Key Components of a GST Receipt

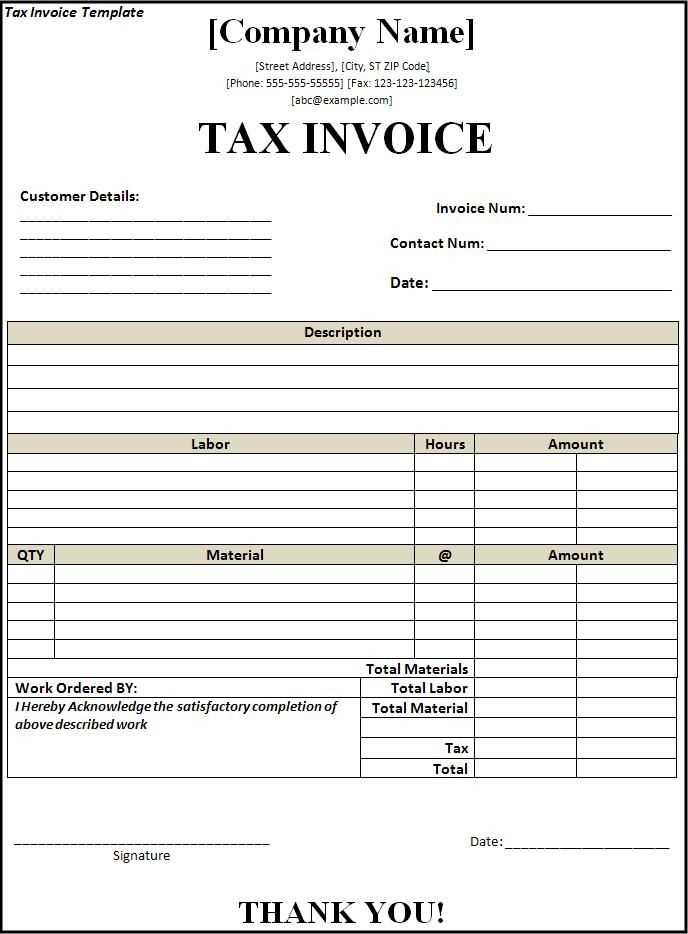

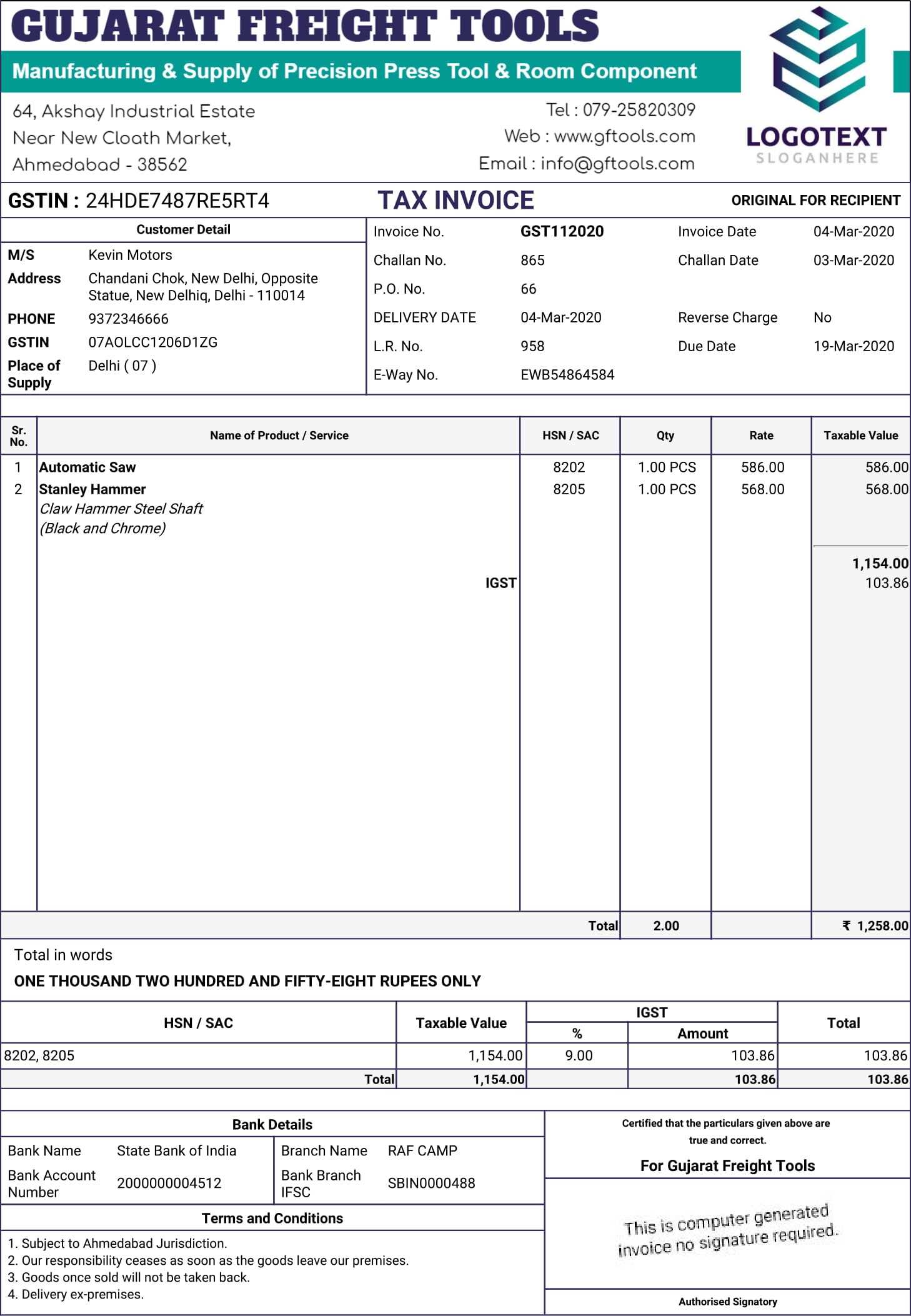

In New Zealand, a GST receipt needs to meet specific criteria to ensure compliance with the Goods and Services Tax Act. A basic GST receipt template should include:

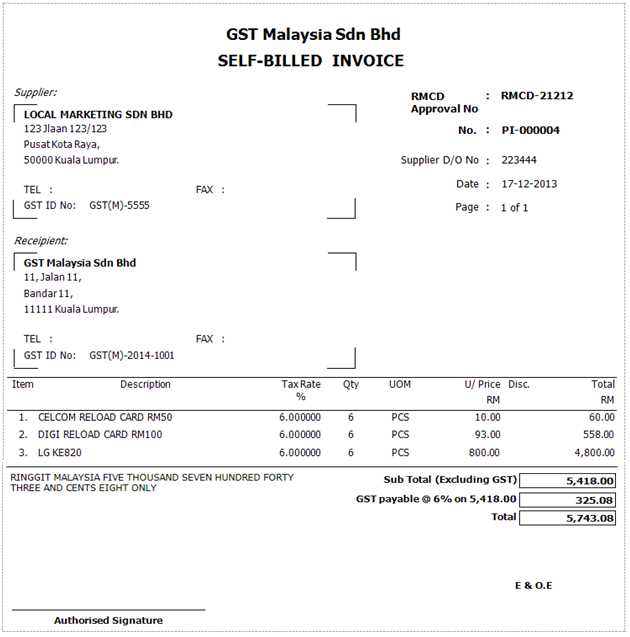

- Supplier’s Name and Address: Clearly mention the business name and physical address.

- GST Number: The GST registration number must be included.

- Date of Issue: This should be the exact date the transaction took place.

- Itemized List of Goods or Services: Include a breakdown of the items or services provided with their individual prices and quantities.

- GST Amount: Display the GST amount separately, showing the calculation of the tax at 15%.

- Total Amount: Show the total cost including GST at the end of the receipt.

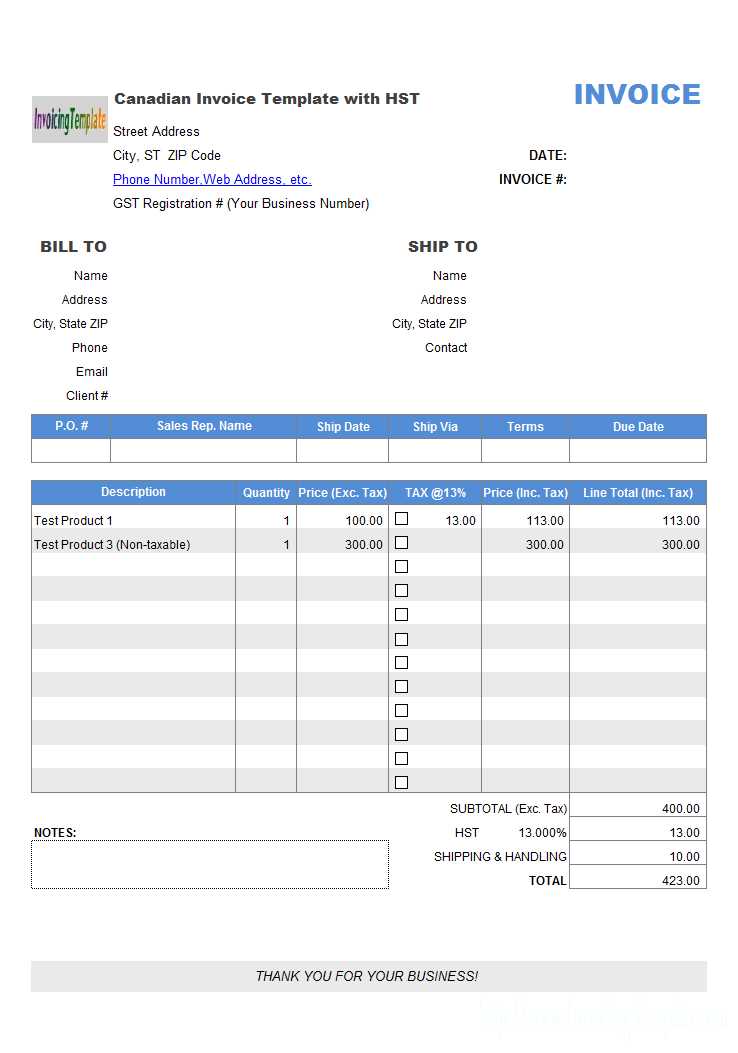

Formatting Tips for a GST Receipt

Keep the receipt clear and easy to understand. Here’s how to structure the receipt for easy readability:

- Use a simple, clean layout with clear headings for each section.

- Ensure the GST amount is separated from the item prices to avoid confusion.

- Choose a readable font size and leave space between sections to reduce clutter.

- If applicable, include a description or reference number for the transaction.

Digital GST Receipts

For digital transactions, GST receipts can be sent via email or through an online platform. Ensure the template you use complies with the same requirements as a physical receipt. Most online accounting systems allow you to generate compliant GST receipts automatically.

GST Receipt Template in New Zealand

To issue a valid GST receipt in New Zealand, ensure it meets the requirements set by the Inland Revenue Department (IRD). The receipt should clearly identify the business, contain details of the transaction, and reflect the GST-inclusive price.

Understanding GST Requirements for Receipts

A GST receipt in New Zealand must include the following: the GST number of the supplier, the total amount paid (including GST), a breakdown of GST, and the date of the transaction. It’s crucial to ensure that your receipt format complies with these standards to avoid issues during audits.

Step-by-Step Guide to Creating a GST Receipt Design

1. Start with your business name, address, and GST registration number at the top.

2. List the products or services provided with their individual prices, specifying the GST amount for each item.

3. Show the total value, including GST, at the bottom, with a clear breakdown between net amount and GST.

4. Include the transaction date and any other pertinent details like payment method.

By following this structure, you can create a professional and compliant GST receipt for your customers.

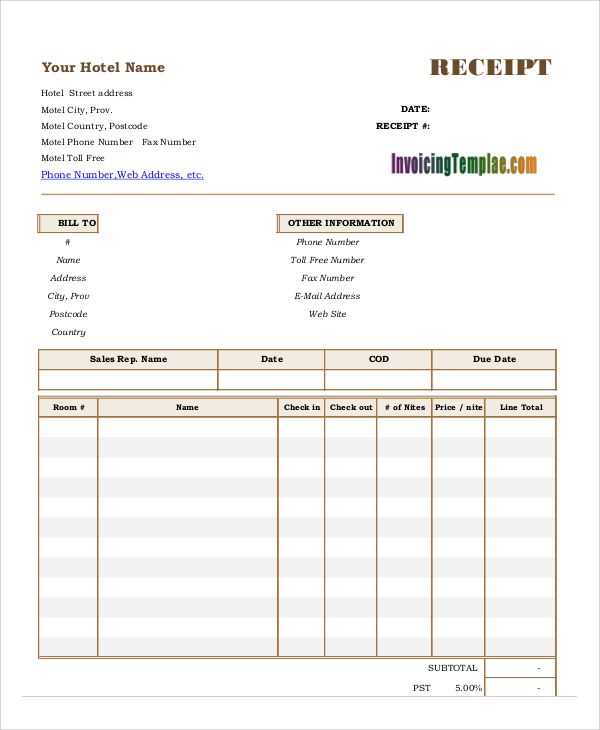

Tailoring Your GST Receipt for Various Businesses

The content of your GST receipt may vary based on your industry. For instance, in the retail sector, receipts should focus on individual product pricing and GST, whereas service-based businesses may need to highlight the type of service provided and the corresponding GST amount. Adapt the receipt template to reflect your specific business transactions.

Common Errors to Avoid When Issuing GST Receipts

Avoid omitting the GST number or failing to break down the GST from the total amount. These mistakes can lead to compliance issues. Ensure your receipt clearly distinguishes between net amounts and GST charges, and verify that all fields are filled in correctly before issuing.

Digital Tools to Streamline GST Receipt Creation

Consider using accounting software to automate receipt creation. Many tools can generate GST-compliant receipts with all the necessary details, minimizing human error and saving time. These tools also allow you to store receipts digitally, making it easier to track transactions for future reference.