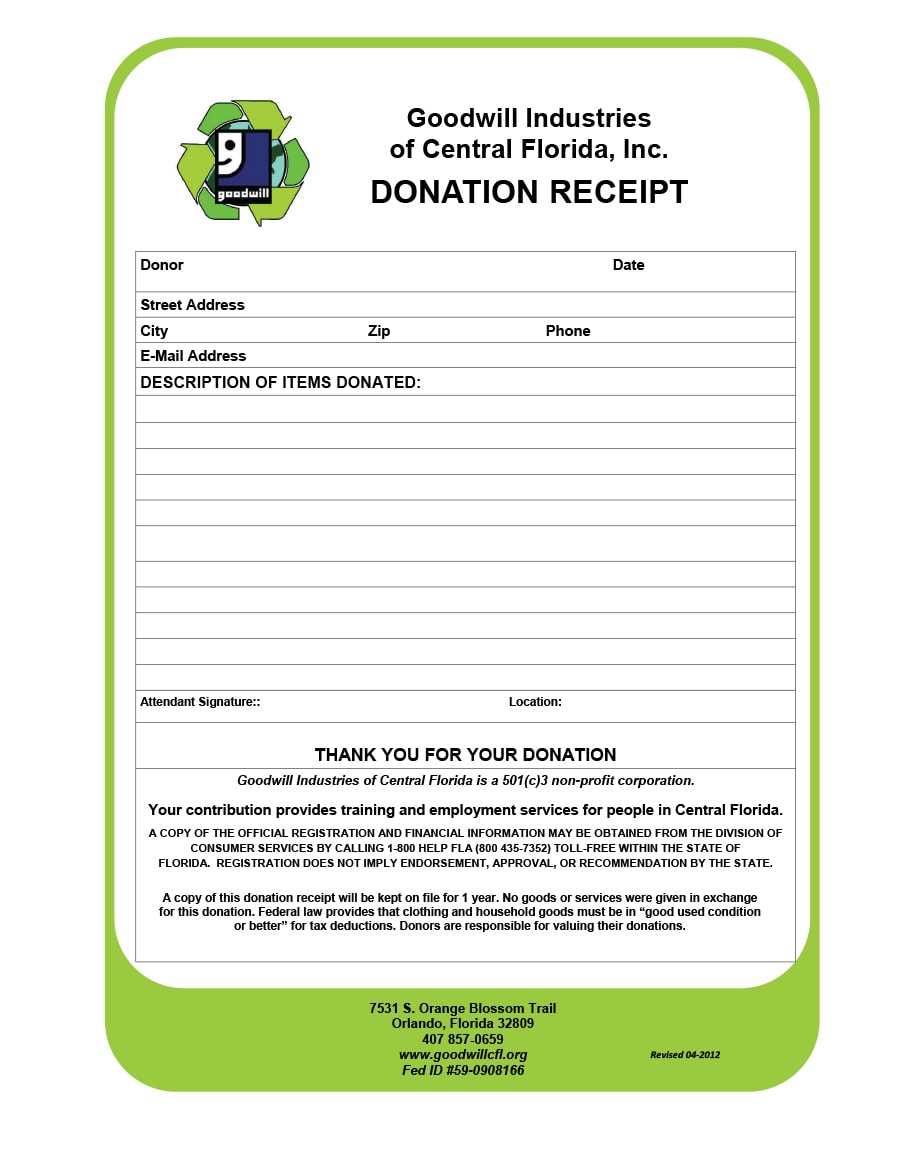

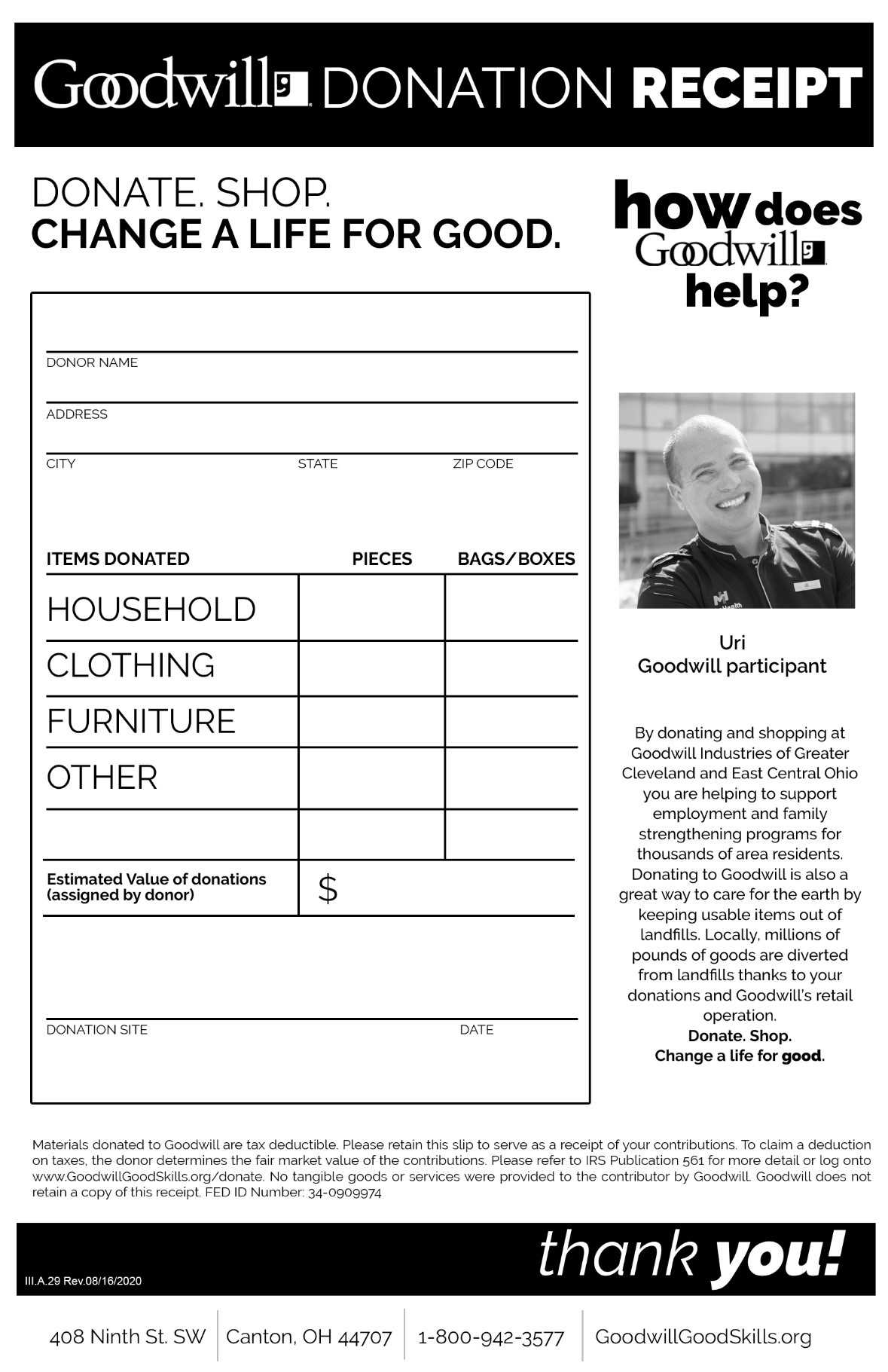

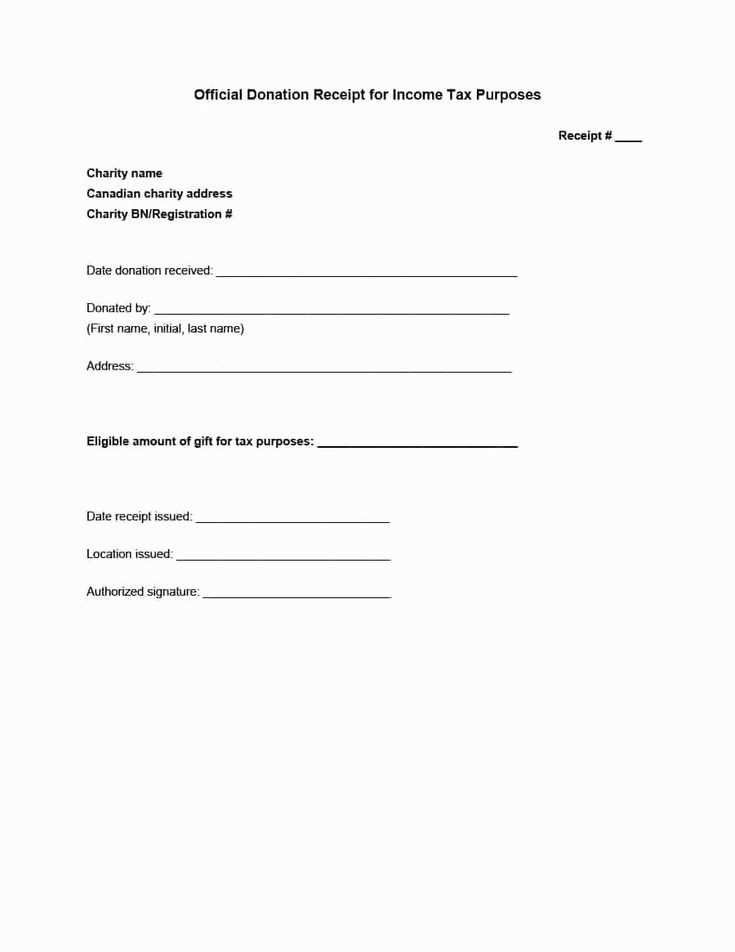

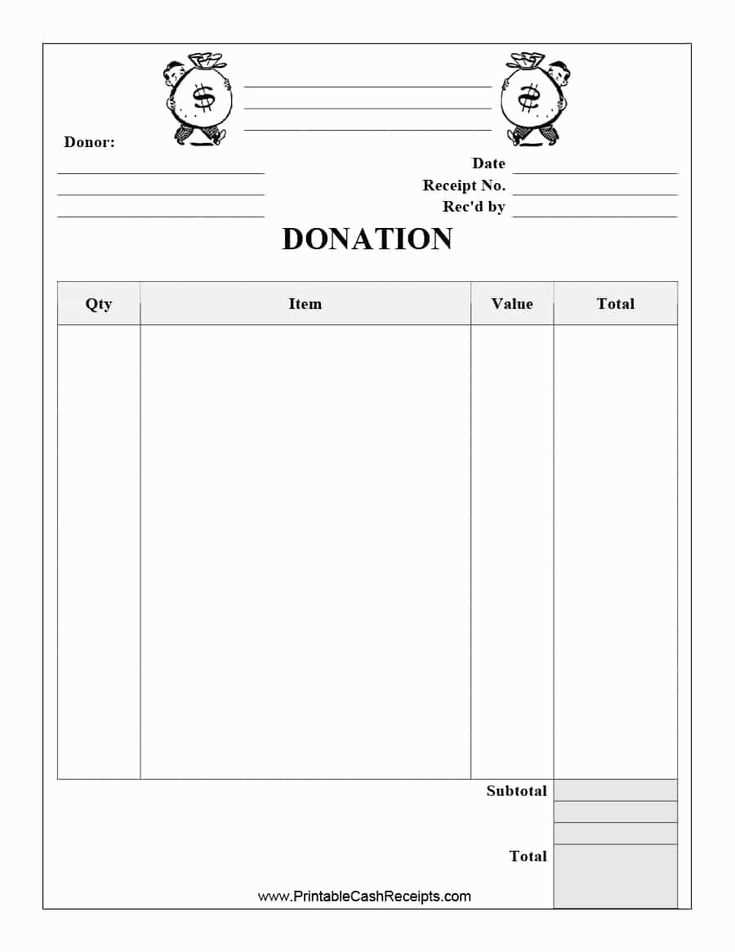

Creating a goodwill receipt template requires attention to specific details to ensure it serves its purpose effectively. A goodwill receipt is issued to acknowledge donations made to a charitable organization, providing the donor with a written record for tax deduction purposes. The template should clearly list the donor’s information, the item(s) donated, and their condition, along with a statement indicating no goods or services were received in exchange.

Key Elements to Include in a Receipt

Ensure the following elements are present in the template:

- Donor’s full name and address

- Details of the donated items, including quantity and description

- Condition of items (new, used, etc.)

- Statement about no goods or services provided in exchange for the donation

- Date of donation

- Signature of the recipient organization

- Tax identification number of the charity (if applicable)

How to Customize a Template

Customize the template by incorporating your organization’s branding and adjusting the language to match your tone. Ensure the fields are clear and easy to fill out, and make room for any additional information your charity might require. Consider using a digital format to make it easier to share receipts with donors.

Be mindful of local tax laws and regulations to ensure compliance. Having a standardized receipt template that is clear and accurate can help build trust with donors and streamline your record-keeping process.

Legal Considerations for Goodwill Receipts

Goodwill receipts must be accurate to ensure that donors can use them for tax deductions. It’s crucial to avoid over- or under-valuing the donated items, as the donor is responsible for determining the fair market value. Your organization should not appraise the items but should focus on providing a truthful acknowledgment of the donation. Be sure to include the necessary legal disclaimers, particularly around the lack of exchange for the donation.

Additionally, you may need to include an IRS-compliant statement for US-based charities, or similar declarations if operating in other countries. Double-check local regulations for further requirements.

Common Mistakes to Avoid When Issuing Receipts

Avoid the following mistakes to ensure smooth operations and donor satisfaction:

- Incorrectly valuing donated items

- Missing required information, such as the date of donation or donor’s details

- Using vague descriptions for items donated

- Failing to acknowledge the lack of goods or services in return

By paying close attention to these aspects, your receipts will meet legal standards and support your organization’s fundraising efforts effectively.