If you’re looking for a clear and structured way to document your HRA transactions, creating a simple receipt template can save you time and ensure accuracy. This template allows you to track your expenses, providing a detailed account for reimbursement or tax purposes. Make sure to include basic elements such as the date, the amount, and the specific services covered by the HRA for easy reference.

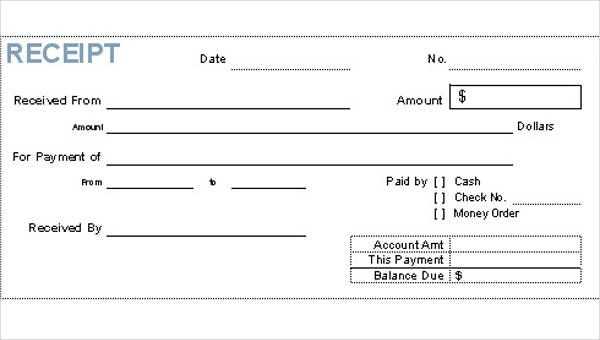

Begin with a straightforward header indicating that the document is a receipt. Follow this with the recipient’s details, including their name, contact information, and any identification number associated with the HRA. Clearly list the services rendered or products purchased, alongside the respective costs. It’s helpful to itemize these, as it ensures transparency and minimizes any confusion during the review process.

Remember to provide space for additional notes or comments, particularly if the transaction involves complex reimbursements or multiple services. The receipt should also feature the total amount spent and, if applicable, a breakdown of the reimbursement expected. This will help both parties stay on track and avoid misunderstandings.

Here is the corrected version with minimized repetitions:

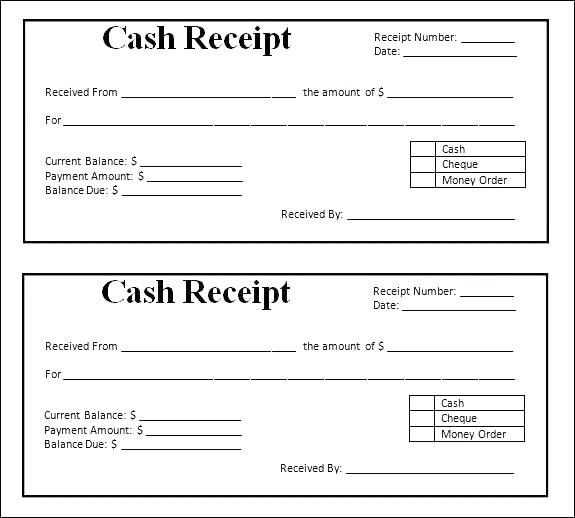

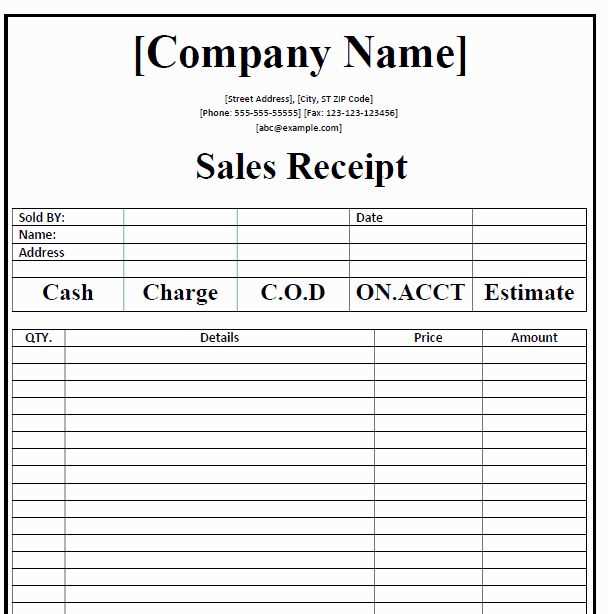

Ensure the receipt template clearly displays the essential transaction details, such as date, amount, and item description. Avoid overcrowding the layout with unnecessary fields. Focus on the most relevant information to maintain clarity.

Streamlining Design

Use a simple layout that guides the user’s attention to key information. Highlight the total amount and transaction date, ensuring they are easily visible. Organize the text in a clear hierarchy, with bold fonts for important fields and regular text for details.

Reducing Redundancy

Limit repetitive phrases like “amount paid” or “total amount.” Instead, use the same terminology consistently throughout the template. This avoids unnecessary duplication and keeps the template concise.

HRA Receipt Template: A Practical Guide

How to Customize Your HRA Receipt Template

Key Elements to Include in an HRA Receipt

Best Practices for Organizing Receipts

How to Ensure Tax Compliance

Common Mistakes When Creating HRA Receipts

Tips for Streamlining the Submission Process

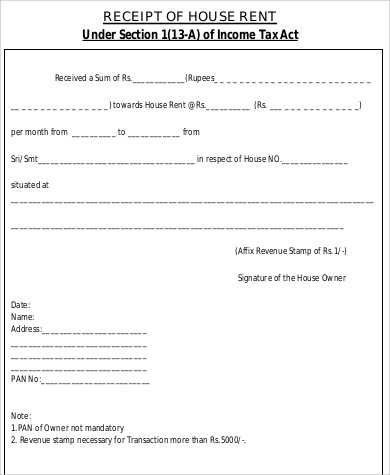

To create an effective HRA receipt template, start by clearly labeling each section of the receipt. Include the name of the employee, the date of the expense, the nature of the expense, and the amount. Keep the format consistent to simplify the review process and ensure that all required information is easy to locate.

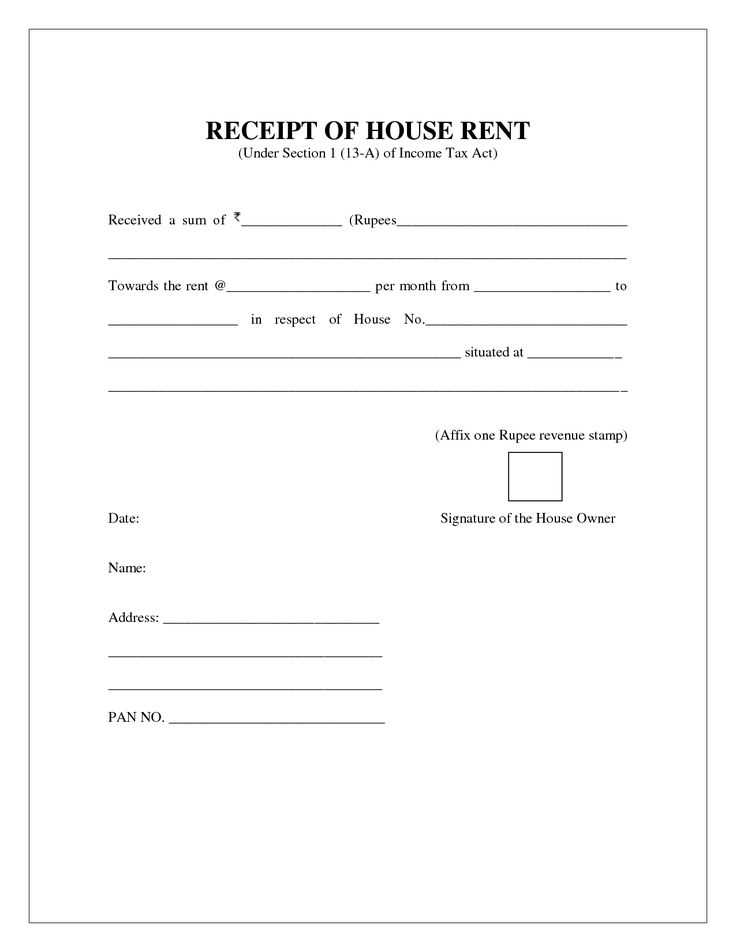

The key elements of an HRA receipt should include a detailed breakdown of the expense, the vendor’s name, a description of the product or service, and any applicable taxes. It’s also crucial to include the total amount reimbursed, as well as the employee’s name and signature for verification purposes.

When organizing receipts, ensure that they are categorized according to the type of expense, such as medical, dental, or vision. This helps streamline tracking and ensures that each receipt is processed efficiently. Use clear labels or folders to keep receipts organized by month or expense category.

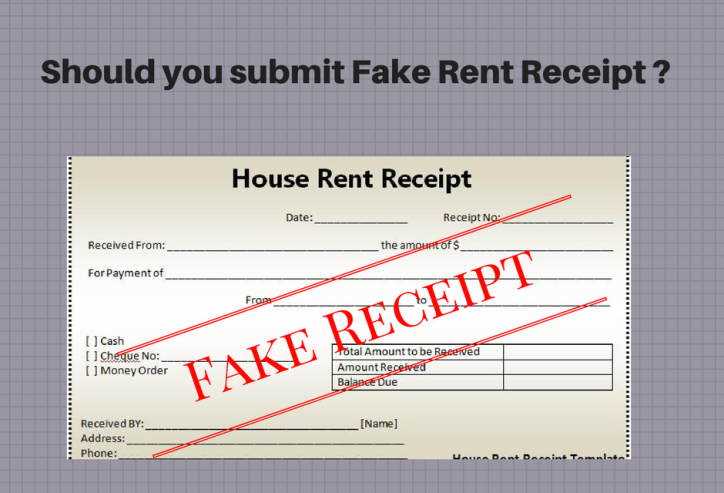

For tax compliance, make sure the receipts meet the IRS requirements. Only eligible expenses should be included, and the receipt should reflect the exact amount spent. Avoid submitting receipts that lack the necessary documentation, such as itemized invoices or payment confirmations, as these may not be accepted during audits.

Avoid common mistakes like missing signatures, incomplete details, or submitting receipts for ineligible expenses. Always double-check the amounts and ensure they match the supporting documentation. Additionally, refrain from using generic or vague descriptions when listing expenses, as this can create confusion and delays in processing.

Streamline the submission process by creating a digital version of the receipt template. This can help reduce paper clutter and speed up processing. Ensure that all fields are easily fillable, and provide clear instructions for submitting receipts electronically or in paper form, depending on the preferred method of your organization.