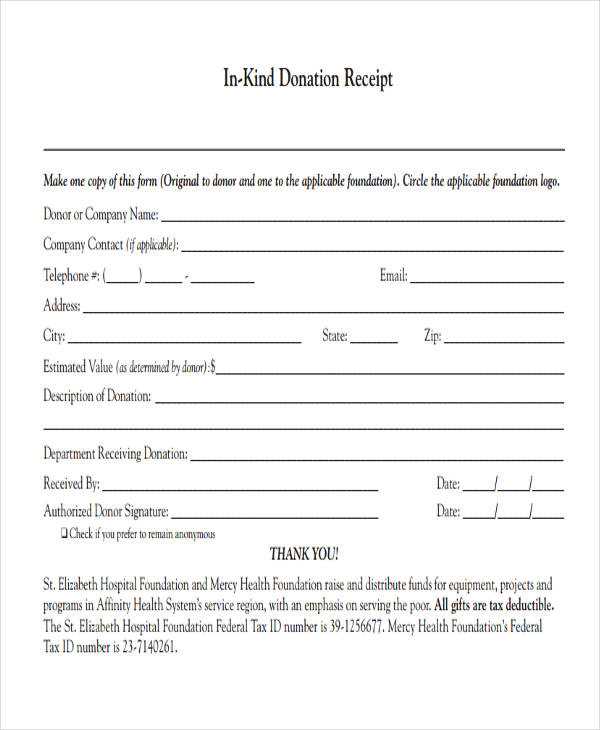

To create a clear and organized receipt for in-kind gifts, start with a simple template that includes key information. Begin by specifying the name of the donor and the recipient, followed by the date of the gift. Be sure to describe the item or service provided, including its estimated value if applicable.

Include a section to confirm that the gift was received in good condition, which ensures transparency between both parties. If necessary, add a brief statement that the gift is non-cash and non-refundable, to clarify the nature of the donation.

Details to include: item description, donor and recipient names, date of transfer, and any applicable value. This structured approach will help avoid confusion and maintain a professional record of in-kind donations.

Here is the modified version with reduced repetitions:

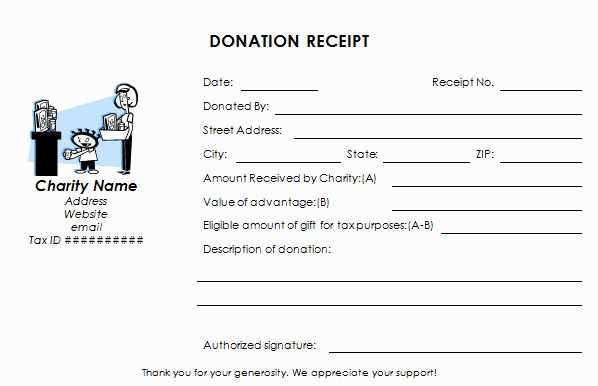

To create a clear and concise “In-kind gift receipt,” ensure the document includes only key details such as the donor’s name, the description of the gift, and its fair market value. Avoid unnecessary jargon and keep the wording simple. The receipt should also mention the date the gift was received and confirm that no goods or services were exchanged for the donation. This keeps the focus on the charitable nature of the gift. Be specific about the type of gift to avoid ambiguity, but refrain from repeating details. Clearly state that the donor has received no tax benefits in return. This version reduces redundancy while maintaining all necessary information for documentation and compliance.

In Kind Donation Receipt Template

Understanding the Significance of an In Kind Gift Receipt

Essential Elements to Include in an In Kind Donation Receipt

How to Document Donated Items for Legal Compliance

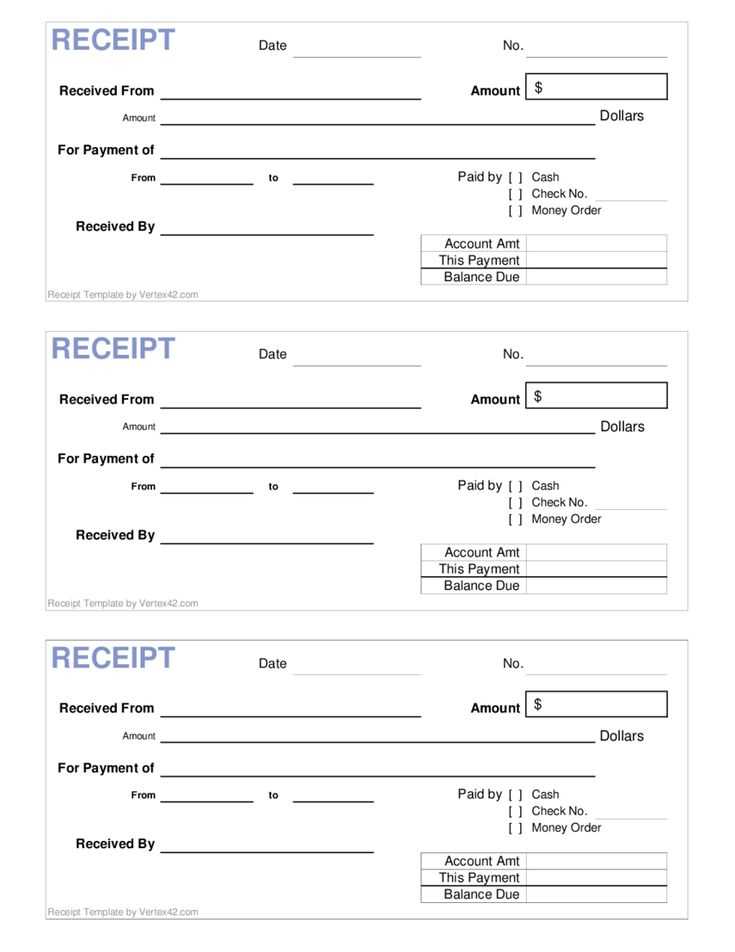

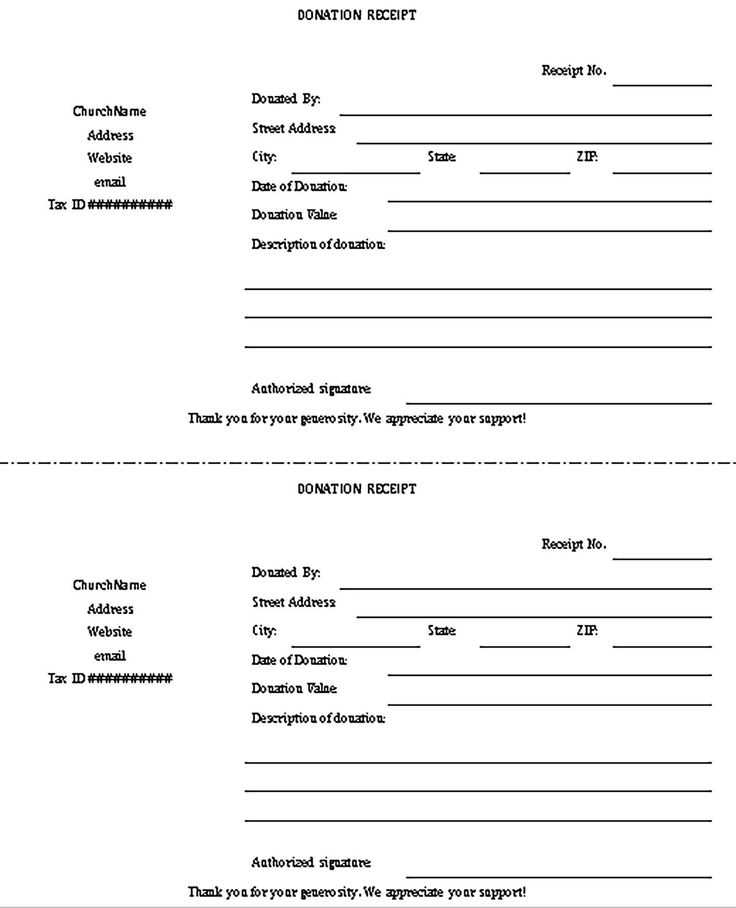

Customizing Templates for Various Types of Gifts

Issuing an In Kind Receipt for Tax Benefits

Common Errors to Avoid When Preparing a Gift Receipt

Documenting in kind donations accurately is key to maintaining transparency and compliance with tax laws. A proper receipt ensures that both the donor and the recipient organization are protected.

Incorporate these elements in the receipt: Date of donation, detailed description of items, estimated fair market value (FMV), and the donor’s name and address. If applicable, include a statement confirming no goods or services were provided in exchange for the donation.

For legal compliance, clearly record the value of each donated item or set of items. Avoid placing vague or ambiguous descriptions on the receipt. Donors must also be able to reference the receipt for tax deduction purposes, so itemize everything carefully.

Customizing templates is important when dealing with different types of gifts. Whether it’s furniture, electronics, or clothing, each category might require specific details. Make sure the template accommodates various types of donations by leaving room for item specifics, condition, and value.

Tax benefits come into play when the donation is correctly documented. Ensure the receipt includes the necessary language to allow donors to claim their contributions for tax purposes. An accurate value estimate is often necessary to substantiate deductions on tax returns.

Avoid common mistakes: Failing to include a clear description, assigning unrealistic values, or neglecting to mention that no goods or services were exchanged can create problems for both donors and organizations. Also, double-check the date and donor’s information for accuracy.