Essential Elements of an HOA Receipt

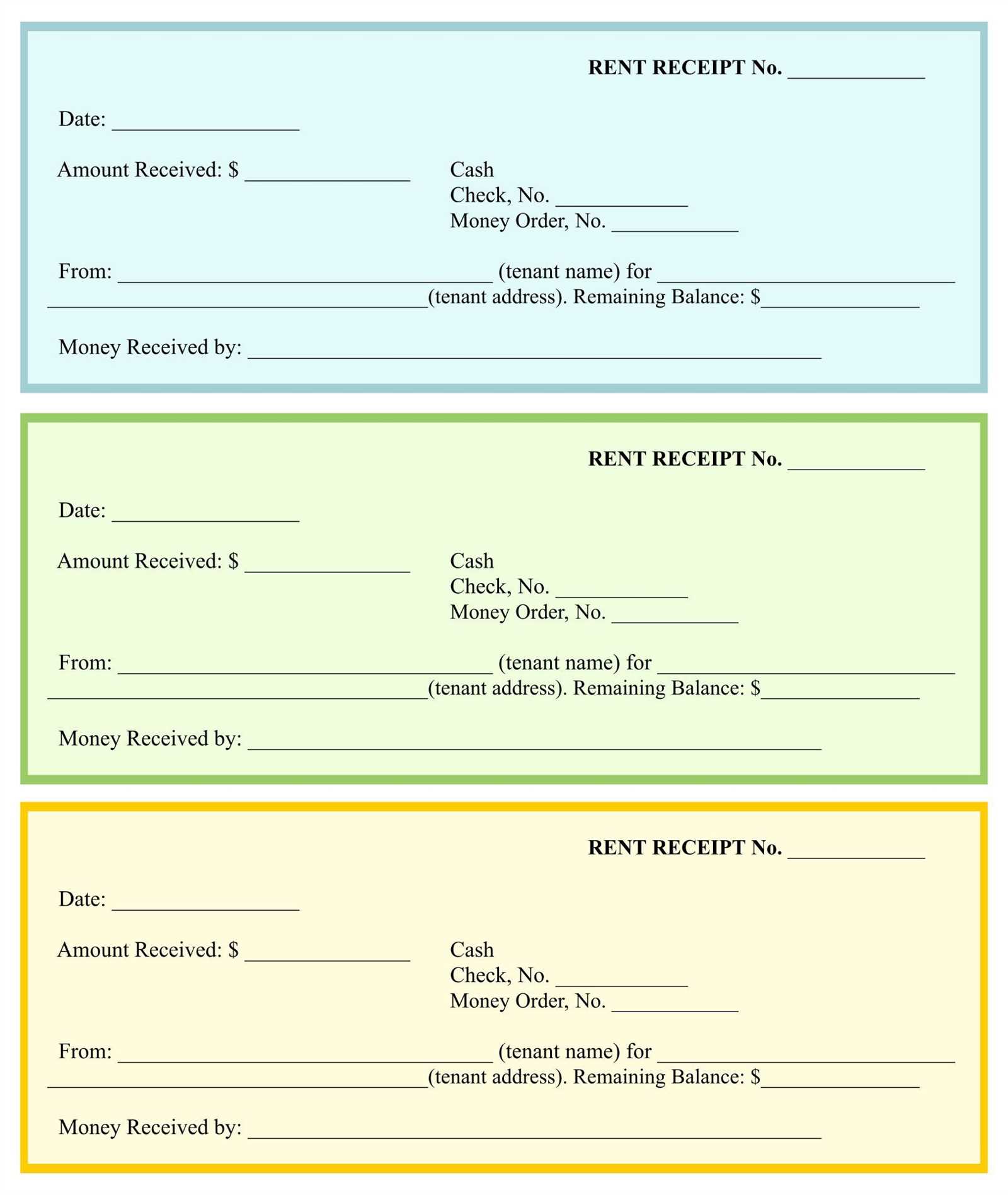

Every homeowner’s association (HOA) needs a clear and structured receipt template to document payments properly. A well-organized receipt should include:

- Date of Payment: Clearly indicate when the transaction occurred.

- Payer Information: Include the homeowner’s name and property address.

- Amount Paid: Specify the exact amount and payment method.

- Description: Clarify whether the payment covers dues, special assessments, or fines.

- Receipt Number: Use a unique identifier for easy tracking.

- Authorized Signature: A signature from the HOA representative confirms validity.

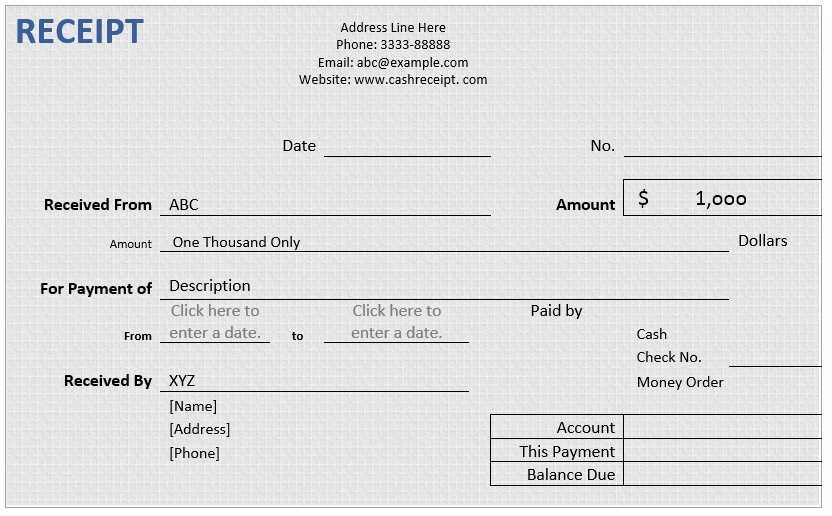

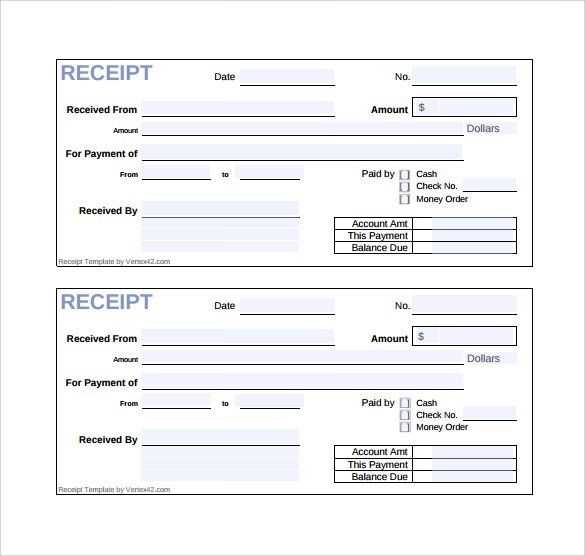

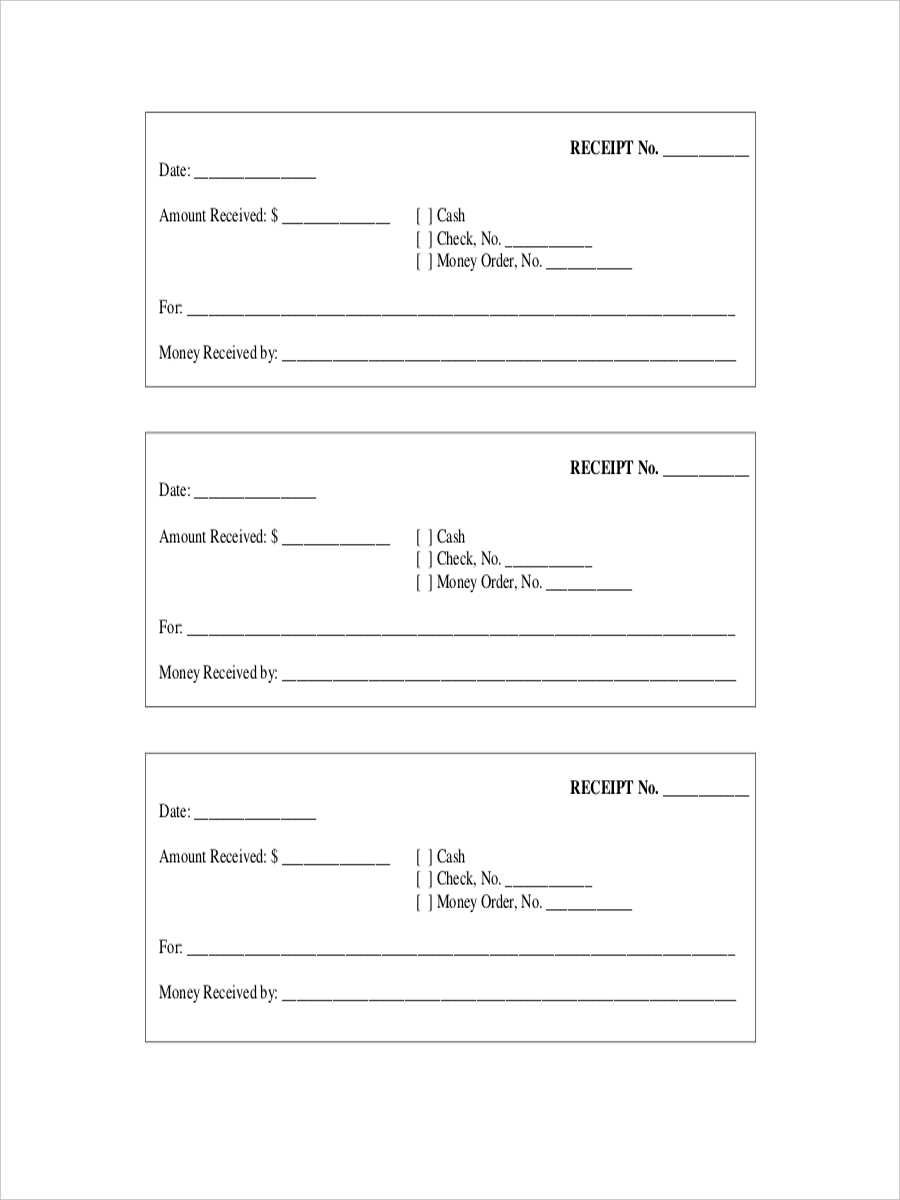

Sample HOA Receipt Template

Using a consistent format ensures accuracy and professionalism. Below is a simple layout for an HOA receipt:

Homeowners Association Receipt

Date: [Insert Date]

Receipt No.: [Unique Number]

Received From: [Homeowner’s Name]

Property Address: [Homeowner’s Address]

Amount: $[Amount]

Payment Method: [Cash, Check, Online Transfer]

Purpose: [Dues, Special Assessment, Fine]

Received By: [HOA Representative]

Signature: ____________________

Best Practices for Issuing HOA Receipts

To maintain trust and transparency, follow these guidelines:

- Issue receipts immediately after payment.

- Use digital records to minimize errors and simplify audits.

- Provide homeowners with both printed and electronic copies.

- Ensure receipts align with financial records for consistency.

A structured receipt system improves HOA management, reduces disputes, and ensures accurate financial tracking.

HOA Receipt Template: A Practical Guide

Key Elements to Include in a Payment Receipt

Formatting Guidelines for Clear Documentation

Common Mistakes to Avoid in Payment Records

Digital vs. Paper: Pros and Cons of Receipts

Legal Considerations for Financial Documentation

Customizing a Template for Various Needs

Include the homeowner’s name, address, and payment date to ensure accuracy. Specify the amount paid, payment method, and the period covered. Add a unique receipt number for easy tracking. If there are late fees or discounts, list them separately to maintain transparency.

Use a clean, readable layout with clear section headings. Align figures properly and avoid excessive formatting. Consistent font size and logical spacing improve readability. A structured template reduces misinterpretations and simplifies record-keeping.

Errors often arise from missing or incorrect details. Double-check payment amounts, dates, and homeowner information before finalizing. Avoid vague descriptions like “miscellaneous fees” and instead specify charges. Skipping a receipt number complicates audits and tracking.

Digital receipts offer automation, searchability, and environmental benefits. They reduce storage needs and streamline bookkeeping. Paper receipts provide a tangible record but require careful filing. Combining both methods ensures redundancy and accessibility.

State laws dictate retention periods and required details. Some jurisdictions mandate signatures or specific disclaimers. Check local regulations to ensure compliance. Secure digital backups protect against data loss.

Tailor templates for different needs by adjusting fields. Rental payments, special assessments, and dues may require unique sections. Automate calculations where possible and add branding elements like a logo for professionalism.