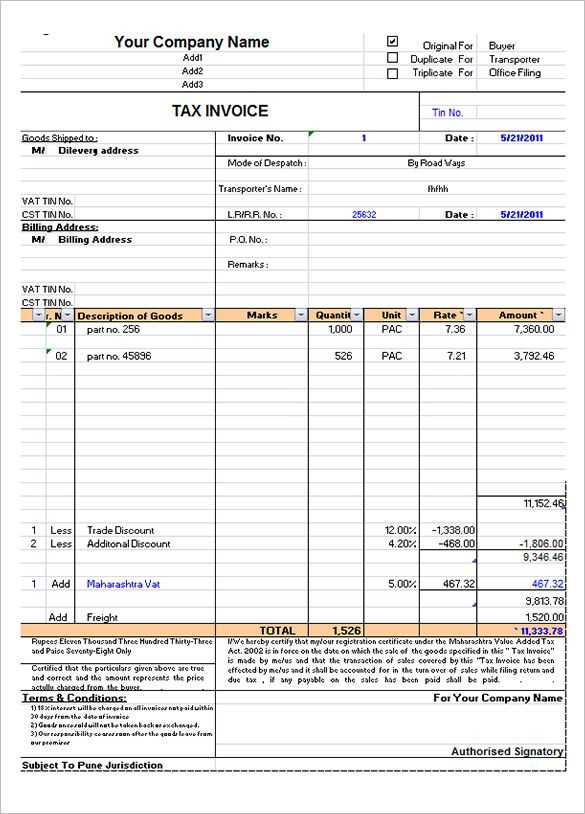

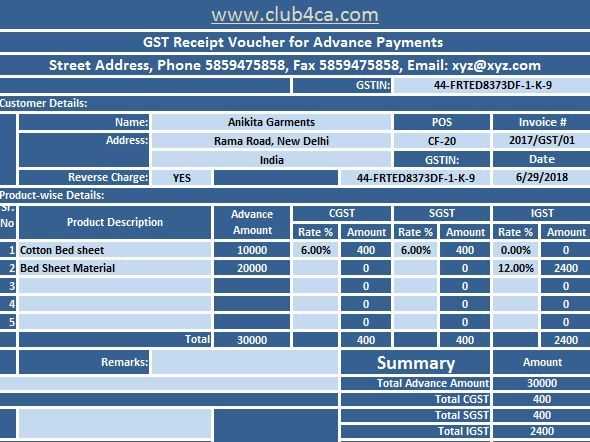

To create a GST receipt, include specific details that comply with GST laws. Start by adding the supplier’s name, address, and GSTIN (Goods and Services Tax Identification Number). This will ensure your receipt is valid for tax purposes. Be clear about the transaction, including the description of goods or services provided.

Include the GST rate and amount: It’s crucial to specify the GST rate applied to the transaction and the total GST amount. Ensure this is clearly shown, as it directly impacts tax filings and audits. Break down the amount for transparency and record-keeping.

Make sure to highlight the total payable amount: The total amount should include the GST-inclusive sum, providing a clear picture of the final price after taxes. It’s also helpful to add a line noting whether the transaction is under reverse charge or not. This minimizes confusion in case of audits or future reference.

Here’s the corrected version:

To create a GST receipt, include the following details:

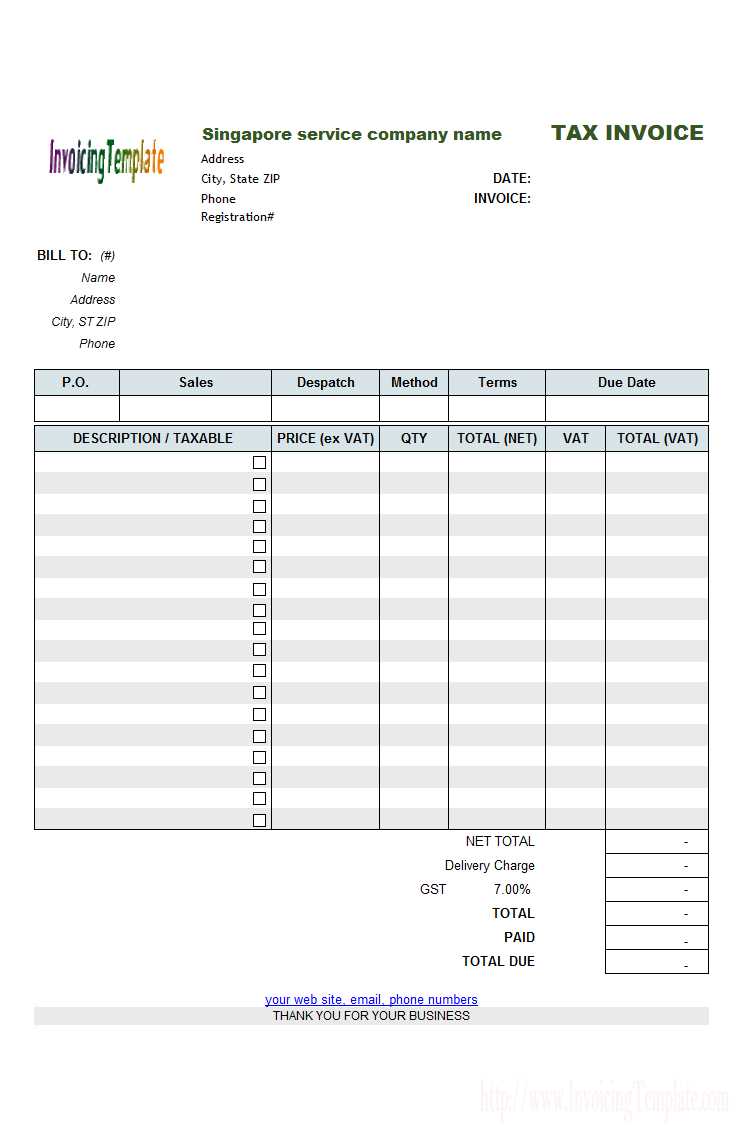

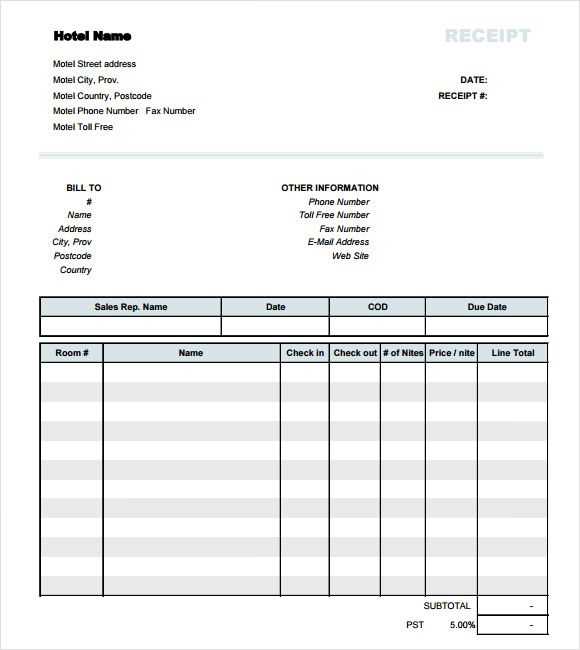

1. Your business name, address, and GST registration number. Ensure this information is prominently displayed at the top of the receipt.

2. Customer’s name and address, if applicable. This helps establish a clear transaction record.

3. Date of the transaction. This is critical for accurate record keeping and tax purposes.

4. A unique receipt number. This should be sequential and easy to reference for both you and your customer.

5. A breakdown of the goods or services provided, with individual prices and quantities.

6. The GST amount charged. Clearly show this figure to ensure compliance with tax regulations.

7. The total amount paid. This should be clearly separated from the GST amount for transparency.

Ensure all data is accurate and clearly formatted. Use a simple, easy-to-read font, and double-check that the GST amount aligns with current rates. By following these steps, you’ll create a professional and compliant GST receipt.

GST Receipt Template: Practical Guide

To create a functional GST receipt template, focus on these key elements. First, include your business name, address, and GST identification number. These details are critical for both compliance and customer clarity.

For the itemized list, provide a description of the goods or services, including quantities and individual prices. Follow this with the applicable GST rate and the amount charged for GST. This breakdown is essential for transparency and for the customer to easily see how the tax is applied to each item.

Next, include the total amount due, clearly displaying the subtotal, GST amount, and final total. This helps the customer quickly understand their payment breakdown.

To personalize the receipt template for your business, ensure the design aligns with your brand. Use your business logo, choose appropriate fonts, and maintain consistency with your other documents. This adds a professional touch and reinforces brand recognition.