Creating a clear and professional receipt for your clothing store is key to maintaining customer trust and keeping your transactions organized. The template should include all relevant information such as store details, transaction specifics, and items purchased.

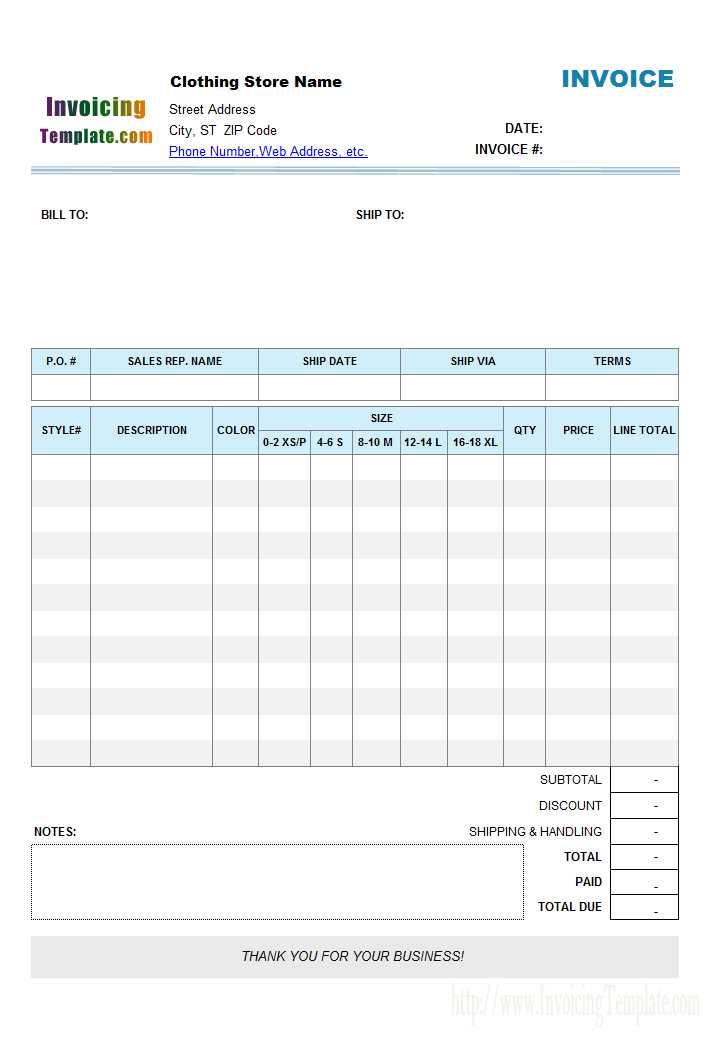

Start by listing your store name, address, and contact details at the top. Make sure the date and time of the purchase are clearly visible. It’s also helpful to include a unique invoice number for easy reference.

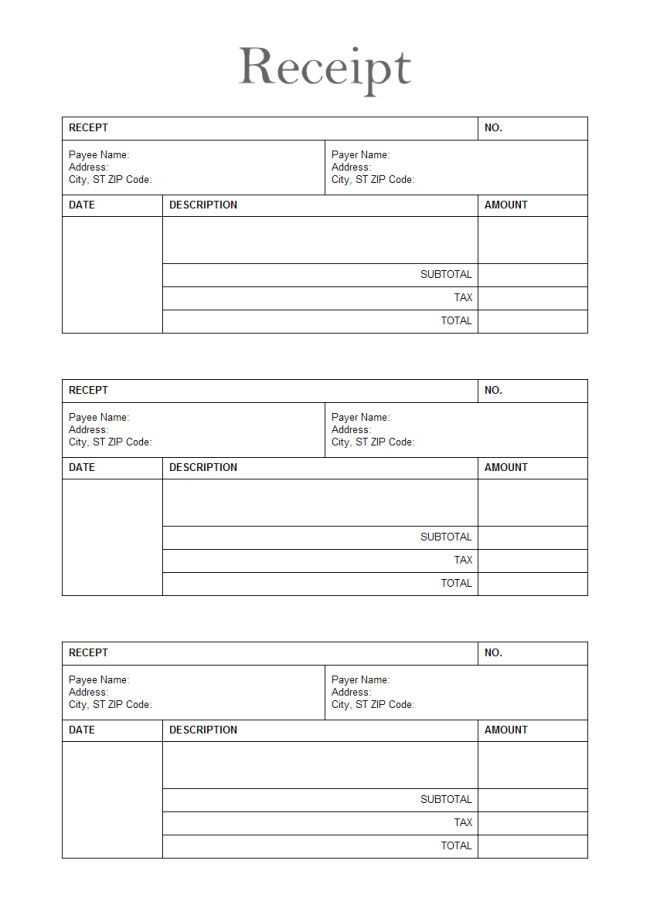

Each item purchased should be listed with its description, quantity, and price. A subtotal section, followed by applicable taxes and a final total amount, is necessary for clarity.

For added convenience, include a space for any discounts or promotions that were applied during the transaction. Additionally, offering a simple return policy or store terms at the bottom helps customers feel secure in their purchases.

Here’s the revised version of your text:

To create a seamless and accurate receipt template for your Indian clothing store, focus on these key sections:

1. Store Information

- Include your store’s name, address, contact number, and email at the top for clear identification.

- Consider adding a store logo for better branding.

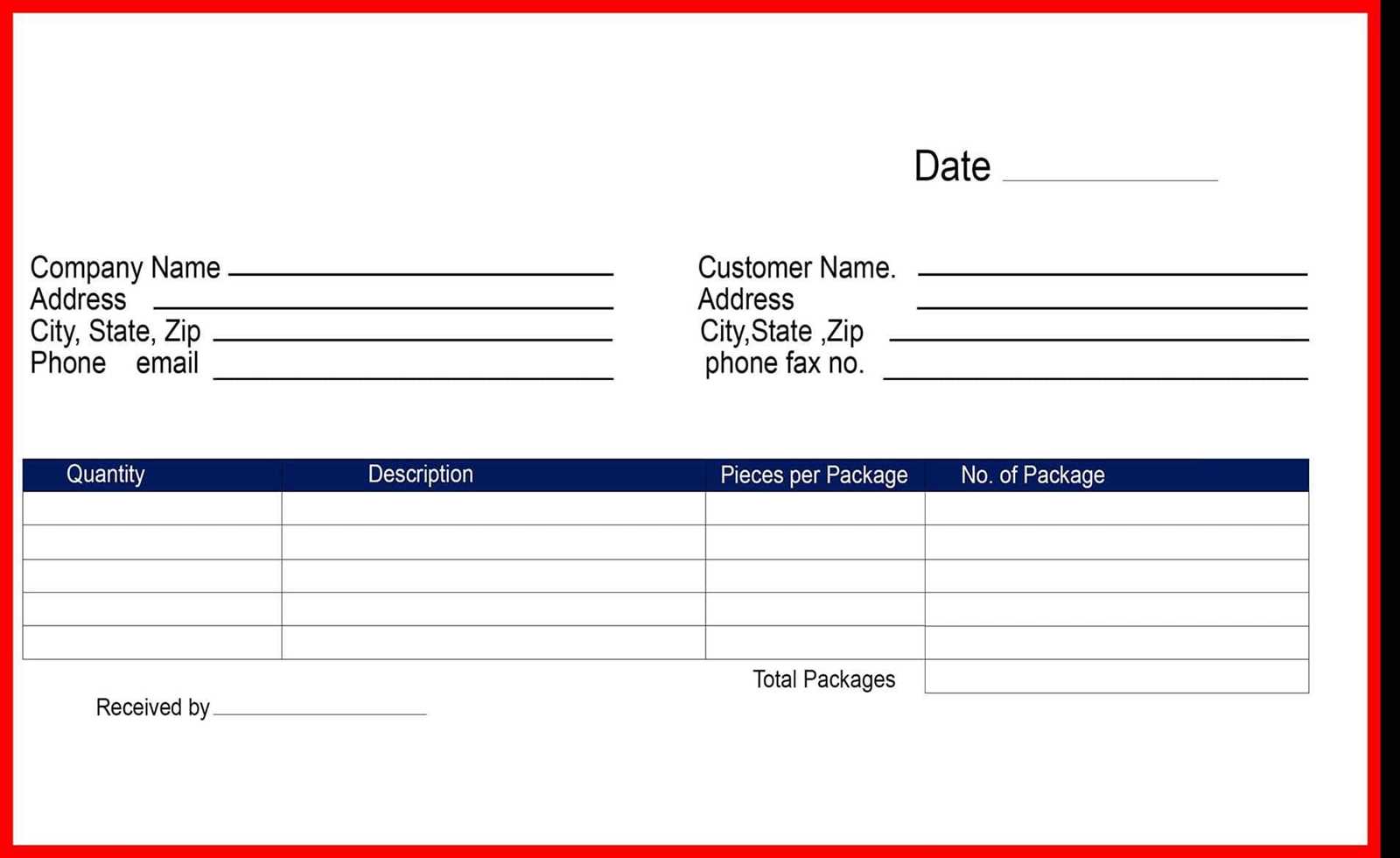

2. Customer Details

- Provide space for the customer’s name, contact details, and billing address, especially for delivery services.

- Allow for optional loyalty program numbers or membership codes if applicable.

3. Product Details

- List items purchased with clear descriptions (e.g., fabric type, color, and size).

- Ensure each product has an individual price listed, along with quantity and total cost.

4. Transaction Summary

- Show the subtotal, applicable taxes, and any discounts applied.

- Include the total amount due at the bottom for quick reference.

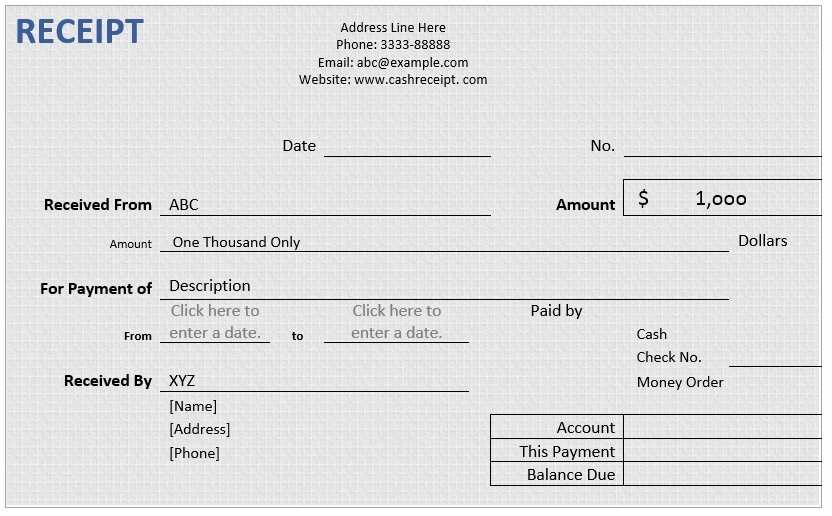

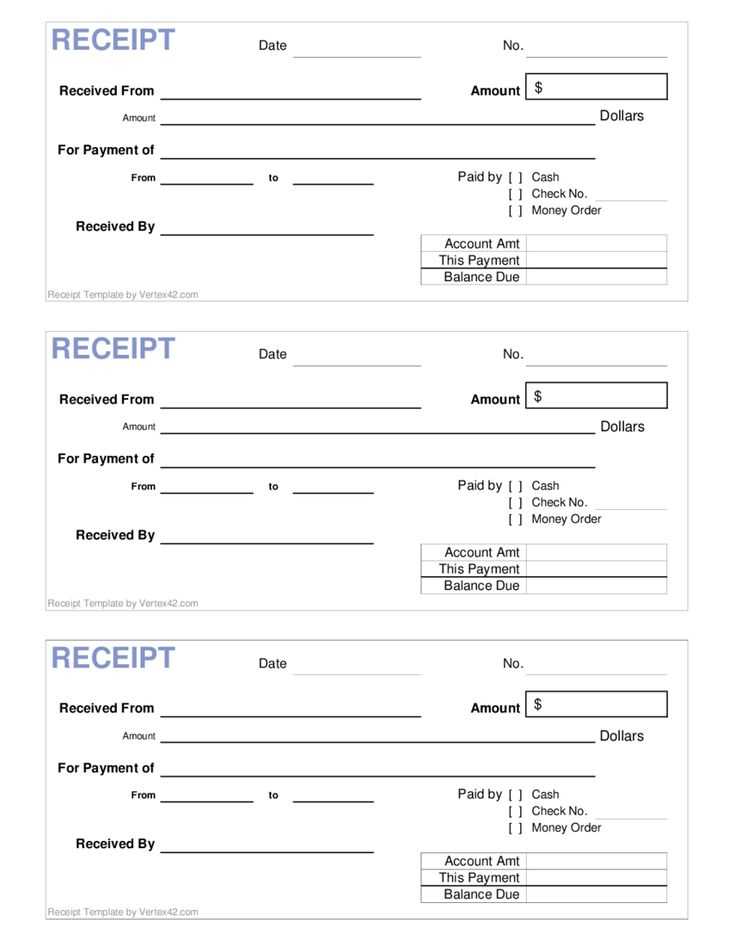

5. Payment Information

- Record the payment method (e.g., cash, card, online transfer) and any transaction reference numbers.

- Consider adding a section for partial payments if applicable.

Keep the design clean and easily readable, and ensure it aligns with your store’s branding. A good receipt should be clear, professional, and informative.

- Indian Clothing Store Receipt Template

Creating a clear and structured receipt for an Indian clothing store is key to ensuring customers understand their purchase details. A receipt template should include the store’s name, the customer’s information, items bought, prices, taxes, and total amount paid.

Key Components to Include

Each receipt should feature the store’s name, address, and contact information. Below that, you should include a unique receipt number for easy tracking. Ensure the date and time of purchase are visible to help customers reference their transactions later.

Itemization

List the clothing items purchased along with their individual prices. Include any applicable discounts or promotions applied to the items. Make sure to include the total for each item, as well as the subtotal before tax.

Finally, the receipt should display the total price including taxes, as well as the payment method (cash, card, or digital payment). This transparency helps build trust with customers.

To create a straightforward and easy-to-understand receipt format, focus on clarity and simplicity. Display key information clearly, making sure each detail stands out for both the customer and store personnel.

Start with the store’s name, logo, and contact details at the top. This section should be prominent but not overwhelming. Right beneath it, include the date and time of the transaction. This helps provide a clear record of the purchase time.

The list of items purchased should be organized in a table. Include columns for item description, quantity, unit price, and total price. Align all text properly and use bold or underlined text for important elements like the item name and total price. This makes it easier for the customer to verify their purchases at a glance.

| Item Description | Quantity | Unit Price | Total Price |

|---|---|---|---|

| Cotton Saree | 1 | ₹1200 | ₹1200 |

| Silk Dupatta | 1 | ₹500 | ₹500 |

Next, list any discounts, taxes, or additional fees in a separate section below the itemized list. Label each entry clearly so customers understand how the total was calculated. Keep the layout clean by avoiding unnecessary clutter.

Finally, include a clear and easily readable total at the bottom. Highlight it with a larger font size or bold text to ensure it is noticeable. Offer a breakdown of the total to include the sum of items, taxes, and discounts.

By organizing the receipt into clearly defined sections, customers will have no trouble understanding their purchase details. A well-structured receipt promotes transparency and customer trust.

Include a separate section for local taxes and discounts to ensure clarity and accuracy in receipts. List each tax and discount on a new line, specifying the rate and total amount applied. For taxes, label them according to the local law, such as “State Tax,” “GST,” or “Service Tax,” and show the applicable rate next to the name. For discounts, provide details like “Seasonal Discount” or “Coupon Discount” with the discount percentage or flat amount next to the label.

For taxes, always calculate them based on the subtotal before any discounts are applied. This ensures that the taxes are correct and in line with tax regulations. If there are multiple tax types (e.g., VAT, service tax), list them individually with their respective amounts.

For discounts, specify whether the discount is applied before or after taxes. If it’s applied before, subtract it from the total amount before calculating taxes. If it’s after, apply the discount after taxes have been calculated. This keeps the receipt transparent and avoids any confusion for customers.

Example:

- Subtotal: ₹1000.00

- State Tax (18%): ₹180.00

- Seasonal Discount (10%): -₹100.00

- Total: ₹1080.00

This clear breakdown helps both customers and businesses understand how taxes and discounts contribute to the final price. Always ensure the calculation is transparent and easily understandable, making the receipt user-friendly for both parties.

Clearly specify each payment method used. For credit card payments, include the card type and last four digits. For cash, state the exact amount received and the change given, if applicable. For digital payments like Google Pay or Paytm, display the transaction ID and payment method name for easy tracking.

If a customer uses multiple payment methods, break down the total amount accordingly. List each payment type separately, with the corresponding amounts, for easy verification. For gift cards, mention the card number, value redeemed, and remaining balance, if relevant.

For international payments, display both the original amount and the INR equivalent to ensure clarity for foreign customers. If the transaction involves currency conversion, include the conversion rate used at the time of the transaction. This helps avoid confusion and ensures transparency.

Make sure to include the store’s name and logo at the top of the receipt. This immediately identifies the source of the purchase and provides a professional touch. The date and time of the transaction should follow, placed clearly for easy reference. It helps both the customer and the store keep track of the purchase timeline.

List each item purchased with its description, size, and price. Use bullet points for better clarity, ensuring that customers can easily read and understand what they are paying for. A subtotal should follow, displaying the total cost of the items before tax.

Next, display the tax amount applied. This is crucial for transparency. A clear breakdown will help customers verify their calculations. Afterward, the final amount due should be listed, including any discounts or promotions that were applied. Make sure the payment method is included at the bottom, whether it’s cash, credit card, or digital payment.

At the very bottom, add any return or exchange policies and customer service contact details. This information ensures that the customer is aware of their rights and can reach out if needed. Include the store’s social media or website links to encourage further engagement.