A well-structured grocery receipt template helps keep track of purchases, manage budgets, and ensures all transactions are accurately recorded. Use a template that clearly lists items, prices, and applicable taxes. This organization simplifies reviewing expenses and preparing for returns or exchanges. Focus on creating sections for the store name, purchase date, and itemized details to maintain clarity.

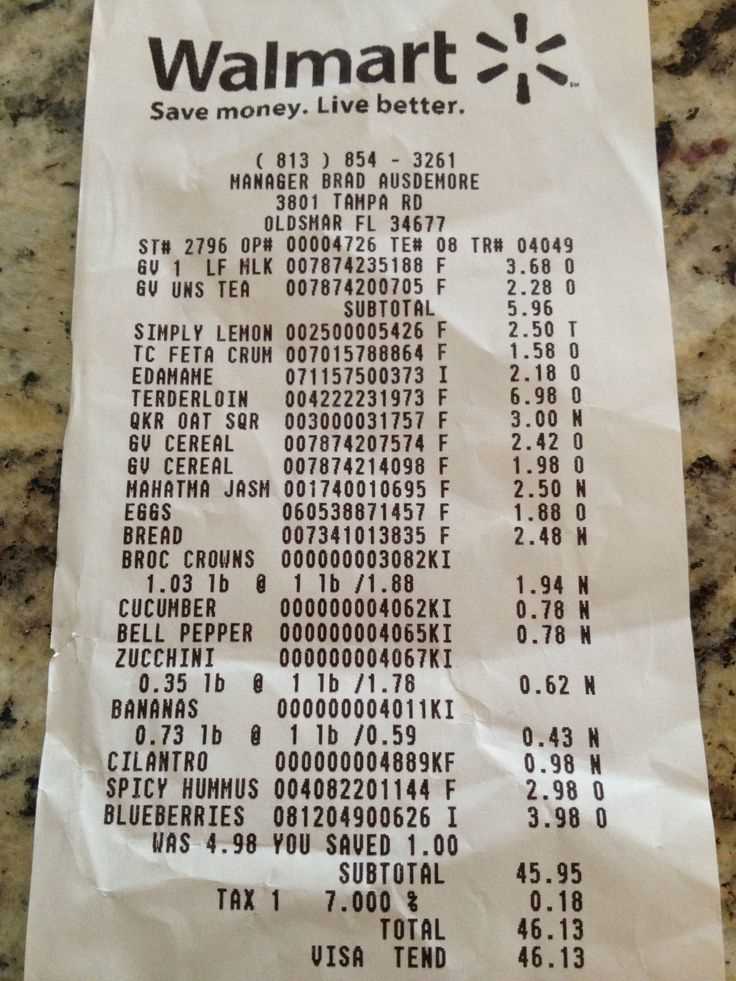

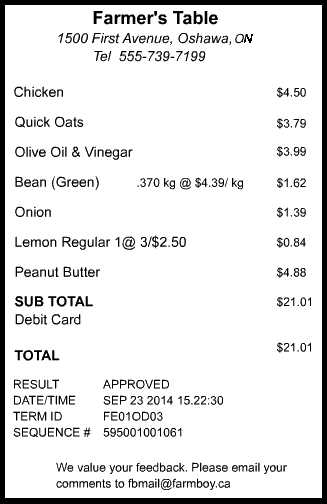

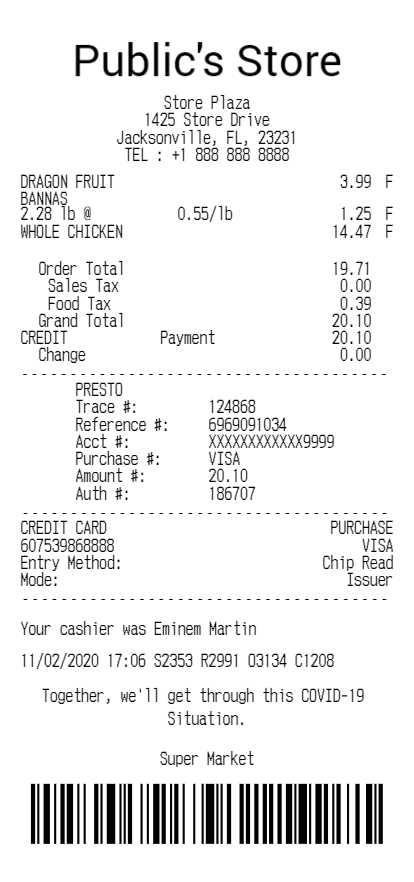

Include separate columns for item descriptions, quantities, individual prices, and total costs. Consider adding an area for payment method, ensuring that each purchase is properly attributed to a payment source. This adds another layer of convenience for financial tracking.

Make sure to account for sales tax and any discounts applied to the items. Having these figures visibly displayed makes it easier to cross-check your calculations and ensures transparency in your spending. A detailed layout reduces errors, making the receipt a reliable record for both personal and business purposes.

Here’s a version of the text with reduced repetition while preserving the meaning:

When designing a grocery receipt template, clarity is key. Use distinct sections for each category of information, such as item names, prices, and totals. This structure makes it easier for customers to understand their purchase at a glance.

Streamlining the Layout

Group related items together. For example, list produce separately from dairy and packaged goods. This reduces clutter and helps prevent confusion at checkout. Additionally, ensure that item descriptions are clear and concise, avoiding unnecessary details.

Optimizing Readability

Choose a font size that is easy to read. Avoid overly small fonts that can make it hard for customers to review their purchases. Adequate spacing between items will improve readability and help customers feel confident about their transactions.

Grocery Receipt Template: Practical Insights

Choosing the Ideal Format for Your Grocery Receipt Template

Customizing Categories for Clearer Expense Tracking

Incorporating Discounts and Coupons into Your Template

Ensuring Accurate Tax Calculation in the Template

Including Store Branding and Contact Information

Exporting and Sharing Your Template for Use

Start by selecting a template that aligns with your store’s needs and layout preferences. Use a simple, organized format that clearly displays items, quantities, and prices for easy reference. Ensure it has distinct sections for item details, taxes, and totals. Consider templates that offer both a printed and digital version, as this will give flexibility to both store operations and customer preferences.

Customizing Categories for Clearer Expense Tracking

Organize your receipt by grouping items into logical categories such as groceries, household goods, or personal care. This helps customers see their spending distribution and aids in better financial tracking. Adjust the categories based on your store’s offerings and the preferences of your customer base to provide a personalized shopping experience.

Incorporating Discounts and Coupons into Your Template

Ensure that the template includes dedicated fields for coupons, promotions, and loyalty discounts. This makes it easier for customers to track savings and provides transparency. Make sure the discount breakdown is clear, showing both the original price and the discounted amount. This ensures customers understand the savings they received.

Accurately calculating taxes is crucial for clarity. Include a tax section that displays the applicable tax rate and the amount charged. If your store operates in multiple regions with varying tax laws, create separate templates for each tax zone to ensure accuracy in all transactions.

To strengthen your brand identity, include your store’s logo, name, and contact information at the top of the receipt. This not only promotes your business but also helps customers reach out if needed. A well-branded receipt gives a professional touch and improves customer recall.

Export your template in formats like PDF or Excel, making it easy to share with colleagues or integrate into accounting systems. Additionally, offering a digital version that can be emailed directly to customers adds convenience and reduces paper waste.