Need a Home Depot receipt template that includes Rustoleum purchases? A structured template helps track expenses, manage warranties, and streamline returns. Whether for business records or personal use, an accurate format ensures clarity.

A standard Home Depot receipt lists the store location, date, itemized purchases, payment method, and transaction ID. Including Rustoleum products requires clear descriptions, unit prices, and SKU numbers. This detail simplifies tax deductions and inventory tracking.

Digital and printable templates offer flexibility. Formats like PDF and Excel allow easy customization, ensuring each receipt aligns with specific needs. Adding company logos, purchase notes, or tax breakdowns enhances documentation.

Reliable templates save time when handling purchase verification. Consistent formatting prevents discrepancies and supports organized financial records. Choosing a structured template reduces errors and improves workflow.

Here is the corrected version with redundancy removed:

To improve the clarity of your Home Depot receipt template, eliminate repeated information and focus on key details. This will make the template more concise and easier to follow.

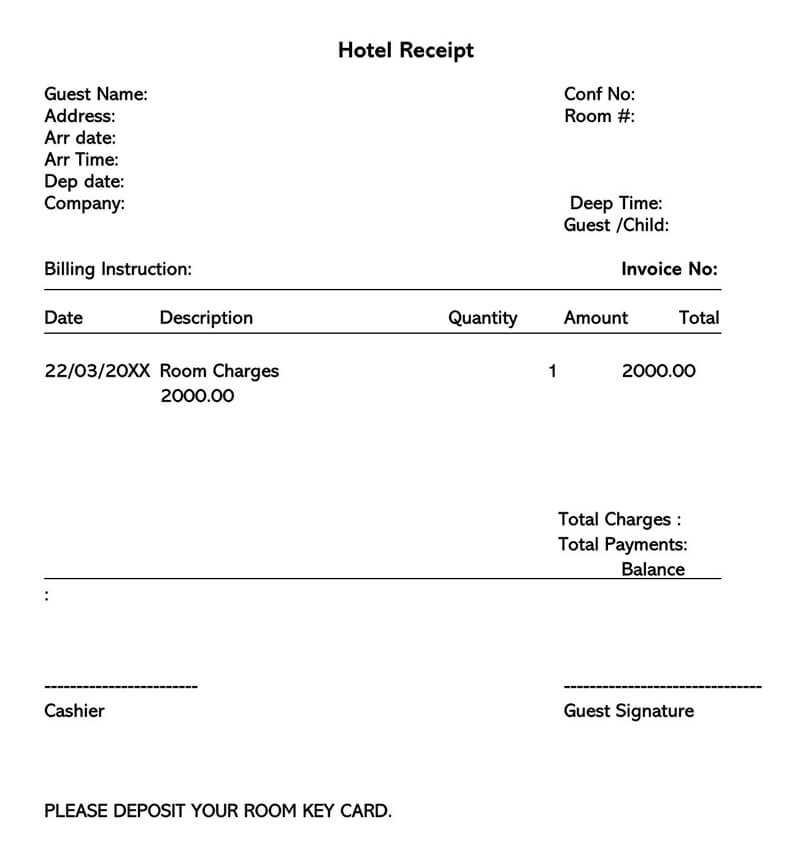

Receipt Structure

Ensure the essential components are present without duplication:

| Item | Quantity | Price |

|---|---|---|

| Rust-Oleum Paint | 1 | $25.99 |

| Paint Primer | 1 | $12.99 |

| Brush Set | 1 | $9.99 |

| Total | $48.97 |

Additional Recommendations

After reviewing your receipt template, make sure to keep the font consistent and highlight the transaction total for easy reference. Avoid unnecessary details, like excessive tax breakdowns unless required by the customer.

- Home Depot Receipt Template with Rustoleum

To create a Home Depot receipt template that includes Rustoleum products, ensure the template accurately represents the purchase details. Include the product name, quantity, unit price, total price, and applicable taxes for each item. Highlight the specific Rustoleum items purchased, such as paints or primers, and provide clear item descriptions to avoid confusion.

When formatting, use a clean, organized structure with separate columns for each detail: product name, quantity, price, and total cost. Include a subtotal and a clear breakdown of any discounts or promotions applied to Rustoleum products, if applicable.

In the footer, include store information such as address, contact details, and any necessary return policies for Rustoleum products. This will help ensure the receipt template is both informative and professional.

Visit Home Depot’s website to download a store receipt form, which is available in the customer service section. The form is typically used for returns and exchanges or warranty claims. If you prefer in-person assistance, go to the customer service desk at any Home Depot store to request a printed version. Alternatively, you can contact Home Depot’s support team by phone or email to obtain a receipt form specific to your transaction. Many locations also offer digital receipts through the Home Depot app, which you can access and print from your device.

To customize a purchase receipt for Rustoleum items, start by ensuring that the product name and details are clearly visible. Include the exact product type, color, and size to avoid confusion. List the quantity purchased and ensure the total price reflects any promotions or discounts applied during the transaction.

Include Specific Rustoleum Product Information

Make sure the receipt specifies which Rustoleum product was bought, such as Rustoleum spray paint or a primer. Add a product code or SKU to help identify the item quickly. This prevents ambiguity if the customer needs to return or exchange the product.

Highlight Pricing Details

If there are multiple Rustoleum products on the same receipt, organize the items in a table format, showing individual prices, quantities, and total costs. Don’t forget to list taxes, as they can vary depending on location. Highlight any discounts applied to Rustoleum products for clarity.

Customize the receipt footer to include company contact information and store policies for returns and warranties on Rustoleum items.

In a Home Depot receipt template with Rust-Oleum, make sure to include these important details:

| Field | Description |

|---|---|

| Date of Purchase | Include the exact date of the transaction for record-keeping and warranty purposes. |

| Item Description | Clearly list the products purchased, including brand and quantity, such as “Rust-Oleum paint” and any relevant product details. |

| Price | Provide the price per unit and the total cost for each item, including any applicable discounts or promotions. |

| Tax Information | Show the sales tax applied to the total amount to ensure the template is accurate for accounting purposes. |

| Store Location | List the specific Home Depot store location for verification and return inquiries. |

| Transaction Number | Include a unique transaction number for reference in case of returns or inquiries. |

Incorrect alignment is a frequent issue. Ensure all text, prices, and item details align properly to improve readability. Check if the margins and line spacing are consistent across the document. If you use a template, verify the settings for left, right, and center alignments are correctly applied. Adjust any misaligned items manually to maintain a uniform look.

Inconsistent Font Styles can make the receipt hard to read. Use one font type for the entire receipt or a combination of two for headings and content. Standardize font size and weight throughout the document, except where distinctions are needed, like for section headers.

Missing or Misplaced Information is another common problem. Ensure each section, such as the store name, transaction details, and product names, is present and correctly formatted. If you’re using a template, check that all placeholders are correctly replaced with accurate data, and double-check the layout to ensure no sections are cut off.

Inaccurate or Non-Standard Date Formats can cause confusion. Stick to a consistent date format (e.g., MM/DD/YYYY) across all receipts. If the template allows customization, make sure the date field follows a clear, recognizable format for easy reference.

Cluttered Information can overwhelm readers. Use white space effectively to break up the sections. Avoid overloading the receipt with unnecessary text or too many graphics. A clean, simple design will make the information clearer.

Print receipts directly from your computer or mobile device using a standard inkjet or laser printer. Ensure the printer is configured correctly with the paper size matching the receipt format. Adjust printer settings to ensure clarity and legibility, particularly for detailed purchase information.

- For digital storage, scan printed receipts using a flatbed scanner or a mobile scanning app. Save the files in PDF or image format for easy access and sharing.

- Consider using cloud storage services like Google Drive or Dropbox for automatic backups. These services allow you to store receipts securely and access them from any device.

- Label each digital receipt with clear and relevant filenames for quick reference, such as including the date and the store name in the file title.

- Use receipt management apps that offer features like OCR (Optical Character Recognition) to extract data from scanned receipts and categorize them automatically. These apps sync across devices for better accessibility.

Ensure the accuracy and completeness of the data entered on the form. Any discrepancies in information can lead to legal or financial issues, including tax-related penalties or disputes. Always cross-check receipt details with relevant records.

- Maintain proper documentation: Keep copies of forms for tax reporting, warranties, and other legal purposes.

- Understand applicable laws: Verify whether the form aligns with local regulations for record-keeping or sales tax requirements.

- Consider privacy concerns: Avoid sharing sensitive information without ensuring compliance with privacy laws such as GDPR or CCPA.

- Use forms for business purposes only: If used for business deductions, make sure all items purchased and documented meet legal criteria for business expenses.

- Consult with professionals: For complicated cases or large transactions, seek advice from accountants or legal experts to avoid potential mistakes.

Home Depot Receipt Template with Rust-Oleum

Use this template to document your Home Depot purchase for Rust-Oleum products. It will help you track your spending, itemized list, and ensure warranty information is stored for future reference. Make sure to input the correct product names, quantities, and prices. Check for accuracy before finalizing the record.

How to Customize the Template

Start by entering your transaction details such as the date, store location, and receipt number. Then, list all Rust-Oleum products purchased with the corresponding prices. Add taxes, if applicable, and total the amount to match your receipt.

Store the Receipt for Warranty Claims

Rust-Oleum products often come with warranty information that requires a valid proof of purchase. Keep the receipt template in a secure location, either digitally or physically, for easy access when filing warranty claims or returns.