To keep track of all expenses during a home remodeling project, a receipt template can be a huge time-saver. It helps ensure transparency and organization, whether for personal use or for reporting to clients. A well-structured receipt provides clear details of each purchase and service, making it easier to monitor costs, identify discrepancies, and prepare for final budgeting.

Start with itemizing each material and labor charge. Break down the cost of materials like paint, fixtures, or flooring, along with the labor charges from contractors. This approach prevents confusion later and gives you a transparent record of the work done. Be sure to include dates, quantities, and any applicable taxes.

Tracking payments and receipts effectively also ensures you’re prepared for any warranty claims or future repairs. A proper receipt template keeps all the necessary information in one place, from the vendor name to the payment method, creating a simple yet powerful tool for your remodeling documentation. This way, you can maintain an accurate record throughout the remodeling process.

Here’s a revised version of your sentences with reduced repetition:

Focus on simplifying the structure of your sentences. Eliminate redundant words or phrases and use concise language. For example, instead of repeating a point in different ways, state it clearly once. In the context of remodeling receipts, avoid phrases like “for your convenience” and “as a part of the process,” as they add little value. Instead, focus directly on the costs and services provided.

Clarity and Precision

Use clear terms for services and materials. Instead of using generic descriptions like “high-quality materials,” specify what types of materials are being used. This not only avoids repetition but also provides more transparency to the recipient. If there are specific brands or features, mention them directly to avoid vague references.

Structure and Organization

Group related items together. For instance, list labor costs separately from material costs and highlight any additional charges. This avoids repeating “additional costs” or “extra charges” throughout the receipt. Keep the layout simple and easy to follow to enhance readability and prevent unnecessary redundancy.

- How to List Materials and Labor Charges Clearly

List materials and labor costs with transparency and precision to avoid misunderstandings. Start with clear itemization and precise quantities. For each material, specify the type, brand, and unit price. For labor, include the hourly rate and estimated time per task.

To make the charges easy to read, organize the list in a table format. Below is an example layout:

| Item | Description | Unit Price | Quantity | Total |

|---|---|---|---|---|

| Paint | Latex White, 1 gallon | $25 | 5 | $125 |

| Labor | Painting walls | $30/hr | 8 hours | $240 |

| Wood | Oak wood planks, 8 ft | $15 | 10 | $150 |

| Total | $515 | |||

Clearly separate labor and materials to make it easy for clients to distinguish between the costs. Group related items together and use simple, direct descriptions. This format helps clients see exactly what they are paying for and avoids any confusion during the project.

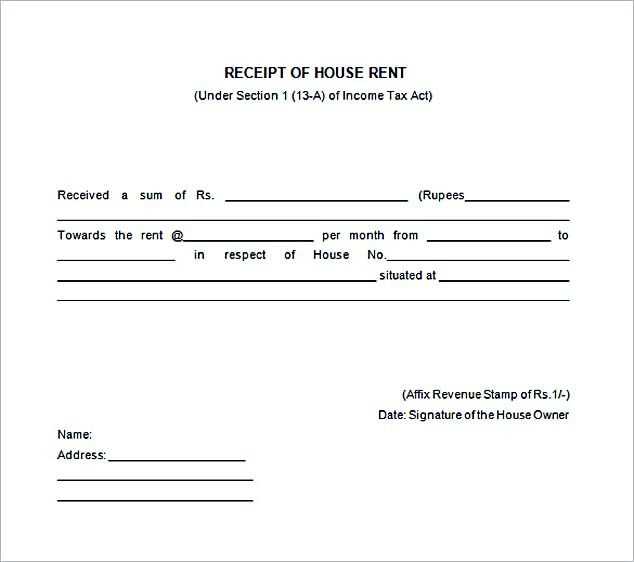

Clearly state the tax amount on your receipt. Include both the taxable subtotal and the tax rate used to calculate the charge. This ensures transparency and prevents future misunderstandings with clients or authorities.

Breaking Down Tax Charges

For accuracy, list tax charges separately from other costs. For example, after the cost of materials and labor, include a line showing the tax amount applied to the total. This allows clients to see how the tax is calculated based on the services and items purchased.

Stating the Tax Rate

Specify the tax rate used in the calculation. Include the local tax rate or any special tax rates that apply to remodeling services. If multiple rates are applicable (e.g., for different regions or types of work), make sure to break them down clearly.

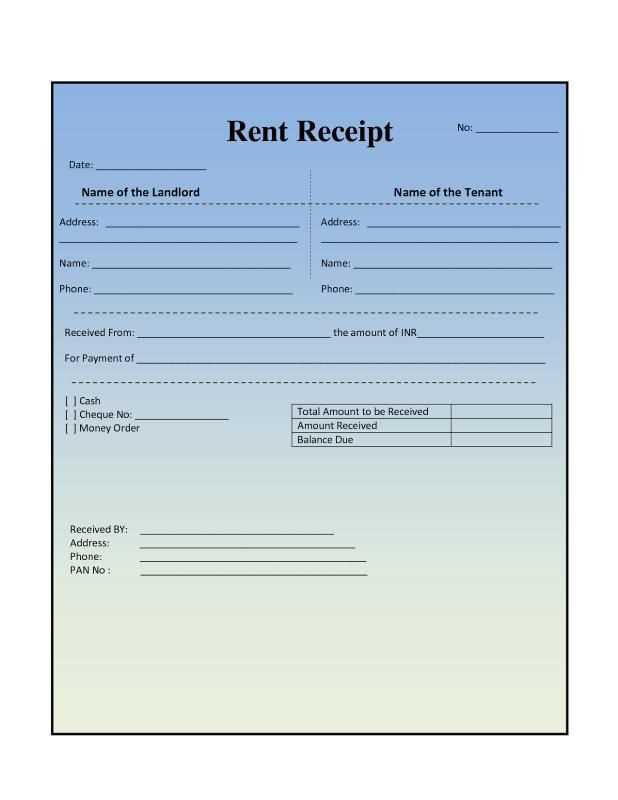

Ensure that both the contractor and client’s contact details are included clearly and accurately. This will facilitate easy communication throughout the remodeling process. Start by including the full name, address, phone number, and email for both parties. Additionally, specify the preferred communication method to avoid confusion.

- Contractor’s Information: Include the contractor’s full business name, office address, phone number, and email address. If possible, add their license number for reference.

- Client’s Information: List the client’s full name, address, phone number, and email. It is also helpful to include the best time to reach them.

Both parties should verify their details to ensure no errors in contact information, as this will help in addressing any issues quickly. Consider adding a designated contact person for large projects or when multiple contractors are involved.

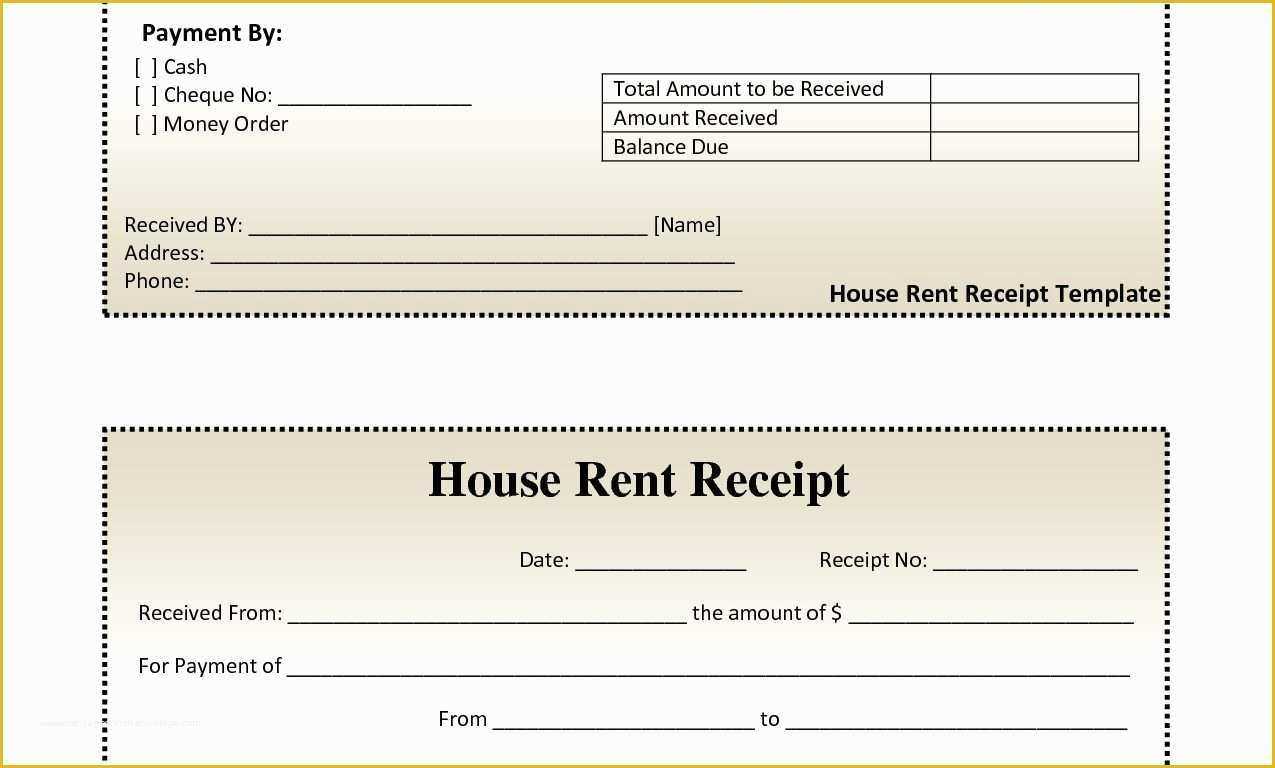

Clearly define payment terms in the template by specifying the total amount, deposit requirements, and due dates. Specify whether payments will be divided into installments or if a lump sum is required. Make sure the installment schedule is aligned with project milestones, such as the completion of specific phases. Add an option for a late fee if payments are not received on time, ensuring that the fee percentage or amount is clearly stated.

Include Milestone Payments

List the payment milestones based on the completion of major tasks. For example, outline when the initial payment is due after signing the contract, and when subsequent payments are triggered upon completion of construction phases. This approach keeps the project cash flow steady and ensures both parties are clear about expectations.

Define Late Payment Penalties

To avoid delays in project completion, include a penalty clause for overdue payments. Specify the exact penalty for late payments, whether it’s a fixed fee or a percentage of the overdue amount. Make it clear how many days after the due date the payment will be considered late, ensuring that the client is aware of the financial consequences of missing a deadline.

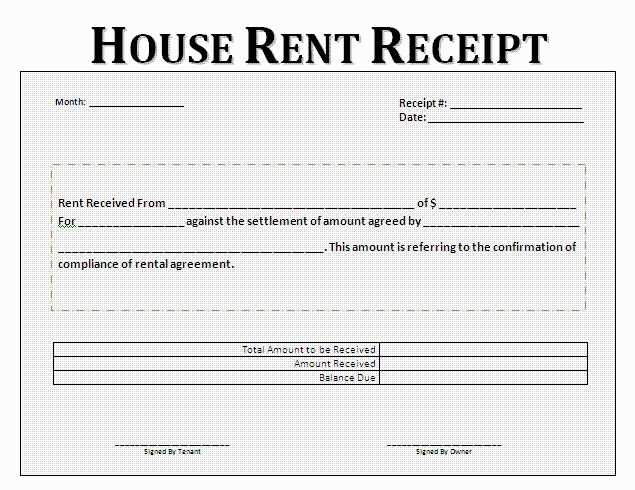

Use the receipt template to log every expense associated with the remodeling project. Include details like the date, vendor, item description, and total cost for each purchase. This allows for easy categorization and comparison of costs over time, helping you spot areas where you may overspend.

When entering costs, be sure to record both the material and labor expenses separately. This will give you a clearer view of where your budget is allocated and help you adjust future spending if needed. Don’t forget to add any tax or delivery charges, as these can significantly affect the final total.

Keep all receipts organized in a way that makes sense for the scope of the project. You can sort them by room, type of work, or by the stages of the remodeling process. Regularly update the receipt log to track progress and avoid surprises when it’s time to review your spending.

At the end of the project, analyze the data. Look at total expenses by category, and compare them with your initial budget. This can highlight any areas where costs were higher than expected, helping you plan more accurately for future renovations.

Organizing your remodeling expenses can be a challenge, but using a detailed receipt template can simplify the process. A well-structured template will help you track costs, ensure transparency, and stay within budget. Here’s how to create one.

Receipt Header Information

- Include the project name, such as “Kitchen Remodel” or “Bathroom Update.”

- Clearly state the date the work was completed or paid for.

- Make space for the contractor’s name and contact details.

- Ensure your own name and contact details are listed as the client.

Breakdown of Costs

- Provide a detailed list of all materials purchased, such as tiles, paint, or fixtures, including quantities and individual costs.

- List labor charges with a breakdown of hours worked and hourly rates for each worker or subcontractor.

- Include any additional fees, such as permit costs, transportation, or disposal charges.

Use this template to keep all receipts in one place, allowing you to refer back to them when necessary for tax purposes or project planning. Having clear records helps avoid confusion and ensures accountability on both sides.