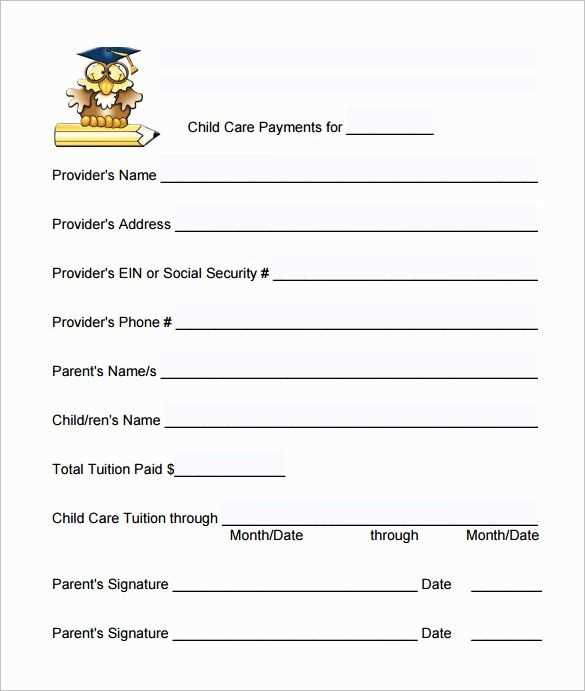

A clear and structured receipt helps parents track payments and simplifies tax reporting. Use a template that includes payment details, provider information, and a breakdown of services.

Key details to include: Parent and provider names, payment date, service period, amount paid, and payment method. Adding a signature section enhances credibility.

Why a structured receipt matters: It ensures transparency, reduces disputes, and provides parents with necessary records for reimbursement or tax deductions.

Choose a format that works best for your daycare, whether digital or printed. A standardized template saves time and maintains consistency across all transactions.

Here’s the corrected version:

Include the full name of the daycare provider at the top of the receipt. This helps clarify who is issuing the document. Specify the period for which the child care services were provided, such as “January 2025” or a range of dates like “01/01/2025 to 01/31/2025.” List the child’s name clearly to avoid any confusion.

Details to Include

Indicate the amount paid for the services, either by week, month, or total amount, depending on your agreement with the parents. For transparency, break down any additional costs, such as late fees or extra hours, and include a subtotal. Provide the payment method used (e.g., cash, check, or online transfer) for record-keeping purposes.

Signature and Date

Ensure that both the daycare provider’s signature and the date of issuance are included. This confirms the authenticity of the receipt. Double-check all the details for accuracy before giving it to the client.

- Home Daycare Child Care Receipt Template

To create a clear and professional receipt for home daycare services, include the following key elements:

- Date of Service: Specify the start and end dates for the services provided. This helps clarify the billing period for both parties.

- Provider Information: Include the name, address, and contact details of the daycare provider.

- Parent or Guardian Information: List the name and contact details of the person receiving the care.

- Child’s Information: Include the child’s full name and age for reference.

- Detailed Description of Services: Specify the type of care provided (e.g., daily daycare, after-school care) and the total number of hours/days worked.

- Total Payment: Clearly state the amount due for the services rendered. Include any taxes or additional charges, if applicable.

- Payment Method: Note how the payment was made (e.g., cash, check, or online transfer) and any relevant transaction details.

- Provider’s Signature: Include a space for the daycare provider to sign and confirm the receipt.

This format ensures both clarity and transparency for both the daycare provider and the parents, allowing for easy record-keeping and reference. Use this structure for all daycare-related receipts to maintain consistency.

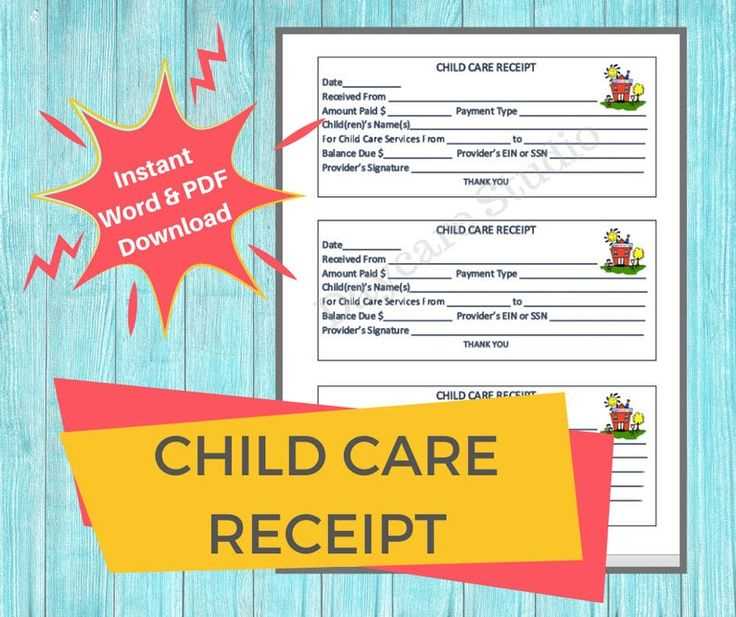

Include the following key details on your daycare receipt: business name, address, and phone number, along with the child’s name, the care provider’s name, and the dates services were provided. Specify the total amount paid, listing the payment breakdown if applicable, such as weekly or daily rates, and any additional services provided, like meals or transportation. Clearly state the amount paid for the period, making it easy to match against bank statements.

Detailed Information to Include

For each payment, provide a clear breakdown: the total hours of care, the rate per hour or day, and the total cost. If the provider offers discounts or special pricing for multiple children or extended hours, note these adjustments. Include payment methods, such as cash, check, or electronic transfers, and the corresponding dates.

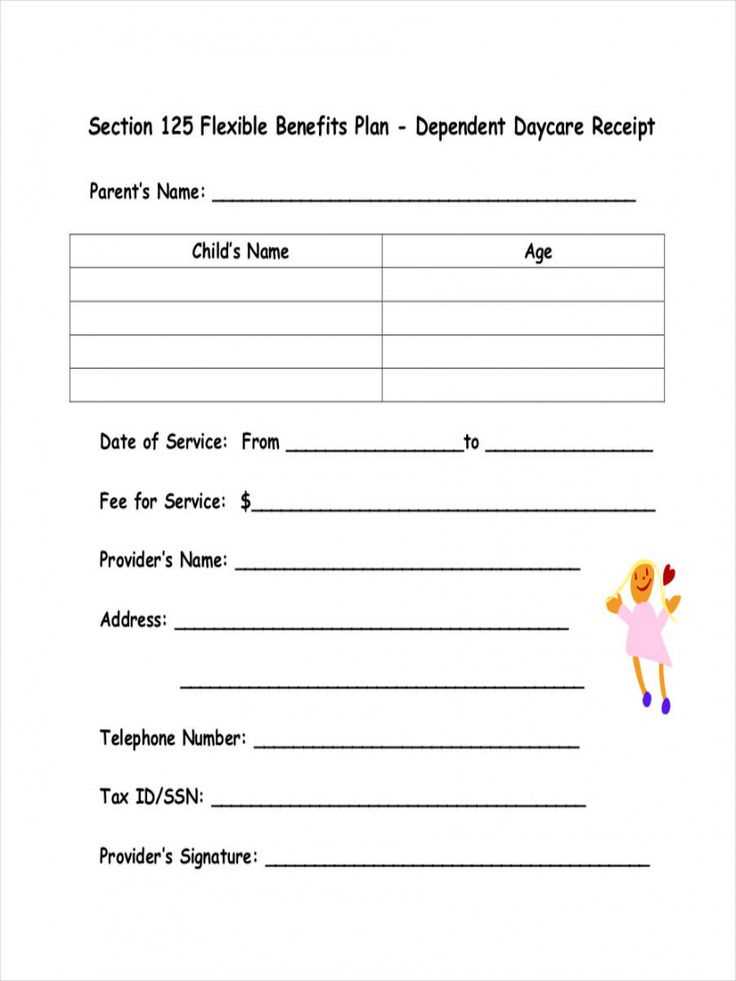

Tax Requirements

Ensure that the receipt includes a statement confirming that the daycare provider is a legitimate business. Include a tax identification number (TIN) or social security number (SSN) to comply with tax regulations. This will make the receipt useful for claiming child care tax credits or deductions when filing taxes.

A home child care receipt must include several specific details to ensure both the provider and the parent have a clear record of the transaction. Start by including the provider’s full name and business name, if applicable. This helps establish the legitimacy of the transaction.

Provider and Parent Information

Include the provider’s contact details, such as phone number and address. Also, list the parent’s or guardian’s name, address, and contact information. This ensures both parties are clearly identified.

Details of Services Provided

Clearly state the dates and hours during which child care services were provided. This helps avoid misunderstandings and provides a detailed record for tax purposes. Be sure to also include the rate per hour or total amount charged for the period.

List any additional charges or discounts that apply, such as late fees or sibling discounts. These specifics keep the receipt transparent and understandable.

Payment Information

Record the payment method (cash, check, or electronic transfer) and the amount paid. If the payment was partial, indicate the remaining balance.

Finally, include the date the payment was made, as well as the signature of the provider or any other authorized party. This adds an extra layer of security and legitimacy to the transaction.

Ensure that all the necessary details are included in the receipt. A common mistake is failing to list the caregiver’s name or business name, which makes the receipt invalid. Always provide clear and accurate information to avoid confusion during tax filing or audits.

Missing Payment Dates

Accurate date recording is critical. Leaving out the payment date or including incorrect dates can lead to disputes. Record the exact date when the service was paid for to prevent confusion over payment periods.

Incorrect Amounts

Ensure that the amount paid matches the listed charges. Double-check calculations and any adjustments made to avoid errors that could affect tax returns or cause issues with clients.

Unclear Service Description

Clearly describe the services provided. Avoid vague terms like “childcare” and include specific details, such as “full-day care” or “part-time care,” to provide transparency for both parents and tax purposes.

Failure to Sign the Receipt

Always sign receipts to validate them. A missing signature can create doubts about the authenticity of the document. Sign each receipt personally or use an authorized signature if needed.

Incorrect Contact Information

Include correct contact information for both the caregiver and the parent. If there’s an error in phone numbers or email addresses, it can cause delays in communication and verification issues.

Sample Daycare Receipt Table

| Service Description | Amount Paid | Payment Date | Caregiver’s Signature |

|---|---|---|---|

| Full-Day Care | $50.00 | 02/10/2025 | Jane Doe |

| Part-Time Care | $30.00 | 02/10/2025 | Jane Doe |

Home Daycare Child Care Receipt Template

Provide clear details in your receipt. Include the caregiver’s name, address, and contact information at the top. Specify the child’s name, the dates of care, and the total number of hours worked. List the hourly or daily rate and total payment received. Clearly state the payment method and any additional services provided, like meals or transportation. Be concise but thorough, ensuring all necessary information is easy to locate and understand.

Payment Details

Clearly break down the payment. Indicate if the rate is hourly, daily, or weekly. Include any applicable taxes or discounts. This helps the parent verify the amount paid and track payments for tax purposes.

Additional Notes

If any special agreements were made, such as holiday rates or discounts, document them on the receipt. This ensures transparency and avoids confusion later on.