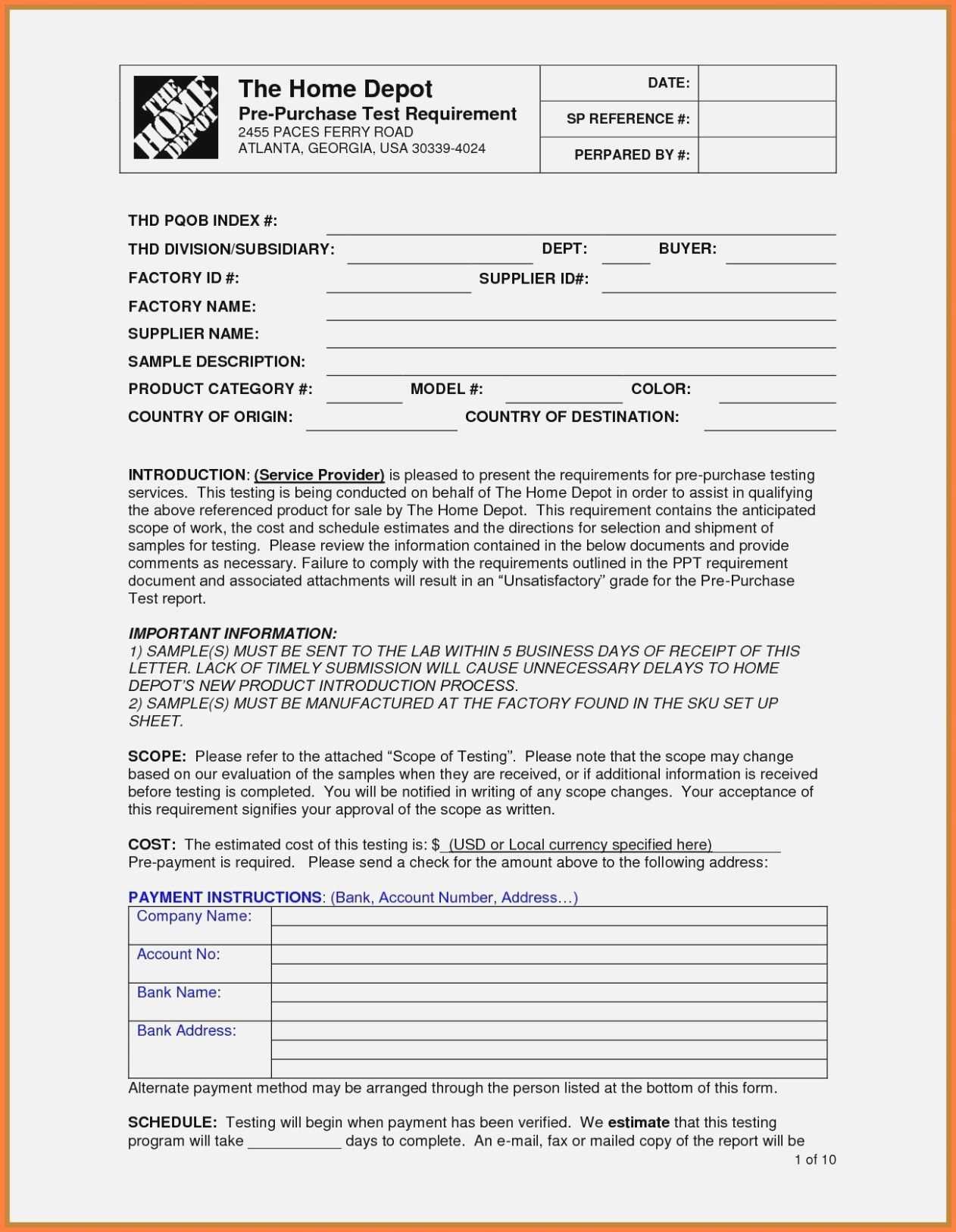

When you need a simple and clear receipt template for Home Depot purchases, choosing the right format can save you time and frustration. Custom templates allow you to capture all necessary details like product names, prices, and taxes without the clutter. If you often need to track multiple purchases, creating a reusable receipt template is a quick solution that ensures consistency in your records.

Templates can be tailored to include specific information like customer names, purchase dates, and itemized lists, making them especially useful for business owners or contractors. A clear template reduces the chances of missing critical data, making the process smoother for both you and your clients.

Using a Home Depot receipt template also simplifies the process of storing and retrieving receipts. Whether for warranty claims or project budgeting, having a structured document ready to go speeds up the task at hand. This approach eliminates the guesswork and ensures your data stays accurate, organized, and accessible for future reference.

Here is the corrected version with repeated words minimized:

Remove unnecessary duplicate information from your Home Depot receipt templates. Focus on keeping the key details clear and concise for easy reference. For example, instead of listing “item” repeatedly, make sure each product has its own unique description, price, and quantity. This will ensure that your templates are visually appealing and user-friendly. Organize the receipt layout logically to highlight the most important data, such as totals, taxes, and discounts, without overcrowding the space with redundant text.

Tips for Clarity

To streamline your receipt templates, adjust the formatting to reduce repetitive phrases. Keep sections distinct by using bullet points or separating each category of information (items, total cost, etc.) into its own area. This helps customers find the information they need without wading through repetitive or cluttered content.

Optimizing for Readability

Eliminate any phrases that don’t directly add value to the transaction. For instance, avoid over-explaining return policies or payment methods unless they are essential to the transaction itself. This allows the customer to focus on the details that matter most, improving the overall experience.

Home Depot Receipt Templates: A Practical Guide

How to Create Custom Receipts for Your Business

Key Features to Include in a Home Depot Receipt

Adjusting Layouts for Different Transaction Types at Home Depot

How to Add Tax and Discounts to Home Depot Receipts

Saving and Printing Templates for Future Use

Common Issues with Home Depot Receipts and How to Solve Them

Start by choosing a template that fits your business needs. Many online tools offer customizable Home Depot receipt templates, which can help you generate professional-looking receipts quickly. You can design receipts for purchases, returns, or exchanges by adjusting the layout accordingly. The key is to make sure it’s clear and easy to understand for your customers.

Key Features to Include in a Home Depot Receipt

Include the store’s name, address, and contact details at the top. A receipt number, transaction date, and time should follow, as these are essential for record-keeping and customer reference. Itemized lists of purchased products or services, their prices, and quantities are crucial. Don’t forget to add the total amount due, along with tax and any discounts applied. If applicable, include any warranty or return information too.

Adjusting Layouts for Different Transaction Types at Home Depot

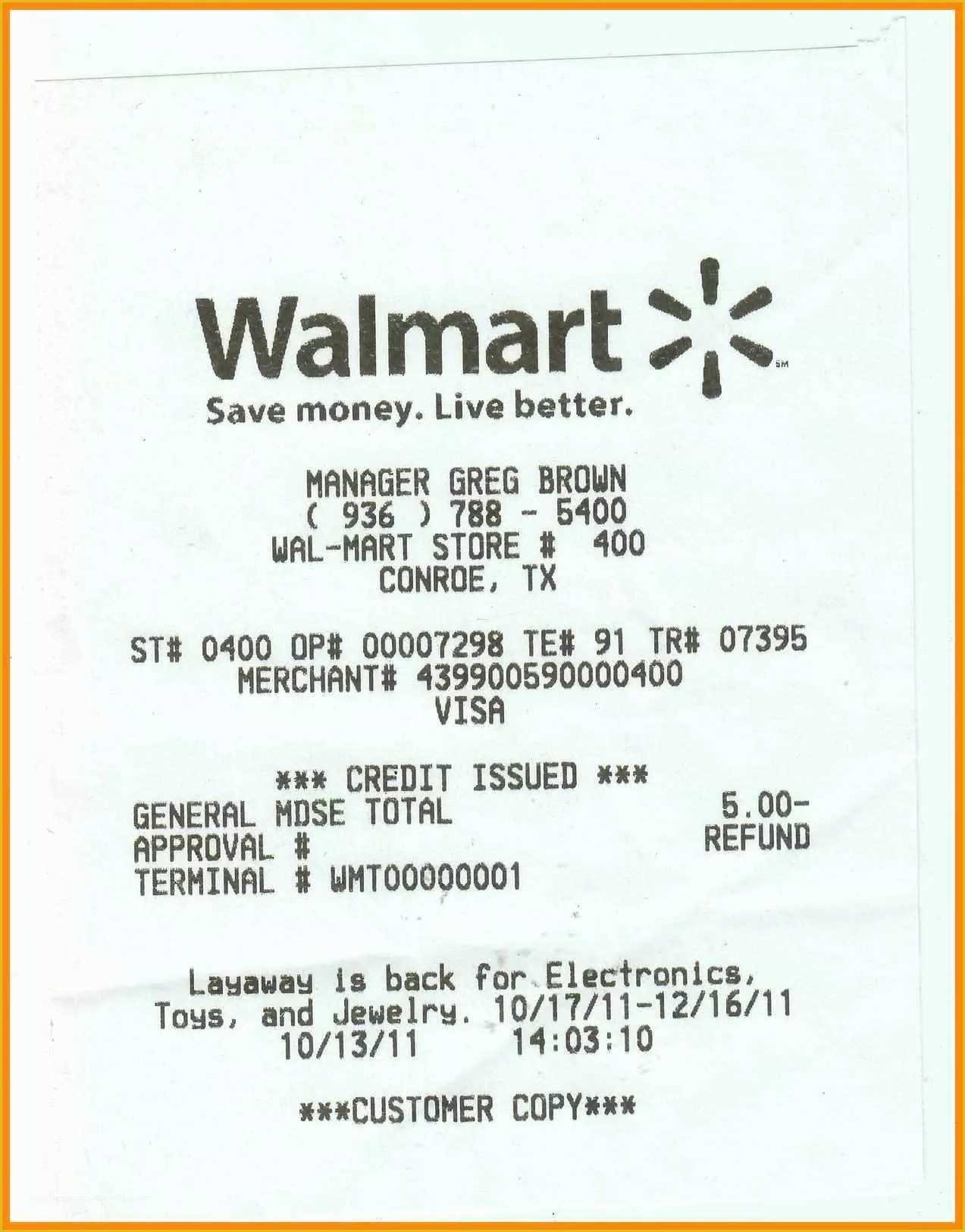

Different transaction types–such as purchases, refunds, or exchanges–may require specific layout adjustments. For instance, receipts for exchanges should clearly indicate the item returned and replaced, with both original and new item details. Refund receipts should highlight the refunded amount and the method of reimbursement, whether cash, credit card, or store credit.

To add tax and discounts, you’ll need to set up formulas within the template. Most receipt software lets you calculate tax automatically based on location. Discounts can be applied manually or automatically depending on your business’s discount policies. Ensure the discounts are clearly marked and subtract them from the total to avoid confusion.

Save your templates for future use by either storing them digitally or printing them for physical records. Many businesses use cloud-based systems to ensure accessibility from multiple devices, allowing you to easily generate receipts whenever needed. Additionally, regularly update your templates to reflect any changes in tax rates or discounts.

If you encounter common issues like miscalculation of tax or incorrect product details, double-check the input data and review the formulas used in the template. Make sure the template is compatible with your printer settings to avoid issues with printing formatting. If receipts appear cluttered or difficult to read, streamline the layout by removing unnecessary information or adjusting text sizes.