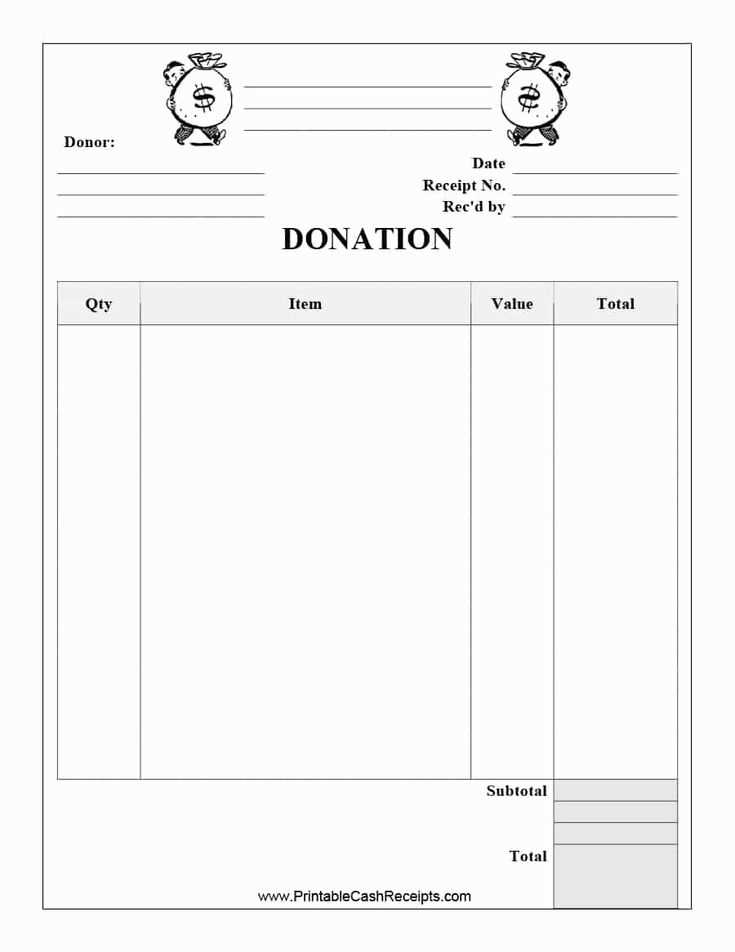

Creating a well-structured in-kind receipt template is simple and highly beneficial for documenting the receipt of goods or services. A clear template helps maintain transparency and ensures both the giver and the recipient have a mutual understanding of the donation details. This guide will walk you through the key elements to include in an effective receipt.

The basic structure should clearly identify the donor and recipient, along with a detailed description of the goods or services donated. Include the date of donation and an accurate description, specifying the type, quantity, and value of the items. Remember, if the donation involves services, provide details on the nature of the service and its estimated value. It’s also important to note any specific conditions attached to the donation.

For proper documentation, be sure to state the purpose of the donation, especially if it’s for tax purposes or other official uses. Additionally, while not always required, including a thank-you message can add a personal touch to the receipt. Keep the format straightforward and easy to understand for both parties involved.

Here’s a refined version that eliminates repetitions and keeps the meaning intact:

To create an in-kind receipt, ensure that it includes all necessary details without redundancy. Start by specifying the donor’s name and contact details, followed by the description of the donated items. Clearly state the quantity, condition, and any relevant specifications for each item. Include the date of receipt and a statement affirming that no goods or services were exchanged for the donation.

It’s important to keep the language clear and concise while maintaining all the necessary legal elements. Include a section acknowledging the donation and confirming its non-monetary value, without using vague terms or excessive phrasing.

Ensure that the receipt complies with tax regulations by including a note that the donation may be tax-deductible, depending on the donor’s circumstances. This can help both parties maintain proper documentation for tax purposes.

- Donor’s full name and address

- Description of the donated items (including quantity and condition)

- Date of receipt

- Confirmation that no goods or services were received in exchange

- Tax-deductibility notice (if applicable)

Review the receipt for accuracy before issuing it. A well-structured in-kind receipt is a simple yet effective way to document donations and comply with relevant laws.

How to Create an In-Kind Receipt Template for Donations

Key Information to Include in Your In-Kind Receipt Template

Practical Tips for Using In-Kind Receipts for Recordkeeping

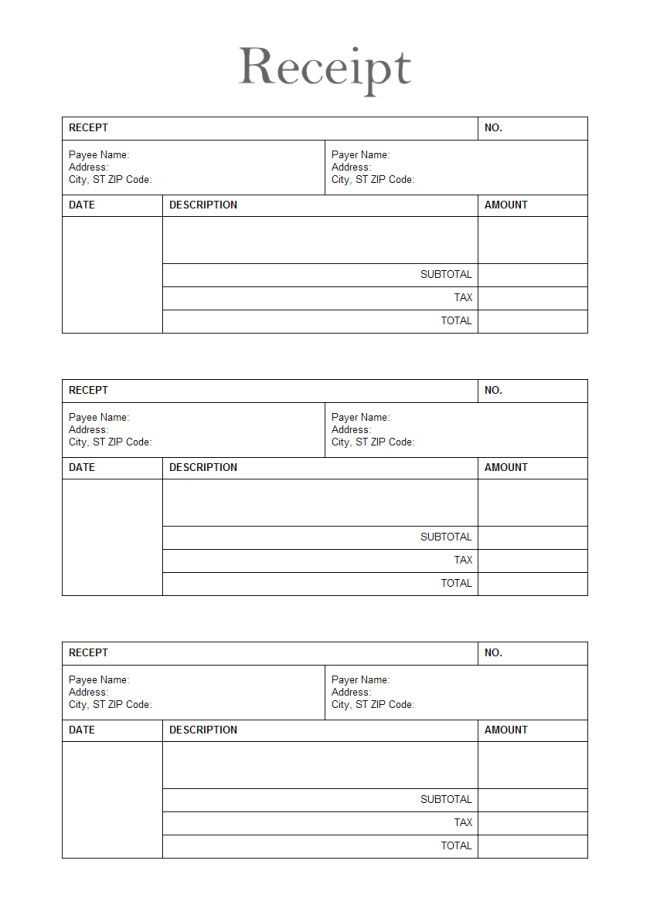

Begin by creating a clear header with your organization’s name, address, and contact details. Include the date of receipt to establish the timeline for the donation. This makes it easier for both the donor and your organization to keep track of transactions.

Details of the Donated Items

Each item should be described in detail. Include the item name, quantity, condition (new, used, etc.), and any relevant specifics like model numbers or sizes. This avoids ambiguity and ensures both parties agree on what was donated.

Donor Information

Record the donor’s full name, address, and contact information. This allows for easier follow-up and tax documentation purposes. If the donation is from a business, include the company’s name and address as well.

Value of the Donation

Clearly note that the donor is responsible for determining the value of the items. Include a disclaimer that the organization does not assign a monetary value to in-kind donations. This helps protect both parties from potential disputes.

Signatures

Both the donor and the organization’s representative should sign and date the receipt. This ensures that both parties acknowledge the transaction and that the receipt is valid for tax purposes.

Practical Tips for Using In-Kind Receipts for Recordkeeping

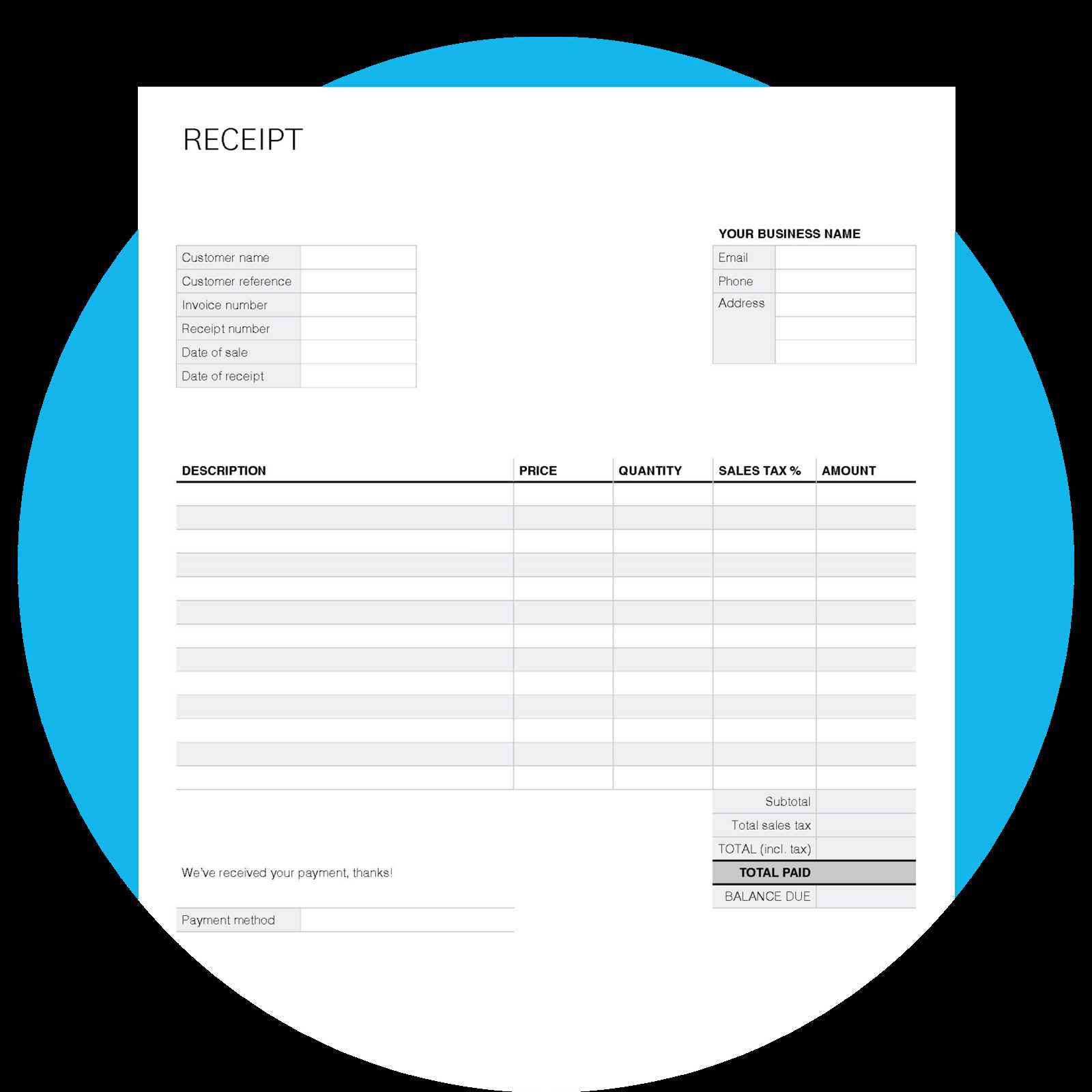

Maintain an organized system for storing receipts. Whether digital or paper, categorize donations by date and type of item. Keep receipts easily accessible for audits, tax purposes, or if donors request a copy.

Regularly update your records to reflect all received donations. Cross-check the details to avoid errors and ensure all necessary documentation is on file. This proactive approach will keep your records accurate and up to date.

Let me know if you need further adjustments!

If you require any modifications to the receipt template, feel free to reach out. Adjustments can range from simple layout tweaks to specific formatting needs. I am more than happy to make changes until everything aligns with your requirements.

Customizing Your Template

To make the template work perfectly for your use case, consider including unique fields that reflect your transactions accurately. Adding a personalized logo or adjusting font styles can give the document a professional look while maintaining clarity and ease of understanding.

Final Review

Before finalizing, ensure all essential details such as transaction dates, amounts, and signatures are correctly displayed. Double-check for any errors or missing information, and let me know if you need any help with these steps. I’ll ensure everything is just right!