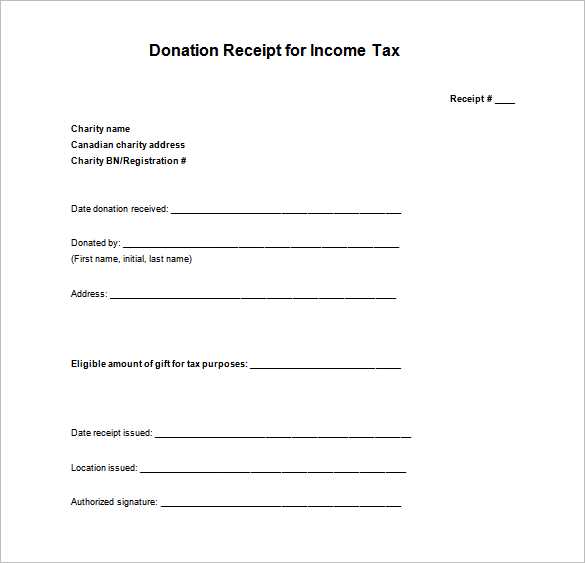

For Canadians who need to issue an income tax receipt, it’s important to use a template that meets the necessary requirements. A proper receipt should include the recipient’s name, the amount donated, and the date of the donation. Make sure to include the charity’s name, address, and charitable registration number as well. This helps ensure that the donation can be claimed for tax purposes.

Use a simple, clear layout. Start with the name of the donor, followed by the donation amount, and the date received. Next, list the organization’s information, including the registration number. Don’t forget to add any specific details required by the Canada Revenue Agency (CRA), like a description of the goods or services exchanged for the donation, if applicable.

Ensure that the receipt is signed by an authorized person within the organization. This signature validates the donation and ensures that it is eligible for tax credit. Keep a record of the issued receipts in case of future audits or inquiries.

Income Tax Receipt Template Canada

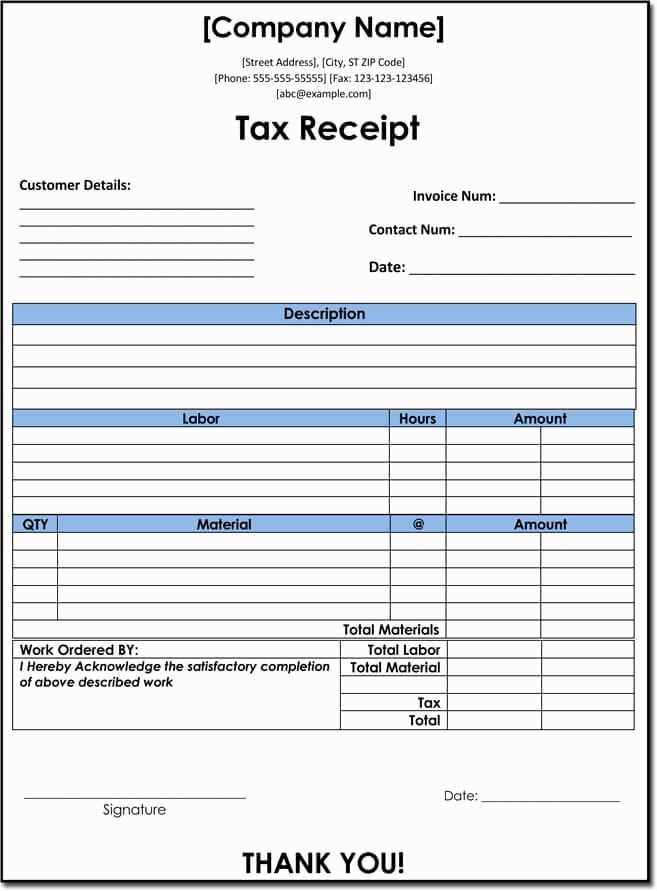

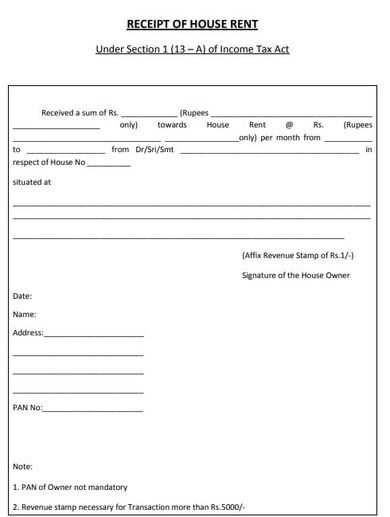

For those preparing tax filings, an income tax receipt template can streamline the process. A basic template should include the following key details:

- Recipient Name: Clearly state the name of the individual or entity receiving the payment.

- Amount: Specify the total amount paid, including any taxes, if applicable.

- Date: Include the exact date the payment was made or received.

- Purpose of Payment: Briefly explain what the payment was for (e.g., donation, service rendered).

- Payee Information: Include the name and contact details of the individual or organization issuing the receipt.

The format should be clear and concise, avoiding unnecessary information. It’s crucial to keep the receipt simple and easy to read, as it will be used for official tax purposes. If the receipt involves charitable donations, make sure to include the charity’s registration number for tax credit eligibility.

For a legally compliant receipt, ensure that all details are accurate. Keep a copy for your records, as receipts may be needed for future audits or claims. You can create a digital version, but make sure it is formatted correctly for printing, with a professional and neat appearance.

Creating a Simple Income Tax Receipt

To create a basic income tax receipt, follow these steps to ensure clarity and compliance with Canadian requirements.

1. Include Business Information

- Business name

- Business address

- Contact details (phone number, email)

- Business registration number (if applicable)

2. Add the Payer’s Information

- Payer’s name

- Payer’s address

- Payer’s phone number or email (optional)

Next, list the details of the payment received, such as the amount, date, and a brief description of the service or goods provided.

3. Specify Payment Details

- Date of payment

- Total amount received

- Method of payment (cash, cheque, or electronic transfer)

- Invoice number (if applicable)

Lastly, include a statement that confirms the payment was received in full, followed by your signature or authorized representative’s name and title.

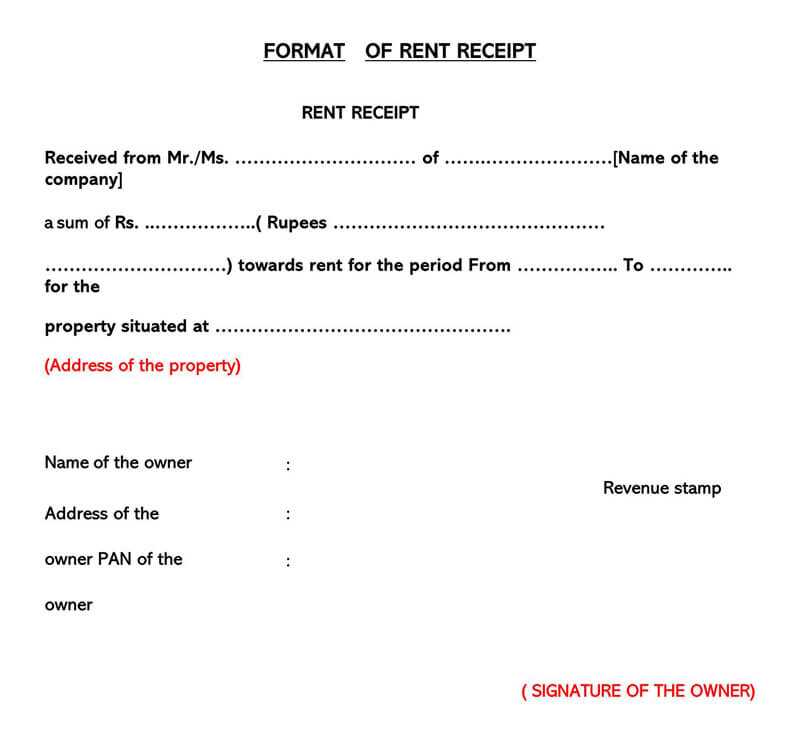

Key Information to Include in Your Template

Make sure to list the payer’s full name and address at the top of the receipt. This identifies the source of the income and makes the document valid for tax purposes.

Include the date of payment and a payment reference number. These details help track the transaction and provide a clear timeline for both parties involved.

Specify the amount paid in both numbers and words to avoid confusion. Include the currency as well, particularly if the payment was made in a foreign currency.

List any tax deductions or withholding amounts separately. This transparency ensures accuracy when filing taxes.

Provide a clear description of the nature of the payment (e.g., salary, rental income, or freelance work). This helps categorize the income correctly.

Include your business or personal tax identification number. It’s necessary for tax tracking and confirming that the payment was made to the correct taxpayer.

Finally, include a signature or authorized stamp to confirm the receipt’s authenticity.

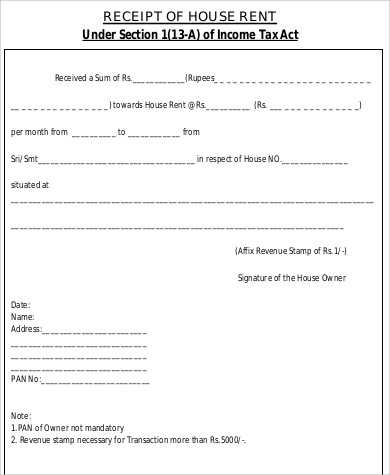

How to Customize for Different Income Types

To customize an income tax receipt template for various income types, begin by identifying the specific sources of income. Each type–whether it’s salary, freelance earnings, or investment income–has unique reporting requirements. Start by adding specific categories for each type in your template. For instance, for salary income, include sections for gross earnings, tax deductions, and net pay. For freelance work, consider adding space for project details and payments received, as they may vary month to month.

For investment income, include fields for dividends, interest, and capital gains, ensuring that each is reported separately. You can create additional lines for special deductions or credits related to different income types, like RRSP contributions for salaried employees or business expenses for freelancers. Make sure to adjust the tax rate according to the income type, as different sources may be subject to varying rates or credits.

Always keep the format simple and clear, while ensuring that all necessary details are included. Adding separate sections or even color-coding different income types can make the template more user-friendly and organized. Don’t forget to allow for updates in tax regulations or income-related changes, ensuring your template remains accurate year after year.